In February 2025, global markets are grappling with tariff uncertainties and mixed economic signals, as the U.S. job growth falls short of expectations and major indices like the S&P 500 experience slight declines amidst ongoing trade tensions. Amidst these dynamics, high growth tech stocks present intriguing opportunities for investors seeking to navigate this complex landscape by focusing on innovation-driven companies that can potentially thrive despite broader market volatility.

Top 10 High Growth Tech Companies

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| eWeLLLtd | 26.41% | 28.82% | ★★★★★★ |

| Ascelia Pharma | 68.22% | 59.79% | ★★★★★★ |

| Alnylam Pharmaceuticals | 21.62% | 56.70% | ★★★★★★ |

| Fine M-TecLTD | 36.52% | 135.02% | ★★★★★★ |

| Alkami Technology | 21.99% | 102.65% | ★★★★★★ |

| Travere Therapeutics | 30.52% | 61.89% | ★★★★★★ |

| Initiator Pharma | 73.95% | 31.67% | ★★★★★★ |

| JNTC | 29.48% | 104.37% | ★★★★★★ |

| Dmall | 29.53% | 88.37% | ★★★★★★ |

| Delton Technology (Guangzhou) | 20.25% | 29.52% | ★★★★★★ |

Click here to see the full list of 1217 stocks from our High Growth Tech and AI Stocks screener.

We're going to check out a few of the best picks from our screener tool.

China Leadshine Technology (SZSE:002979)

Simply Wall St Growth Rating: ★★★★★☆

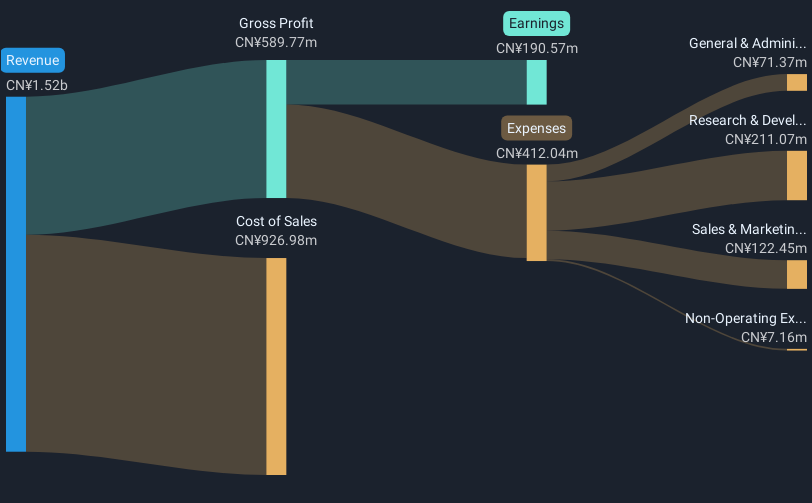

Overview: China Leadshine Technology Co., Ltd. specializes in designing, manufacturing, and selling motion control equipment and components in China, with a market capitalization of CN¥12.06 billion.

Operations: Leadshine focuses on the production and distribution of motion control equipment, generating revenue primarily from these products within China. The company has a market capitalization of CN¥12.06 billion.

China Leadshine Technology has demonstrated robust growth metrics, outpacing its industry with a remarkable 84.3% earnings increase over the past year, significantly higher than the Electronic industry's average of 3%. This performance is underpinned by an aggressive R&D investment strategy, which not only fuels innovation but also aligns with projected annual revenue and earnings growth rates of 21.1% and 28.6%, respectively—both figures surpassing broader market averages. Recent strategic moves include an extended share buyback plan, underscoring confidence in sustained financial health and commitment to shareholder value. These elements collectively position China Leadshine as a dynamic contender in the high-tech sector, leveraging substantial reinvestment in technological advancements to secure its competitive edge.

SHIFT (TSE:3697)

Simply Wall St Growth Rating: ★★★★★☆

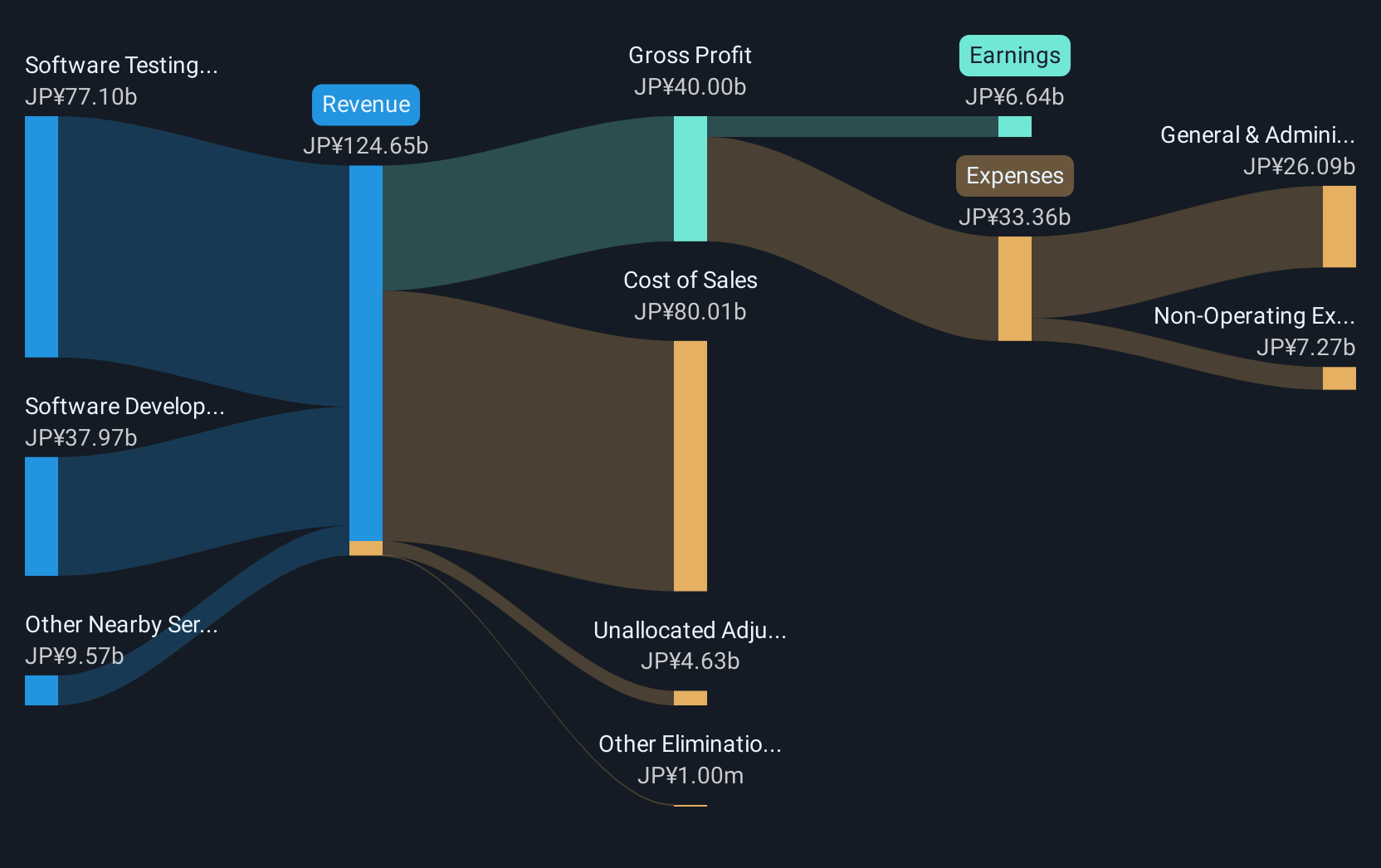

Overview: SHIFT Inc. is a Japanese company specializing in software quality assurance and testing solutions, with a market cap of ¥372.13 billion.

Operations: SHIFT Inc. generates revenue primarily through software testing related services, which account for ¥74.26 billion, and software development related services contributing ¥36.57 billion.

SHIFT Inc. has carved a niche in the tech sector with its strategic focus on innovation, evidenced by a 16.2% annual revenue growth and an impressive 28.7% surge in earnings, both metrics outstripping the broader Japanese market's averages of 4.2% and 7.7%, respectively. The company's commitment to R&D is highlighted by substantial investments amounting to $1.3 billion last year, accounting for nearly 15% of its total revenue, fostering advancements that promise to keep it at the forefront of technological evolution. Recent corporate actions like a significant stock split underscore management’s confidence in continued growth and shareholder value enhancement amidst a volatile market environment.

- Take a closer look at SHIFT's potential here in our health report.

Examine SHIFT's past performance report to understand how it has performed in the past.

Constellation Software (TSX:CSU)

Simply Wall St Growth Rating: ★★★★★☆

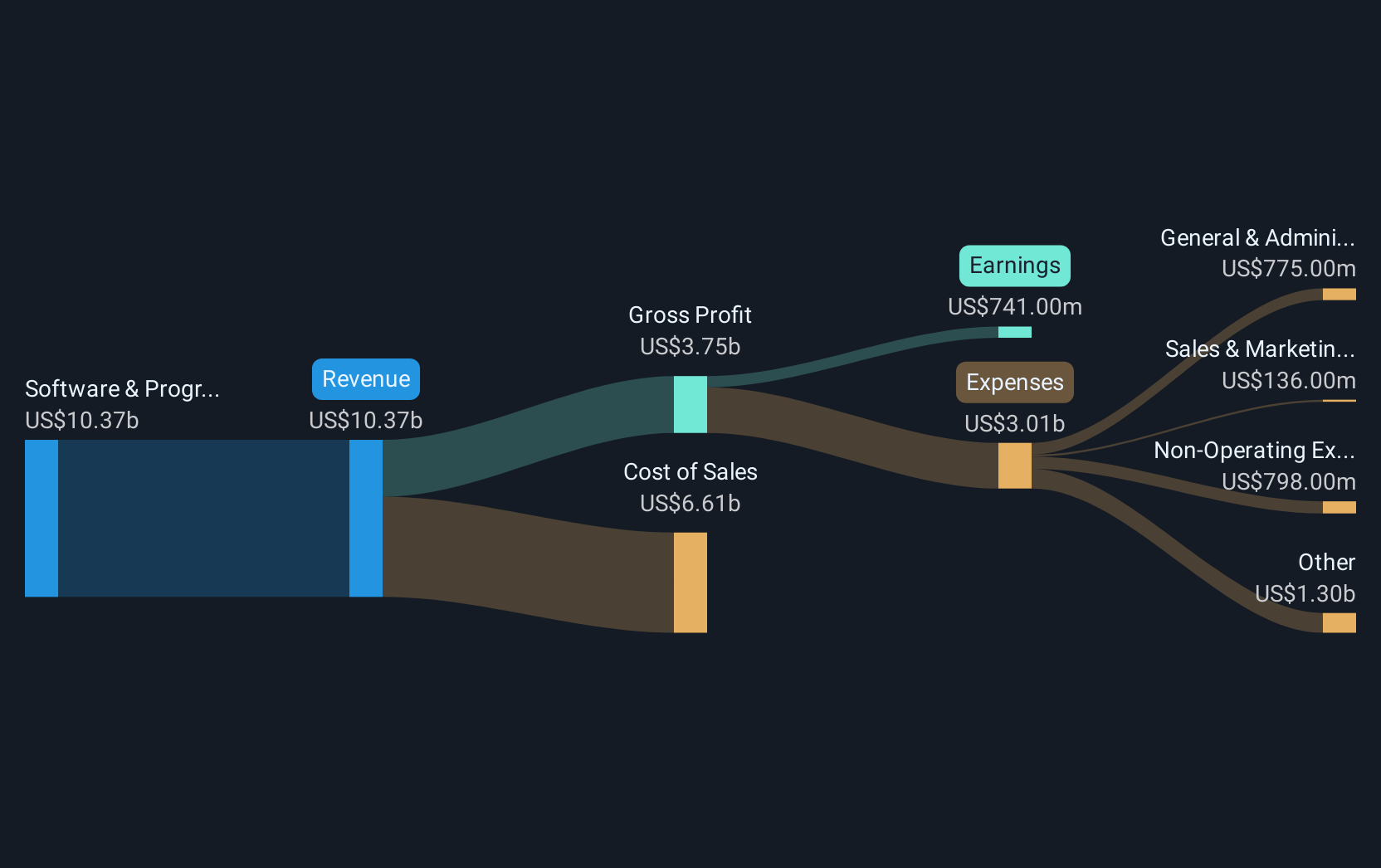

Overview: Constellation Software Inc. acquires, builds, and manages vertical market software businesses globally and has a market cap of CA$104.02 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, which reported $9.68 billion. The net profit margin is a key financial metric to consider, reflecting the company's profitability after all expenses are accounted for.

Constellation Software stands out in the tech landscape with its robust growth metrics, including a notable 15.5% annual revenue increase and a 24.6% surge in yearly earnings growth, significantly outpacing the broader Canadian market averages of 5.9% and 17.8%, respectively. The company's aggressive investment in R&D, which represents a significant portion of its revenue, underscores its commitment to innovation and positions it well for future advancements within the software sector. Recent involvement in acquisition talks for Linx S.A., despite current bids falling short of expectations, highlights Constellation's strategic moves to expand its market footprint and enhance its product offerings amidst competitive industry dynamics.

- Unlock comprehensive insights into our analysis of Constellation Software stock in this health report.

Gain insights into Constellation Software's past trends and performance with our Past report.

Taking Advantage

- Unlock our comprehensive list of 1217 High Growth Tech and AI Stocks by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CSU

Constellation Software

Acquires, builds, and manages vertical market software businesses to develop mission-critical software solutions for public and private sector markets.

Reasonable growth potential with proven track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)