- Japan

- /

- Electrical

- /

- TSE:5659

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing inflation and strong earnings reports, investors are increasingly optimistic about potential rate cuts later in the year. In this environment of rising stock indices and economic recovery signals, dividend stocks can offer stability and income, making them an attractive consideration for those looking to navigate the current market dynamics effectively.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 3.63% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.71% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.59% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| E J Holdings (TSE:2153) | 4.09% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

ITmedia (TSE:2148)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ITmedia Inc. develops and operates Internet-only media platforms offering information on diverse topics in Japan, with a market cap of ¥30.29 billion.

Operations: ITmedia Inc.'s revenue is derived from its B to B Media segment, generating ¥6.58 billion, and its B to C Media segment, contributing ¥1.43 billion.

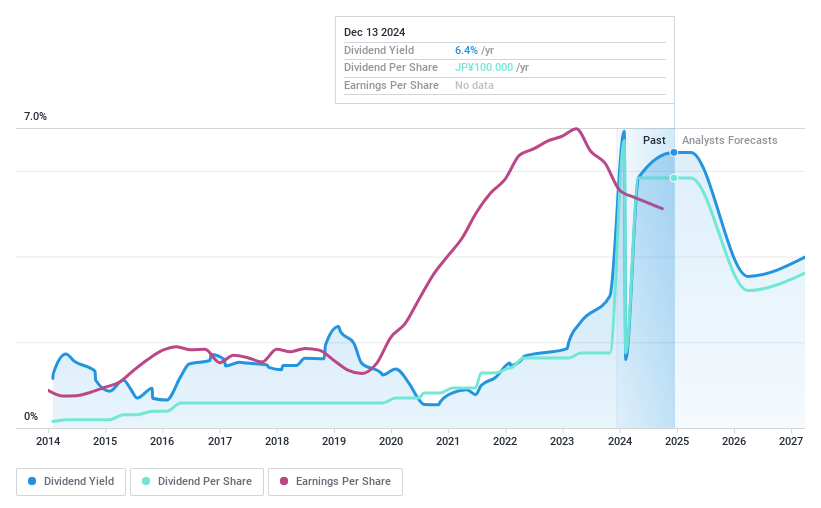

Dividend Yield: 6.4%

ITmedia trades at 29.7% below its estimated fair value, offering potential value for investors. Its dividend yield of 6.4% ranks in the top 25% of the JP market, but sustainability is a concern with high payout ratios: 136.8% of earnings and 133.3% of cash flows are used for dividends, indicating coverage issues. Despite this, ITmedia's dividends have been stable and growing over the past decade without volatility.

- Unlock comprehensive insights into our analysis of ITmedia stock in this dividend report.

- Our valuation report unveils the possibility ITmedia's shares may be trading at a discount.

Nippon SeisenLtd (TSE:5659)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nippon Seisen Co., Ltd. manufactures and sells stainless steel wires both in Japan and internationally, with a market cap of ¥41.35 billion.

Operations: Nippon Seisen Co., Ltd.'s revenue is primarily derived from Japan at ¥41.34 billion, followed by Thailand at ¥5.44 billion, and China and South Korea at ¥1.59 billion.

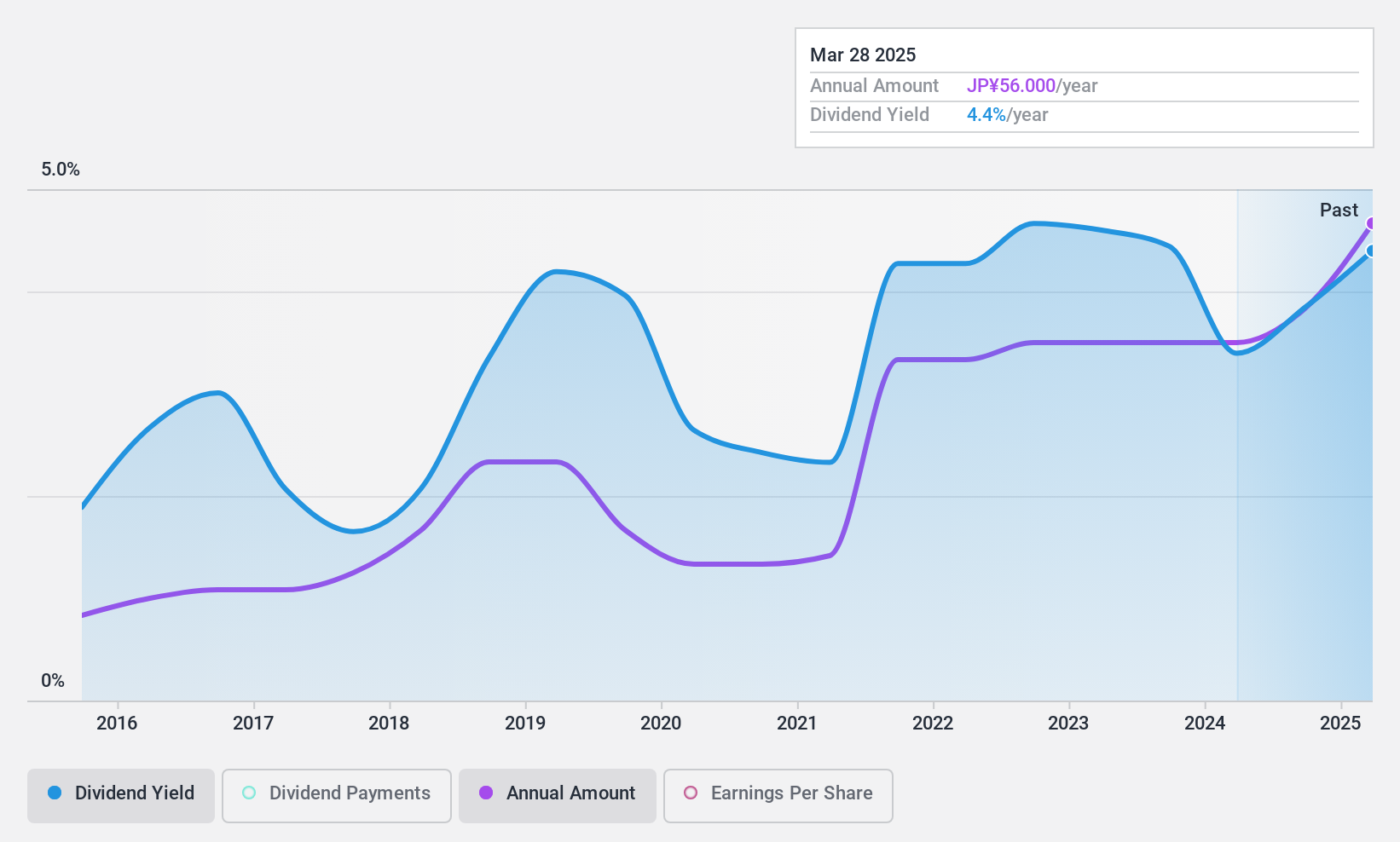

Dividend Yield: 4.2%

Nippon Seisen trades at 70.6% below its estimated fair value, yet its dividend yield of 4.15% is among the top 25% in Japan. However, sustainability is questionable due to a high payout ratio of 223.3%, indicating dividends aren't well covered by earnings despite being supported by cash flows with a payout ratio of 54.2%. Recent guidance suggests stable profits, but dividend payments have been volatile and reduced significantly this year compared to last year.

- Navigate through the intricacies of Nippon SeisenLtd with our comprehensive dividend report here.

- The analysis detailed in our Nippon SeisenLtd valuation report hints at an inflated share price compared to its estimated value.

Honda Motor (TSE:7267)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Honda Motor Co., Ltd. is a global company engaged in the development, manufacturing, and distribution of motorcycles, automobiles, power products, and other offerings across Japan, North America, Europe, Asia, and international markets with a market cap of approximately ¥6.92 trillion.

Operations: Honda Motor Co., Ltd.'s revenue segments include the Automobile Business at ¥14.57 billion, Motorcycle Business at ¥3.46 billion, Financial Services Business at ¥3.49 billion, and Power Products and Other Businesses at ¥411.25 million.

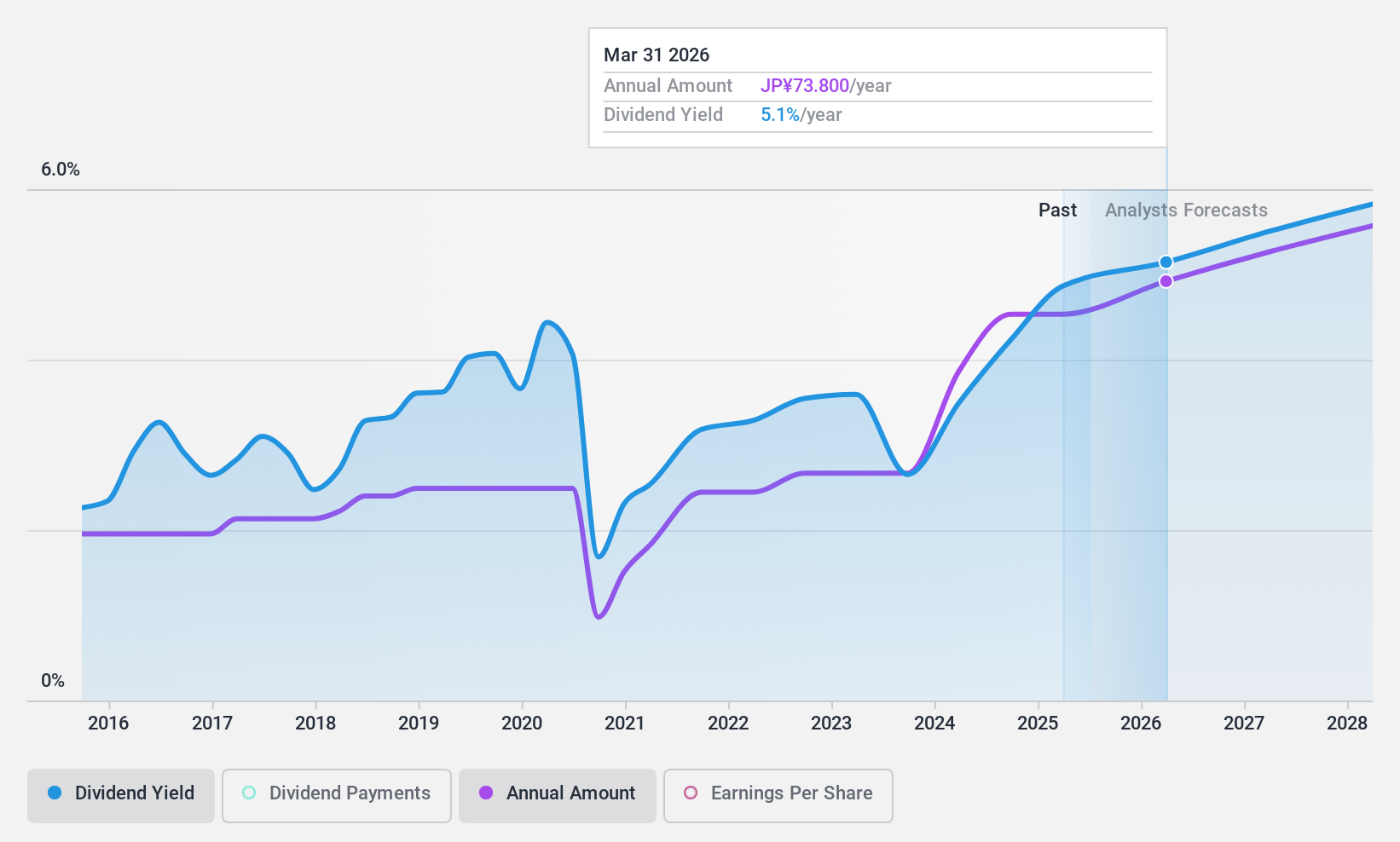

Dividend Yield: 4.6%

Honda Motor's dividend yield of 4.56% ranks in the top 25% of Japanese dividend payers, yet it isn't well covered by free cash flows. Despite stable and growing dividends over the past decade, sustainability concerns arise as payouts exceed earnings coverage. Honda's strategic initiatives in electric vehicles and potential merger talks with Nissan may influence future financial stability. The company's share repurchase program aims to enhance capital efficiency and shareholder returns, further reflecting its commitment to maintaining investor value.

- Get an in-depth perspective on Honda Motor's performance by reading our dividend report here.

- The analysis detailed in our Honda Motor valuation report hints at an deflated share price compared to its estimated value.

Where To Now?

- Take a closer look at our Top Dividend Stocks list of 1983 companies by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon SeisenLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5659

Nippon SeisenLtd

Manufactures and sells stainless steel wires in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Market Insights

Community Narratives