- China

- /

- Electrical

- /

- SHSE:688006

Three Companies Estimated To Be Priced Below Value In January 2025

Reviewed by Simply Wall St

As we step into January 2025, global markets present a mixed picture, with U.S. equities closing out another strong year despite recent volatility and economic indicators like the Chicago PMI highlighting ongoing challenges in manufacturing. Amidst this backdrop of fluctuating indices and economic signals, investors often seek opportunities in stocks perceived to be undervalued, which can offer potential for growth when market conditions stabilize or improve. Identifying such stocks involves evaluating their intrinsic value relative to their current market price, particularly during periods of profit-taking or economic uncertainty as seen recently.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Avant Group (TSE:3836) | ¥1881.00 | ¥3755.69 | 49.9% |

| NBTM New Materials Group (SHSE:600114) | CN¥15.55 | CN¥31.01 | 49.8% |

| Sudarshan Chemical Industries (BSE:506655) | ₹1120.30 | ₹2231.24 | 49.8% |

| Emporiki Eisagogiki Aftokiniton Ditrohon kai Mihanon Thalassis Societe Anonyme (ATSE:MOTO) | €2.725 | €5.45 | 50% |

| Hyundai Rotem (KOSE:A064350) | ₩54300.00 | ₩108421.71 | 49.9% |

| W5 Solutions (OM:W5) | SEK46.85 | SEK93.57 | 49.9% |

| Mr. Cooper Group (NasdaqCM:COOP) | US$93.54 | US$186.41 | 49.8% |

| Exosens (ENXTPA:EXENS) | €22.42 | €44.72 | 49.9% |

| Vogo (ENXTPA:ALVGO) | €2.93 | €5.85 | 49.9% |

| iFLYTEKLTD (SZSE:002230) | CN¥45.41 | CN¥90.62 | 49.9% |

Here's a peek at a few of the choices from the screener.

Zhejiang HangKe Technology (SHSE:688006)

Overview: Zhejiang HangKe Technology Incorporated Company specializes in designing, developing, producing, and selling lithium-ion battery post-processing systems for the charging and discharging industry both in China and internationally, with a market cap of CN¥10.20 billion.

Operations: Revenue segments for Zhejiang HangKe Technology focus on the design, development, production, and sale of lithium-ion battery post-processing systems for the charging and discharging industry in China and abroad.

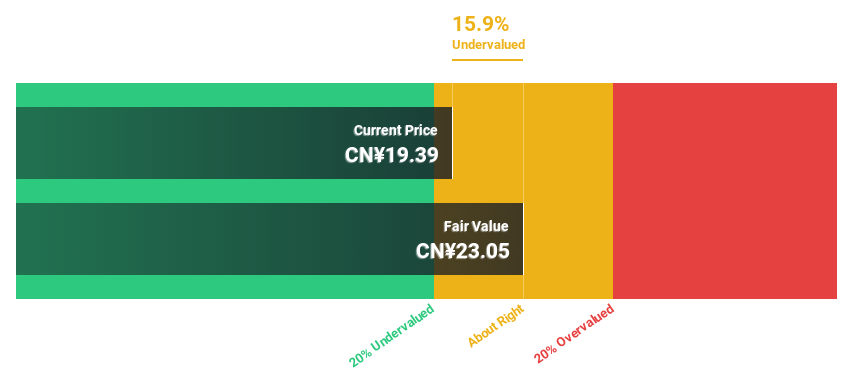

Estimated Discount To Fair Value: 24.2%

Zhejiang HangKe Technology is trading at CNY 16.95, significantly below its estimated fair value of CNY 22.35, indicating it may be undervalued based on cash flows. Despite a decline in net income to CNY 375.85 million from last year's CNY 713.75 million, the company's revenue and earnings are forecast to grow faster than the Chinese market at rates of 24.4% and 38.1% per year respectively, suggesting potential for future growth despite current challenges in profit margins and dividend coverage.

- The analysis detailed in our Zhejiang HangKe Technology growth report hints at robust future financial performance.

- Take a closer look at Zhejiang HangKe Technology's balance sheet health here in our report.

Chengdu Zhimingda Electronics (SHSE:688636)

Overview: Chengdu Zhimingda Electronics Co., Ltd. specializes in providing customized embedded modules and solutions in China, with a market cap of CN¥2.86 billion.

Operations: The company generates revenue of CN¥472.61 million from its Aerospace & Defense segment.

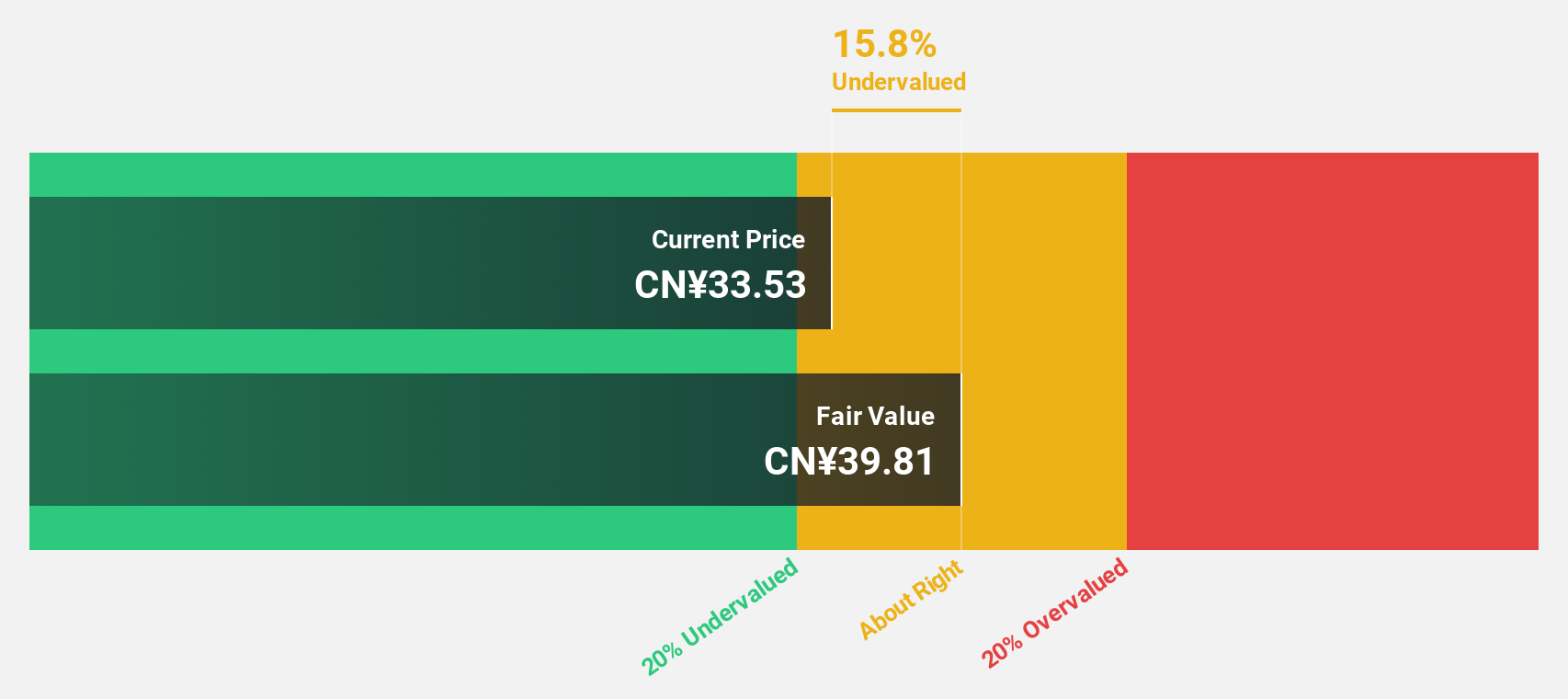

Estimated Discount To Fair Value: 18.5%

Chengdu Zhimingda Electronics, trading at CN¥26.16, is undervalued compared to its fair value estimate of CN¥32.08. Despite current challenges with declining sales and a net loss of CN¥9.16 million for the nine months ending September 2024, the company's revenue and earnings are projected to grow significantly faster than the Chinese market at 30.6% and 63.7% per year respectively, highlighting strong potential for future growth despite recent profit margin declines due to large one-off items impacting results.

- Our growth report here indicates Chengdu Zhimingda Electronics may be poised for an improving outlook.

- Unlock comprehensive insights into our analysis of Chengdu Zhimingda Electronics stock in this financial health report.

Alchip Technologies (TWSE:3661)

Overview: Alchip Technologies, Limited, along with its subsidiaries, focuses on the research and development, design, and manufacture of fabless application-specific integrated circuits (ASIC) and system on a chip (SOC) in Japan, Taiwan, and China, with a market cap of NT$247.80 billion.

Operations: The company's revenue primarily comes from its semiconductors segment, which generated NT$48.12 billion.

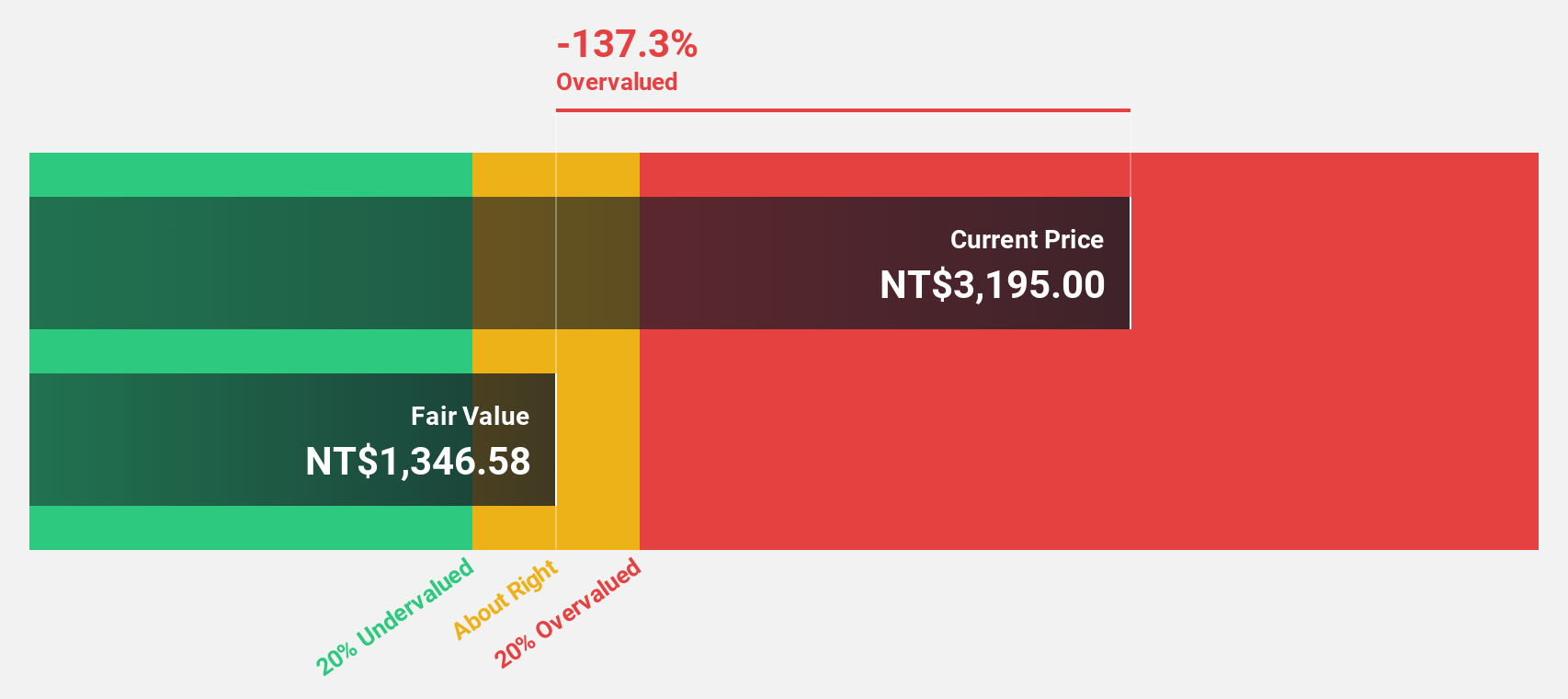

Estimated Discount To Fair Value: 42.8%

Alchip Technologies, trading at NT$3,095, is significantly undervalued with a fair value estimate of NT$5,414.7. Recent earnings show robust growth with net income reaching TWD 1.79 billion in Q3 2024. Despite past shareholder dilution and share price volatility, Alchip's revenue and earnings are forecast to grow substantially faster than the Taiwan market at 23.8% and 29.6% per year respectively, supported by advanced technology developments like the pioneering 2nm test chip initiative.

- Insights from our recent growth report point to a promising forecast for Alchip Technologies' business outlook.

- Get an in-depth perspective on Alchip Technologies' balance sheet by reading our health report here.

Key Takeaways

- Take a closer look at our Undervalued Stocks Based On Cash Flows list of 884 companies by clicking here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zhejiang HangKe Technology might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688006

Zhejiang HangKe Technology

Designs, develops, produces, and sells lithium-ion (Li-ion) battery post-processing systems for charging and discharging industry in China and internationally.

Undervalued with high growth potential.