- Japan

- /

- Trade Distributors

- /

- TSE:8066

Undiscovered Gems Three Promising Stocks To Explore In January 2025

Reviewed by Simply Wall St

As we enter 2025, global markets are navigating a complex landscape marked by mixed performances across major indices and economic indicators. Despite recent contractions in manufacturing activity and revised GDP forecasts, the U.S. stock market has sustained impressive gains over the past two years, highlighting opportunities for investors willing to explore lesser-known stocks with potential growth prospects. In this context, identifying promising stocks often involves looking beyond short-term fluctuations to assess fundamental strengths and long-term resilience in various sectors.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Canal Shipping Agencies | NA | 8.92% | 22.01% | ★★★★★★ |

| Sugar Terminals | NA | 3.14% | 3.53% | ★★★★★★ |

| Mendelson Infrastructures & Industries | 32.64% | 6.72% | 15.39% | ★★★★★★ |

| Payton Industries | NA | 9.27% | 15.41% | ★★★★★★ |

| Suez Canal Company for Technology Settling (S.A.E) | NA | 22.31% | 13.60% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Jamuna Bank | 85.07% | 7.37% | -3.87% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Potens Semiconductor (TPEX:7712)

Simply Wall St Value Rating: ★★★★★☆

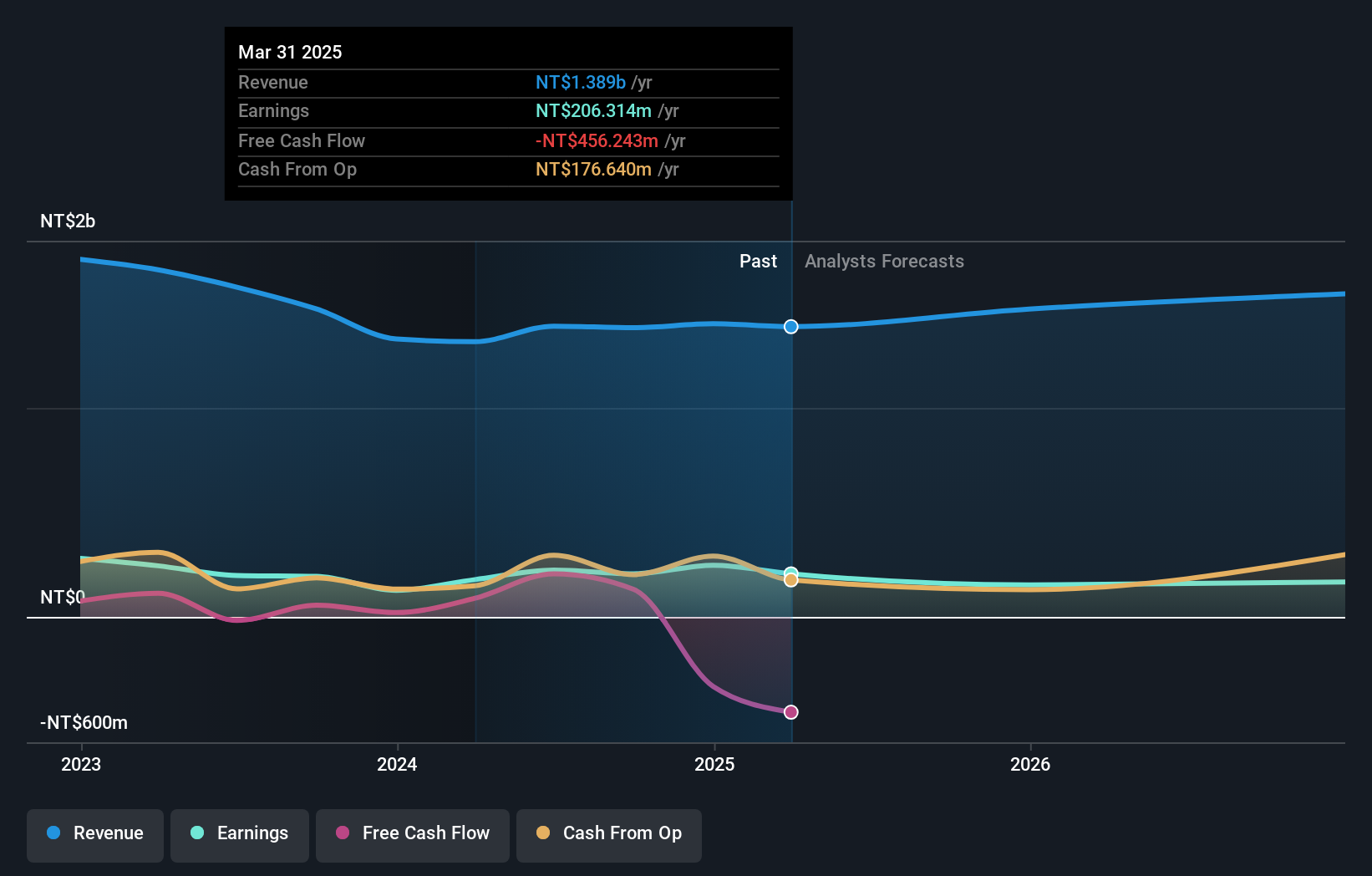

Overview: Potens Semiconductor Corp. designs, develops, and sells power discrete devices across Taiwan, Asia, Europe, and internationally with a market capitalization of NT$8.25 billion.

Operations: Potens Semiconductor generates revenue primarily from the manufacturing of electronic components, amounting to NT$1.38 billion.

Potens Semiconductor, a nimble player in the semiconductor sector, has showcased robust earnings growth of 6.3% over the past year, outpacing the industry's 5.9%. Despite a recent dip in third-quarter sales to TWD 351.15 million from TWD 358.77 million last year, net income for nine months surged to TWD 201.03 million compared to TWD 122.3 million previously, reflecting strong operational performance. The company also filed a follow-on equity offering worth TWD 627.6 million, signaling potential expansion plans amidst its high-quality earnings and positive free cash flow position as of late September 2024.

- Click here and access our complete health analysis report to understand the dynamics of Potens Semiconductor.

Gain insights into Potens Semiconductor's past trends and performance with our Past report.

Remixpoint (TSE:3825)

Simply Wall St Value Rating: ★★★★★★

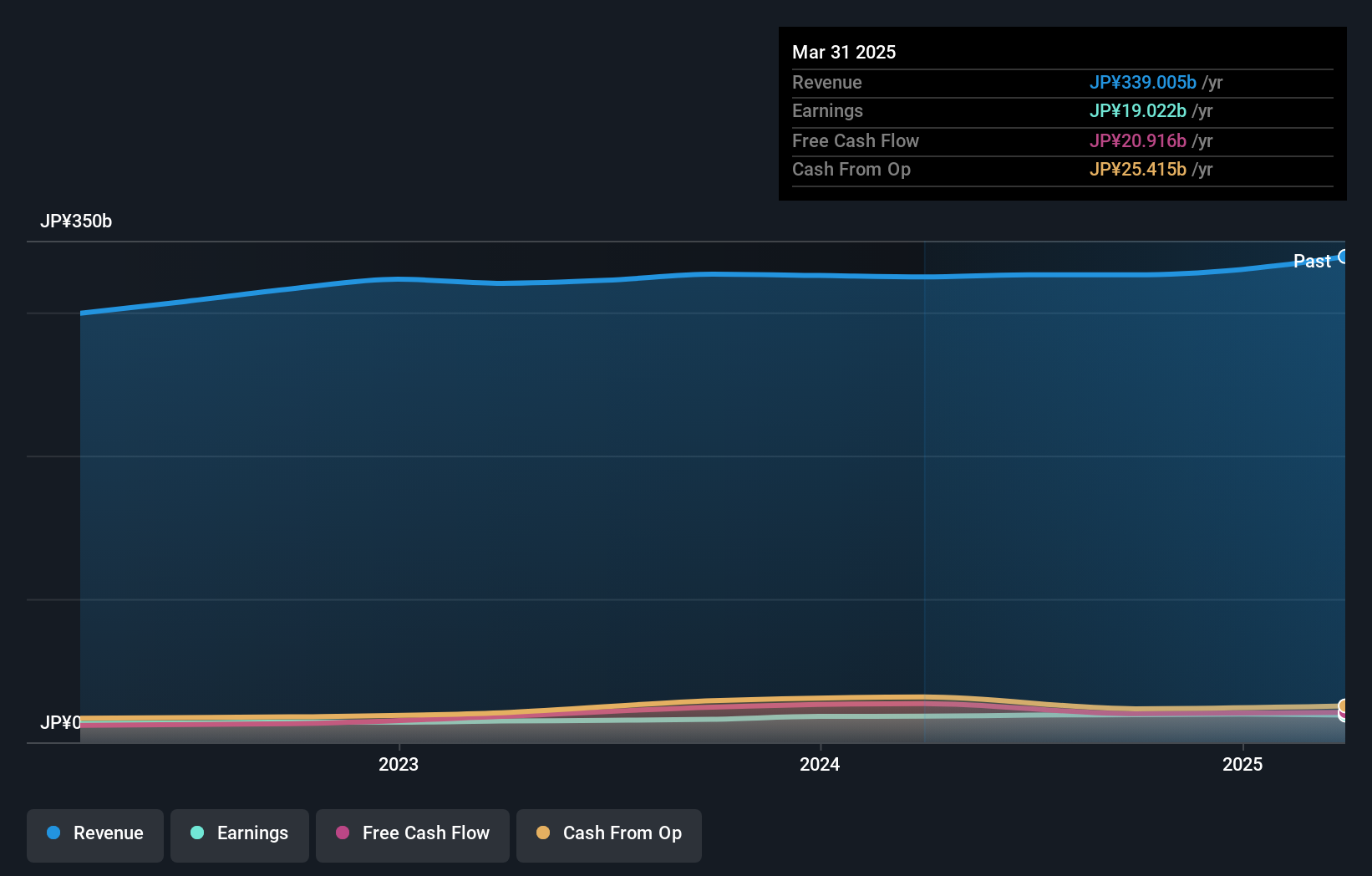

Overview: Remixpoint, Inc. focuses on the development and sale of energy management systems and energy-saving support consulting services in Japan, with a market capitalization of approximately ¥43.19 billion.

Operations: The company's primary revenue streams are from its Energy Business, generating ¥19.33 billion, and its Resilience Business, contributing ¥1.34 billion.

Remixpoint's recent performance paints an intriguing picture, with earnings growth of 170.1% over the past year, significantly outpacing the IT industry's 10.3%. Despite this impressive growth, a notable one-off loss of ¥747 million impacted its financial results for the year ending September 2024. On a positive note, Remixpoint's debt-to-equity ratio has improved dramatically from 41.2% to just 2.5% over five years, reflecting prudent financial management. The company projects net sales of ¥24.20 billion and an operating profit of ¥835 million for fiscal year ending March 2025, suggesting continued momentum despite recent volatility in share price.

- Unlock comprehensive insights into our analysis of Remixpoint stock in this health report.

Gain insights into Remixpoint's historical performance by reviewing our past performance report.

Mitani (TSE:8066)

Simply Wall St Value Rating: ★★★★★★

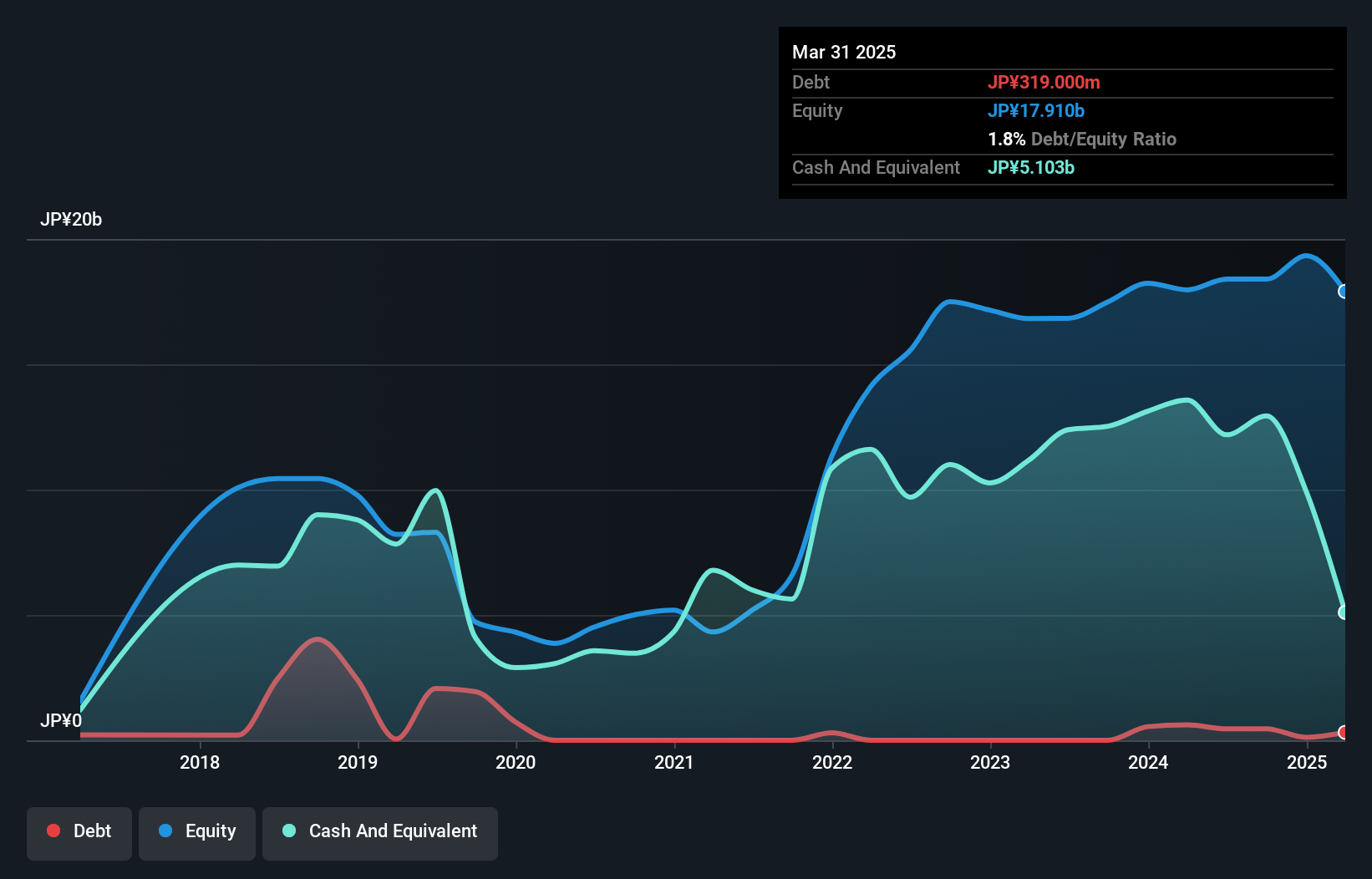

Overview: Mitani Corporation operates in the information system, construction, and energy sectors both in Japan and internationally, with a market cap of ¥171.59 billion.

Operations: Mitani Corporation generates revenue primarily from its Corporate Supply Related Business, which accounts for ¥234.23 billion, and its Lifestyle/Local Service Related Business, contributing ¥147.62 billion. The Information System Related Business adds ¥30.64 billion to the overall revenue stream.

Mitani, a promising player in its sector, has shown impressive earnings growth of 20% over the past year, far outpacing the industry average of 0.8%. The company seems to be on solid financial footing with a debt-to-equity ratio reduced from 7.3 to 5 over five years and maintains more cash than total debt, indicating strong liquidity. Trading at about 23% below estimated fair value suggests potential undervaluation. Recently, Mitani completed a share repurchase program worth ¥1.73 billion for 922,000 shares as part of its capital policy aimed at returning value to shareholders.

Key Takeaways

- Embark on your investment journey to our 4667 Undiscovered Gems With Strong Fundamentals selection here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8066

Mitani

Engages in the information system, construction, energy, and other businesses in Japan and internationally.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives