- China

- /

- Metals and Mining

- /

- SZSE:000426

Asian Market: 3 Companies Estimated To Be Trading Below Intrinsic Value

Reviewed by Simply Wall St

As global markets grapple with renewed U.S.-China trade tensions and geopolitical uncertainties, investors are increasingly looking toward Asia for potential opportunities. In this environment, identifying stocks that may be trading below their intrinsic value can provide a strategic advantage, offering the potential for growth despite broader market challenges.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Shanghai V-Test Semiconductor Tech (SHSE:688372) | CN¥82.38 | CN¥163.36 | 49.6% |

| Range Intelligent Computing Technology Group (SZSE:300442) | CN¥50.25 | CN¥97.87 | 48.7% |

| Nan Juen International (TPEX:6584) | NT$233.00 | NT$454.20 | 48.7% |

| Japan Eyewear Holdings (TSE:5889) | ¥2103.00 | ¥4095.17 | 48.6% |

| Guangdong Lyric Robot AutomationLtd (SHSE:688499) | CN¥61.70 | CN¥120.88 | 49% |

| GigaVis (KOSDAQ:A420770) | ₩40850.00 | ₩80645.70 | 49.3% |

| Everest Medicines (SEHK:1952) | HK$53.20 | HK$105.05 | 49.4% |

| Dizal (Jiangsu) Pharmaceutical (SHSE:688192) | CN¥67.78 | CN¥132.90 | 49% |

| Beijing LongRuan Technologies (SHSE:688078) | CN¥30.25 | CN¥59.80 | 49.4% |

| Aecc Aero Science and TechnologyLtd (SHSE:600391) | CN¥28.07 | CN¥54.50 | 48.5% |

We'll examine a selection from our screener results.

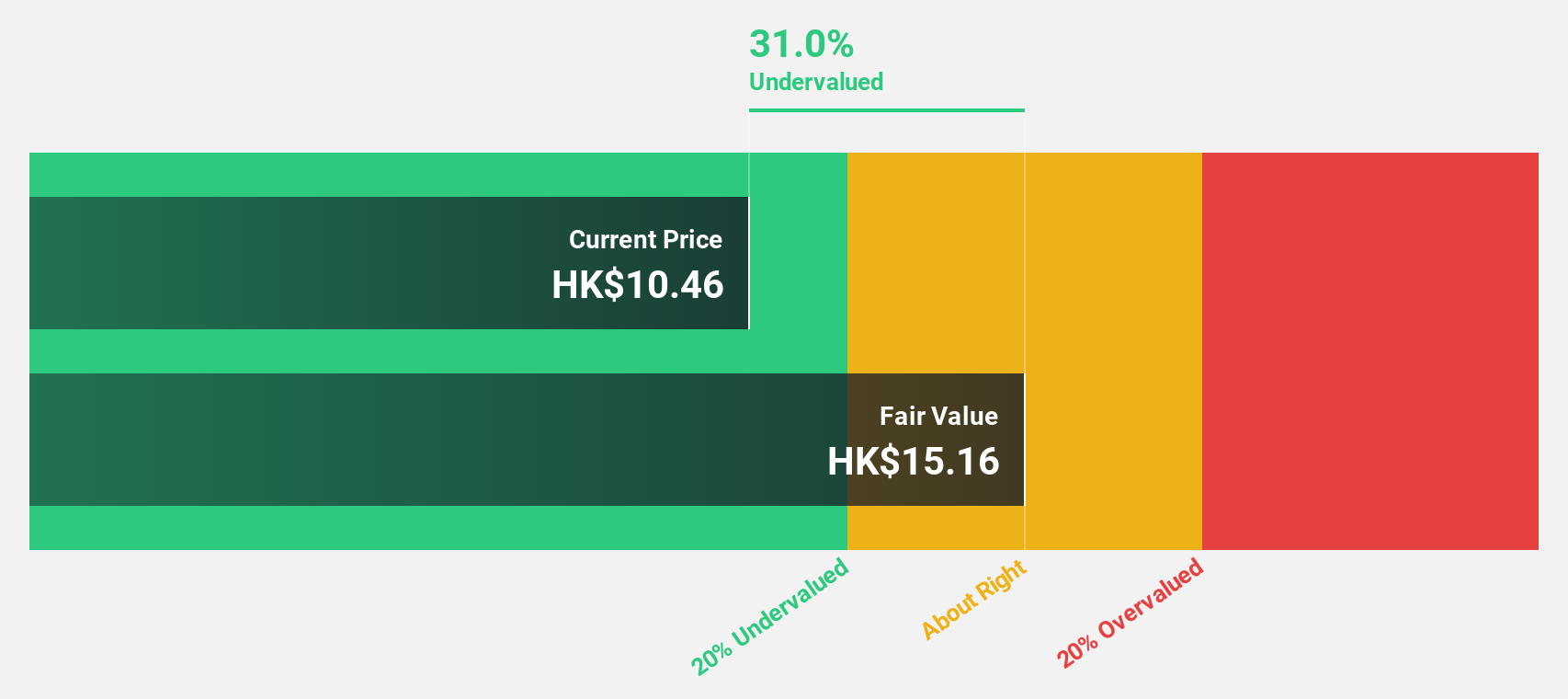

Xiaocaiyuan International Holding (SEHK:999)

Overview: Xiaocaiyuan International Holding Ltd., with a market cap of HK$12.49 billion, operates in the restaurant business in the People’s Republic of China as an investment holding company.

Operations: The company generates revenue primarily from its restaurant operations, amounting to CN¥3.23 billion, and its delivery business, contributing CN¥2.13 billion.

Estimated Discount To Fair Value: 33.2%

Xiaocaiyuan International Holding is currently trading at a substantial discount, approximately 33.2% below its estimated fair value of HK$15.89, based on discounted cash flow analysis. The company's earnings are projected to grow significantly at 24.5% annually, outpacing the Hong Kong market average. Recent financial results show a notable increase in net income to CNY 382.4 million for the half-year ended June 2025, reflecting improved operational efficiency and cost control measures.

- The analysis detailed in our Xiaocaiyuan International Holding growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Xiaocaiyuan International Holding.

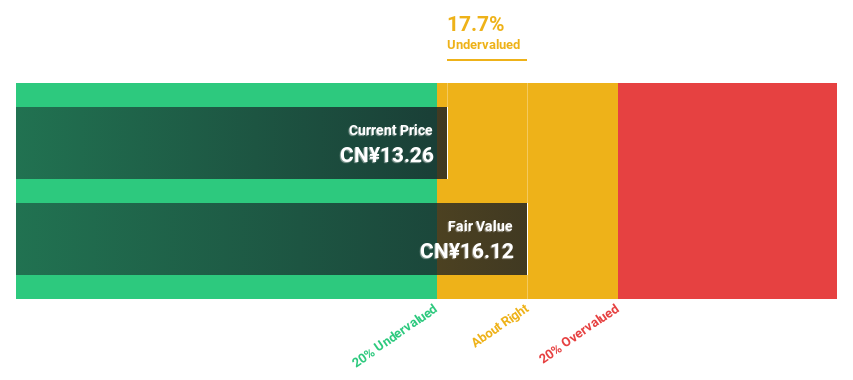

Inner Mongolia Xingye Silver&Tin MiningLtd (SZSE:000426)

Overview: Inner Mongolia Xingye Silver&Tin Mining Co., Ltd operates in China, focusing on the mining and smelting of non-ferrous and precious metals, with a market capitalization of CN¥64.46 billion.

Operations: The company generates revenue primarily from its mining industry segment, amounting to CN¥4.51 billion.

Estimated Discount To Fair Value: 27.3%

Inner Mongolia Xingye Silver & Tin Mining Ltd is trading at a significant discount, 27.3% below its estimated fair value of CN¥49.93, according to a discounted cash flow analysis. Despite recent earnings showing a decline in net income to CN¥795.68 million for the half-year ended June 2025, revenue increased to CN¥2,473.1 million from the previous year. The company's projected annual earnings growth of 25% remains robust compared to market averages despite recent volatility in share price.

- Upon reviewing our latest growth report, Inner Mongolia Xingye Silver&Tin MiningLtd's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Inner Mongolia Xingye Silver&Tin MiningLtd with our detailed financial health report.

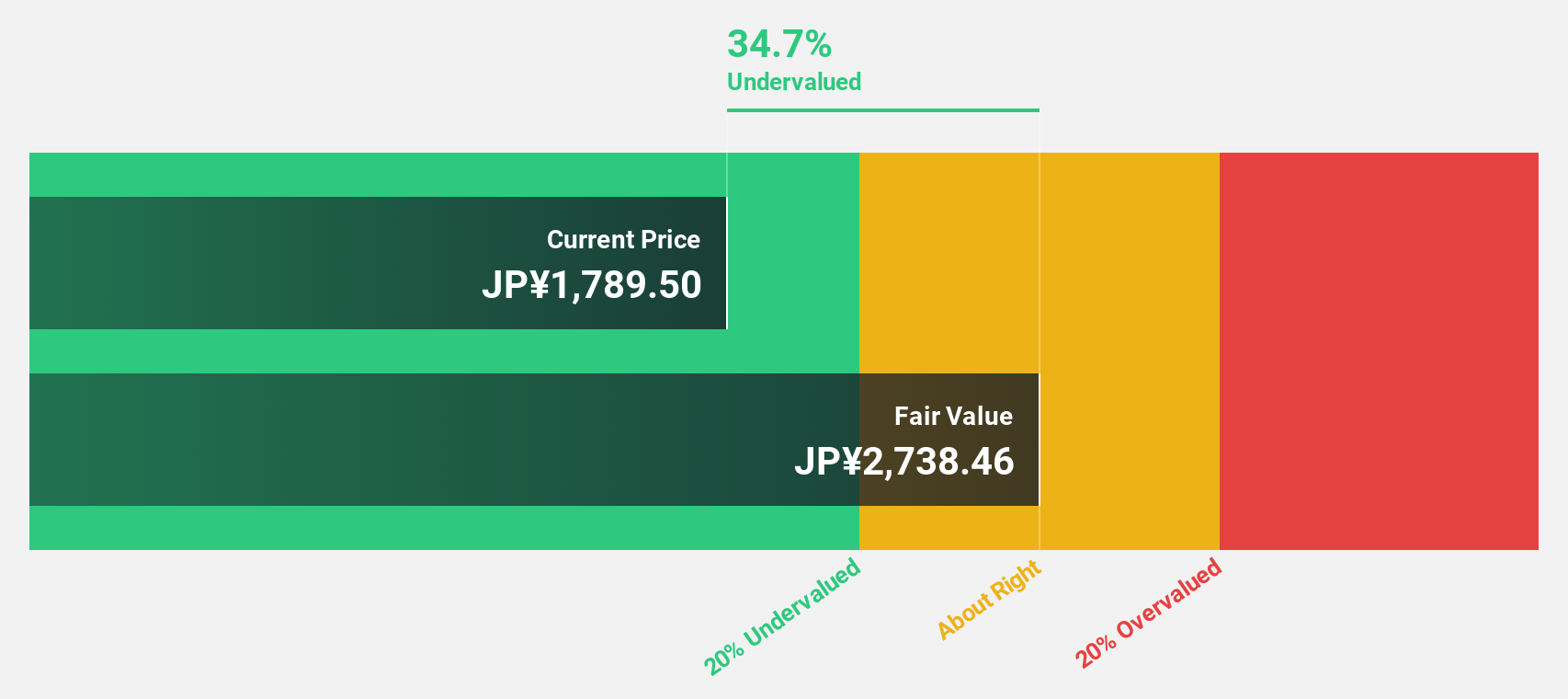

Rorze (TSE:6323)

Overview: Rorze Corporation designs, develops, manufactures, and sells automation systems for semiconductor and flat panel display production globally, with a market cap of ¥417.36 billion.

Operations: The company generates revenue from the design, development, manufacture, and sale of automation systems for semiconductor and flat panel display production on a global scale.

Estimated Discount To Fair Value: 11.9%

Rorze is trading 11.9% below its estimated fair value of ¥2,731.74, suggesting potential undervaluation based on cash flows. Despite a recent decline in profit margins to 14.4% from 22.8%, the company forecasts annual earnings growth of 19.5%, outpacing the JP market's average of 8%. Recent share buybacks totaling ¥4,999.94 million might reflect management's confidence but have not stabilized its highly volatile share price over the past three months.

- According our earnings growth report, there's an indication that Rorze might be ready to expand.

- Dive into the specifics of Rorze here with our thorough financial health report.

Key Takeaways

- Unlock more gems! Our Undervalued Asian Stocks Based On Cash Flows screener has unearthed 276 more companies for you to explore.Click here to unveil our expertly curated list of 279 Undervalued Asian Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:000426

Inner Mongolia Xingye Silver&Tin MiningLtd

Engages in mining and smelting non-ferrous and precious metals in China.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives