We Think That There Are Some Issues For Chugai Pharmaceutical (TSE:4519) Beyond Its Promising Earnings

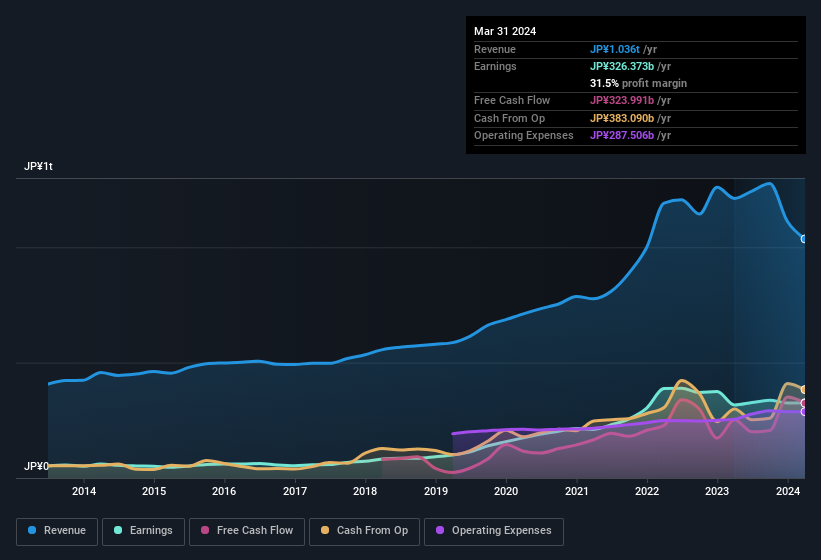

Chugai Pharmaceutical Co., Ltd.'s (TSE:4519 ) stock didn't jump after it announced some healthy earnings. Our analysis showed that there are some concerning factors in the earnings that investors may be cautious of.

See our latest analysis for Chugai Pharmaceutical

The Power Of Non-Operating Revenue

At most companies, some revenue streams, such as government grants, are accounted for as non-operating revenue, while the core business is said to produce operating revenue. Generally speaking, operating revenue is a more reliable guide to the sustainable revenue generating capacity of the business. Importantly, the non-operating revenue often comes without associated ongoing costs, so it can boost profit by letting it fall straight to the bottom line, making the operating business seem better than it really is. It's worth noting that Chugai Pharmaceutical saw a big increase in non-operating revenue over the last year. Indeed, its non-operating revenue rose from JP¥123.6b last year to JP¥148.6b this year. The high levels of non-operating revenue are problematic because if (and when) they do not repeat, then overall revenue (and profitability) of the firm will fall. In order to better understand a company's profit result, it can sometimes help to consider whether the result would be very different without a sudden increase in non-operating revenue.

That might leave you wondering what analysts are forecasting in terms of future profitability. Luckily, you can click here to see an interactive graph depicting future profitability, based on their estimates.

Our Take On Chugai Pharmaceutical's Profit Performance

When considering the nature of Chugai Pharmaceutical's earnings, we'd absolutely keep in mind that it saw an increase in non-operating revenue in the last year, which would in turn have boosted its profit, potentially in an unsustainable manner. Therefore, it seems possible to us that Chugai Pharmaceutical's true underlying earnings power is actually less than its statutory profit. But at least holders can take some solace from the 55% per annum growth in EPS for the last three. The goal of this article has been to assess how well we can rely on the statutory earnings to reflect the company's potential, but there is plenty more to consider. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. Case in point: We've spotted 1 warning sign for Chugai Pharmaceutical you should be aware of.

This note has only looked at a single factor that sheds light on the nature of Chugai Pharmaceutical's profit. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:4519

Chugai Pharmaceutical

Engages in the research, development, manufacture, sale, importation, and exportation of pharmaceuticals in Japan and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives