- Japan

- /

- Trade Distributors

- /

- TSE:9906

Shizuoka Financial GroupInc And 2 Other Leading Dividend Stocks

Reviewed by Simply Wall St

As global markets navigate a period of mixed performance and economic uncertainty, with the S&P 500 Index marking strong annual gains despite recent fluctuations, investors are increasingly turning their attention to dividend stocks as a potential source of stability and income. In this environment, identifying robust dividend-paying companies can be particularly appealing for those seeking consistent returns amidst market volatility.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.49% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 5.10% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.61% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.49% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.36% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.89% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.89% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.81% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 6.07% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.06% | ★★★★★★ |

Click here to see the full list of 1972 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

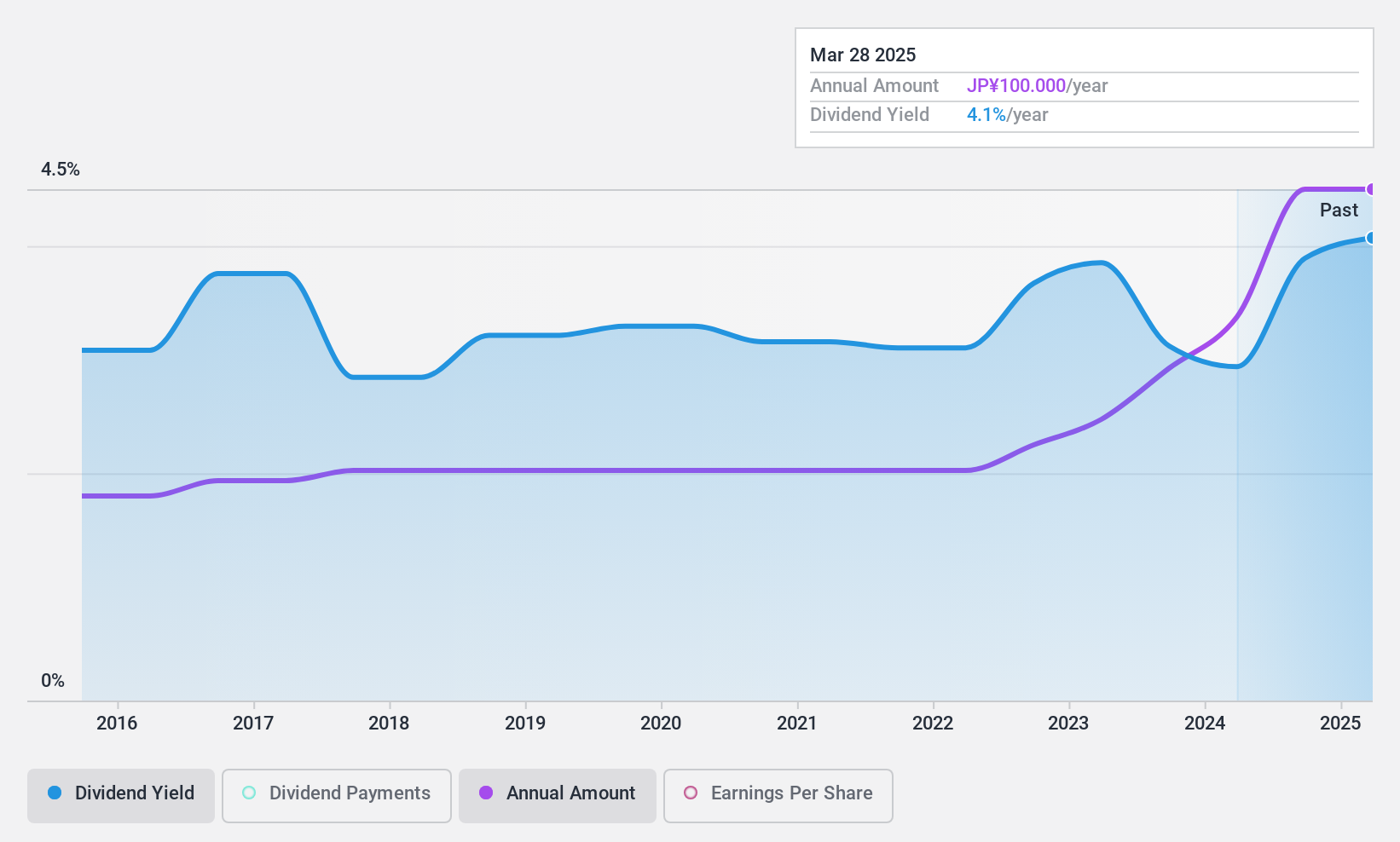

Shizuoka Financial GroupInc (TSE:5831)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shizuoka Financial Group, Inc., along with its subsidiaries, offers a range of banking products and services and has a market capitalization of approximately ¥705.75 billion.

Operations: Shizuoka Financial Group, Inc. generates revenue from its main segments, including Banking with ¥199.86 billion and Leasing with ¥33.37 billion.

Dividend Yield: 3.8%

Shizuoka Financial Group offers a stable and reliable dividend, with payments consistently growing over the past decade. Its current yield of 3.81% ranks in the top 25% of Japanese dividend payers, supported by a low payout ratio of 38.2%. Recent earnings growth and a share repurchase program signal financial strength, though future dividend coverage remains uncertain. The stock trades significantly below its estimated fair value, adding potential appeal for investors seeking dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Shizuoka Financial GroupInc.

- The valuation report we've compiled suggests that Shizuoka Financial GroupInc's current price could be quite moderate.

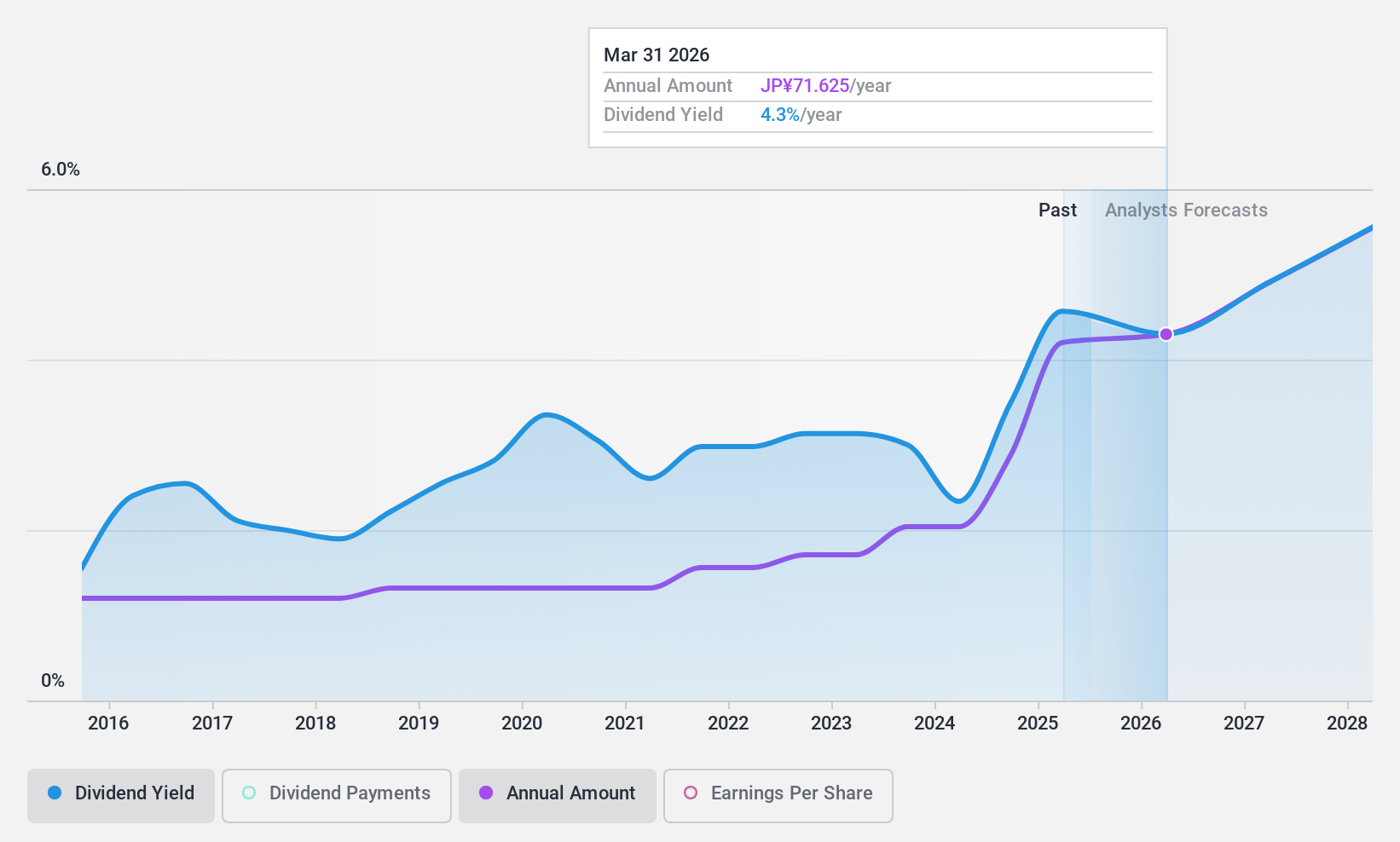

Fujii Sangyo (TSE:9906)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Fujii Sangyo Corporation operates in Japan, selling electrical construction materials, electrical equipment, machine tools, information equipment, and civil engineering and construction machinery with a market cap of ¥21.31 billion.

Operations: Fujii Sangyo Corporation's revenue segments include the sale of electrical construction materials, electrical equipment, machine tools, information equipment, and civil engineering and construction machinery.

Dividend Yield: 3.9%

Fujii Sangyo provides a high and reliable dividend yield of 3.88%, ranking among the top 25% in Japan. Its dividends are well-supported by both earnings and cash flows, with low payout ratios of 23.3% and 25.1%, respectively, ensuring sustainability. Over the past decade, dividends have been stable and consistently increasing. Additionally, Fujii Sangyo's earnings grew by 11.8% last year, enhancing its capacity to maintain robust dividend payouts while trading significantly below estimated fair value.

- Take a closer look at Fujii Sangyo's potential here in our dividend report.

- According our valuation report, there's an indication that Fujii Sangyo's share price might be on the cheaper side.

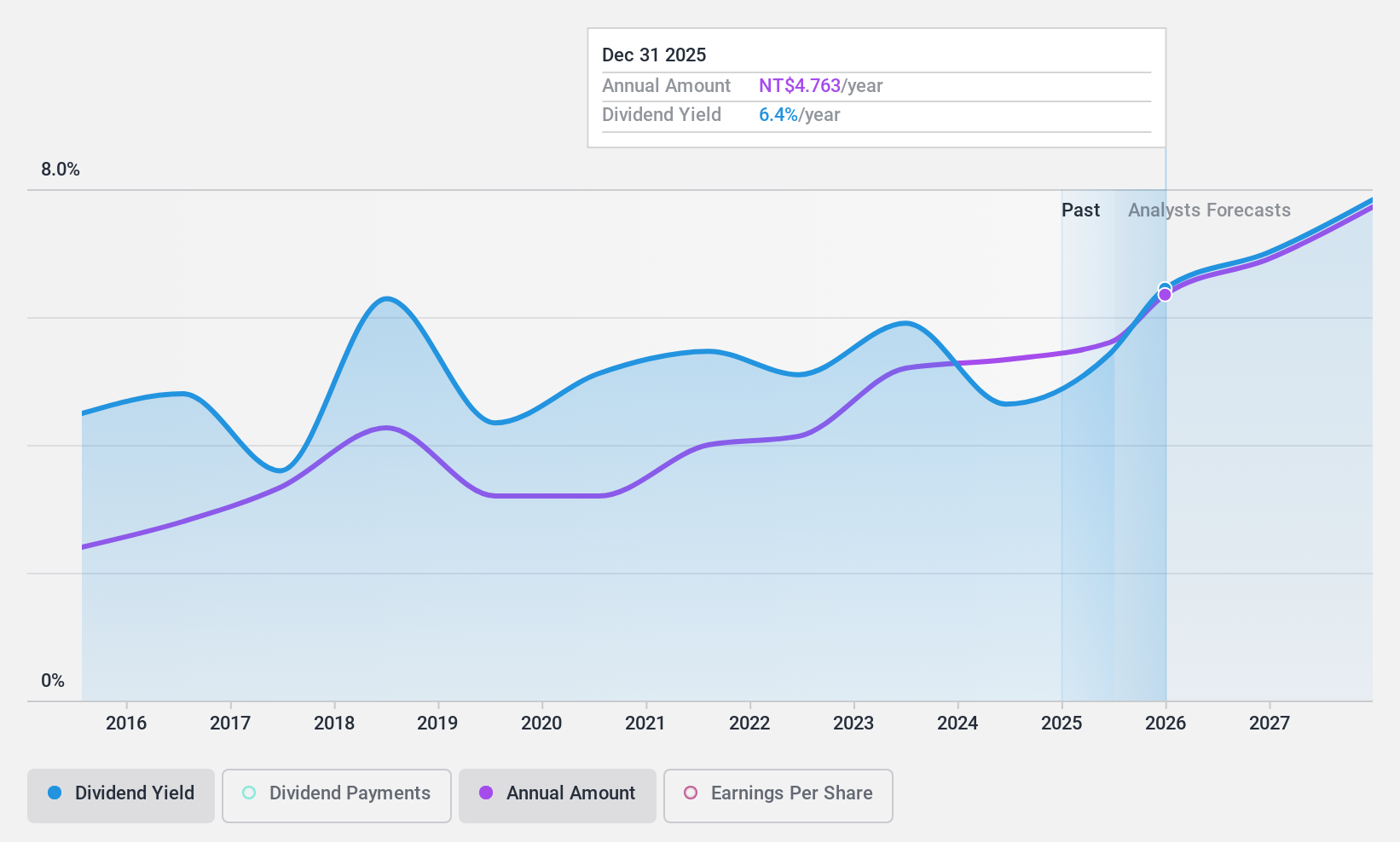

Primax Electronics (TWSE:4915)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Primax Electronics Ltd., along with its subsidiaries, manufactures and sells computer and non-computer peripherals across China, Europe, the Americas, and internationally, with a market cap of NT$35.96 billion.

Operations: Primax Electronics Ltd. generates revenue from its Computer Peripheral Equipment Business Group, amounting to NT$24.11 billion, and its Non-Computer Peripheral Equipment Business Group, which contributes NT$34.93 billion.

Dividend Yield: 5.1%

Primax Electronics offers a dividend yield of 5.06%, placing it in the top 25% of Taiwan's market. The dividends are supported by earnings and cash flows, with payout ratios of 70.6% and 32.2%, respectively. Despite this, its dividend history has been volatile over the past decade, showing inconsistency in growth and stability. Recent earnings reports show modest increases in income, suggesting potential for future dividend reliability improvement as trading remains below estimated fair value by 25.5%.

- Navigate through the intricacies of Primax Electronics with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Primax Electronics' share price might be too pessimistic.

Make It Happen

- Click here to access our complete index of 1972 Top Dividend Stocks.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9906

Fujii Sangyo

Engages in the sale of electrical construction materials, electrical equipment, machine tools, information equipment, and civil engineering and construction machinery in Japan.

Flawless balance sheet 6 star dividend payer.

Market Insights

Community Narratives