- Japan

- /

- Infrastructure

- /

- TSE:9377

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are experiencing a notable upswing, driven by easing core inflation in the U.S. and robust bank earnings that have propelled major stock indexes higher. This positive momentum presents an opportune time to explore dividend stocks, which can offer stable income streams and potential growth, especially in a market environment where value stocks are outperforming growth shares amid rising oil prices and strong financial sector performance.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.07% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.65% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

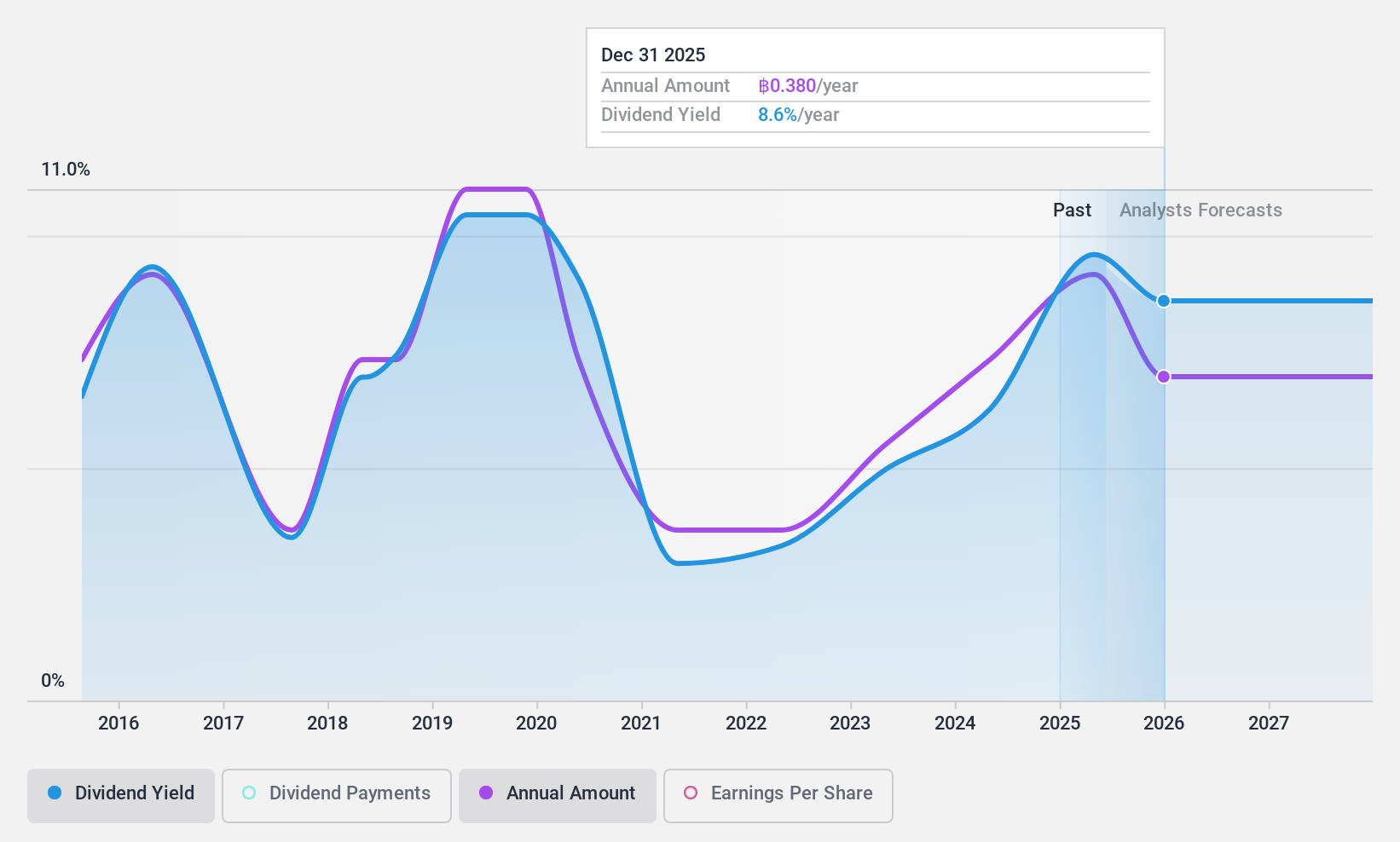

Rojana Industrial Park (SET:ROJNA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Rojana Industrial Park Public Company Limited, with a market cap of approximately THB11.92 billion, operates in Thailand where it manufactures and sells electricity generated from solar cell systems.

Operations: Rojana Industrial Park Public Company Limited generates revenue through its power plants (THB11.79 billion), water plants (THB726 million), rental services (THB32 million), and real estate sold and related services (THB6.65 billion).

Dividend Yield: 6.8%

Rojana Industrial Park's dividend payments are well-covered by earnings (21.4% payout ratio) and cash flows (12.5% cash payout ratio), despite a volatile 10-year track record. Recent earnings surged, with third-quarter net income reaching THB 2.26 billion from THB 267.68 million year-on-year, yet its dividend yield of 6.78% lags behind Thailand's top payers at 7.34%. The stock trades at a significant discount to estimated fair value but faces projected earnings declines ahead.

- Get an in-depth perspective on Rojana Industrial Park's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Rojana Industrial Park is priced lower than what may be justified by its financials.

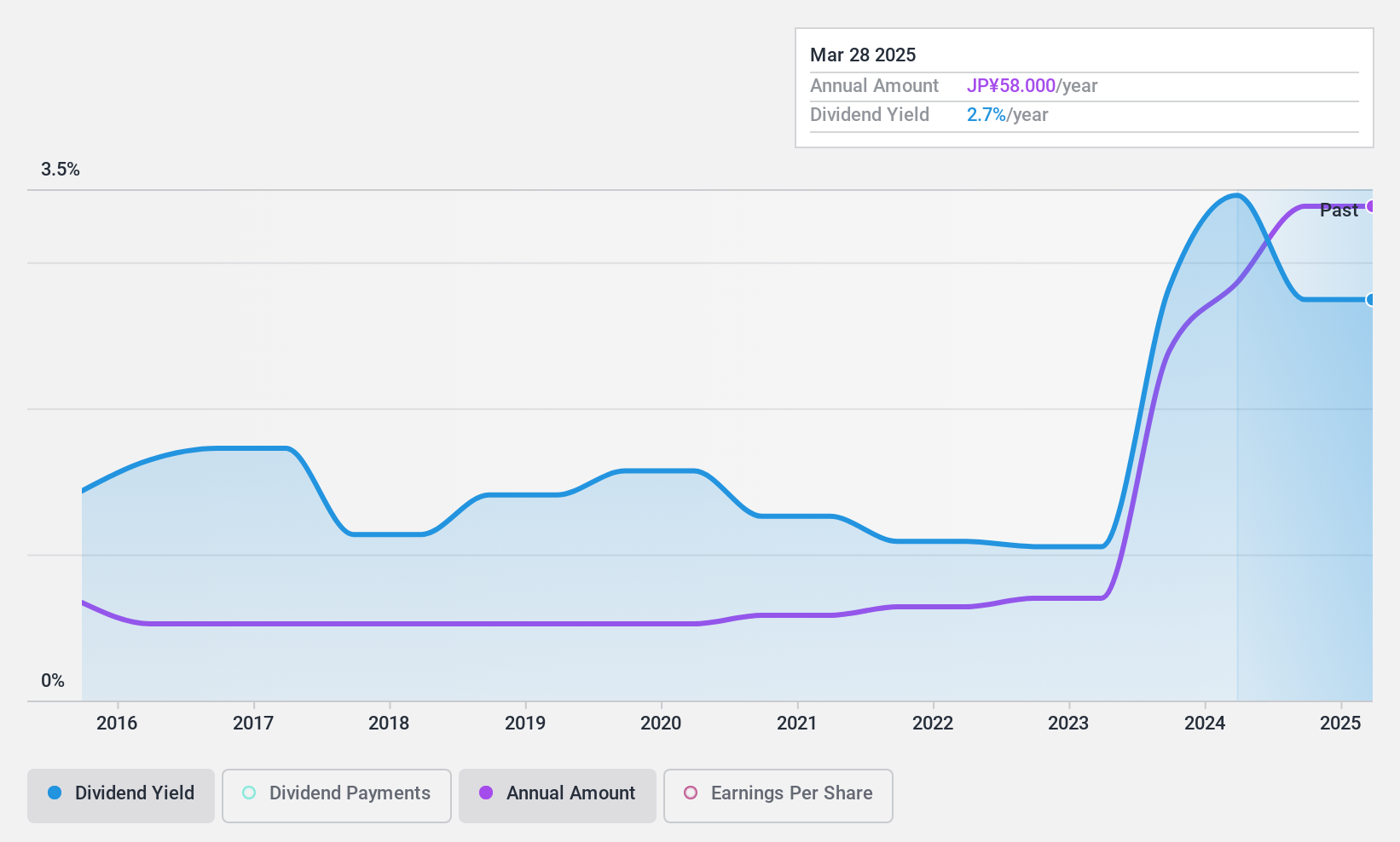

Startia HoldingsInc (TSE:3393)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Startia Holdings, Inc. operates in the IT sector both within Japan and internationally, with a market capitalization of ¥20.65 billion.

Operations: Startia Holdings, Inc. generates revenue through its Digital Marketing Related Business, which accounts for ¥3.67 billion, and its IT Infrastructure Related Business (including business applications), contributing ¥16.86 billion.

Dividend Yield: 4.5%

Startia Holdings' dividend payments are supported by earnings (45.9% payout ratio) and cash flows (76.5% cash payout ratio), though the dividend history has been volatile over the past decade. The company announced a second-quarter dividend of ¥46 per share, with plans to increase it to ¥56 for fiscal year 2025, up from ¥48 last year. Recent earnings guidance projects net sales of JPY 21.45 billion and profit attributable to owners at JPY 1.8 billion for the fiscal year ending March 2025.

- Navigate through the intricacies of Startia HoldingsInc with our comprehensive dividend report here.

- The valuation report we've compiled suggests that Startia HoldingsInc's current price could be inflated.

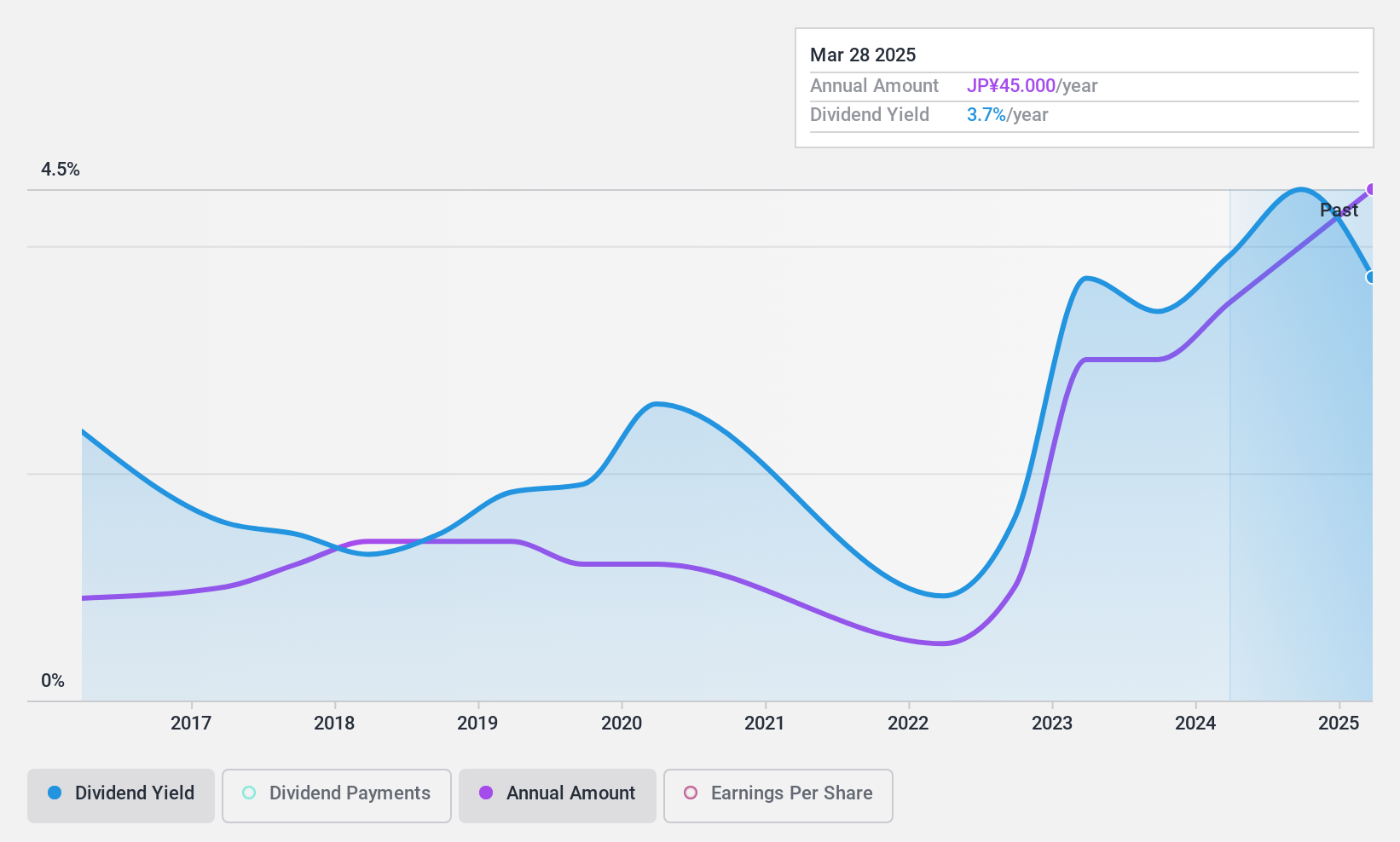

AGP (TSE:9377)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: AGP Corporation supports airport infrastructure in Japan and has a market cap of ¥15.75 billion.

Operations: AGP Corporation generates revenue through its Engineering Segment (¥6.83 billion), Power Supply Business (¥5.67 billion), and Merchandise Sales Business (¥1.08 billion).

Dividend Yield: 3.9%

AGP's dividend yield of 3.85% ranks in the top 25% of JP market dividend payers, yet it is not well supported by free cash flows and has been unreliable over the past decade with volatility exceeding a 20% annual drop. While earnings have grown by 9.1% recently and cover the current payout ratio of 76.5%, non-cash earnings raise concerns about quality and sustainability ahead of Q3 results expected on January 24, 2025.

- Dive into the specifics of AGP here with our thorough dividend report.

- According our valuation report, there's an indication that AGP's share price might be on the expensive side.

Taking Advantage

- Click through to start exploring the rest of the 1977 Top Dividend Stocks now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9377

Excellent balance sheet average dividend payer.