- China

- /

- Electrical

- /

- SZSE:300822

Undiscovered Gems with Strong Potential for January 2025

Reviewed by Simply Wall St

As 2025 begins, global markets are navigating a mixed landscape with U.S. stocks closing out a strong year despite recent fluctuations and economic indicators such as the Chicago PMI showing signs of contraction in manufacturing activity. Amidst this backdrop, identifying promising small-cap stocks can be particularly rewarding, as these companies often offer unique growth opportunities that may not yet be fully recognized by the broader market.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| Ampire | NA | 1.50% | 11.39% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Shenzhen Bestek Technology (SZSE:300822)

Simply Wall St Value Rating: ★★★★★★

Overview: Shenzhen Bestek Technology Co., Ltd. focuses on the research, development, manufacture, and sale of smart controllers and products both in China and internationally, with a market cap of CN¥6.12 billion.

Operations: Shenzhen Bestek Technology generates revenue primarily through the sale of smart controllers and products. The company has a market capitalization of CN¥6.12 billion, reflecting its scale in the industry.

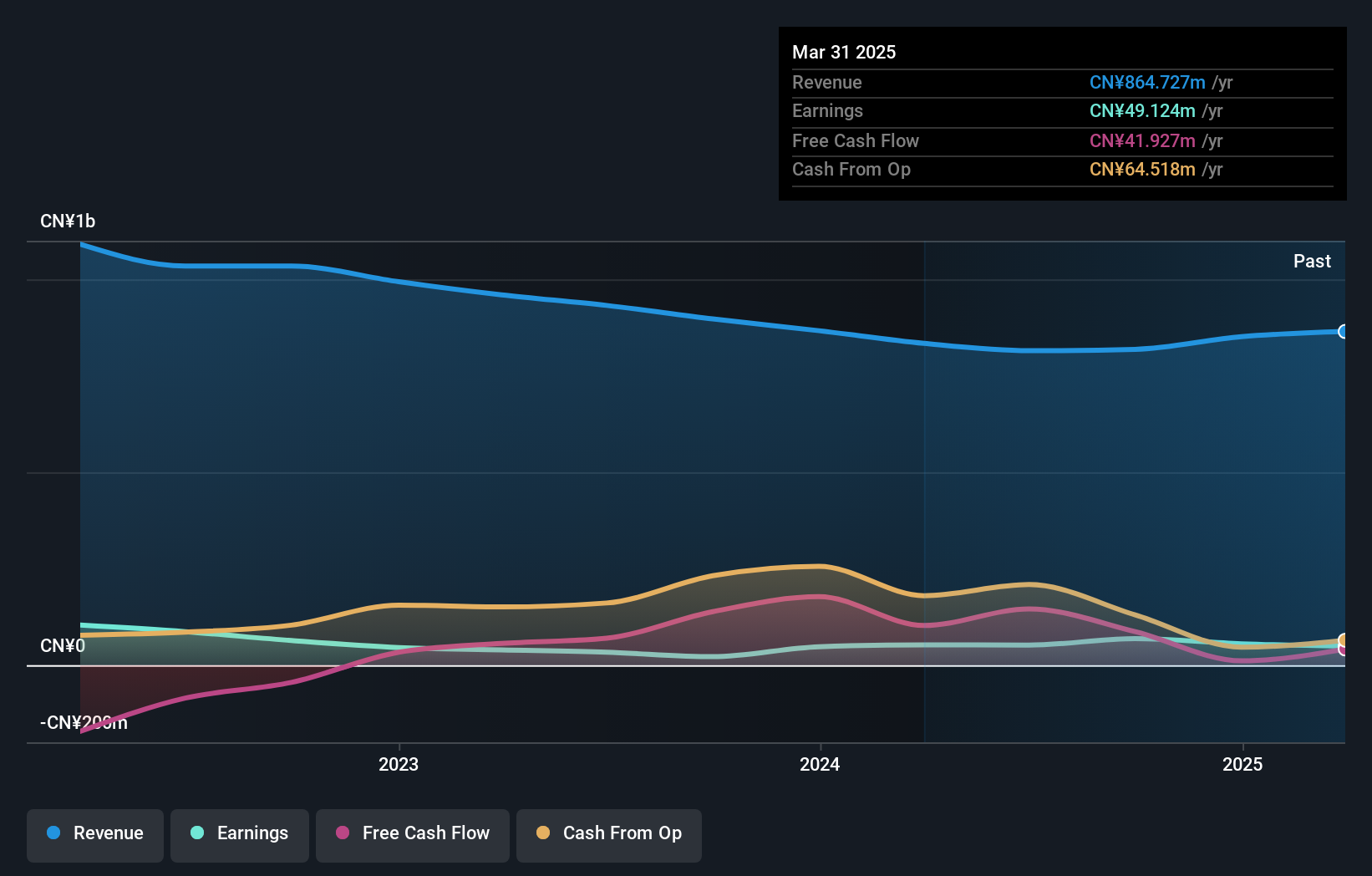

Shenzhen Bestek Technology, a small player in the tech space, has shown impressive earnings growth of 213.5% over the past year, outpacing its industry peers. Despite this surge, sales for the first nine months of 2024 were CNY 650.78 million, down from CNY 699.09 million last year. However, net income rose to CNY 59.65 million from CNY 38.64 million previously, suggesting improved profitability with basic earnings per share climbing to CNY 0.19 from CNY 0.12 a year ago. The company is debt-free and boasts high-quality earnings but faces volatility in its share price recently.

Minami Acoustics (SZSE:301383)

Simply Wall St Value Rating: ★★★★★★

Overview: Minami Acoustics Limited focuses on the research, development, production, and sale of electroacoustic components and accessories in China with a market capitalization of CN¥8.05 billion.

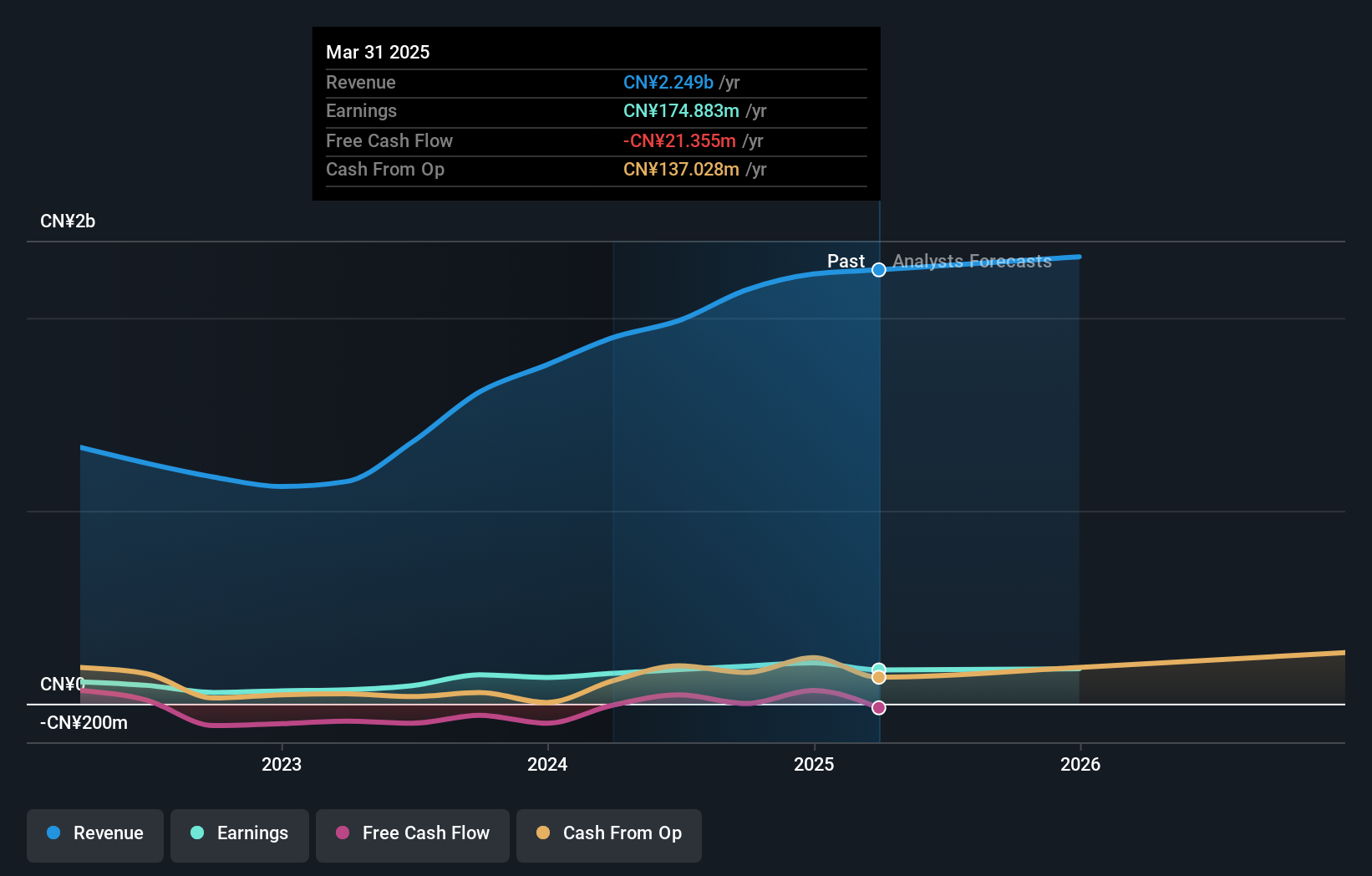

Operations: Minami Acoustics generates revenue primarily from its electronic component segment, totaling CN¥2.14 billion.

Minami Acoustics, a nimble player in the consumer durables sector, has shown impressive earnings growth of 29.4% over the past year, outpacing its industry peers. The company operates debt-free now, a notable improvement from five years ago when it had a debt-to-equity ratio of 52.7%. Recent earnings reports highlight net income rising to CNY 167.75 million for the first nine months of 2024 from CNY 109.7 million in the previous year, with basic earnings per share increasing to CNY 1.03 from CNY 0.81. Despite these financial strengths, its stock price has been highly volatile recently.

- Delve into the full analysis health report here for a deeper understanding of Minami Acoustics.

Evaluate Minami Acoustics' historical performance by accessing our past performance report.

Shenzhen Q&D Circuits (SZSE:301628)

Simply Wall St Value Rating: ★★★★★☆

Overview: Shenzhen Q&D Circuits Co., Ltd. focuses on the manufacturing and distribution of electronic components, with a market capitalization of CN¥5.25 billion.

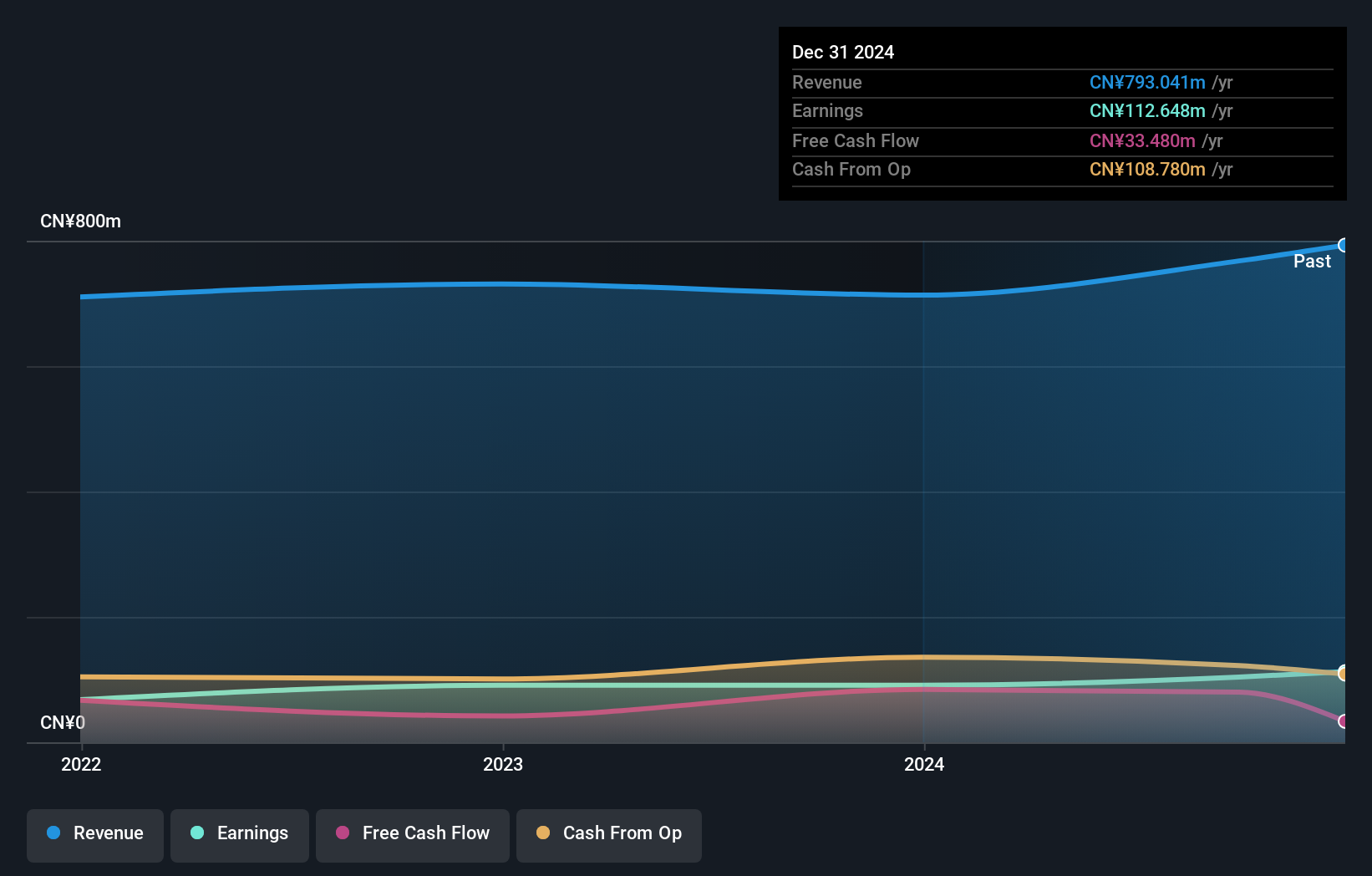

Operations: Q&D Circuits generates revenue primarily from its electronic components and parts segment, amounting to CN¥767.83 million. The company's market capitalization stands at approximately CN¥5.25 billion.

Shenzhen Q&D Circuits, a notable player in the electronics sector, has been making waves with its robust financial performance. Recently added to key indices like the Shenzhen Stock Exchange A Share Index, it reported sales of CNY 585.02 million for nine months ending September 2024, up from CNY 530.4 million last year. The company's net income reached CNY 79.66 million compared to CNY 66.74 million previously, reflecting strong earnings growth at 14.2%, outpacing industry averages. With more cash than debt and interest payments well-covered by EBIT at an impressive ratio of over 342 times, it stands on solid financial ground despite share price volatility in recent months.

- Get an in-depth perspective on Shenzhen Q&D Circuits' performance by reading our health report here.

Summing It All Up

- Get an in-depth perspective on all 4660 Undiscovered Gems With Strong Fundamentals by using our screener here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:300822

Shenzhen Bestek Technology

Engages in the research and development, manufacture, and sale of smart controllers and products in China and internationally.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives