Vanguard founder Jack Bogle helped spearhead the low-cost index fund, putting average returns within reach of every investor. But if you pick the right individual stocks, you could make more than that. For example, the USS Co., Ltd. (TSE:4732) share price is up 39% in the last three years, slightly above the market return. Zooming in, the stock is up just 1.7% in the last year.

Now it's worth having a look at the company's fundamentals too, because that will help us determine if the long term shareholder return has matched the performance of the underlying business.

Check out our latest analysis for USS

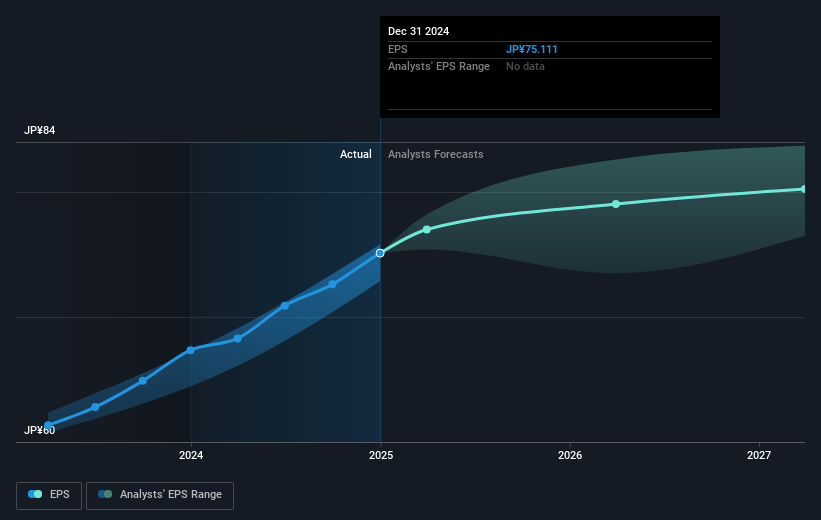

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

USS was able to grow its EPS at 64% per year over three years, sending the share price higher. This EPS growth is higher than the 12% average annual increase in the share price. Therefore, it seems the market has moderated its expectations for growth, somewhat.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

It is of course excellent to see how USS has grown profits over the years, but the future is more important for shareholders. Take a more thorough look at USS' financial health with this free report on its balance sheet.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of USS, it has a TSR of 53% for the last 3 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

USS shareholders gained a total return of 4.9% during the year. But that was short of the market average. If we look back over five years, the returns are even better, coming in at 10% per year for five years. It's quite possible the business continues to execute with prowess, even as the share price gains are slowing. Importantly, we haven't analysed USS' dividend history. This free visual report on its dividends is a must-read if you're thinking of buying.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Japanese exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4732

Flawless balance sheet established dividend payer.

Market Insights

Community Narratives