- Saudi Arabia

- /

- Banks

- /

- SASE:1180

Discover January 2025's Top Dividend Stocks

Reviewed by Simply Wall St

As we enter January 2025, global markets are navigating a complex landscape marked by inflation concerns and political uncertainties, with U.S. equities experiencing notable declines amid a strong labor market and hawkish Federal Reserve signals. In this environment of fluctuating indices and economic unpredictability, dividend stocks can offer investors stability through regular income streams, making them an attractive option for those looking to balance risk in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.07% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.45% | ★★★★★★ |

| MISC Berhad (KLSE:MISC) | 5.10% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.15% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.03% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.62% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.56% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.91% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.08% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.89% | ★★★★★★ |

Click here to see the full list of 2003 stocks from our Top Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

Saudi National Bank (SASE:1180)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: The Saudi National Bank, with a market cap of SAR204.81 billion, operates through its subsidiaries to offer a range of banking products and services both in the Kingdom of Saudi Arabia and internationally.

Operations: The Saudi National Bank generates its revenue from several segments, including Retail at SAR16.51 billion, Wholesale at SAR13.44 billion, International at SAR1.79 billion, and Capital Market at SAR2.49 billion.

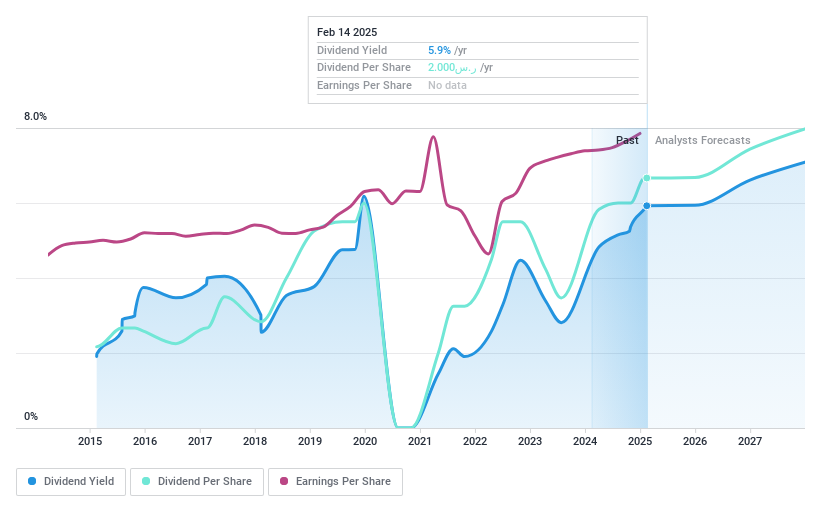

Dividend Yield: 5.2%

Saudi National Bank's dividends are covered by earnings with a payout ratio of 53.8%, positioning it among the top 25% of dividend payers in the Saudi market. Despite a history of volatile dividends, recent earnings growth and a favorable price-to-earnings ratio (10.3x) suggest potential value for investors. The completion of SAR 6 billion in fixed-income offerings may enhance its financial stability, supporting future dividend sustainability amidst forecasts for continued revenue growth.

- Get an in-depth perspective on Saudi National Bank's performance by reading our dividend report here.

- According our valuation report, there's an indication that Saudi National Bank's share price might be on the cheaper side.

Honeys Holdings (TSE:2792)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Honeys Holdings Co., Ltd. is involved in the planning, manufacturing, and wholesale of women's clothing and accessories, with a market cap of ¥48.29 billion.

Operations: Honeys Holdings Co., Ltd. generates revenue through its operations in the women's apparel and accessories sector, encompassing activities from design to wholesale distribution.

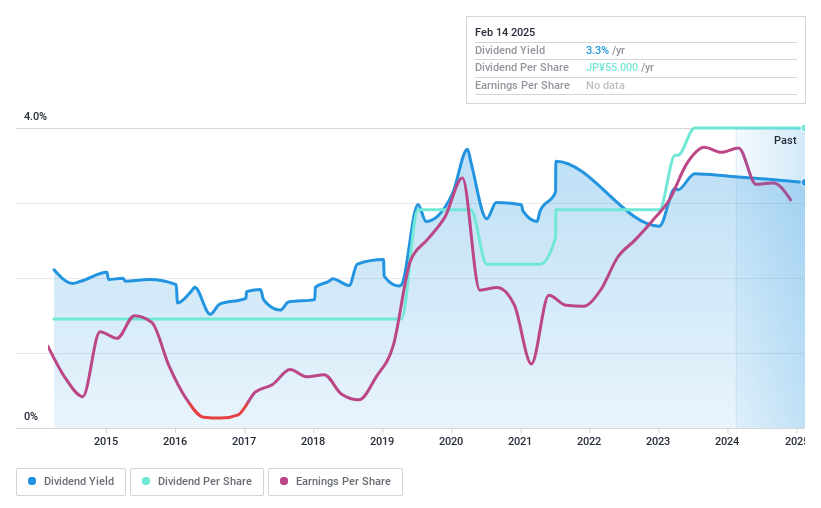

Dividend Yield: 3.2%

Honeys Holdings announced a consistent dividend of ¥25.00 per share for Q2, payable on January 31, 2025. The payout ratio is sustainable at 33.8%, supported by earnings and cash flows with a cash payout ratio of 67%. Despite past volatility in dividends, payments have grown over the last decade. Trading at a discount to estimated fair value, Honeys Holdings offers potential value but remains outside Japan's top dividend payers due to its lower yield.

- Unlock comprehensive insights into our analysis of Honeys Holdings stock in this dividend report.

- In light of our recent valuation report, it seems possible that Honeys Holdings is trading behind its estimated value.

MLP (XTRA:MLP)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: MLP SE, with a market cap of €696.23 million, offers financial services to private, corporate, and institutional clients in Germany through its subsidiaries.

Operations: MLP SE generates revenue through various segments including Financial Consulting (€436.56 million), FERI (€253.38 million), Banking (€216.22 million), DOMCURA (€128.50 million), Deutschland.Immobilien (€57.54 million), and Industrial Broker (€37.20 million).

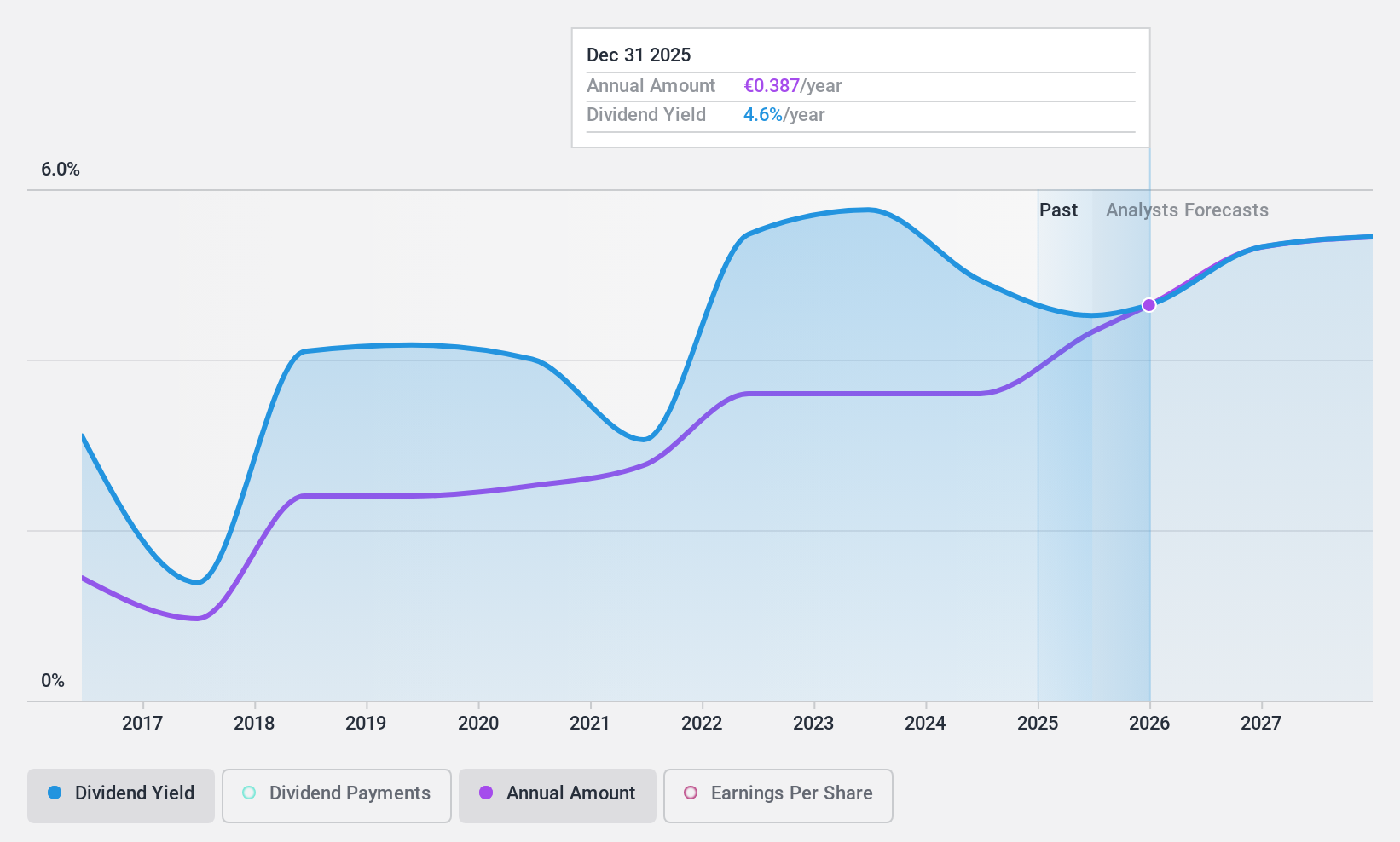

Dividend Yield: 4.7%

MLP's dividend yield of 4.71% lags behind the top German market payers, but its dividends are well-covered by earnings and cash flows, with a payout ratio of 51.1% and a cash payout ratio of 15.6%. Despite an unstable dividend history, payments have increased over the past decade. Recent earnings growth supports sustainability, as Q3 revenue rose to €249.03 million from €209.67 million year-on-year, indicating potential for future stability in dividends.

- Dive into the specifics of MLP here with our thorough dividend report.

- Upon reviewing our latest valuation report, MLP's share price might be too pessimistic.

Next Steps

- Dive into all 2003 of the Top Dividend Stocks we have identified here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:1180

Saudi National Bank

Through its subsidiaries, provides various banking products and services in the Kingdom of Saudi Arabia and internationally.

Flawless balance sheet established dividend payer.