- China

- /

- Electronic Equipment and Components

- /

- SZSE:002056

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets navigate a mixed start to 2025, with the S&P 500 and Nasdaq Composite closing out another strong year despite recent fluctuations, investors are keenly observing economic indicators like the Chicago PMI and GDP forecasts for signs of future trends. Amidst this backdrop, dividend stocks continue to attract attention for their potential to provide steady income streams, especially during periods of market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.30% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.58% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.72% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.53% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.51% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.60% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.47% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

Click here to see the full list of 1997 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Pacific Basin Shipping (SEHK:2343)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Pacific Basin Shipping Limited is an investment holding company that provides dry bulk shipping services globally, with a market capitalization of approximately HK$8.32 billion.

Operations: Pacific Basin Shipping Limited generates revenue primarily from its dry bulk shipping services, amounting to $2.43 billion.

Dividend Yield: 6%

Pacific Basin Shipping's dividend is well covered by earnings and cash flows, with payout ratios of 44.6% and 30.1%, respectively, suggesting sustainability despite a volatile history over the past decade. Recent board changes may impact governance temporarily, as the Audit Committee currently lacks required members. The stock trades significantly below estimated fair value but offers a lower yield compared to top-tier Hong Kong dividend payers, reflecting potential growth rather than immediate high income returns.

- Navigate through the intricacies of Pacific Basin Shipping with our comprehensive dividend report here.

- In light of our recent valuation report, it seems possible that Pacific Basin Shipping is trading behind its estimated value.

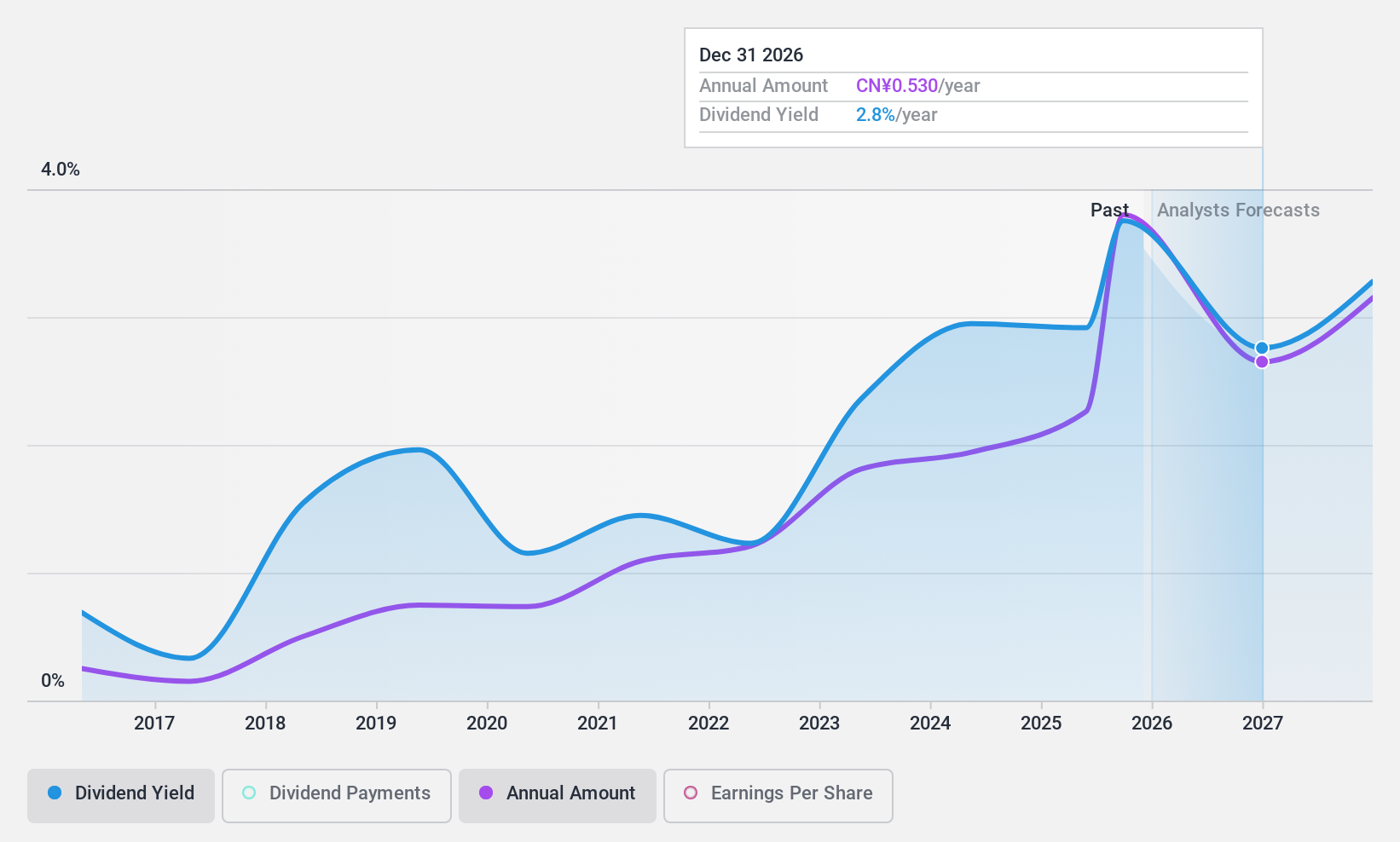

China Merchants Bank (SHSE:600036)

Simply Wall St Dividend Rating: ★★★★★★

Overview: China Merchants Bank Co., Ltd., along with its subsidiaries, offers a range of banking products and services and has a market capitalization of approximately CN¥977.10 billion.

Operations: China Merchants Bank Co., Ltd. operates through various revenue segments, including retail banking, corporate banking, and treasury operations.

Dividend Yield: 5.1%

China Merchants Bank's dividend yield of 5.06% is among the top in China's market, with stable and growing payouts over the past decade. The dividends are well covered by earnings, indicated by a low payout ratio of 35.2%, ensuring sustainability. Recent board changes and a CNY 30 billion fixed-income offering highlight ongoing strategic maneuvers, while trading at a significant discount to estimated fair value suggests potential capital appreciation alongside dividend income.

- Click to explore a detailed breakdown of our findings in China Merchants Bank's dividend report.

- Our valuation report here indicates China Merchants Bank may be overvalued.

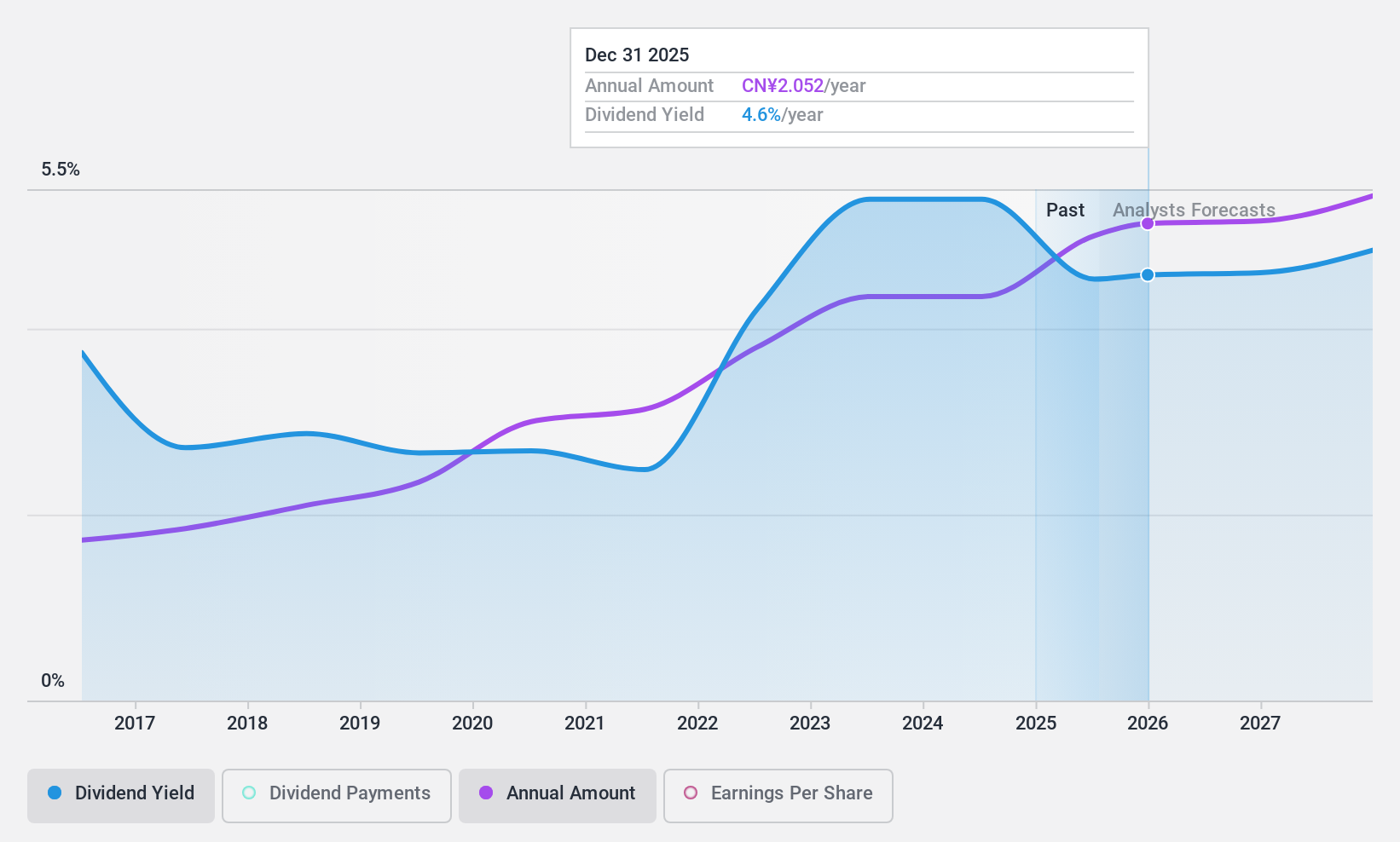

Hengdian Group DMEGC Magnetics Ltd (SZSE:002056)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Hengdian Group DMEGC Magnetics Ltd operates in the production of magnetic materials, components, PV solar products, and lithium-ion batteries both in China and internationally, with a market cap of CN¥20.37 billion.

Operations: Hengdian Group DMEGC Magnetics Ltd generates revenue from its magnetic materials, components, PV solar products, and lithium-ion batteries segments.

Dividend Yield: 3.1%

Hengdian Group DMEGC Magnetics Ltd. offers a dividend yield of 3.06%, ranking in the top 25% of CN market payers, though its dividends have been volatile and not well covered by cash flows, with a high cash payout ratio of 429%. While earnings cover the dividends with a reasonable payout ratio of 57.6%, recent buybacks totaling CNY 280.73 million reflect strategic financial maneuvers amid declining sales and profits over the past year.

- Click here to discover the nuances of Hengdian Group DMEGC Magnetics Ltd with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Hengdian Group DMEGC Magnetics Ltd is priced lower than what may be justified by its financials.

Seize The Opportunity

- Navigate through the entire inventory of 1997 Top Dividend Stocks here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade Hengdian Group DMEGC Magnetics Ltd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Hengdian Group DMEGC Magnetics Ltd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002056

Hengdian Group DMEGC Magnetics Ltd

Provides magnetic materials, components, PV solar products, and lithium-ion batteries in China and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives