As we enter January 2025, global markets are navigating a mixed landscape with the S&P 500 and Nasdaq Composite closing out another strong year despite recent economic challenges, such as the contraction in Chicago's PMI and a downward revision of GDP forecasts. Amidst these fluctuations, small-cap stocks have shown resilience, exemplified by gains in indices like the Russell 2000, highlighting potential opportunities for investors seeking undiscovered gems. In this environment of cautious optimism, identifying promising stocks often involves looking beyond immediate market sentiment to factors like innovative business models and robust financial health that can thrive even when broader economic indicators suggest uncertainty.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Resource Alam Indonesia | 2.66% | 30.36% | 43.87% | ★★★★★★ |

| Morris State Bancshares | 10.20% | -0.28% | 6.97% | ★★★★★★ |

| Bahrain National Holding Company B.S.C | NA | 20.11% | 5.44% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| An Phat Bioplastics | 58.77% | 10.41% | -1.47% | ★★★★★★ |

| Ampire | NA | 1.50% | 11.39% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| MOBI Industry | 27.54% | 2.93% | 22.05% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Hangzhou Kaierda Welding RobotLtd (SHSE:688255)

Simply Wall St Value Rating: ★★★★★★

Overview: Hangzhou Kaierda Welding Robot Co., Ltd. focuses on the research, development, manufacture, and sale of industrial welding equipment and welding robots in China, with a market cap of CN¥2.73 billion.

Operations: Kaierda generates revenue primarily from the sale of industrial welding equipment and welding robots. The company's cost structure is influenced by manufacturing expenses, which impact its profitability. Its net profit margin has shown fluctuations, reflecting changes in operational efficiency and market conditions.

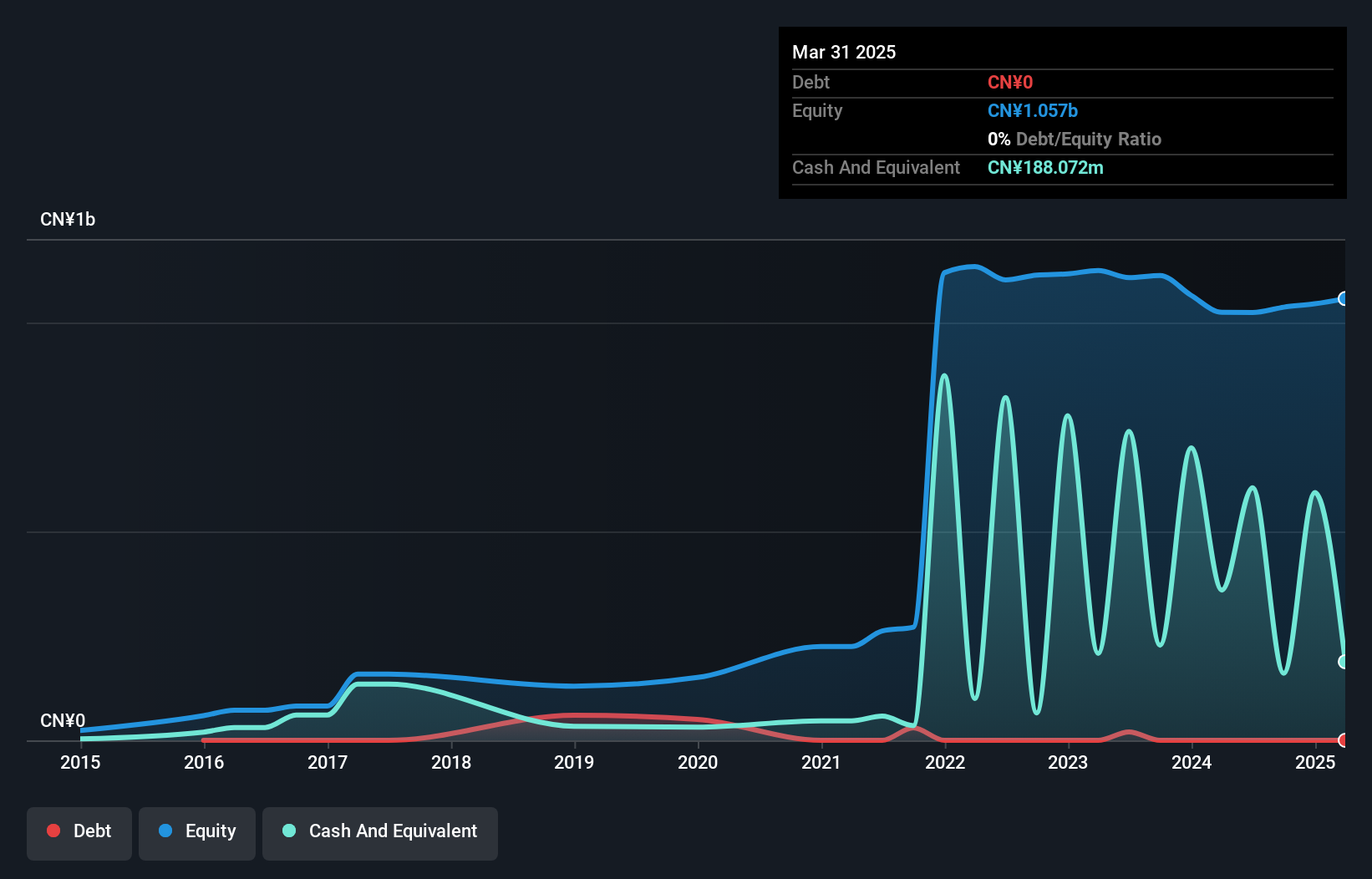

Hangzhou Kaierda, a nimble player in the robotics sector, showcases high-quality earnings and no debt, marking a shift from a 36.2% debt-to-equity ratio five years ago. The company's recent performance is highlighted by sales of CNY 451.56 million for the first nine months of 2024, up from CNY 350.35 million last year, with net income rising to CNY 29.27 million from CNY 16.38 million previously. Despite its volatile share price recently, Hangzhou Kaierda's earnings growth of 95.7% outpaces the machinery industry average significantly while maintaining positive free cash flow and profitability without debt concerns.

- Delve into the full analysis health report here for a deeper understanding of Hangzhou Kaierda Welding RobotLtd.

Learn about Hangzhou Kaierda Welding RobotLtd's historical performance.

Nanjing Hicin Pharmaceutical (SZSE:300584)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Nanjing Hicin Pharmaceutical Co., Ltd. is involved in the research, development, production, and sale of chemical preparations, APIs, and intermediates with a market cap of CN¥2.45 billion.

Operations: Nanjing Hicin generates revenue primarily from its pharmaceuticals segment, which accounts for CN¥500.38 million.

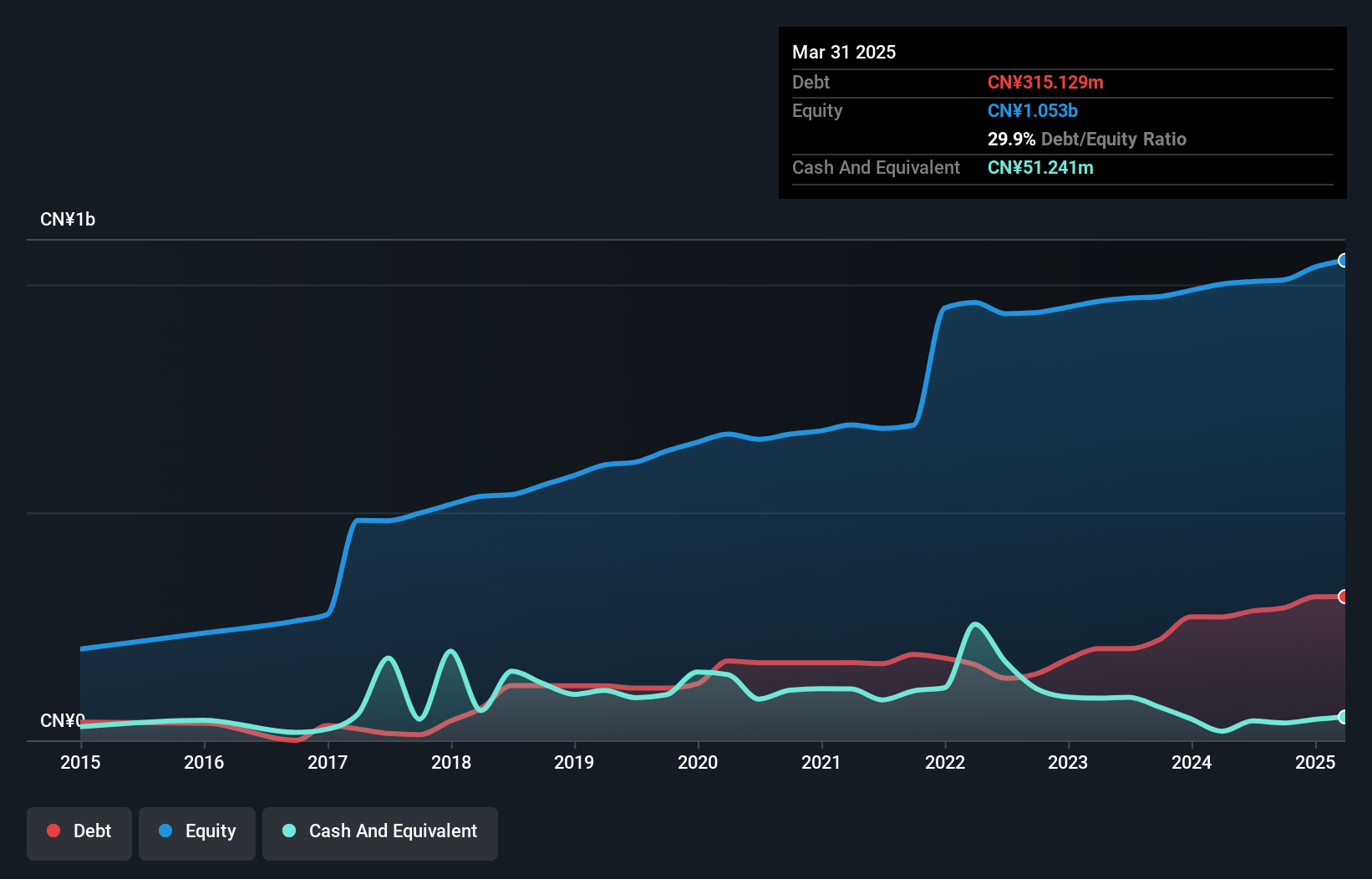

Nanjing Hicin Pharmaceutical, a smaller player in the pharmaceuticals sector, has demonstrated notable earnings growth of 20.8% over the past year, outpacing the industry's -2.5%. Despite a 9.3% annual decline in earnings over five years, recent results show improvement with net income rising to CNY 28.12 million from CNY 22.42 million year-on-year for nine months ending September 2024. The company's debt to equity ratio climbed from 18% to 28.8% over five years; however, its net debt to equity remains satisfactory at 25%. Earnings per share increased as well, indicating potential resilience amidst industry challenges.

Shenzhen Cotran New MaterialLtd (SZSE:300731)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Shenzhen Cotran New Material Co., Ltd. specializes in manufacturing and providing waterproof and sealing insulation products and solutions in China, with a market cap of CN¥2.78 billion.

Operations: Shenzhen Cotran New Material Co., Ltd. generates revenue primarily from the production and sales of high-performance special rubber sealing materials, amounting to CN¥794.50 million.

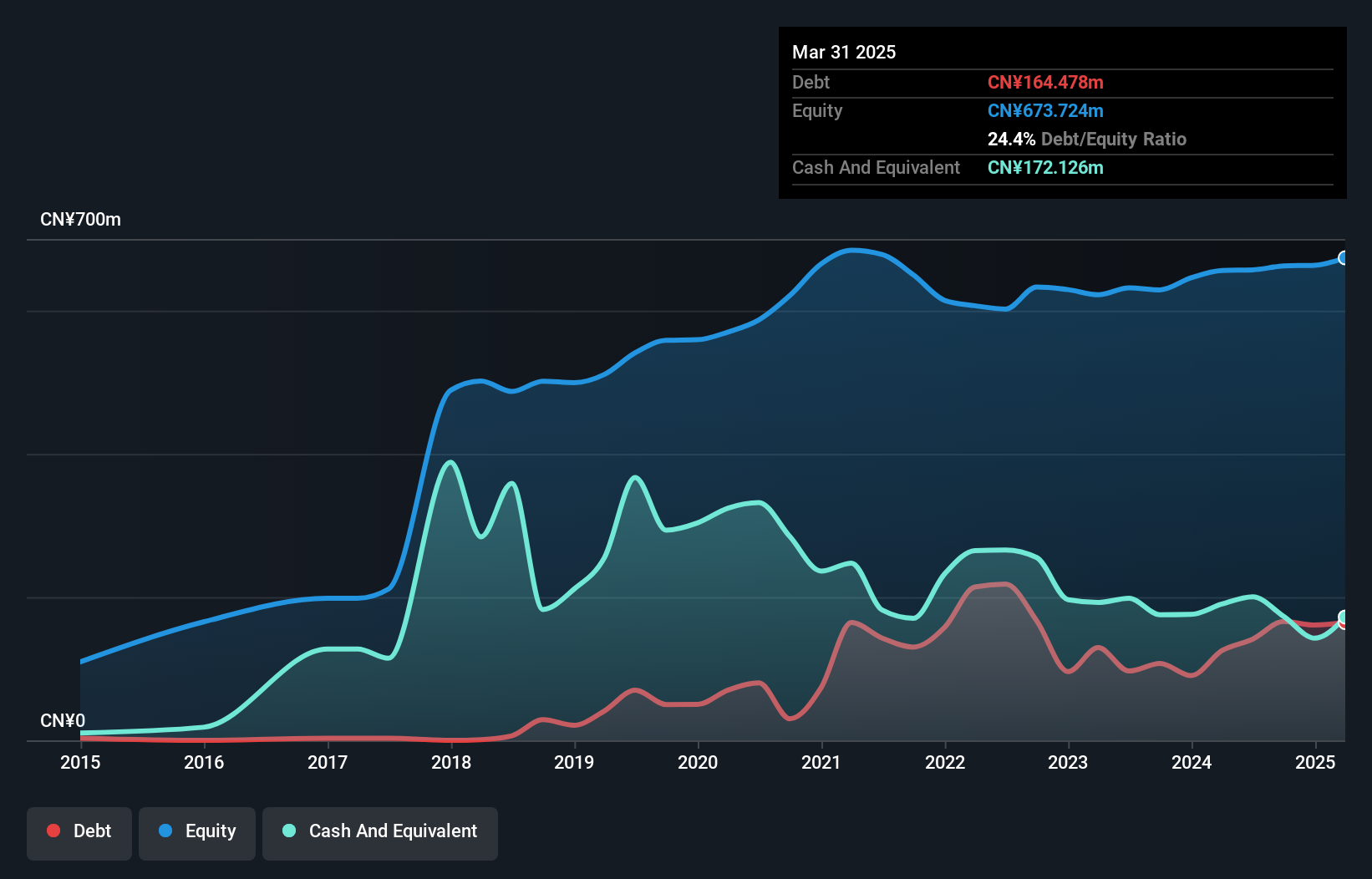

Shenzhen Cotran New Material Ltd. has shown impressive earnings growth of 60% over the past year, outpacing its industry peers significantly. Despite a volatile share price in recent months, the company remains profitable with high-quality earnings and more cash than total debt. However, its debt-to-equity ratio has risen from 9% to 25% over five years, which may concern some investors. Recent financial results indicate sales increased to CNY 593 million from CNY 357 million year-on-year, though net income slightly dipped to CNY 10.67 million from CNY 10.93 million, reflecting potential challenges in maintaining profitability margins amidst growth.

Taking Advantage

- Click here to access our complete index of 4660 Undiscovered Gems With Strong Fundamentals.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hangzhou Kaierda Welding RobotLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:688255

Hangzhou Kaierda Welding RobotLtd

Engages in the research, development, manufacture, and sale of industrial welding equipment and welding robots in China.

Flawless balance sheet low.

Market Insights

Community Narratives