Unpleasant Surprises Could Be In Store For Santen Pharmaceutical Co., Ltd.'s (TSE:4536) Shares

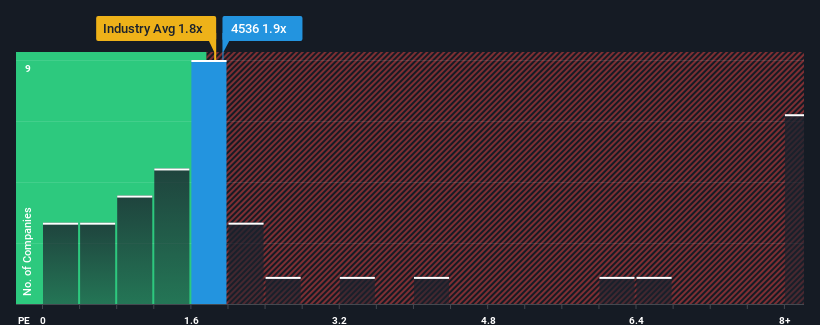

There wouldn't be many who think Santen Pharmaceutical Co., Ltd.'s (TSE:4536) price-to-sales (or "P/S") ratio of 1.9x is worth a mention when the median P/S for the Pharmaceuticals industry in Japan is similar at about 1.8x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

See our latest analysis for Santen Pharmaceutical

How Santen Pharmaceutical Has Been Performing

Recent revenue growth for Santen Pharmaceutical has been in line with the industry. It seems that many are expecting the mediocre revenue performance to persist, which has held the P/S ratio back. Those who are bullish on Santen Pharmaceutical will be hoping that revenue performance can pick up, so that they can pick up the stock at a slightly lower valuation.

Want the full picture on analyst estimates for the company? Then our free report on Santen Pharmaceutical will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Santen Pharmaceutical's to be considered reasonable.

Retrospectively, the last year delivered a decent 8.2% gain to the company's revenues. Revenue has also lifted 21% in aggregate from three years ago, partly thanks to the last 12 months of growth. So we can start by confirming that the company has actually done a good job of growing revenue over that time.

Looking ahead now, revenue is anticipated to slump, contracting by 1.5% each year during the coming three years according to the nine analysts following the company. Meanwhile, the broader industry is forecast to expand by 6.8% per annum, which paints a poor picture.

With this information, we find it concerning that Santen Pharmaceutical is trading at a fairly similar P/S compared to the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. There's a good chance these shareholders are setting themselves up for future disappointment if the P/S falls to levels more in line with the negative growth outlook.

What Does Santen Pharmaceutical's P/S Mean For Investors?

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our check of Santen Pharmaceutical's analyst forecasts revealed that its outlook for shrinking revenue isn't bringing down its P/S as much as we would have predicted. When we see a gloomy outlook like this, our immediate thoughts are that the share price is at risk of declining, negatively impacting P/S. If we consider the revenue outlook, the P/S seems to indicate that potential investors may be paying a premium for the stock.

A lot of potential risks can sit within a company's balance sheet. Take a look at our free balance sheet analysis for Santen Pharmaceutical with six simple checks on some of these key factors.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4536

Santen Pharmaceutical

Engages in the research and development, manufacture, and marketing of pharmaceuticals and medical devices in Japan and internationally.

Flawless balance sheet established dividend payer.