None Highlights These 3 Top Undiscovered Gems with Strong Potential

Reviewed by Simply Wall St

As global markets react to cooling inflation and robust bank earnings, major U.S. stock indexes have rebounded, with small-cap stocks showing notable strength as evidenced by the S&P MidCap 400's impressive gains. Amid this dynamic backdrop, identifying under-the-radar stocks with strong fundamentals and growth potential becomes crucial for investors looking to capitalize on market opportunities.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Wilson Bank Holding | NA | 7.87% | 8.22% | ★★★★★★ |

| ManpowerGroup Greater China | NA | 14.56% | 1.58% | ★★★★★★ |

| Natural Food International Holding | NA | 2.49% | 20.35% | ★★★★★★ |

| Standard Bank | 0.13% | 27.78% | 30.36% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Sure Global Tech | NA | 10.25% | 20.35% | ★★★★★★ |

| Citra Tubindo | NA | 11.06% | 31.01% | ★★★★★★ |

| Parker Drilling | 46.05% | 0.86% | 52.25% | ★★★★★★ |

| Aesler Grup Internasional | NA | -17.61% | -40.21% | ★★★★★★ |

Let's review some notable picks from our screened stocks.

Shenzhen Uniconn Technology (SZSE:301631)

Simply Wall St Value Rating: ★★★★☆☆

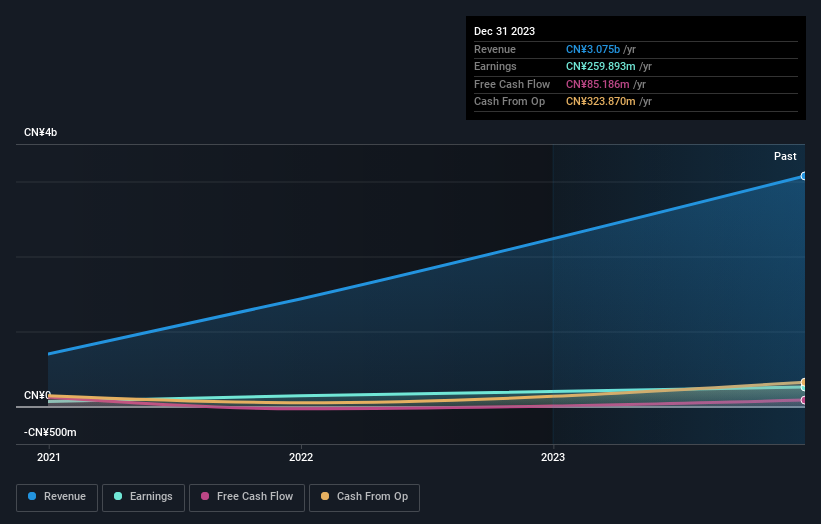

Overview: Shenzhen Uniconn Technology Co., Ltd. specializes in the R&D, design, production, sale, and service of electrical connection components in China with a market capitalization of CN¥7.96 billion.

Operations: Shenzhen Uniconn generates revenue primarily from the sale of electrical connection components. The company has a market capitalization of CN¥7.96 billion.

Shenzhen Uniconn Technology, a dynamic player in the electronics sector, showcased significant growth with earnings surging 29.1% over the past year, outpacing industry norms. The company reported net income of CNY 183.67 million for nine months ending September 2024, up from CNY 177.04 million previously, reflecting robust performance despite market volatility. Trading at about 32.6% below estimated fair value suggests potential undervaluation opportunities for investors seeking promising ventures in this space. With a satisfactory net debt to equity ratio of 5.5%, Shenzhen Uniconn's financial health appears stable amid its recent inclusion in major indices and successful IPO raising CNY 1.19 billion.

- Unlock comprehensive insights into our analysis of Shenzhen Uniconn Technology stock in this health report.

Learn about Shenzhen Uniconn Technology's historical performance.

Hibiya Engineering (TSE:1982)

Simply Wall St Value Rating: ★★★★★★

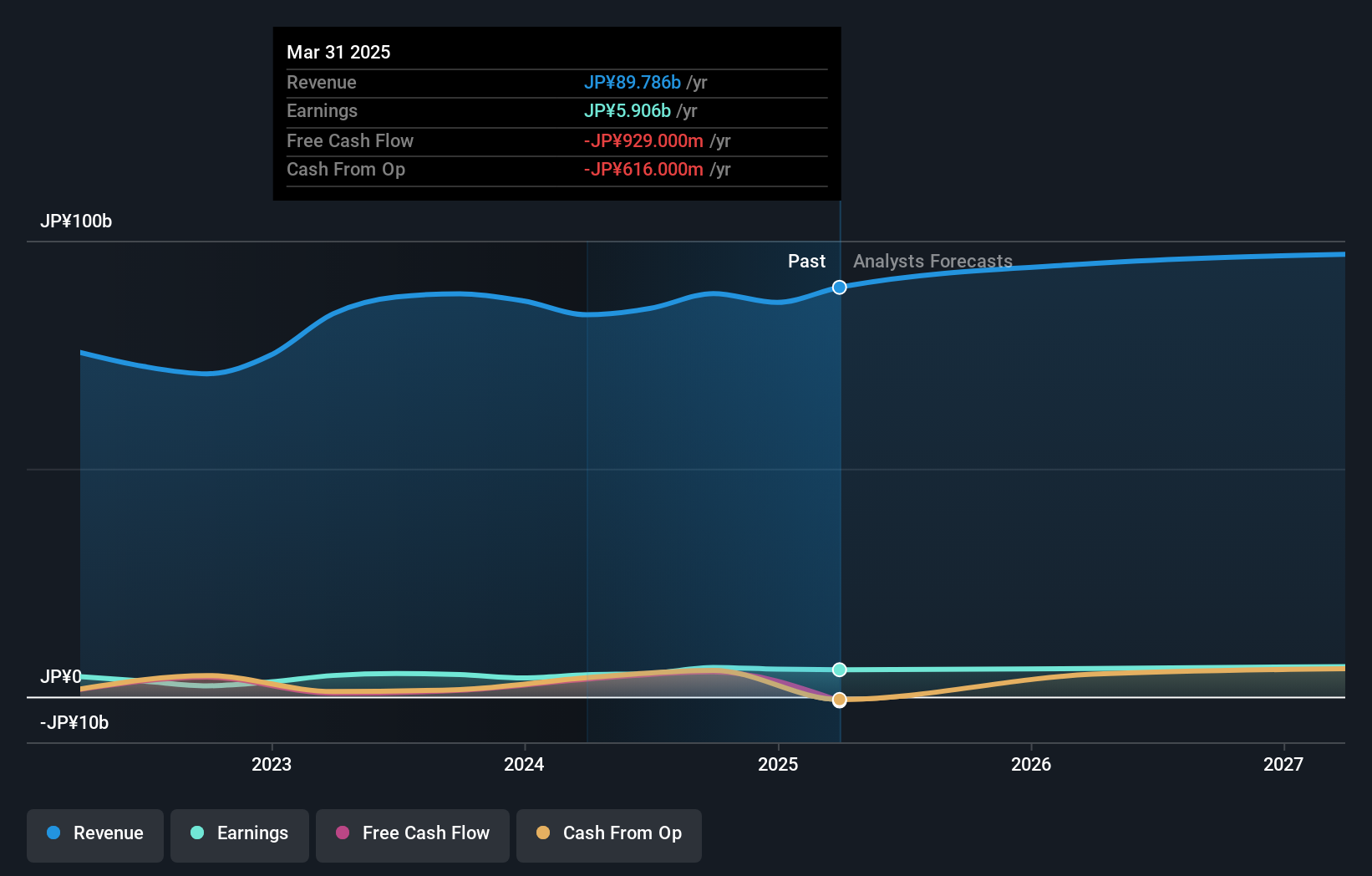

Overview: Hibiya Engineering, Ltd., along with its subsidiaries, offers a range of engineering products and services mainly in Japan and has a market cap of ¥81.12 billion.

Operations: Hibiya Engineering generates revenue primarily from its Equipment Construction Business, which contributes ¥77.50 billion, followed by the Equipment Sales Business at ¥11.52 billion and the Equipment Manufacturing Business at ¥4.26 billion.

Hibiya Engineering, a nimble player in the construction sector, stands out with its debt-free status and impressive earnings growth of 32% over the past year. Trading at 40% below estimated fair value, it seems to offer a compelling opportunity. The company also boasts high-quality earnings and positive free cash flow, indicating robust financial health. Recently, Hibiya completed a share buyback of 475,700 shares for ¥1.61 billion, reflecting confidence in its valuation. Despite recent share price volatility, the firm’s forecasted annual earnings growth of 2% suggests steady progress within industry trends.

- Take a closer look at Hibiya Engineering's potential here in our health report.

Examine Hibiya Engineering's past performance report to understand how it has performed in the past.

Chugoku Marine Paints (TSE:4617)

Simply Wall St Value Rating: ★★★★★★

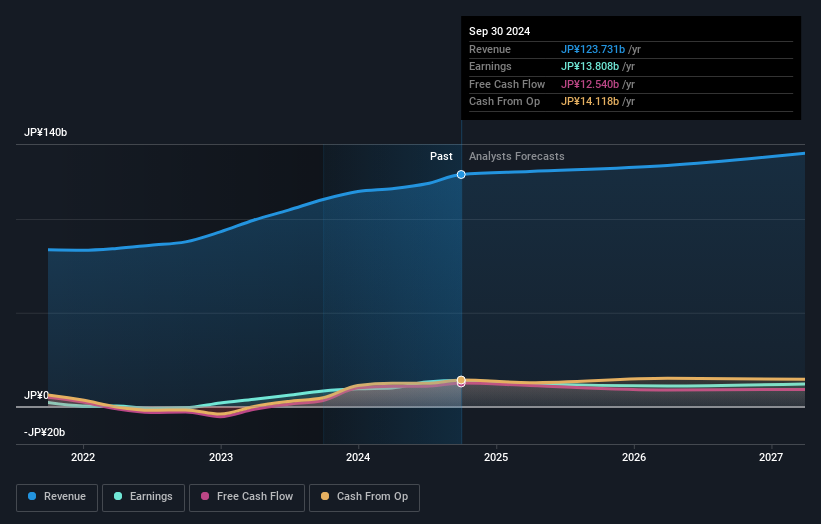

Overview: Chugoku Marine Paints, Ltd. is a global producer and seller of functional coatings with a market capitalization of ¥117.65 billion.

Operations: Chugoku Marine Paints generates revenue primarily from its operations in Japan, China, and Europe and the United States, with Japan contributing ¥48.33 billion and China ¥30.66 billion. The company's financial performance is influenced by its regional sales distribution across these key markets.

Chugoku Marine Paints, a smaller player in the coatings industry, is making waves with its impressive financial metrics. Over the past year, earnings surged by 66.5%, outpacing the Chemicals industry's growth of 13.7%. The company shows strong financial health with a reduced debt-to-equity ratio from 31.1% to 25.5% over five years and trades at an attractive value, being 17.6% below fair value estimates. Despite forecasts suggesting a potential average earnings decline of 5.5% annually for the next three years, Chugoku's current performance and valuation offer intriguing prospects for investors seeking untapped opportunities in niche markets.

- Navigate through the intricacies of Chugoku Marine Paints with our comprehensive health report here.

Gain insights into Chugoku Marine Paints' past trends and performance with our Past report.

Turning Ideas Into Actions

- Discover the full array of 4656 Undiscovered Gems With Strong Fundamentals right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4617

Flawless balance sheet with solid track record and pays a dividend.