- Japan

- /

- Semiconductors

- /

- TSE:6723

What Renesas Electronics (TSE:6723)'s AI-Enabled MCU Rollout Through Mouser Means For Shareholders

Reviewed by Sasha Jovanovic

- Mouser Electronics announced it is now stocking the latest Renesas Electronics products, including over 28,000 parts and newly released AI-enabled microcontrollers and power devices, as of late September 2025.

- The rollout and broad distribution of advanced MCU and power devices highlights Renesas' efforts to address emerging automation and edge AI demand in sectors such as industrial IoT and high-performance computing.

- We'll now examine how the expanded availability of Renesas' AI-enabled MCUs through Mouser could influence its investment outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Renesas Electronics Investment Narrative Recap

To be a shareholder in Renesas Electronics, you have to believe in the company's ability to benefit from growing demand for AI-enabled and efficient edge computing solutions, particularly as industrial IoT and automotive end-markets evolve. The recent news of Mouser Electronics stocking over 28,000 Renesas products, including advanced AI microcontrollers, supports near-term product availability, but does not materially impact the most significant catalyst, which is the broader adoption and ramp-up of Renesas' automotive MCUs outside its core markets. Key risks, like exposure to volatile global tariffs and persistent weakness in major end-markets, are unchanged in the immediate term.

Among the latest product announcements, the introduction of the RA8T2 high-end motor control microcontrollers stands out for its relevance to industrial automation and robotics. While the expanded Mouser distribution fast-tracks Renesas’ AI MCUs into the hands of engineers, new solutions like the RA8T2, offering precision motor control and AI functions, may play a crucial supporting role as the company targets applications requiring both real-time performance and integration flexibility.

However, before considering any position, investors should also be aware that ongoing supply chain and market access risks, particularly those related to global tariffs, may create...

Read the full narrative on Renesas Electronics (it's free!)

Renesas Electronics' outlook anticipates ¥1,642.0 billion in revenue and ¥275.4 billion in earnings by 2028. This is based on analysts' assumptions of 8.9% yearly revenue growth and a ¥371.3 billion increase in earnings from the current level of ¥-95.9 billion.

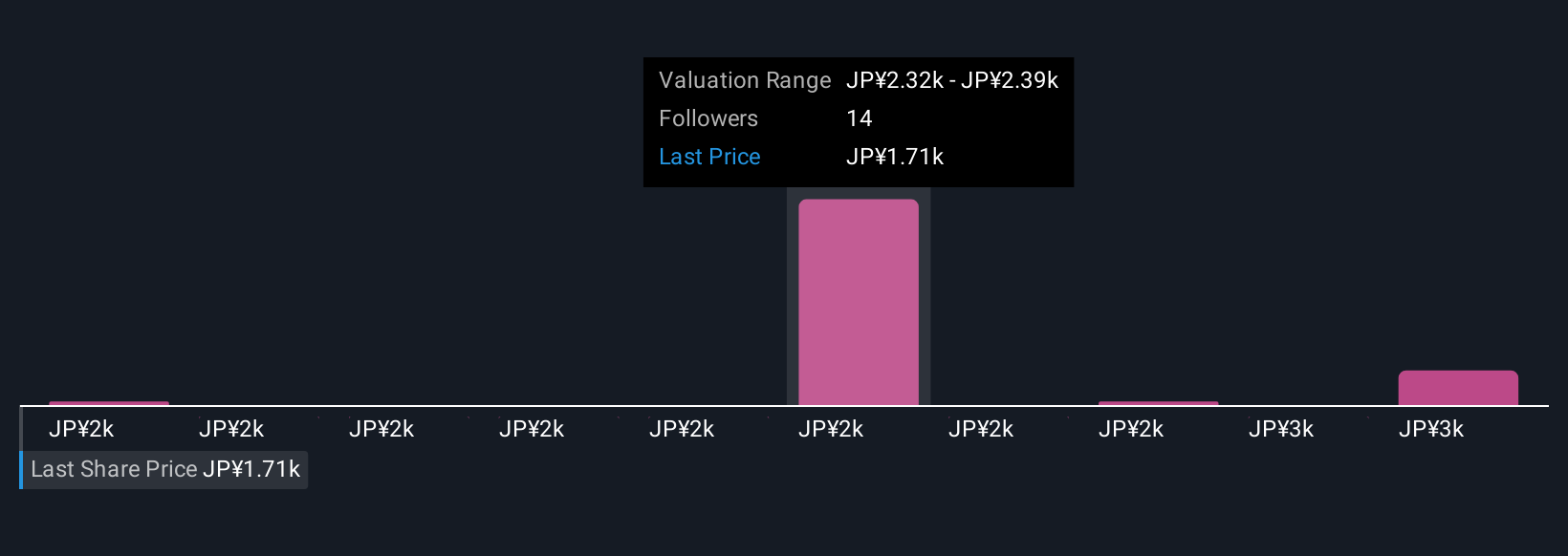

Uncover how Renesas Electronics' forecasts yield a ¥2381 fair value, a 31% upside to its current price.

Exploring Other Perspectives

Four members of the Simply Wall St Community value Renesas between ¥2,000 and ¥2,674 a share, reflecting a wide span of investor fair values. Against this backdrop, ongoing volatility in global trade policy could affect the company’s ability to capture market opportunities, so comparing these views can help you find your own approach.

Explore 4 other fair value estimates on Renesas Electronics - why the stock might be worth as much as 48% more than the current price!

Build Your Own Renesas Electronics Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Renesas Electronics research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Renesas Electronics research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Renesas Electronics' overall financial health at a glance.

Seeking Other Investments?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 24 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6723

Renesas Electronics

Researches, develops, designs, manufactures, sells, and services semiconductors in Japan, China, rest of Asia, Europe, North America, and internationally.

Reasonable growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026