- Japan

- /

- Professional Services

- /

- TSE:4792

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As we enter January 2025, global markets are experiencing a positive shift with U.S. stocks climbing higher due to easing core inflation and strong bank earnings, while European indices are buoyed by slower-than-expected inflation, raising hopes for potential interest rate cuts. Amid these dynamics, dividend stocks remain an attractive option for investors seeking steady income and potential capital appreciation in a market characterized by fluctuating economic indicators and sector performances.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.66% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.45% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.52% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.95% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.65% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.06% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

YAMADA Consulting GroupLtd (TSE:4792)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: YAMADA Consulting Group Ltd. offers a range of consulting services across Japan, Asia, the United States, and internationally, with a market cap of ¥35.39 billion.

Operations: YAMADA Consulting Group Ltd. generates revenue from its Consulting segment, amounting to ¥20.02 billion, and its Investment Business segment, which brings in ¥3.12 billion.

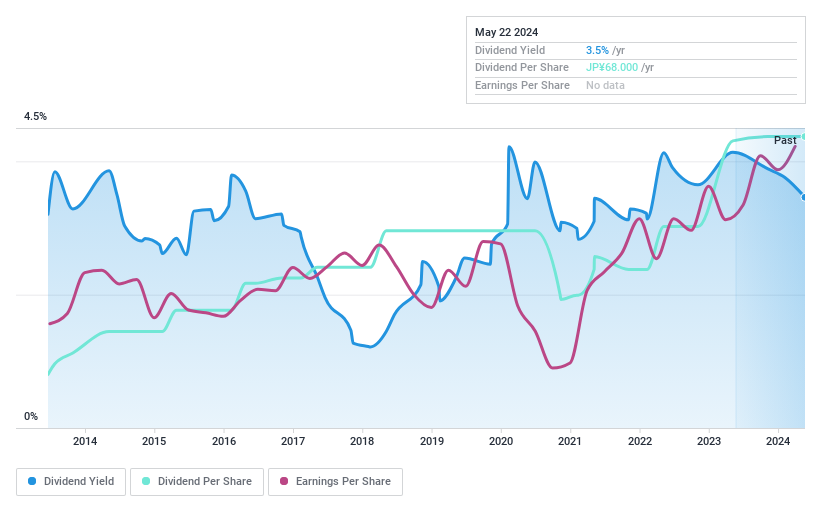

Dividend Yield: 4%

YAMADA Consulting Group Ltd. offers a mixed dividend profile. While its 4.01% yield ranks in the top 25% of JP market payers, dividends are not well covered by free cash flows and have been volatile over the past decade. However, a low payout ratio of 44.2% indicates coverage by earnings, despite high non-cash earnings levels. Recent profit growth of 26.3% suggests potential for future stability if cash flow issues are addressed effectively.

- Dive into the specifics of YAMADA Consulting GroupLtd here with our thorough dividend report.

- Insights from our recent valuation report point to the potential overvaluation of YAMADA Consulting GroupLtd shares in the market.

Teikoku Tsushin Kogyo (TSE:6763)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Teikoku Tsushin Kogyo Co., Ltd. specializes in providing a range of electronic components both in Japan and internationally, with a market cap of ¥21.97 billion.

Operations: Teikoku Tsushin Kogyo Co., Ltd.'s revenue from electronic parts amounts to ¥14.88 billion.

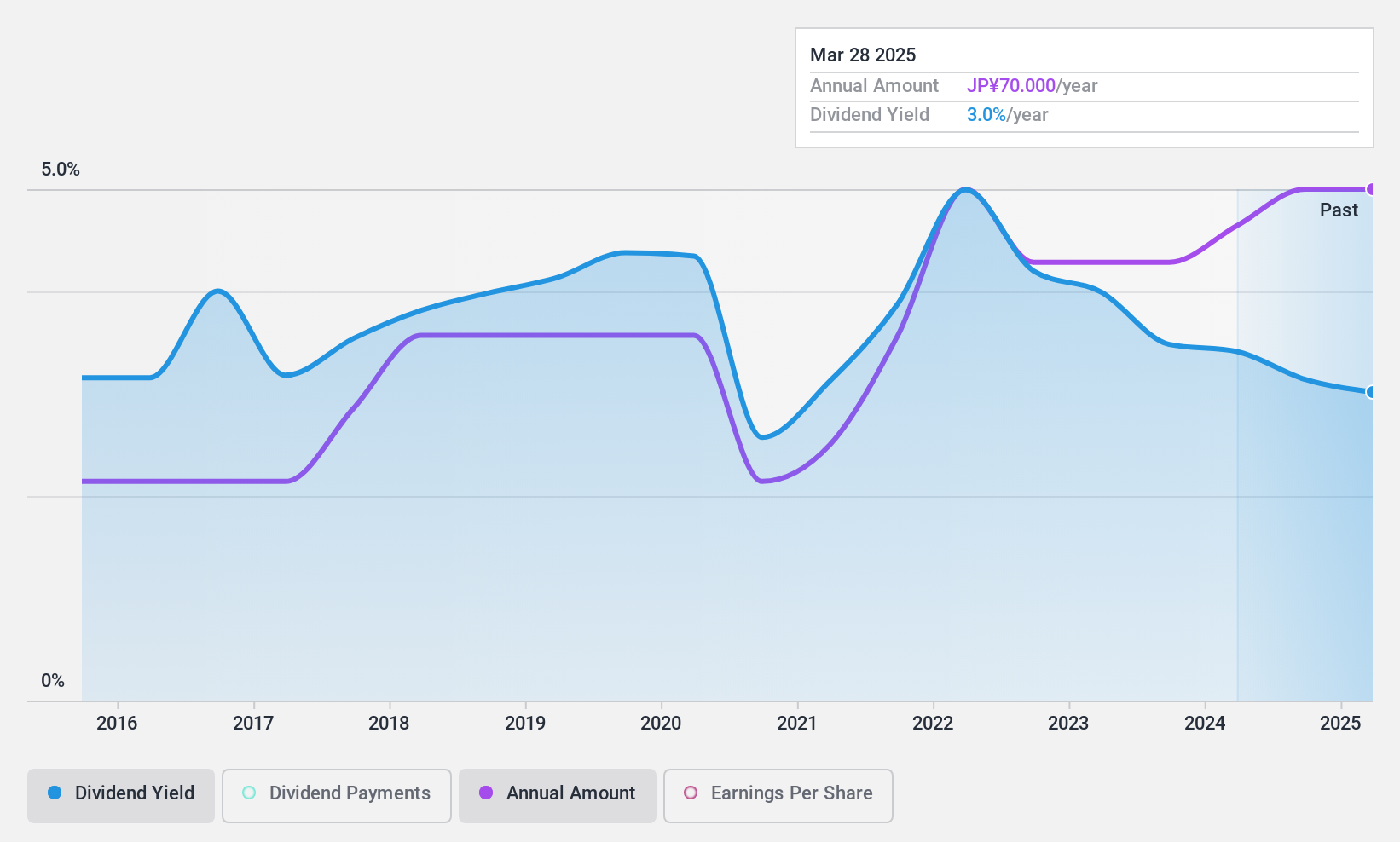

Dividend Yield: 2.9%

Teikoku Tsushin Kogyo's dividend profile is characterized by a low yield of 2.93%, below the top 25% in Japan. Despite a reasonable payout ratio of 58%, indicating earnings coverage, dividends have been volatile over the past decade with significant annual drops. Recent buyback activities, totaling ¥299.82 million for 1.15% of shares, may signal confidence but do not address the unstable dividend history or high cash payout ratio of 89.7%.

- Delve into the full analysis dividend report here for a deeper understanding of Teikoku Tsushin Kogyo.

- The analysis detailed in our Teikoku Tsushin Kogyo valuation report hints at an inflated share price compared to its estimated value.

Foster Electric Company (TSE:6794)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Foster Electric Company, Limited produces and sells loudspeakers, audio equipment, and electronic equipment both in Japan and internationally, with a market cap of ¥364.63 billion.

Operations: Foster Electric Company's revenue segments include the Speaker Business, which generated ¥106.08 billion, and the Mobile Audio Business, contributing ¥13.50 billion.

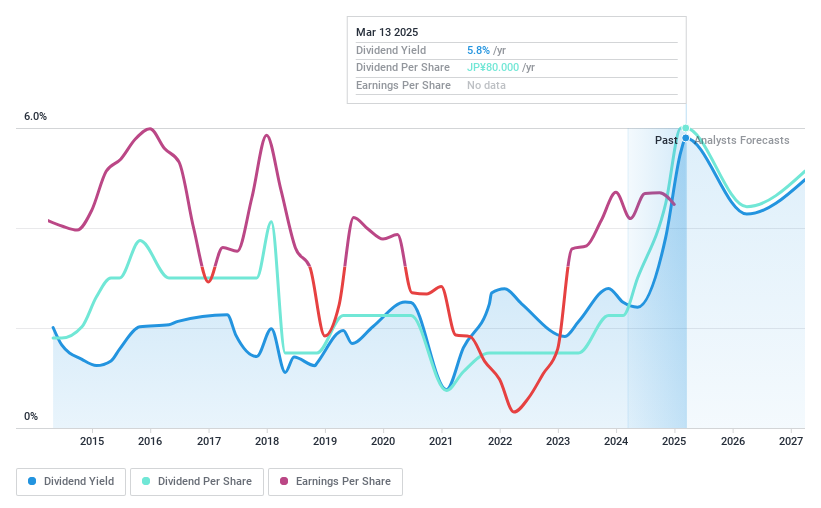

Dividend Yield: 3.7%

Foster Electric Company, trading 35.1% below its estimated fair value, offers a dividend yield of 3.66%, slightly under the top quartile in Japan. Despite past volatility and an unstable dividend record, recent increases suggest improvement, with dividends doubling year-over-year to JPY 20 per share for Q2 and expected to reach JPY 30 by fiscal year's end. Earnings cover dividends well at a low payout ratio of 21.9%, though cash flow coverage is tighter at 70.1%.

- Click here and access our complete dividend analysis report to understand the dynamics of Foster Electric Company.

- Our valuation report unveils the possibility Foster Electric Company's shares may be trading at a discount.

Summing It All Up

- Unlock our comprehensive list of 1983 Top Dividend Stocks by clicking here.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade YAMADA Consulting GroupLtd, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4792

YAMADA Consulting GroupLtd

Provides various consulting services in Japan, Asia, the United States, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives