- Japan

- /

- Specialty Stores

- /

- TSE:7564

Investors in WorkmanLtd (TSE:7564) have unfortunately lost 30% over the last five years

While not a mind-blowing move, it is good to see that the Workman Co.,Ltd. (TSE:7564) share price has gained 25% in the last three months. But over the last half decade, the stock has not performed well. After all, the share price is down 34% in that time, significantly under-performing the market.

It's worthwhile assessing if the company's economics have been moving in lockstep with these underwhelming shareholder returns, or if there is some disparity between the two. So let's do just that.

Check out our latest analysis for WorkmanLtd

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

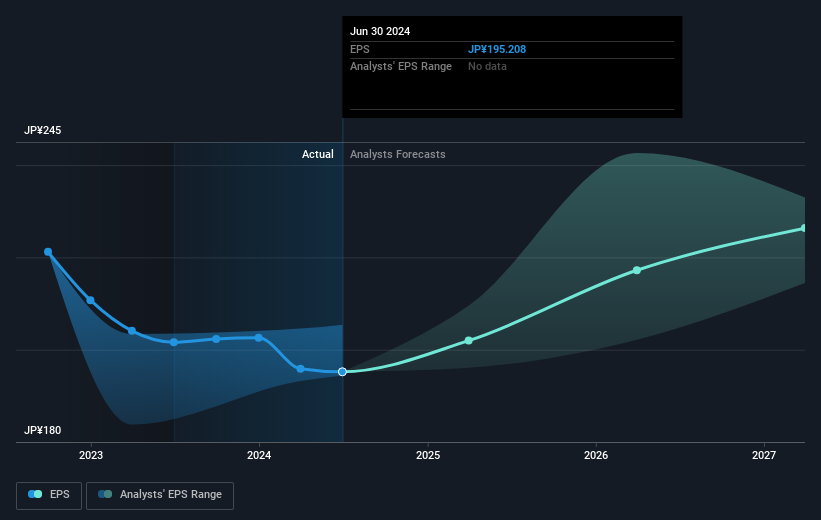

Looking back five years, both WorkmanLtd's share price and EPS declined; the latter at a rate of 6.1% per year. Readers should note that the share price has fallen faster than the EPS, at a rate of 8% per year, over the period. This implies that the market is more cautious about the business these days.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into WorkmanLtd's key metrics by checking this interactive graph of WorkmanLtd's earnings, revenue and cash flow.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between WorkmanLtd's total shareholder return (TSR) and its share price change, which we've covered above. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. We note that WorkmanLtd's TSR, at -30% is higher than its share price return of -34%. When you consider it hasn't been paying a dividend, this data suggests shareholders have benefitted from a spin-off, or had the opportunity to acquire attractively priced shares in a discounted capital raising.

A Different Perspective

Investors in WorkmanLtd had a tough year, with a total loss of 8.1%, against a market gain of about 11%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 5% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. Is WorkmanLtd cheap compared to other companies? These 3 valuation measures might help you decide.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: many of them are unnoticed AND have attractive valuation).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

Valuation is complex, but we're here to simplify it.

Discover if WorkmanLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:7564

Flawless balance sheet with limited growth.

Market Insights

Community Narratives