- Japan

- /

- Healthcare Services

- /

- TSE:4694

Top 3 Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

As global markets experience a rebound, driven by cooling inflation and robust earnings reports, investors are increasingly optimistic about the potential for future growth. In this environment of rising stock indices and easing inflationary pressures, dividend stocks stand out as attractive options for those seeking steady income streams alongside capital appreciation.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Guaranty Trust Holding (NGSE:GTCO) | 6.07% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.90% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.10% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.48% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.45% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.65% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.82% | ★★★★★★ |

Click here to see the full list of 1980 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

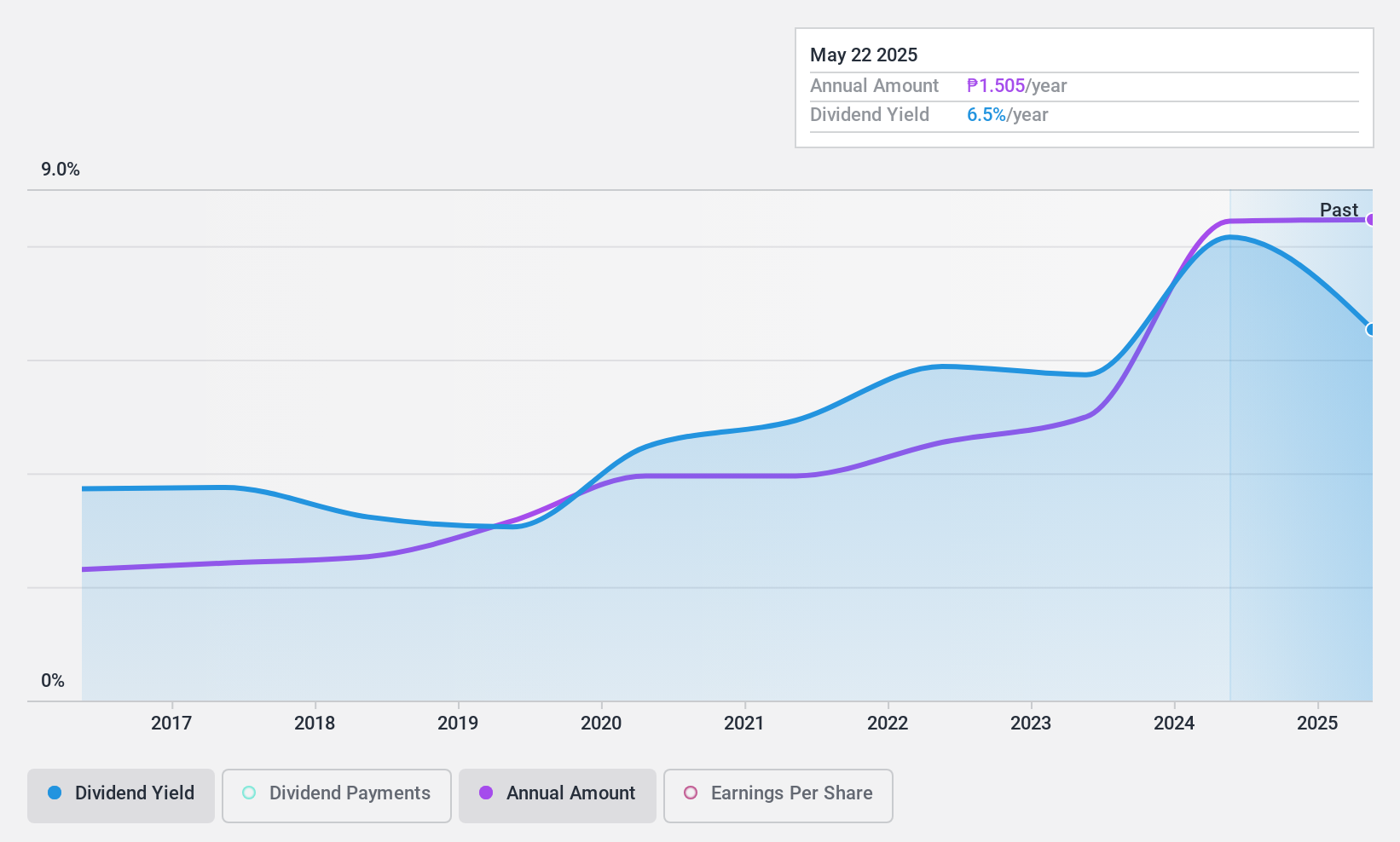

Asian Terminals (PSE:ATI)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Asian Terminals, Inc. operates and manages the South Harbor Port of Manila and the Port of Batangas in the Philippines, with a market cap of ₱32.97 billion.

Operations: Asian Terminals, Inc.'s revenue is primarily derived from its Ports Business segment, which generated ₱15.39 billion.

Dividend Yield: 8.6%

Asian Terminals offers a high dividend yield of 8.63%, placing it in the top 25% of Philippine market payers. Dividends have been stable and growing over the past decade, indicating reliability despite not being fully covered by free cash flows due to a high cash payout ratio of 110.5%. The recent share buyback program worth PHP 2 billion could potentially enhance shareholder value, while its price-to-earnings ratio of 7.9x suggests good value relative to the market.

- Delve into the full analysis dividend report here for a deeper understanding of Asian Terminals.

- Insights from our recent valuation report point to the potential overvaluation of Asian Terminals shares in the market.

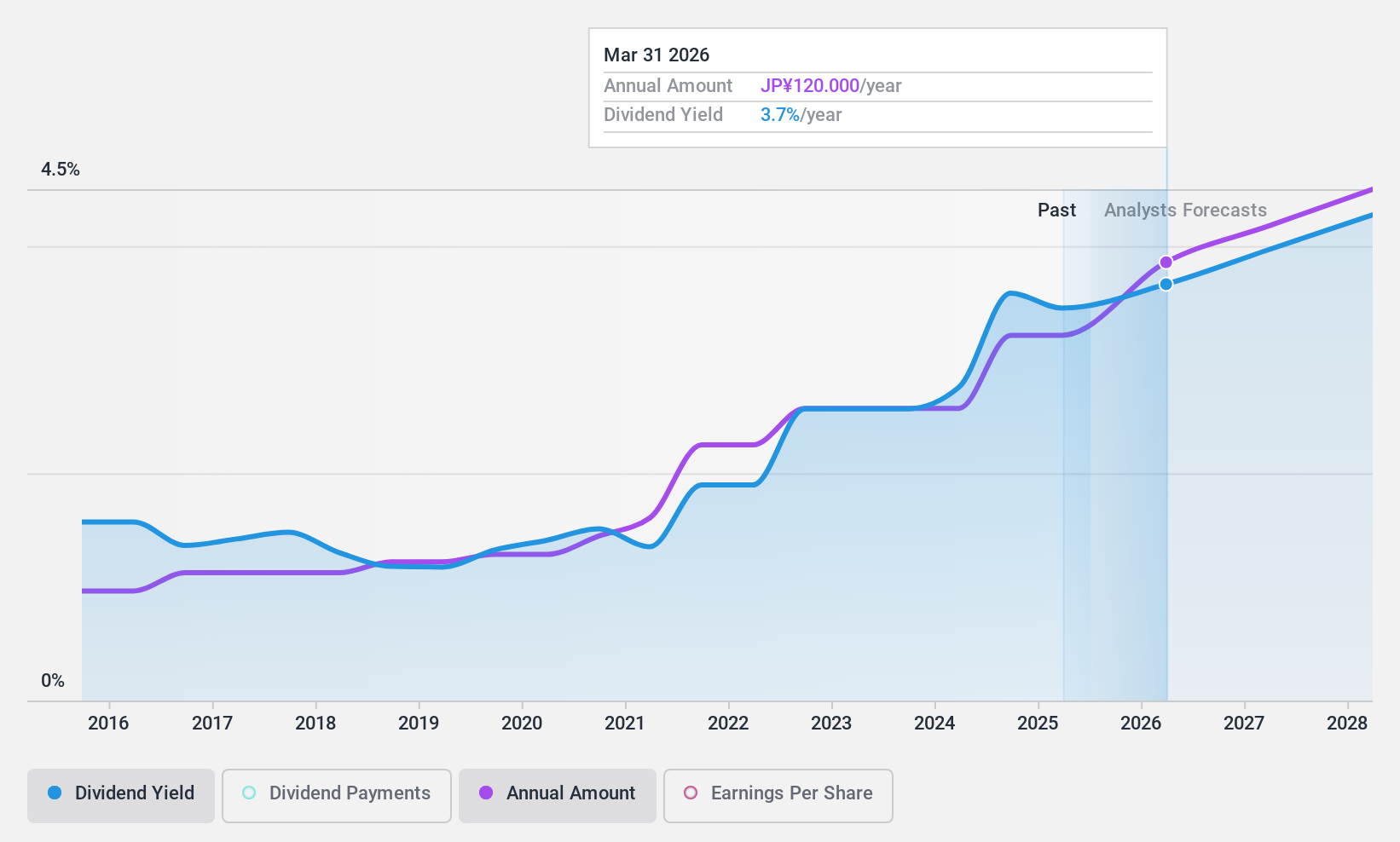

BML (TSE:4694)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: BML, Inc. operates in Japan offering laboratory testing and related services, with a market cap of ¥108.75 billion.

Operations: BML, Inc. generates revenue primarily from its Inspection Business segment, which accounts for ¥131.47 billion.

Dividend Yield: 5%

BML's dividend yield of 4.97% is among the top 25% in the JP market. However, its dividend payments have been unreliable and volatile over the past decade, with earnings not covering them adequately due to a lack of free cash flows despite a reasonable payout ratio of 57.5%. The stock trades at 43% below estimated fair value, but high non-cash earnings may affect quality perceptions. Earnings are projected to grow modestly at 1.78% annually.

- Click to explore a detailed breakdown of our findings in BML's dividend report.

- In light of our recent valuation report, it seems possible that BML is trading behind its estimated value.

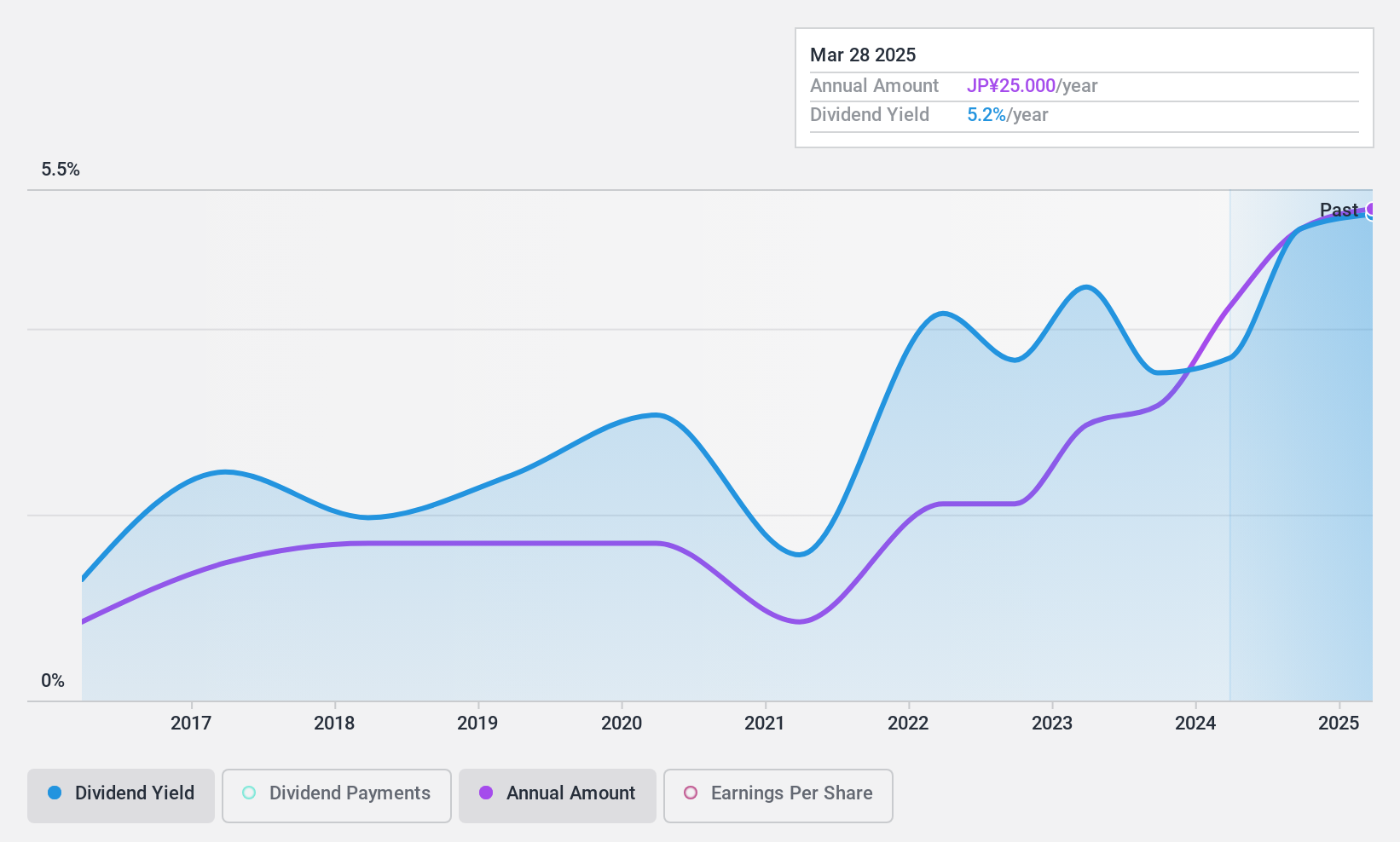

Nissan Tokyo Sales Holdings (TSE:8291)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nissan Tokyo Sales Holdings Co., Ltd. operates in the automobile dealership business in Japan and has a market capitalization of ¥29.31 billion.

Operations: Nissan Tokyo Sales Holdings Co., Ltd. generates revenue primarily from its Automobile Related Business segment, which accounts for ¥144.44 billion.

Dividend Yield: 5%

Nissan Tokyo Sales Holdings offers a dividend yield of 4.95%, placing it in the top 25% of JP market payers. Despite strong earnings growth of 91.2% last year and a low payout ratio of 22.5%, dividends have been unreliable and volatile over the past decade, with no free cash flows to cover them. Recent share buybacks worth ¥2,961 million aim to enhance capital efficiency amidst ongoing equity offerings, reflecting strategic capital management efforts.

- Click here and access our complete dividend analysis report to understand the dynamics of Nissan Tokyo Sales Holdings.

- Our expertly prepared valuation report Nissan Tokyo Sales Holdings implies its share price may be too high.

Where To Now?

- Investigate our full lineup of 1980 Top Dividend Stocks right here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if BML might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4694

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives