- Japan

- /

- Trade Distributors

- /

- TSE:8066

Top 3 Dividend Stocks To Enhance Your Portfolio

Reviewed by Simply Wall St

As global markets navigate a mixed start to the year with U.S. stocks closing out a strong performance in 2024 and economic indicators showing varied signals, investors are increasingly looking for stability amid uncertainty. In such an environment, dividend stocks can offer a reliable income stream and potential for growth, making them an attractive option for enhancing portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.58% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.41% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.39% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.84% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.07% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.06% | ★★★★★★ |

Click here to see the full list of 1979 stocks from our Top Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

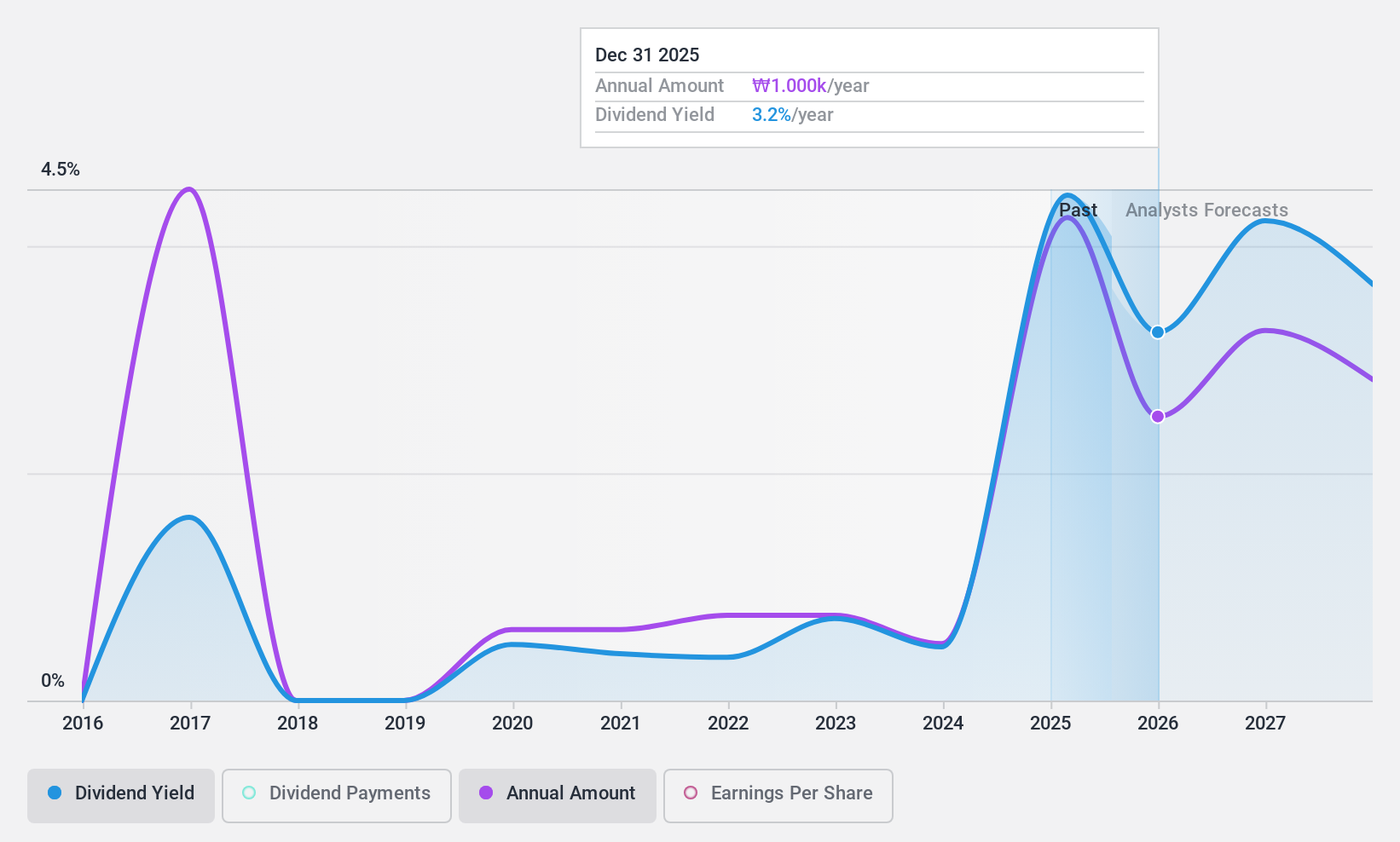

LX Hausys (KOSE:A108670)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: LX Hausys, Ltd., along with its subsidiaries, manufactures and sells building materials both in South Korea and internationally, with a market cap of ₩310.38 billion.

Operations: LX Hausys generates revenue from its Building Materials segment, amounting to ₩2.56 trillion, and its Automotive Materials / Industrial Films segment, contributing ₩1.01 trillion.

Dividend Yield: 5.3%

LX Hausys offers a dividend yield in the top 25% of the KR market, supported by sustainable payout ratios from both earnings (33.3%) and cash flows (36.8%). However, its dividend history is marked by volatility and a lack of growth over nine years. The stock trades at 58.5% below its estimated fair value, indicating potential for capital appreciation despite an unstable dividend track record. Earnings have recently turned positive, with further growth forecasted.

- Dive into the specifics of LX Hausys here with our thorough dividend report.

- Our expertly prepared valuation report LX Hausys implies its share price may be lower than expected.

Kasikornbank (SET:KBANK)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kasikornbank Public Company Limited, along with its subsidiaries, offers commercial banking products and services both in Thailand and internationally, with a market capitalization of THB374.35 billion.

Operations: Kasikornbank generates revenue primarily from its Retail Business (THB69.98 billion), Corporate Business (THB87.72 billion), Muang Thai Group Holding Business (THB13.42 billion), and Treasury and Capital Markets Business and World Business Group (THB32.99 billion).

Dividend Yield: 4.7%

Kasikornbank's dividend yield of 4.75% is lower than the top 25% in Thailand but remains supported by a low payout ratio of 37.4%, suggesting sustainability despite a volatile dividend history over the past decade. The bank's earnings grew significantly by 34% last year, and dividends are expected to be well covered in three years at a 40.2% payout ratio. However, its high level of bad loans (3.8%) warrants caution for investors seeking stability.

- Navigate through the intricacies of Kasikornbank with our comprehensive dividend report here.

- The analysis detailed in our Kasikornbank valuation report hints at an deflated share price compared to its estimated value.

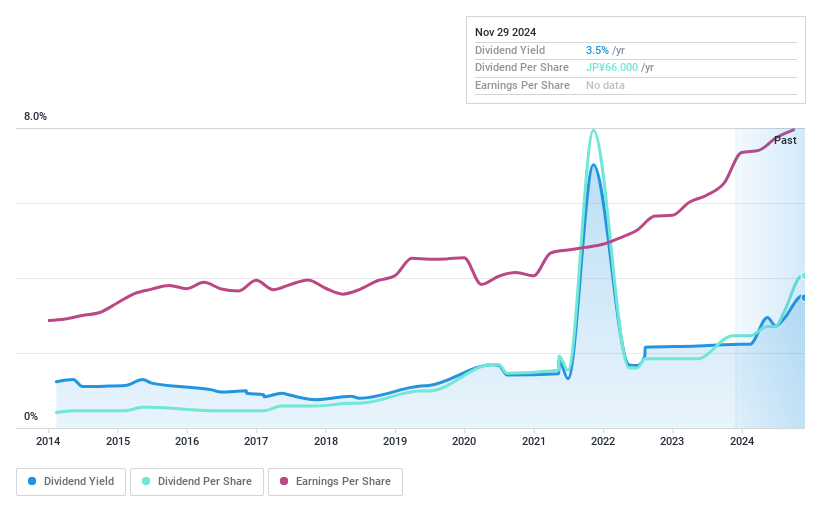

Mitani (TSE:8066)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mitani Corporation operates in the information system, construction, and energy sectors both in Japan and internationally, with a market cap of ¥171.59 billion.

Operations: Mitani Corporation's revenue is primarily derived from its Corporate Supply Related Business, which generated ¥234.23 billion, followed by the Lifestyle/Local Service Related Business at ¥147.62 billion, and the Information System Related Business contributing ¥30.64 billion.

Dividend Yield: 3.3%

Mitani's dividend yield of 3.36% is below the top 25% in Japan, though supported by a low payout ratio of 28.4%, indicating sustainability despite past volatility and unreliability in dividends over ten years. Recent earnings growth of 20.2% enhances coverage, while a share buyback program worth ¥1.73 billion completed recently aims to boost shareholder value, reflecting a commitment to capital policy improvements amidst fluctuating dividend stability.

- Delve into the full analysis dividend report here for a deeper understanding of Mitani.

- Insights from our recent valuation report point to the potential undervaluation of Mitani shares in the market.

Key Takeaways

- Click through to start exploring the rest of the 1976 Top Dividend Stocks now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8066

Mitani

Engages in the information system, construction, energy, and other businesses in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.