- Taiwan

- /

- Semiconductors

- /

- TWSE:2481

Insider Picks For High Growth In December 2024

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by interest rate adjustments and political uncertainties, investors are closely monitoring the impact of these factors on major indices. Amidst this backdrop, insider ownership in growth companies can be a compelling indicator of potential resilience and confidence in future performance.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 41.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| On Holding (NYSE:ONON) | 19.1% | 29.4% |

| Pharma Mar (BME:PHM) | 11.8% | 56.2% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| Credo Technology Group Holding (NasdaqGS:CRDO) | 13.4% | 66.3% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

We'll examine a selection from our screener results.

Serko (NZSE:SKO)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Serko Limited is a Software-as-a-Service technology company offering online travel booking software and expense management services across New Zealand, Australia, North America, Europe, and other international markets with a market cap of NZ$463.08 million.

Operations: The company's revenue primarily comes from its software solutions, amounting to NZ$74.45 million.

Insider Ownership: 31.5%

Revenue Growth Forecast: 22.2% p.a.

Serko is poised for significant growth with its revenue projected to increase by 22.2% annually, outpacing the New Zealand market. Despite a current net loss of NZ$5.11 million, its financial trajectory suggests profitability within three years. Recent strategic moves include integrating NDC content with Amadeus, enhancing corporate travel solutions. While insider trading activity has been minimal recently, the company's growth prospects remain robust amid evolving executive leadership and product enhancements in collaboration with Amadeus.

- Unlock comprehensive insights into our analysis of Serko stock in this growth report.

- Our expertly prepared valuation report Serko implies its share price may be too high.

NEXTAGE (TSE:3186)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: NEXTAGE Co., Ltd. operates in Japan, focusing on the sale of new and used cars, with a market cap of ¥106.33 billion.

Operations: The company generates revenue primarily from its automobile sales and related ancillary businesses, amounting to ¥515.65 billion.

Insider Ownership: 37.9%

Revenue Growth Forecast: 10.9% p.a.

NEXTAGE is trading at a significant discount to its estimated fair value, suggesting potential undervaluation. While earnings are projected to grow 25% annually, surpassing the broader JP market's growth rate, revenue growth of 10.9% per year lags behind higher benchmarks. Despite improved profit margins from last year, they remain modest at 1.6%. The dividend yield of 2.48% lacks robust coverage by free cash flows, and the company's high share price volatility may concern risk-averse investors.

- Click to explore a detailed breakdown of our findings in NEXTAGE's earnings growth report.

- According our valuation report, there's an indication that NEXTAGE's share price might be on the cheaper side.

Panjit International (TWSE:2481)

Simply Wall St Growth Rating: ★★★★☆☆

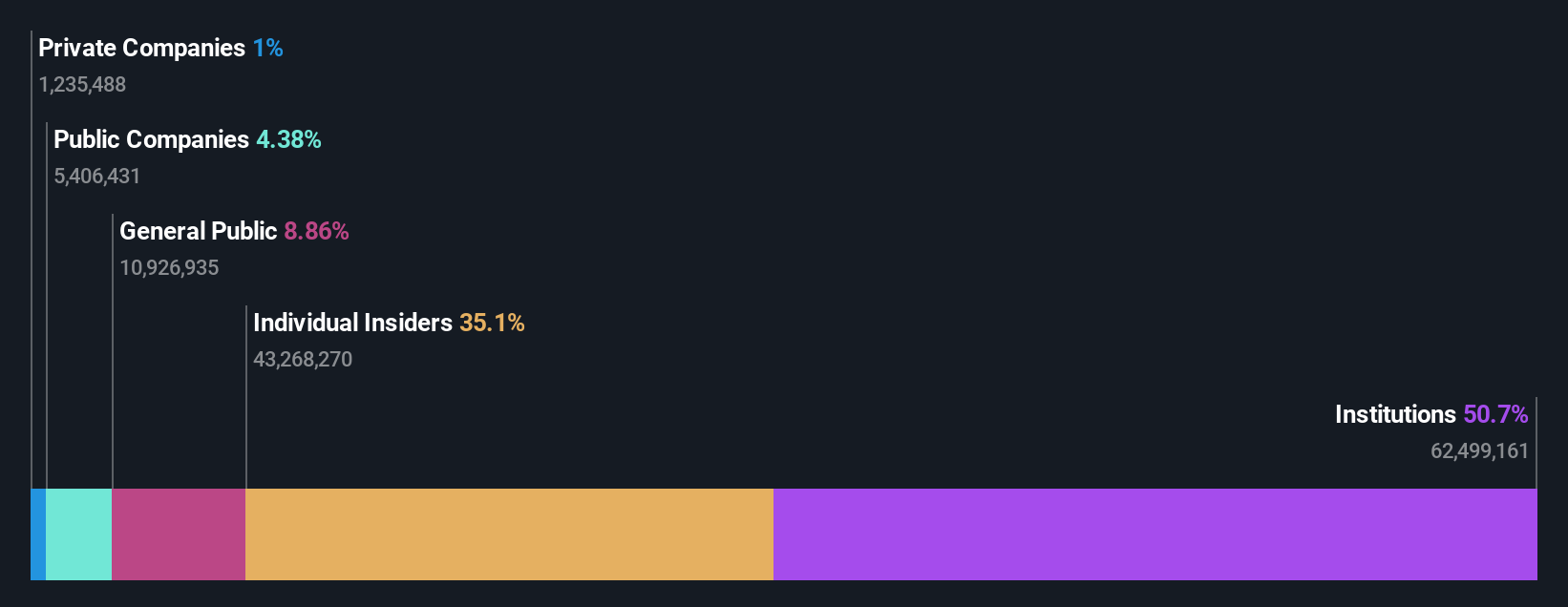

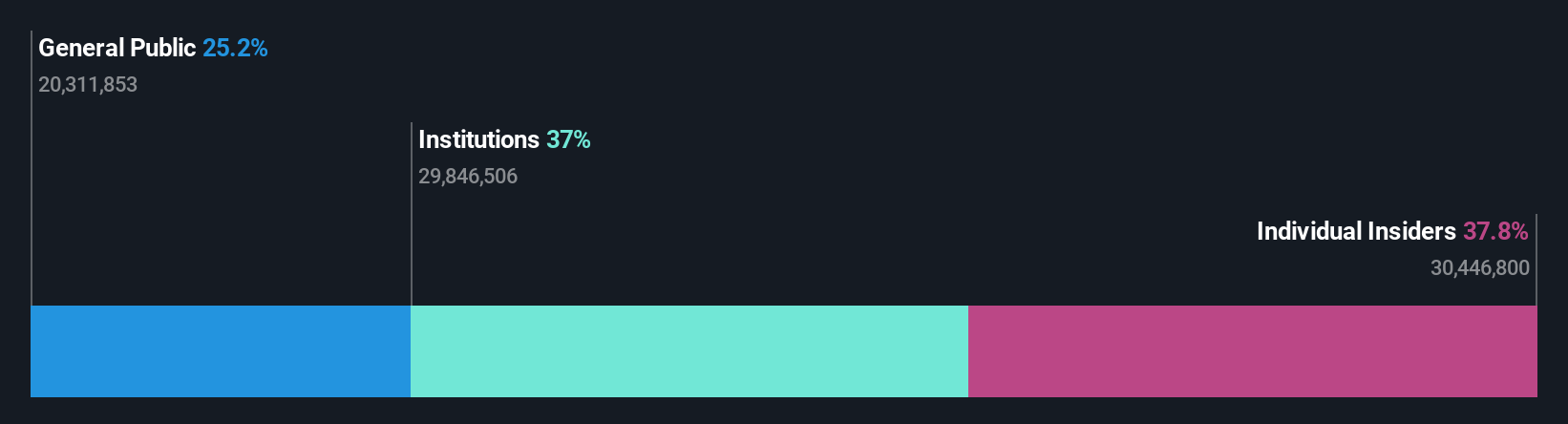

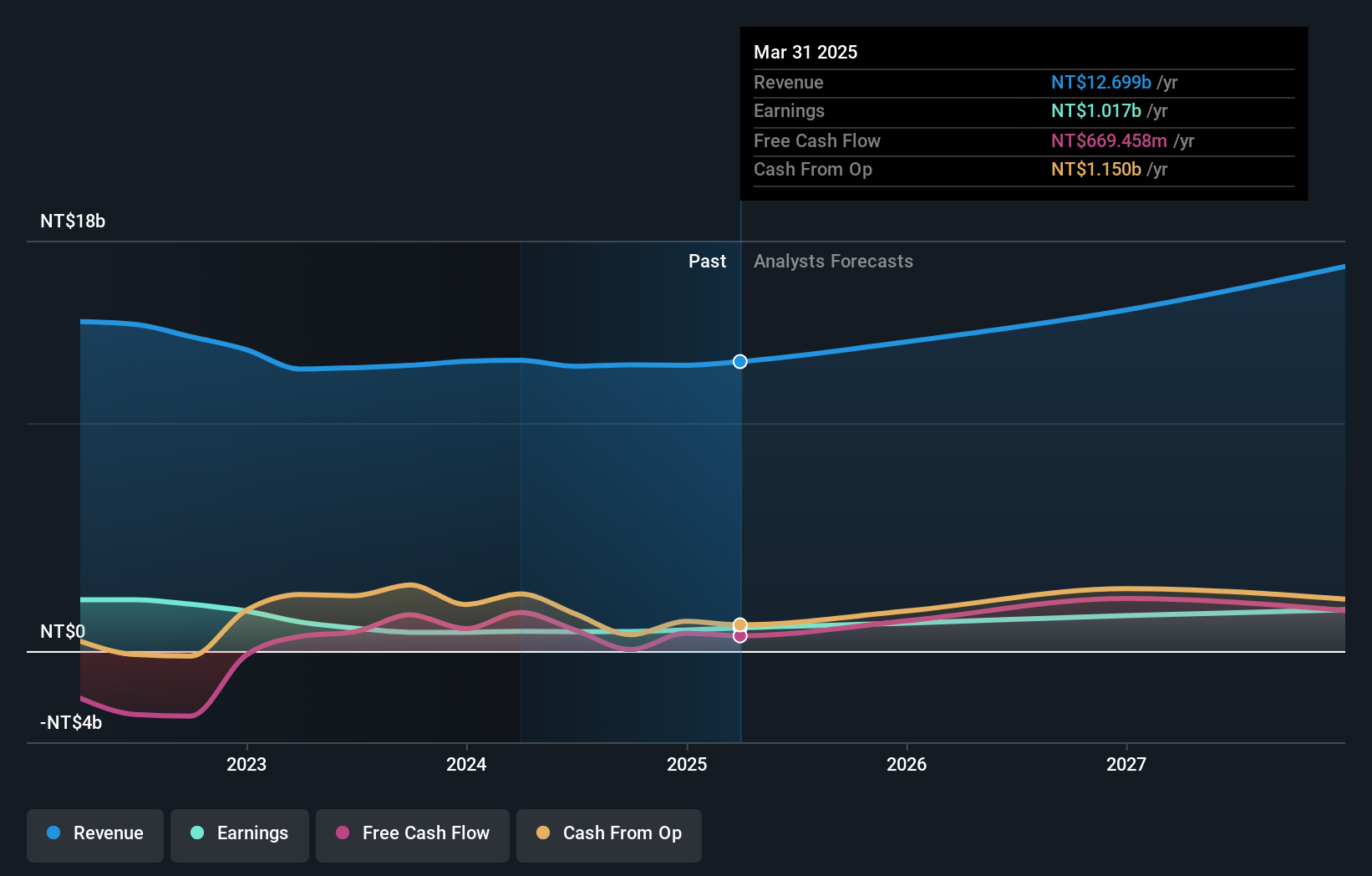

Overview: Panjit International Inc. is involved in the manufacturing, processing, assembling, importing, and exporting of semiconductors across Taiwan, China, Korea, the United States, Japan, Germany, Italy and internationally with a market cap of NT$19.49 billion.

Operations: The company's revenue segments consist of NT$220.88 million from Solar, NT$11.40 billion from Power Split Components, and NT$943.64 million from Power Integrated Circuits and Components.

Insider Ownership: 10.1%

Revenue Growth Forecast: 13.2% p.a.

Panjit International's earnings are forecast to grow significantly at 30.3% annually, outpacing the TW market's growth rate. Despite a lower Price-to-Earnings ratio of 22.7x compared to the semiconductor industry average, revenue growth is expected at 13.2% per year, slightly above the TW market but below high-growth benchmarks. Recent earnings showed modest improvements with TWD 253.45 million net income for Q3 2024, reflecting steady performance amidst moderate dividend coverage challenges.

- Click here and access our complete growth analysis report to understand the dynamics of Panjit International.

- In light of our recent valuation report, it seems possible that Panjit International is trading beyond its estimated value.

Taking Advantage

- Unlock our comprehensive list of 1512 Fast Growing Companies With High Insider Ownership by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TWSE:2481

PANJIT International

Manufactures, processes, assembles, imports, and exports semiconductors in Taiwan, Asia, the Americas, Europe, and internationally.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives