- China

- /

- Semiconductors

- /

- SZSE:300666

Spotlight on Shenzhen Fastprint Circuit TechLtd and 2 Other Insider-Owned Growth Leaders

Reviewed by Simply Wall St

As global markets navigate a mixed landscape, with the S&P 500 Index closing out a strong year despite recent volatility and economic indicators like the Chicago PMI showing signs of contraction, investors continue to seek opportunities in growth companies that demonstrate resilience and potential. In this context, stocks with high insider ownership can be particularly appealing as they often indicate management's confidence in the company's future prospects.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 23.8% | 37.6% |

| Medley (TSE:4480) | 34% | 27.2% |

| Pharma Mar (BME:PHM) | 11.9% | 56.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.3% | 66.3% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 111.4% |

| Findi (ASX:FND) | 34.8% | 112.9% |

Here we highlight a subset of our preferred stocks from the screener.

Shenzhen Fastprint Circuit TechLtd (SZSE:002436)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Shenzhen Fastprint Circuit Tech Co., Ltd. manufactures and sells printed circuit boards (PCBs) both in China and internationally, with a market cap of CN¥17.40 billion.

Operations: The company's revenue is derived from the manufacturing and sale of printed circuit boards (PCBs) both domestically and internationally.

Insider Ownership: 26.2%

Revenue Growth Forecast: 17.6% p.a.

Shenzhen Fastprint Circuit Tech Ltd. has seen its revenue grow to CNY 4.35 billion for the first nine months of 2024, but it reported a net loss of CNY 31.6 million compared to a profit last year. While earnings are projected to grow significantly at nearly 65% annually, revenue growth is slower than desired at 17.6%. The company faces challenges with debt coverage and low future return on equity, yet it's expected to become profitable within three years.

- Take a closer look at Shenzhen Fastprint Circuit TechLtd's potential here in our earnings growth report.

- According our valuation report, there's an indication that Shenzhen Fastprint Circuit TechLtd's share price might be on the expensive side.

Konfoong Materials International (SZSE:300666)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Konfoong Materials International Co., Ltd. operates in the materials industry and has a market cap of CN¥17.43 billion.

Operations: The company generates revenue of CN¥3.38 billion from the Computer, Communications, and other Electronic Equipment Manufacturing segment.

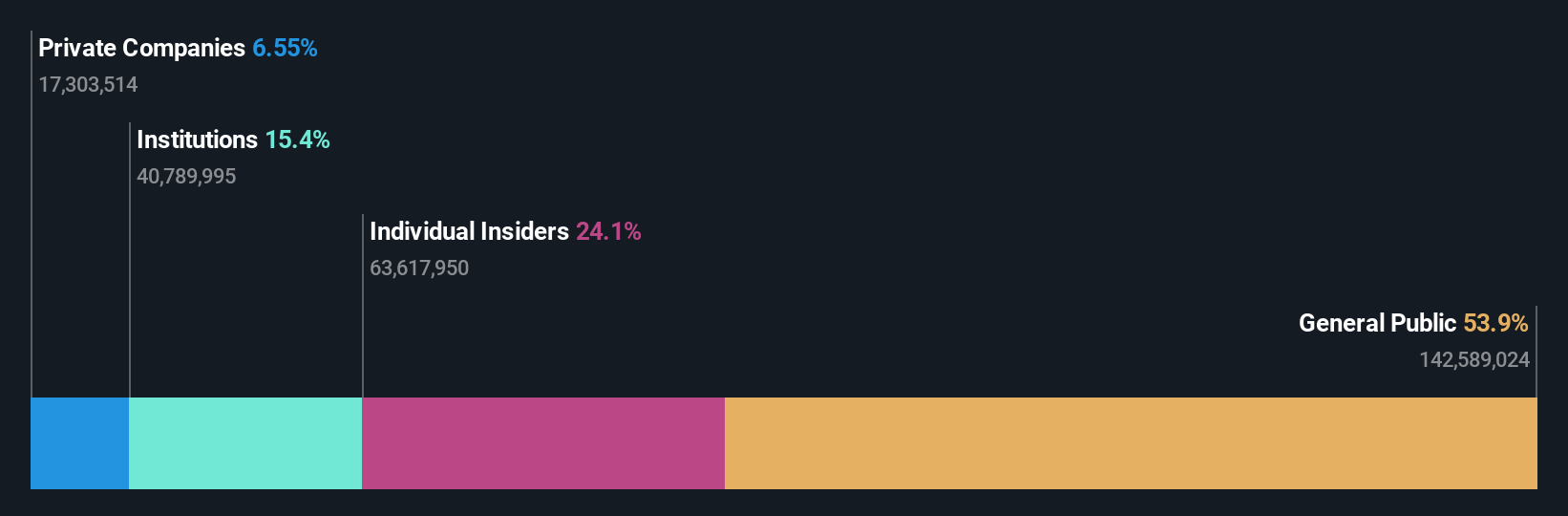

Insider Ownership: 24.1%

Revenue Growth Forecast: 23.1% p.a.

Konfoong Materials International reported strong growth, with sales reaching CNY 2.63 billion for the first nine months of 2024, up from CNY 1.85 billion the previous year. Earnings are expected to grow significantly at over 23% annually, outpacing China's market revenue growth forecast of 13.5%. Despite a lower return on equity forecast of 10.7%, its price-to-earnings ratio is favorable compared to industry averages, indicating potential value in the semiconductor sector.

- Click here and access our complete growth analysis report to understand the dynamics of Konfoong Materials International.

- In light of our recent valuation report, it seems possible that Konfoong Materials International is trading beyond its estimated value.

Zhejiang Top Cloud-agri TechnologyLtd (SZSE:301556)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Zhejiang Top Cloud-agri Technology Co., Ltd. (SZSE:301556) operates in the agricultural technology sector with a market capitalization of CN¥7.13 billion.

Operations: Unfortunately, the provided text does not include specific revenue segment data for Zhejiang Top Cloud-agri Technology Co., Ltd. If you have additional details or another source of information on their revenue segments, please share it so I can assist you further.

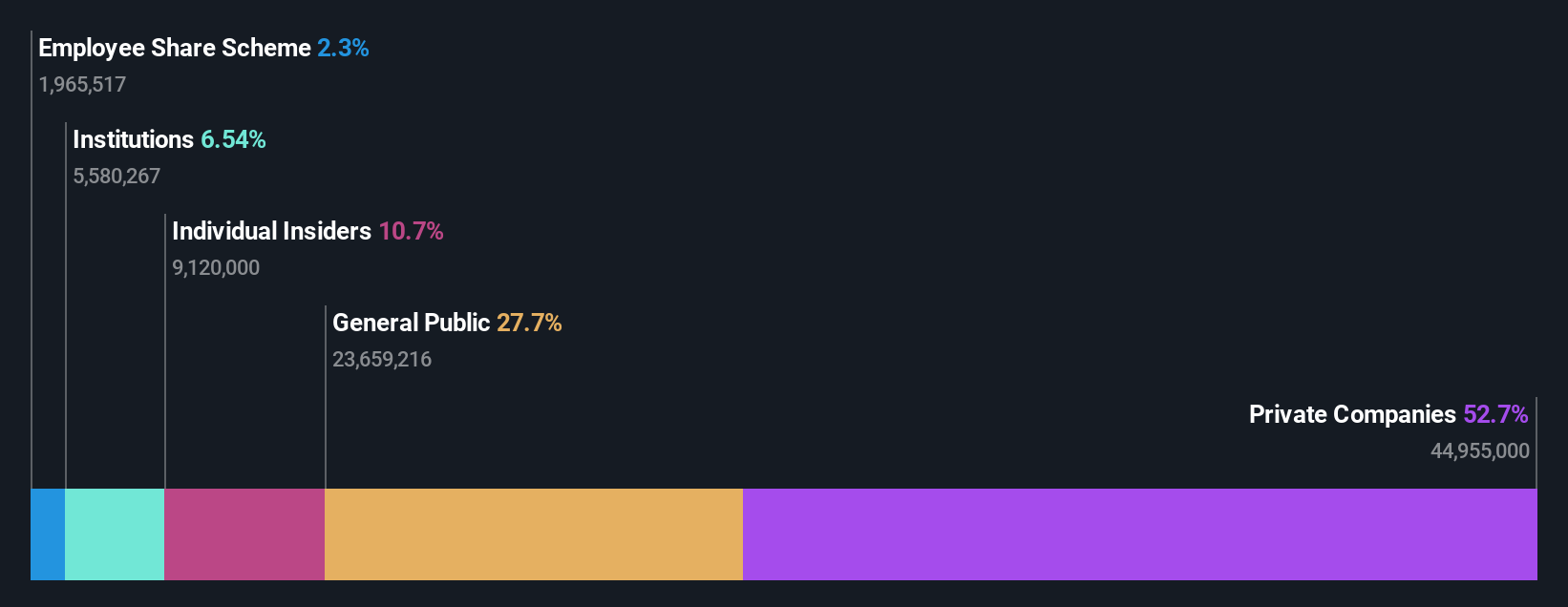

Insider Ownership: 10.7%

Revenue Growth Forecast: 30.6% p.a.

Zhejiang Top Cloud-agri Technology showcases robust growth potential, with revenue and earnings projected to grow significantly faster than the Chinese market, at 30.6% and 31.1% annually, respectively. Despite a volatile share price recently, the company reported sales of CNY 335.51 million for the first nine months of 2024, an increase from CNY 302.3 million in the previous year. The recent IPO raised CNY 309.14 million, enhancing its financial position for future expansion initiatives.

- Navigate through the intricacies of Zhejiang Top Cloud-agri TechnologyLtd with our comprehensive analyst estimates report here.

- The valuation report we've compiled suggests that Zhejiang Top Cloud-agri TechnologyLtd's current price could be inflated.

Where To Now?

- Gain an insight into the universe of 1483 Fast Growing Companies With High Insider Ownership by clicking here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Konfoong Materials International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300666

Konfoong Materials International

Konfoong Materials International Co., Ltd.

Excellent balance sheet with reasonable growth potential.