CREAL Inc. (TSE:2998) shares have had a really impressive month, gaining 27% after a shaky period beforehand. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 23% in the last twelve months.

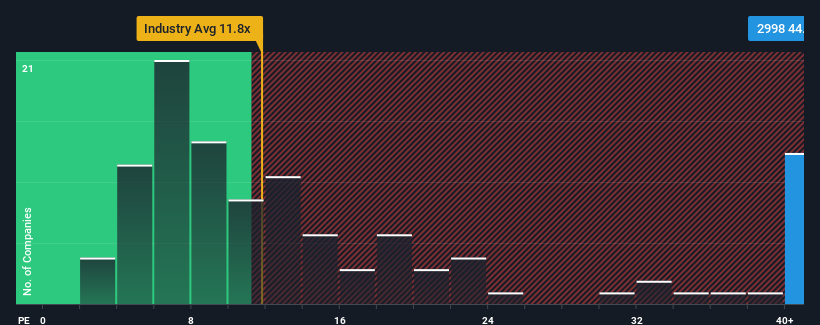

After such a large jump in price, CREAL's price-to-earnings (or "P/E") ratio of 44.6x might make it look like a strong sell right now compared to the market in Japan, where around half of the companies have P/E ratios below 14x and even P/E's below 9x are quite common. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for CREAL as its earnings have been rising faster than most other companies. It seems that many are expecting the strong earnings performance to persist, which has raised the P/E. If not, then existing shareholders might be a little nervous about the viability of the share price.

Check out our latest analysis for CREAL

How Is CREAL's Growth Trending?

There's an inherent assumption that a company should far outperform the market for P/E ratios like CREAL's to be considered reasonable.

Taking a look back first, we see that the company grew earnings per share by an impressive 69% last year. The strong recent performance means it was also able to grow EPS by 792% in total over the last three years. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next year should generate growth of 38% as estimated by the one analyst watching the company. That's shaping up to be materially higher than the 9.7% growth forecast for the broader market.

In light of this, it's understandable that CREAL's P/E sits above the majority of other companies. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On CREAL's P/E

Shares in CREAL have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that CREAL maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

You should always think about risks. Case in point, we've spotted 2 warning signs for CREAL you should be aware of, and 1 of them makes us a bit uncomfortable.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:2998

Excellent balance sheet with questionable track record.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

The "Rate Cut" Supercycle Winner – Profitable & Accelerating

The Industrialist of the Skies – Scaling with "Automotive DNA

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026