- Japan

- /

- Aerospace & Defense

- /

- TSE:186A

Baowu Magnesium Technology And 2 Other Growth Stocks With Strong Insider Ownership

Reviewed by Simply Wall St

As global markets show signs of optimism with cooling inflation and strong bank earnings propelling stocks higher, investors are increasingly focusing on growth companies that demonstrate resilience in fluctuating economic conditions. A key indicator of potential success in such firms is high insider ownership, which often signals confidence from those closest to the company's operations and strategy.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Propel Holdings (TSX:PRL) | 36.8% | 38.9% |

| Waystream Holding (OM:WAYS) | 11.3% | 113.3% |

| Medley (TSE:4480) | 34.1% | 27.2% |

| Pharma Mar (BME:PHM) | 11.9% | 55.1% |

| Kingstone Companies (NasdaqCM:KINS) | 20.8% | 24.9% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.1% |

| Plenti Group (ASX:PLT) | 12.7% | 120.1% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 135% |

| Elliptic Laboratories (OB:ELABS) | 26.8% | 121.1% |

Let's dive into some prime choices out of the screener.

Baowu Magnesium Technology (SZSE:002182)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Baowu Magnesium Technology Co., Ltd. is involved in mining and non-ferrous metal smelting and processing both in China and internationally, with a market cap of CN¥11.34 billion.

Operations: The company generates revenue primarily through its Non-Ferrous Metal Smelting and Rolling Processing segment, which accounts for CN¥8.15 billion.

Insider Ownership: 17%

Earnings Growth Forecast: 61.5% p.a.

Baowu Magnesium Technology is positioned for substantial growth, with revenue expected to increase by 25.2% annually, outpacing the broader Chinese market. Despite a decline in net income to CNY 153.76 million for the first nine months of 2024, earnings are forecasted to grow significantly at 61.5% per year over the next three years. However, concerns include low return on equity projections and insufficient debt coverage by operating cash flow, alongside a dividend yield not well supported by free cash flows.

- Take a closer look at Baowu Magnesium Technology's potential here in our earnings growth report.

- Our comprehensive valuation report raises the possibility that Baowu Magnesium Technology is priced higher than what may be justified by its financials.

PharmaResources (Shanghai) (SZSE:301230)

Simply Wall St Growth Rating: ★★★★★☆

Overview: PharmaResources (Shanghai) Co., Ltd. operates as a CRO, CDMO, and CMO service provider in drug discovery in China with a market cap of CN¥3.38 billion.

Operations: PharmaResources (Shanghai) Co., Ltd. generates revenue through its roles as a CRO, CDMO, and CMO service provider in the Chinese drug discovery sector.

Insider Ownership: 13.9%

Earnings Growth Forecast: 50.8% p.a.

PharmaResources (Shanghai) is expected to experience strong growth, with earnings projected to increase by 50.8% annually, surpassing the broader Chinese market's growth rate. Despite a recent decline in net profit margins from 14.6% to 1.3%, revenue is forecasted to grow at 20.9% per year. The company recently completed a share buyback of CNY 53.08 million, representing 1.47% of shares, but faces challenges with low return on equity and unsustainable dividend coverage.

- Unlock comprehensive insights into our analysis of PharmaResources (Shanghai) stock in this growth report.

- The analysis detailed in our PharmaResources (Shanghai) valuation report hints at an inflated share price compared to its estimated value.

Astroscale Holdings (TSE:186A)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Astroscale Holdings Inc. offers on-orbit service solutions and has a market capitalization of ¥76.48 billion.

Operations: The company's revenue is primarily derived from its In-Orbit Servicing Business, which generated ¥2.35 billion.

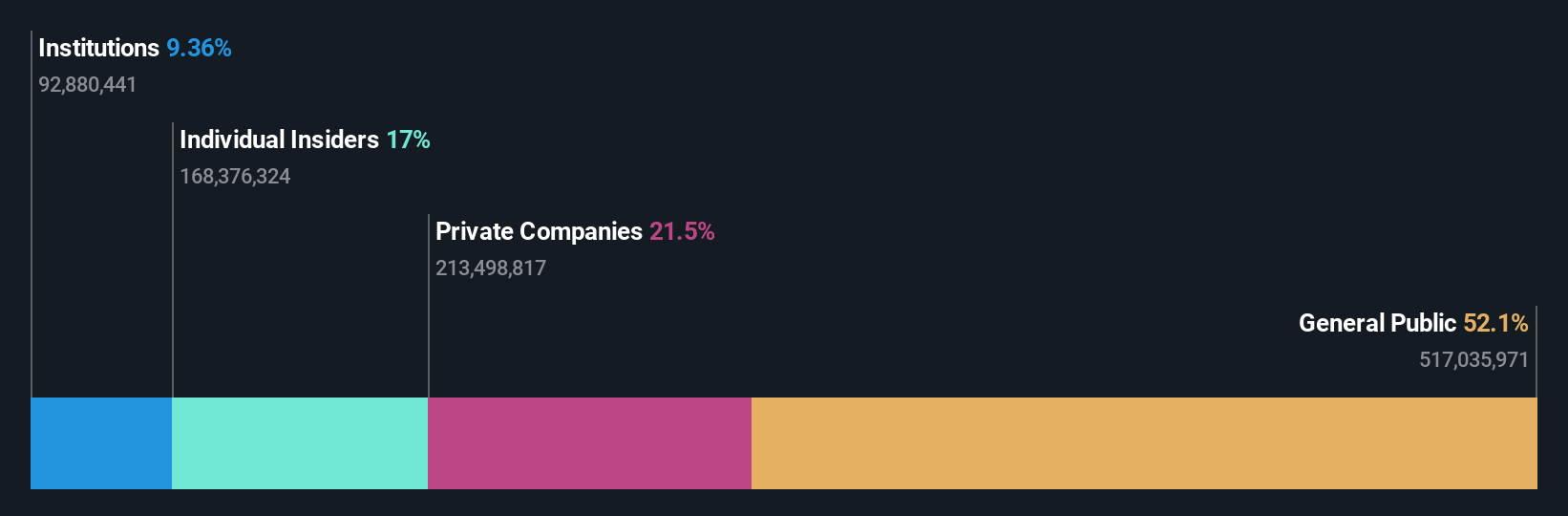

Insider Ownership: 21.3%

Earnings Growth Forecast: 76.6% p.a.

Astroscale Holdings is forecast to see robust revenue growth of 42.5% annually, outpacing the Japanese market's average. However, its Return on Equity is projected to remain modest at 17.1% in three years. The company recently joined the S&P Global BMI Index and announced an ambitious ADRAS-J mission milestone, enhancing its space debris removal capabilities despite facing operational challenges. Financial forecasts indicate significant losses for FY2025 with revenue expected at ¥8 billion (US$0.05 billion).

- Get an in-depth perspective on Astroscale Holdings' performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Astroscale Holdings' shares may be trading at a premium.

Where To Now?

- Click this link to deep-dive into the 1462 companies within our Fast Growing Companies With High Insider Ownership screener.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:186A

High growth potential with adequate balance sheet.