- China

- /

- Electronic Equipment and Components

- /

- SHSE:688002

January 2025's Top Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As we step into 2025, the global markets are reflecting a mixed sentiment with U.S. stocks concluding another strong year despite recent volatility and economic indicators showing signs of contraction in certain regions. Amid these fluctuations, investor interest often gravitates towards growth companies with high insider ownership, as these entities may demonstrate potential resilience and alignment between management and shareholder interests in navigating uncertain market conditions.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| Medley (TSE:4480) | 34% | 27.2% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We're going to check out a few of the best picks from our screener tool.

Raytron TechnologyLtd (SHSE:688002)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Raytron Technology Co., Ltd. specializes in the research, development, design, manufacturing, and sales of uncooled infrared imaging and MEMS sensor technology in China, with a market capitalization of approximately CN¥20.29 billion.

Operations: Raytron Technology Co., Ltd. generates its revenue primarily through the development and sale of uncooled infrared imaging and MEMS sensor technology in China.

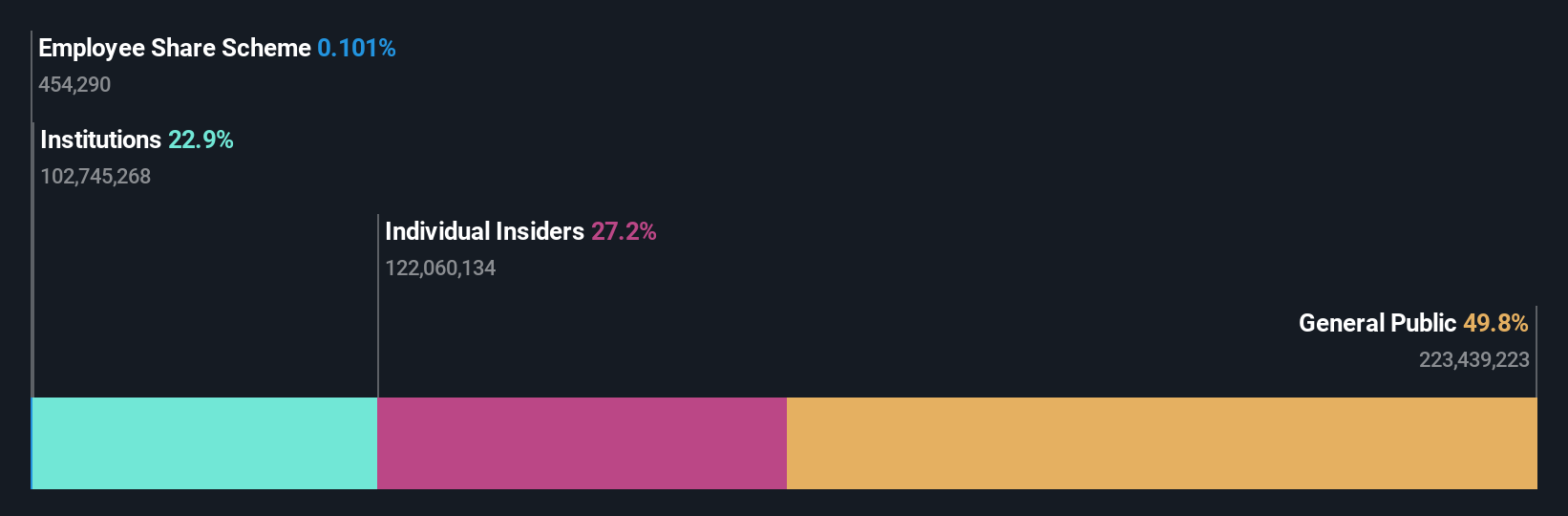

Insider Ownership: 26.9%

Earnings Growth Forecast: 28.7% p.a.

Raytron Technology Ltd. demonstrates potential as a growth company with high insider ownership, as earnings are forecast to grow significantly at 28.7% annually, outpacing the Chinese market's 25.2%. Its price-to-earnings ratio of 34.4x is favorable compared to the industry average of 44.7x, suggesting good value relative to peers. Despite slower revenue growth forecasts, recent earnings reports show increased sales and net income year-over-year, while the company completed a share buyback program worth CNY 65.01 million.

- Get an in-depth perspective on Raytron TechnologyLtd's performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Raytron TechnologyLtd is priced lower than what may be justified by its financials.

Sharetronic Data Technology (SZSE:300857)

Simply Wall St Growth Rating: ★★★★★★

Overview: Sharetronic Data Technology Co., Ltd. is a provider of wireless IoT products operating in China and internationally, with a market cap of CN¥25.63 billion.

Operations: Unfortunately, the information provided does not include specific revenue segments or amounts for Sharetronic Data Technology Co., Ltd.

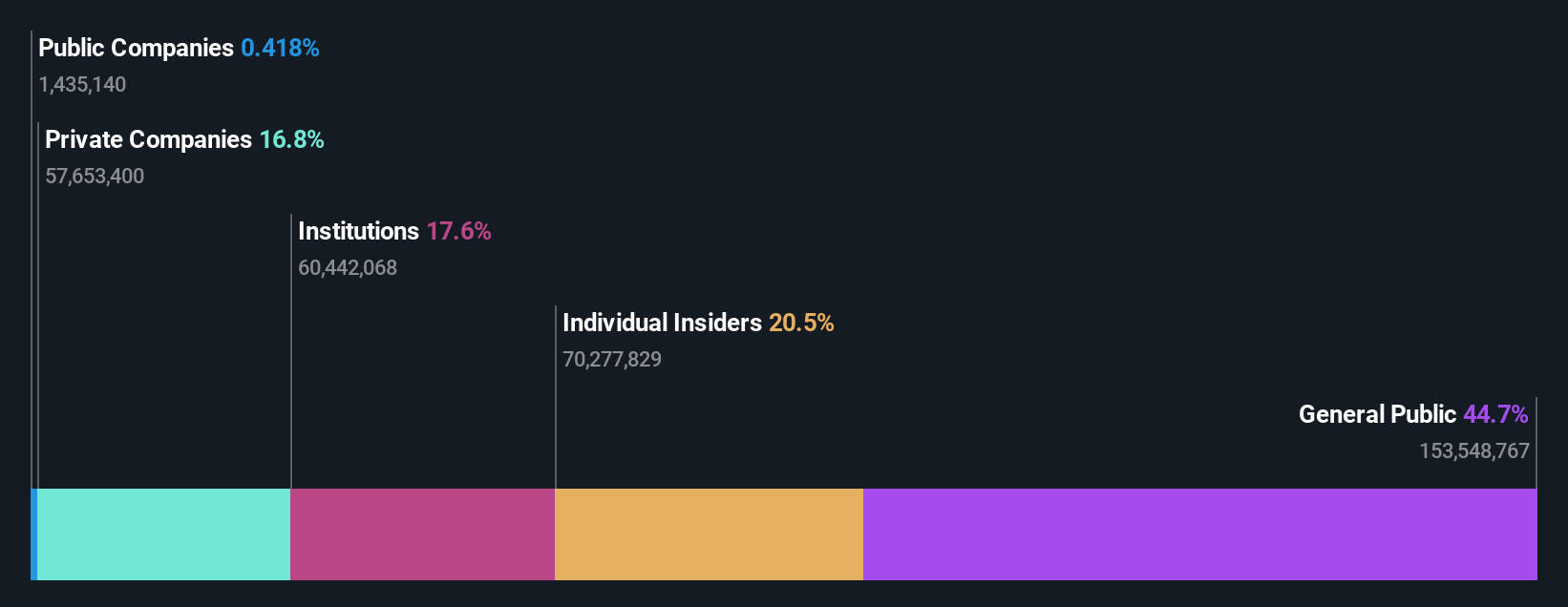

Insider Ownership: 23.5%

Earnings Growth Forecast: 29.1% p.a.

Sharetronic Data Technology's earnings are forecast to grow significantly at 29.07% annually, surpassing the Chinese market's 25.2%, while its revenue growth is also expected to outpace the market. The company's price-to-earnings ratio of 39.4x is below the tech industry average, indicating good value compared to peers. Recent financials reveal a substantial increase in net income and revenue year-over-year, alongside its addition to key Shenzhen Stock Exchange indices, highlighting its growing prominence.

- Dive into the specifics of Sharetronic Data Technology here with our thorough growth forecast report.

- Our valuation report here indicates Sharetronic Data Technology may be undervalued.

World (TSE:3612)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: World Co., Ltd. operates through its subsidiaries to plan, manufacture, retail, sell, and import/export apparel and fashion products both in Japan and internationally, with a market capitalization of ¥83.61 billion.

Operations: World Co., Ltd.'s revenue is generated from planning, manufacturing, retailing, selling, and importing/exporting apparel and fashion products across domestic and international markets.

Insider Ownership: 13.9%

Earnings Growth Forecast: 23.6% p.a.

World Co., Ltd. is positioned for significant earnings growth at 23.62% annually, outpacing the JP market's 7.9%. Despite a high debt level, the stock trades at 77.7% below its estimated fair value, suggesting potential undervaluation. Recent revisions in earnings and dividend forecasts indicate improved financial performance, with revenue projected at ¥230 billion and profit attributable to owners of parent at ¥11.1 billion for FY2025. However, its return on equity remains forecasted low at 14.5%.

- Navigate through the intricacies of World with our comprehensive analyst estimates report here.

- In light of our recent valuation report, it seems possible that World is trading behind its estimated value.

Turning Ideas Into Actions

- Click through to start exploring the rest of the 1480 Fast Growing Companies With High Insider Ownership now.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688002

Raytron TechnologyLtd

Engages in the research and development, design, manufacturing, and sales of uncooled infrared imagining and MEMS sensor technology in China.

Solid track record with excellent balance sheet.