Here's Why We're Not Too Worried About ReproCELL's (TSE:4978) Cash Burn Situation

We can readily understand why investors are attracted to unprofitable companies. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. Having said that, unprofitable companies are risky because they could potentially burn through all their cash and become distressed.

So, the natural question for ReproCELL (TSE:4978) shareholders is whether they should be concerned by its rate of cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). The first step is to compare its cash burn with its cash reserves, to give us its 'cash runway'.

Check out our latest analysis for ReproCELL

Does ReproCELL Have A Long Cash Runway?

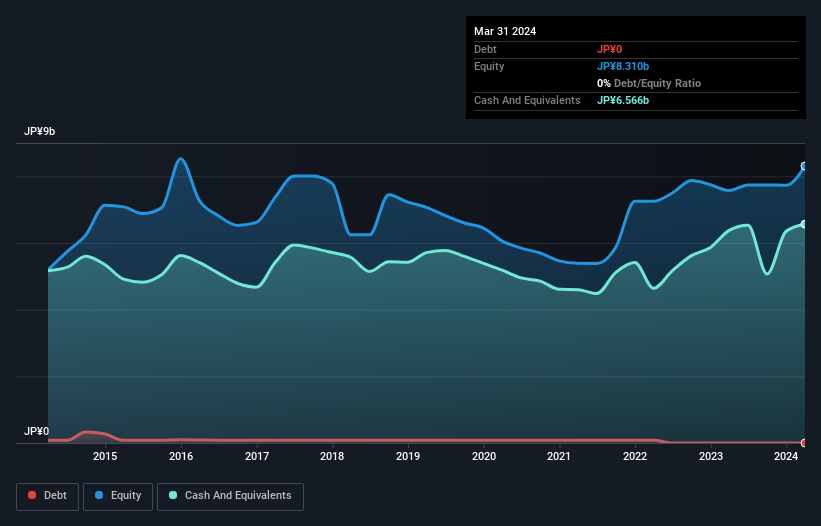

A company's cash runway is calculated by dividing its cash hoard by its cash burn. In March 2024, ReproCELL had JP¥6.6b in cash, and was debt-free. Importantly, its cash burn was JP¥202m over the trailing twelve months. That means it had a cash runway of very many years as of March 2024. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. You can see how its cash balance has changed over time in the image below.

How Well Is ReproCELL Growing?

We reckon the fact that ReproCELL managed to shrink its cash burn by 33% over the last year is rather encouraging. Unfortunately, however, operating revenue declined by 18% during the period. In light of the data above, we're fairly sanguine about the business growth trajectory. In reality, this article only makes a short study of the company's growth data. You can take a look at how ReproCELL has developed its business over time by checking this visualization of its revenue and earnings history.

Can ReproCELL Raise More Cash Easily?

While ReproCELL seems to be in a decent position, we reckon it is still worth thinking about how easily it could raise more cash, if that proved desirable. Companies can raise capital through either debt or equity. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

ReproCELL's cash burn of JP¥202m is about 1.5% of its JP¥14b market capitalisation. So it could almost certainly just borrow a little to fund another year's growth, or else easily raise the cash by issuing a few shares.

So, Should We Worry About ReproCELL's Cash Burn?

As you can probably tell by now, we're not too worried about ReproCELL's cash burn. For example, we think its cash runway suggests that the company is on a good path. While its falling revenue wasn't great, the other factors mentioned in this article more than make up for weakness on that measure. After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash, as it seems on track to meet its needs over the medium term. Taking an in-depth view of risks, we've identified 3 warning signs for ReproCELL that you should be aware of before investing.

Of course ReproCELL may not be the best stock to buy. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4978

ReproCELL

Provides stem cell research and drug discovery services in Japan.

Flawless balance sheet low.