- Japan

- /

- Professional Services

- /

- TSE:9757

3 Stocks Estimated To Be Up To 49.1% Below Their Intrinsic Value

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core inflation in the U.S. and strong earnings from major banks, investors are increasingly focused on identifying opportunities that may be undervalued amid these positive shifts. In this environment, stocks estimated to be significantly below their intrinsic value present potential avenues for growth as they could benefit from improving economic conditions and market optimism.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Alltop Technology (TPEX:3526) | NT$264.50 | NT$526.31 | 49.7% |

| Fudo Tetra (TSE:1813) | ¥2150.00 | ¥4294.32 | 49.9% |

| North Electro-OpticLtd (SHSE:600184) | CN¥10.72 | CN¥21.42 | 49.9% |

| Stille (OM:STIL) | SEK228.00 | SEK453.79 | 49.8% |

| EuroGroup Laminations (BIT:EGLA) | €2.54 | €5.06 | 49.8% |

| Shinko Electric Industries (TSE:6967) | ¥5851.00 | ¥11653.40 | 49.8% |

| Jiangsu Chuanzhiboke Education Technology (SZSE:003032) | CN¥9.10 | CN¥18.17 | 49.9% |

| Equifax (NYSE:EFX) | US$268.88 | US$535.98 | 49.8% |

| BATM Advanced Communications (LSE:BVC) | £0.19 | £0.38 | 49.8% |

| RXO (NYSE:RXO) | US$26.19 | US$52.36 | 50% |

Let's review some notable picks from our screened stocks.

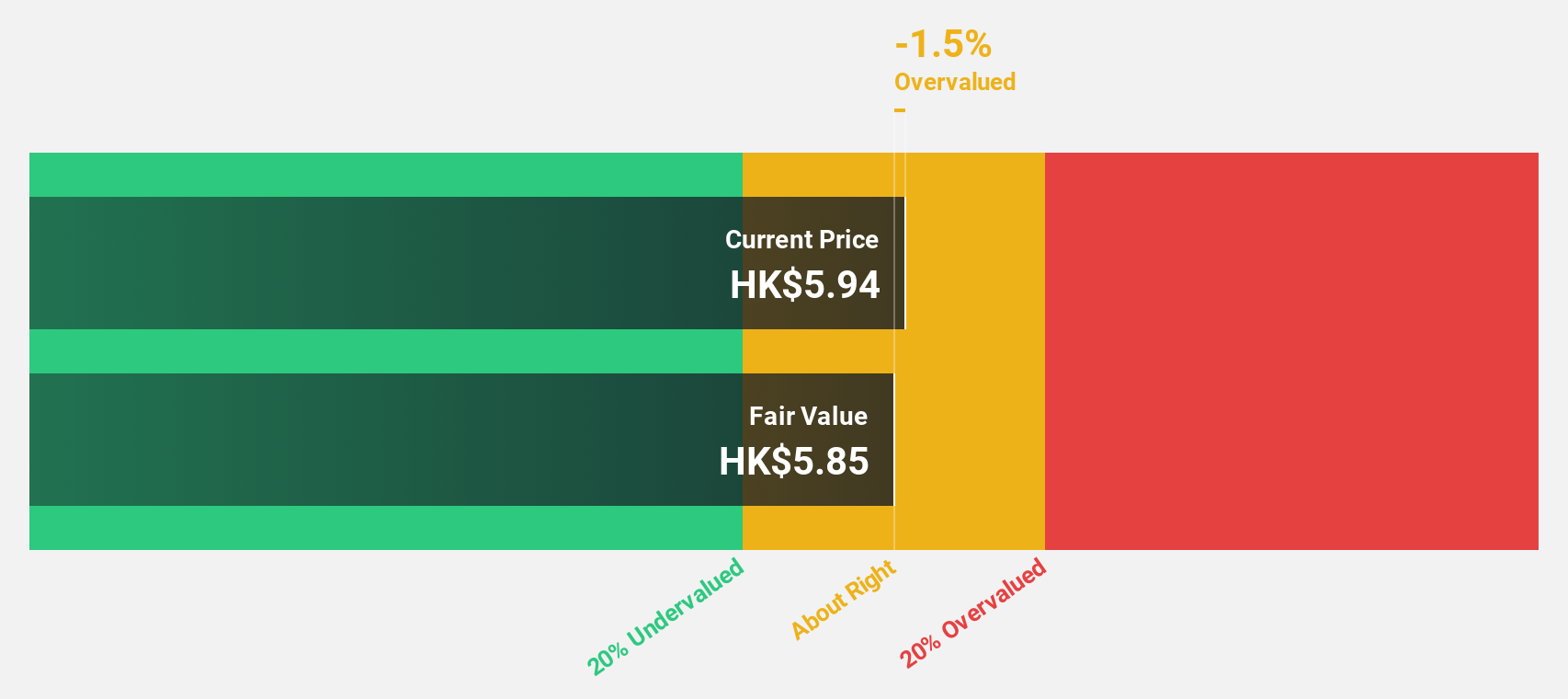

AK Medical Holdings (SEHK:1789)

Overview: AK Medical Holdings Limited is an investment holding company that designs, develops, produces, and markets orthopedic joint implants and related products in China and internationally with a market cap of HK$4.87 billion.

Operations: The company's revenue segments include CN¥989.17 million from orthopedic implants in China and CN¥159.06 million from orthopedic implants in the United Kingdom.

Estimated Discount To Fair Value: 49.1%

AK Medical Holdings is trading at HK$4.37, significantly below its estimated fair value of HK$8.58, suggesting it may be undervalued based on cash flows. Despite a forecasted low return on equity of 13% in three years, earnings are expected to grow significantly by 28.39% annually, outpacing the Hong Kong market's growth rate. Analysts agree on a potential stock price increase of 42.8%, with revenue projected to rise by 24% per year, surpassing market averages.

- Upon reviewing our latest growth report, AK Medical Holdings' projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of AK Medical Holdings.

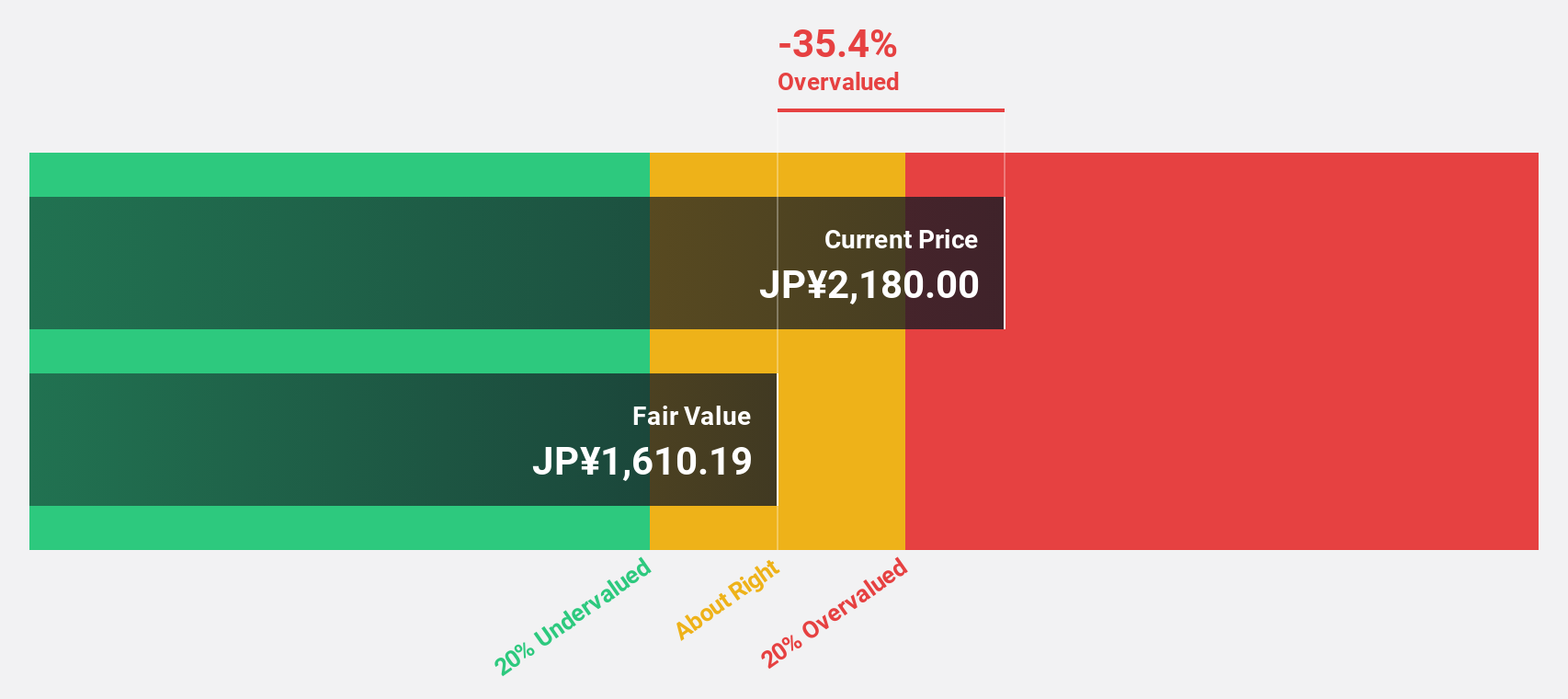

Premium Group (TSE:7199)

Overview: Premium Group Co., Ltd. offers financing and services on a global scale, with a market cap of ¥97.26 billion.

Operations: The company's revenue is primarily derived from Finance (¥20.34 billion), Failure Warranty (¥9.55 billion), and Auto Mobility Service, including the Car Premium Business (¥7.19 billion).

Estimated Discount To Fair Value: 23.4%

Premium Group is trading at ¥2,606, below its estimated fair value of ¥3,402.28. Earnings are projected to grow 19.46% annually, outpacing the JP market's 8% growth rate. Despite debt not being well covered by operating cash flow, analysts expect a stock price rise of 48.4%. Recent dividends increased from ¥13.00 to ¥20.00 per share for Q2 2024, reflecting strong financial performance and shareholder returns focus.

- Our earnings growth report unveils the potential for significant increases in Premium Group's future results.

- Delve into the full analysis health report here for a deeper understanding of Premium Group.

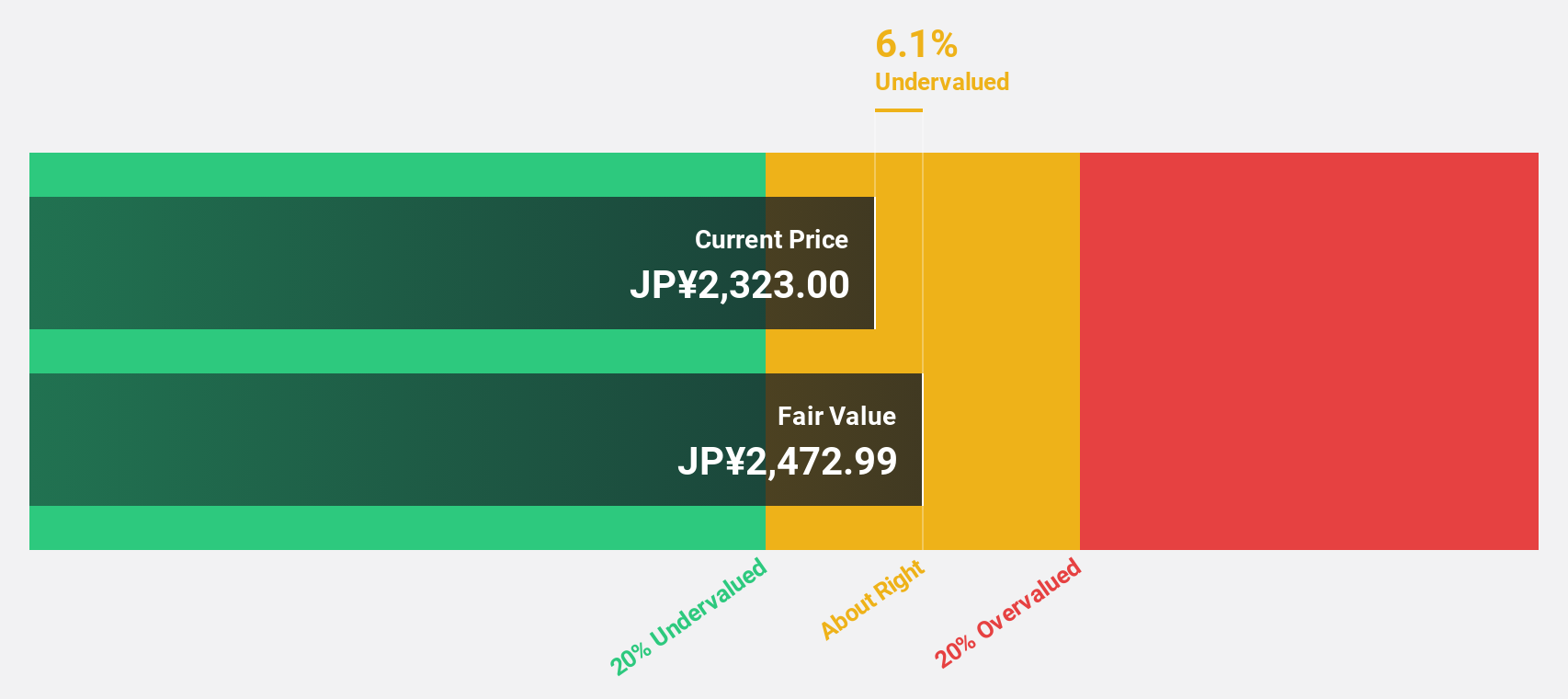

Funai Soken Holdings (TSE:9757)

Overview: Funai Soken Holdings Incorporated offers consulting services across multiple industries in Japan and has a market cap of ¥108.07 billion.

Operations: The company's revenue is primarily derived from consulting services at ¥22.51 billion, with additional income from logistics at ¥4.63 billion and digital solutions at ¥4.77 billion.

Estimated Discount To Fair Value: 23.3%

Funai Soken Holdings is trading at ¥2,358, significantly below its estimated fair value of ¥3,074.75. The company's earnings are projected to grow at 10.7% annually, surpassing the JP market's average growth rate of 8%. Revenue is also expected to increase by 8.9% per year. However, the company has an unstable dividend track record. Despite this, Funai Soken remains undervalued based on discounted cash flow analysis by over 20%.

- Insights from our recent growth report point to a promising forecast for Funai Soken Holdings' business outlook.

- Navigate through the intricacies of Funai Soken Holdings with our comprehensive financial health report here.

Next Steps

- Click this link to deep-dive into the 872 companies within our Undervalued Stocks Based On Cash Flows screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:9757

Funai Soken Holdings

Provides consulting services for various industries in Japan.

Flawless balance sheet with reasonable growth potential and pays a dividend.

Market Insights

Community Narratives