As global markets rally with U.S. stocks reaching record highs amid optimism over trade policies and AI investments, investors are keenly observing the implications of these developments on their portfolios. In this dynamic environment, dividend stocks can offer a measure of stability and income potential, making them an attractive consideration for those looking to navigate the evolving economic landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.25% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.04% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.67% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.49% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.45% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.01% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.41% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.46% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.04% | ★★★★★★ |

Click here to see the full list of 1981 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited is an investment holding company that distributes information technology products across Singapore, Greater China, Australia, India, and internationally with a market cap of SGD255.87 million.

Operations: Multi-Chem Limited generates revenue from several segments: SGD68.30 million from India - IT Business, SGD142.69 million from Others - IT Business, SGD46.00 million from Australia - IT Business, SGD389.78 million from Singapore - IT Business, and SGD1.63 million from Singapore - PCB Business.

Dividend Yield: 9.1%

Multi-Chem reported a slight decline in quarterly earnings, with net income dropping to S$7.11 million from S$9.21 million year-over-year, though nine-month earnings improved. The dividend yield remains attractive at 9.08%, placing it among the top in Singapore's market; however, its dividend history is volatile and unstable over the past decade. Despite this instability, dividends are covered by both earnings and cash flow with payout ratios of 79.8% and 72.7%, respectively.

- Take a closer look at Multi-Chem's potential here in our dividend report.

- According our valuation report, there's an indication that Multi-Chem's share price might be on the cheaper side.

DoshishaLtd (TSE:7483)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Doshisha Co., Ltd. plans, develops, produces, and sells lifestyle-related products in Japan and internationally, with a market cap of ¥71.63 billion.

Operations: Doshisha Co., Ltd. generates revenue primarily from its Wholesale Business, which accounts for ¥46.17 billion, and its Development Business Model, contributing ¥58.88 billion.

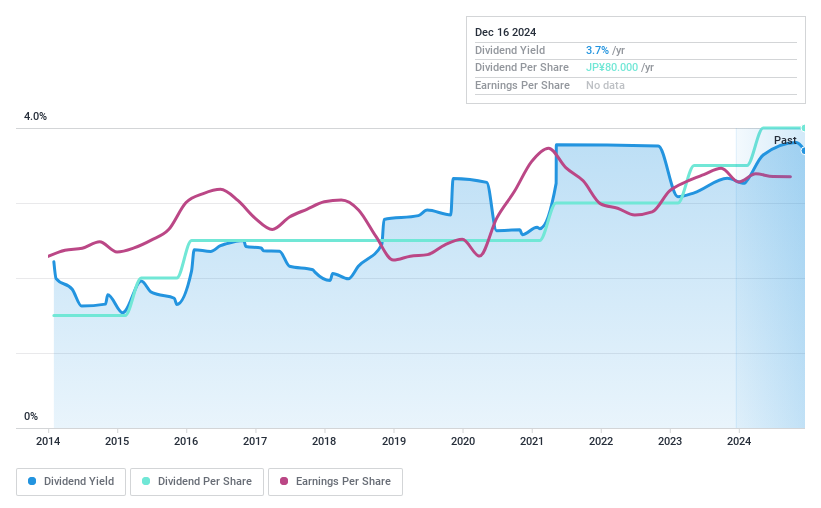

Dividend Yield: 3.8%

Doshisha Ltd. offers an attractive dividend yield of 3.81%, ranking within the top 25% in Japan's market, with stable and growing dividends over the past decade. Recent increases saw dividends rise from ¥35 to ¥40 per share for Q2 2024, payable on December 3, 2024. The company's payout ratios of 44.8% and cash flow coverage at 30.7% indicate sustainability, supported by trading significantly below its estimated fair value.

- Get an in-depth perspective on DoshishaLtd's performance by reading our dividend report here.

- In light of our recent valuation report, it seems possible that DoshishaLtd is trading beyond its estimated value.

Marusan Securities (TSE:8613)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Marusan Securities Co., Ltd. operates in the financial products trading sector in Japan with a market capitalization of ¥67.25 billion.

Operations: Marusan Securities Co., Ltd.'s revenue from its financial products trading business in Japan is ¥19.13 billion.

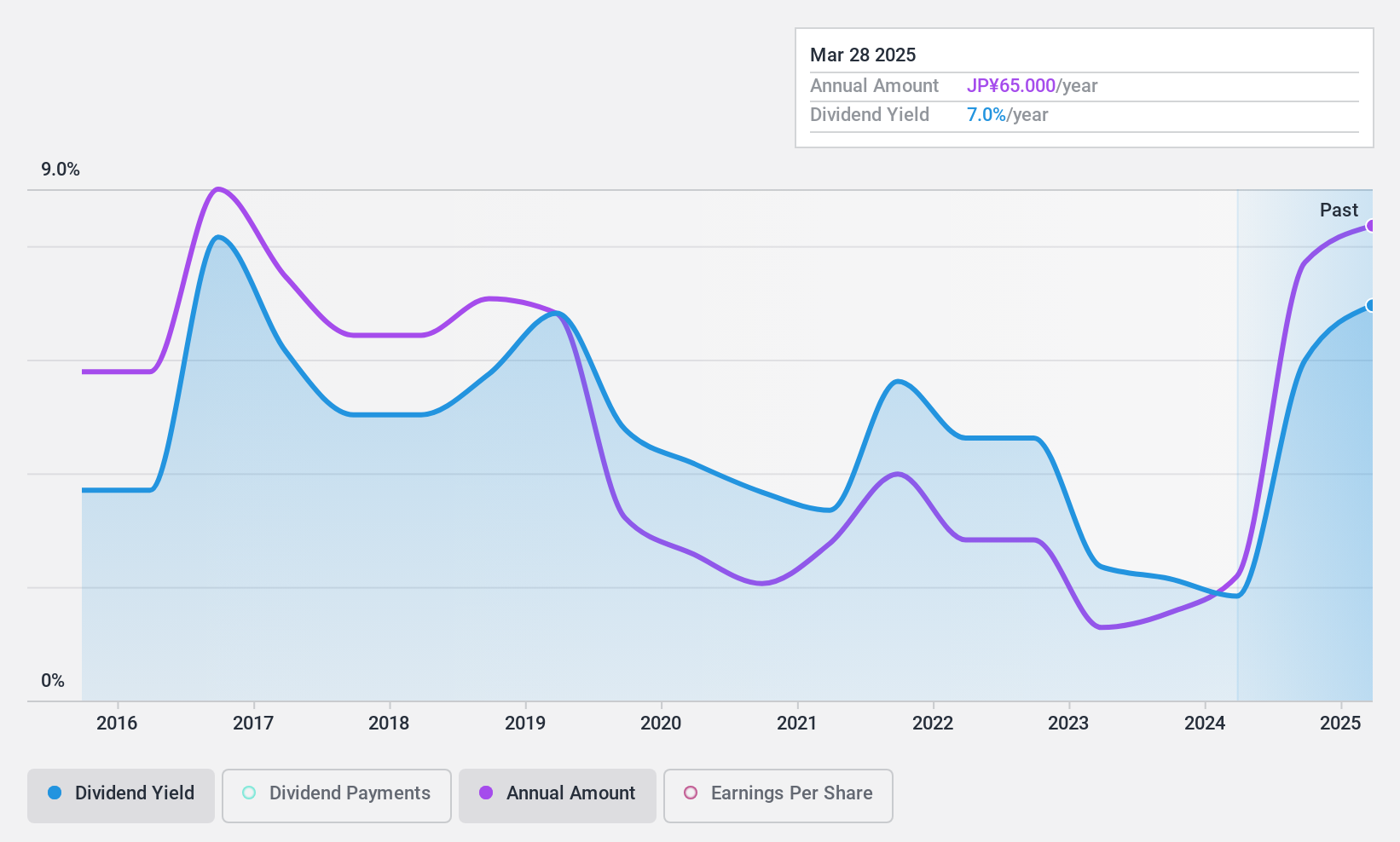

Dividend Yield: 6.2%

Marusan Securities boasts a high dividend yield of 6.23%, placing it among the top 25% in Japan's market, though its dividend history has been volatile, with past annual drops exceeding 20%. Despite this instability, dividends have grown over the last decade. The company's payout ratio of 73.8% and cash payout ratio of 33.5% suggest dividends are well-covered by earnings and cash flows, supported by a significant earnings growth of ¥74.3 billion last year.

- Unlock comprehensive insights into our analysis of Marusan Securities stock in this dividend report.

- Our valuation report here indicates Marusan Securities may be overvalued.

Make It Happen

- Access the full spectrum of 1981 Top Dividend Stocks by clicking on this link.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:AWZ

Multi-Chem

An investment holding company, distributes information technology products in Singapore, Greater China, Australia, India, and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives