- China

- /

- Auto Components

- /

- SZSE:301550

Undiscovered Gems to Explore This January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets reflect a complex landscape with U.S. stocks closing out a strong year despite mixed performances in the final week and economic indicators such as the Chicago PMI highlighting ongoing challenges in manufacturing. Amid this backdrop, small-cap stocks present intriguing opportunities for investors seeking growth potential, particularly those that can navigate economic shifts and leverage unique market positions.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| Ampire | NA | 1.50% | 11.39% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Underneath we present a selection of stocks filtered out by our screen.

Nanjing LES Information Technology (SHSE:688631)

Simply Wall St Value Rating: ★★★★★★

Overview: Nanjing LES Information Technology Co., Ltd. operates in the technology sector with a market capitalization of CN¥13.28 billion, focusing on providing information technology solutions.

Operations: Nanjing LES Information Technology generates revenue through its information technology solutions. The company's financial performance is highlighted by a notable gross profit margin trend over recent periods.

Earnings for Nanjing LES Information Technology grew by 34.8% over the past year, outperforming the Aerospace & Defense industry's -13.4%. Despite a volatile share price recently, this debt-free company is poised for continued growth with earnings forecasted to rise by 25.73% annually. For the nine months ending September 2024, sales reached CNY 917.65 million, down from CNY 966.65 million previously; however, net income improved to CNY 15.58 million from CNY 12.07 million a year earlier, reflecting an increase in basic earnings per share from CNY 0.09 to CNY 0.1.

- Dive into the specifics of Nanjing LES Information Technology here with our thorough health report.

Understand Nanjing LES Information Technology's track record by examining our Past report.

Zhejiang Sling Automobile Bearing (SZSE:301550)

Simply Wall St Value Rating: ★★★★★★

Overview: Zhejiang Sling Automobile Bearing Co., Ltd. specializes in the production of automotive bearings and related components, with a market cap of CN¥7.76 billion.

Operations: With a primary revenue stream from Auto Parts & Accessories amounting to CN¥764.93 million, Zhejiang Sling Automobile Bearing Co., Ltd. focuses on automotive bearings and related components.

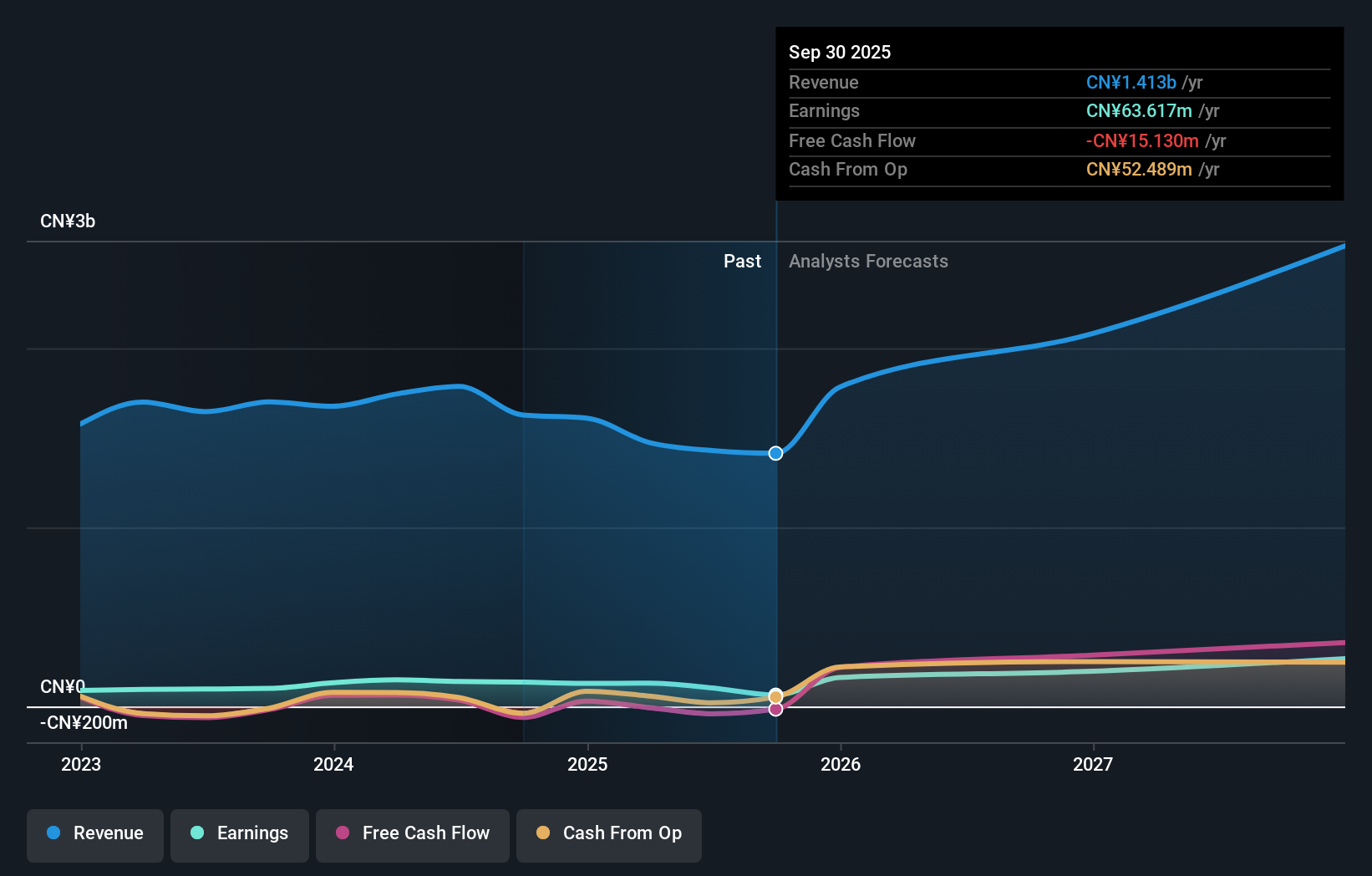

Zhejiang Sling Automobile Bearing, operating in the auto components sector, has shown impressive earnings growth of 31.7% over the past year, outpacing the industry average of 10.5%. The company reported sales of CNY 556.77 million for the first nine months ending September 2024, an increase from CNY 529.96 million a year earlier. Net income also rose to CNY 136.84 million from CNY 106.79 million last year, reflecting solid financial performance despite a highly volatile share price recently observed over three months. Notably debt-free now compared to five years ago when its debt-to-equity ratio was at 47.7%, it suggests improved financial health and stability moving forward without concerns about interest coverage due to zero debt levels currently held by them as well as high-quality non-cash earnings contributing positively towards overall profitability outlooks ahead given forecasts indicating continued annual growth rates nearing approximately twenty percent annually expected soon enough too!

Insyde Software (TPEX:6231)

Simply Wall St Value Rating: ★★★★★★

Overview: Insyde Software Corp. offers system firmware and software engineering services to global clients in the mobile, desktop, server, and embedded systems sectors with a market cap of NT$16.94 billion.

Operations: Revenue primarily stems from software and programming, totaling NT$1.56 billion.

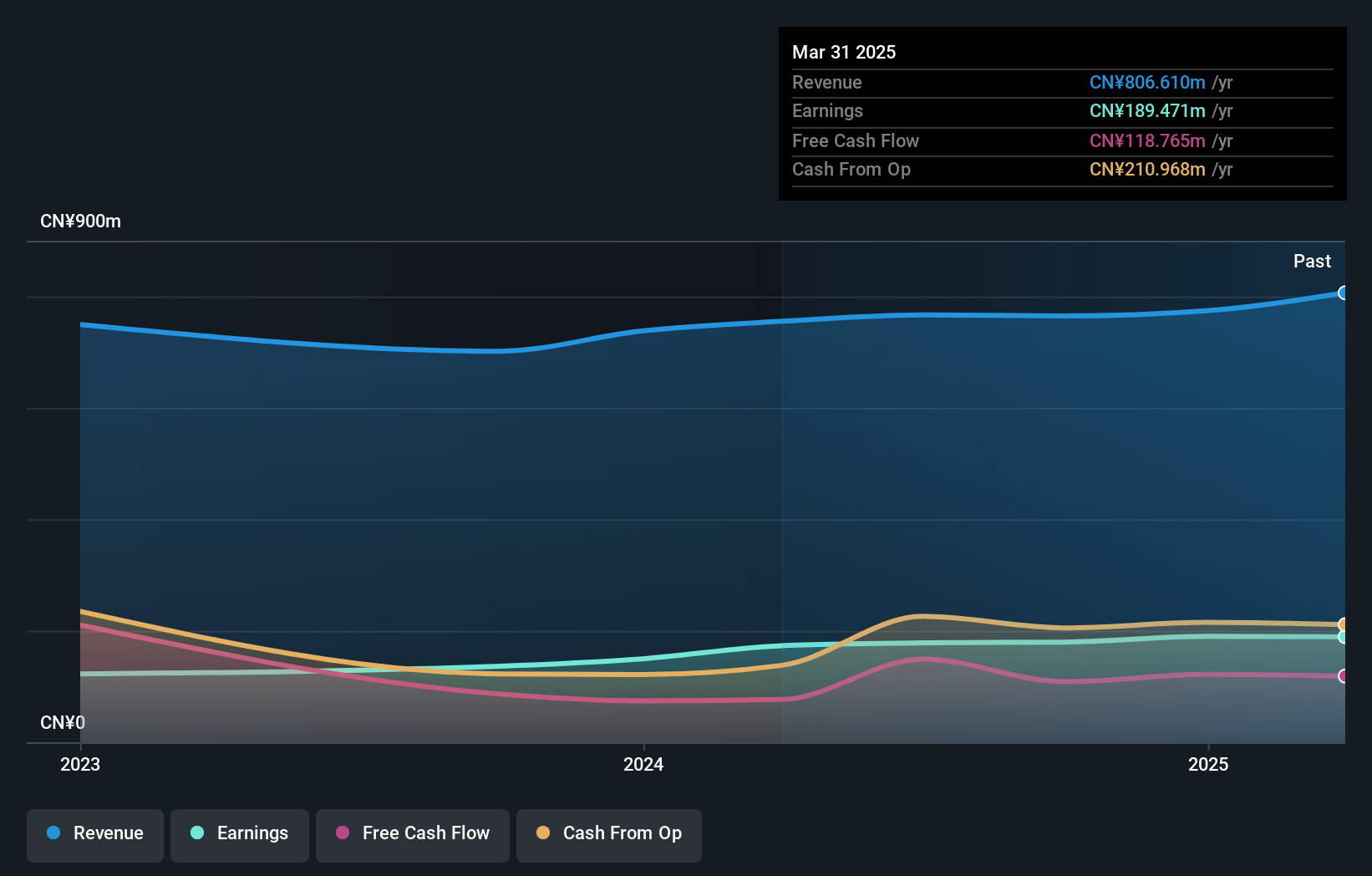

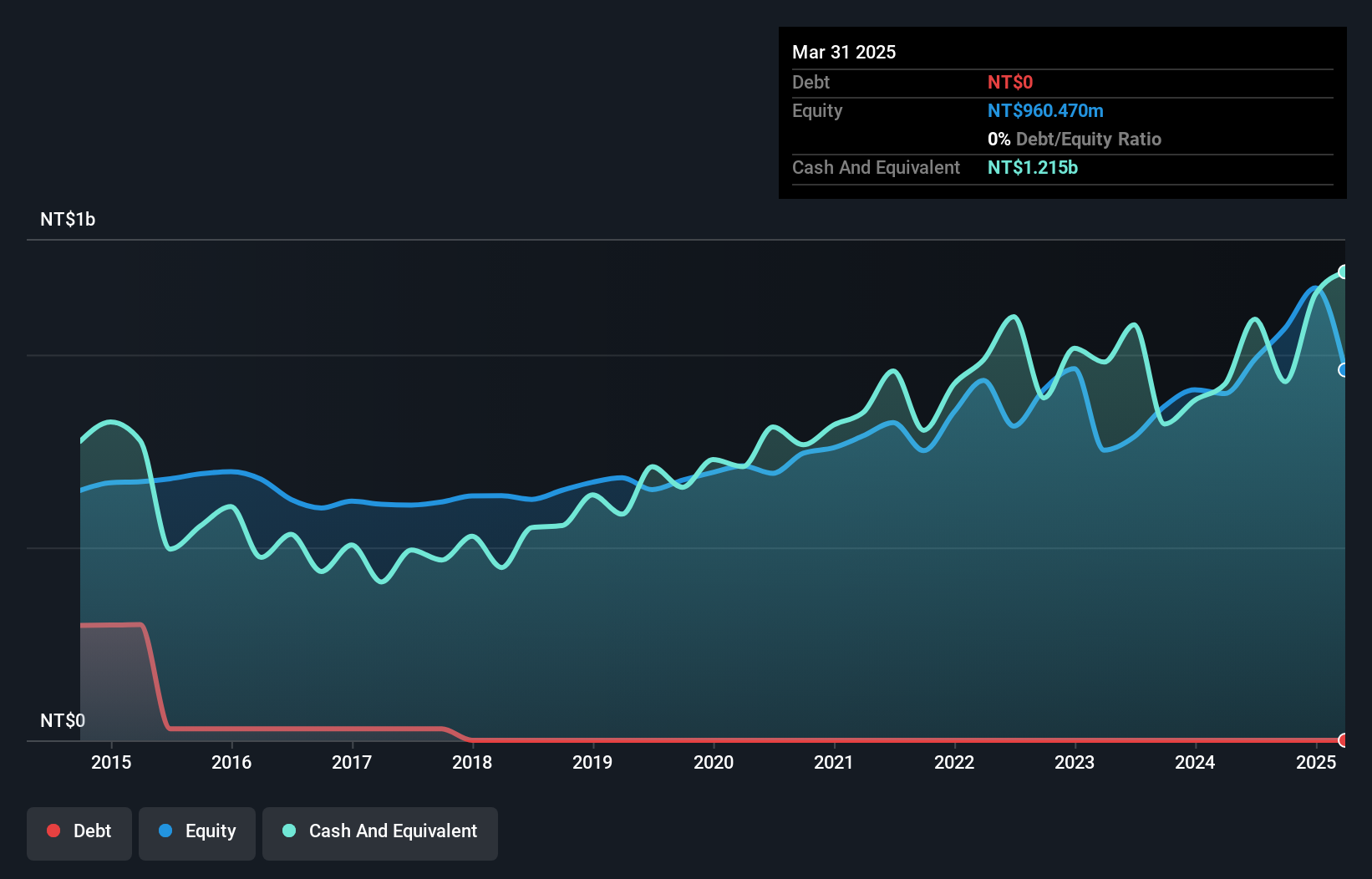

Insyde Software, a nimble player in the tech industry, showcases impressive financial health with no debt and positive free cash flow. Recent earnings growth of 62% outpaced the broader software sector's 17%, highlighting its competitive edge. The company trades at a significant discount, about 56% below estimated fair value, suggesting potential upside for investors. Recent quarterly results show revenue climbing to TWD 413 million from TWD 357 million year-on-year, while net income rose to TWD 88 million from TWD 69 million. Leadership changes in R&D may signal strategic realignments aimed at sustaining innovation and growth momentum.

- Click here to discover the nuances of Insyde Software with our detailed analytical health report.

Gain insights into Insyde Software's past trends and performance with our Past report.

Next Steps

- Access the full spectrum of 4660 Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang Sling Automobile Bearing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:301550

Zhejiang Sling Automobile Bearing

Zhejiang Sling Automobile Bearing Co., Ltd.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives