- Japan

- /

- Gas Utilities

- /

- TSE:8174

CyberAgent And Two More Stocks On The Japanese Exchange That May Be Priced Below Estimated True Value

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, Japan's stock exchange has seen some intriguing movements, particularly with the yen's recent strength potentially impacting export-driven sectors. As investors navigate these complex waters, identifying stocks that may be undervalued becomes a crucial strategy for those looking to capitalize on discrepancies between market price and intrinsic value.

Top 10 Undervalued Stocks Based On Cash Flows In Japan

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Persol HoldingsLtd (TSE:2181) | ¥255.90 | ¥491.48 | 47.9% |

| Hibino (TSE:2469) | ¥2730.00 | ¥5209.50 | 47.6% |

| Fujibo Holdings (TSE:3104) | ¥4790.00 | ¥9403.13 | 49.1% |

| West Holdings (TSE:1407) | ¥2224.00 | ¥4177.67 | 46.8% |

| Macromill (TSE:3978) | ¥888.00 | ¥1681.04 | 47.2% |

| Yokowo (TSE:6800) | ¥2061.00 | ¥3890.71 | 47% |

| DKS (TSE:4461) | ¥3715.00 | ¥7138.15 | 48% |

| Japan Pure ChemicalLtd (TSE:4973) | ¥3455.00 | ¥6360.05 | 45.7% |

| Atrae (TSE:6194) | ¥933.00 | ¥1717.19 | 45.7% |

| freee K.K (TSE:4478) | ¥2723.00 | ¥5232.05 | 48% |

Let's take a closer look at a couple of our picks from the screened companies.

CyberAgent (TSE:4751)

Overview: CyberAgent, Inc. operates primarily in Japan, focusing on media, internet advertising, gaming, and investment development with a market capitalization of approximately ¥491.35 billion.

Operations: The company generates revenue mainly through its media, internet advertising, and gaming segments.

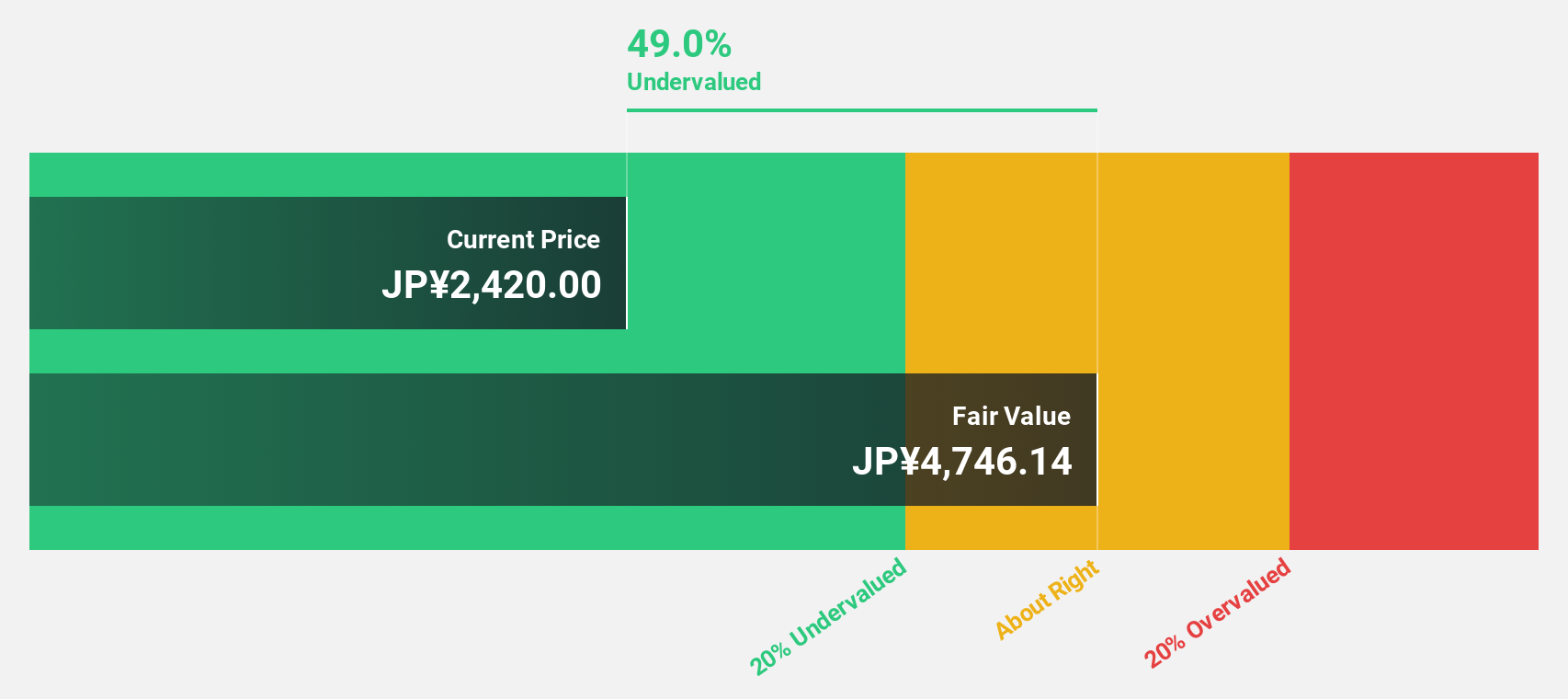

Estimated Discount To Fair Value: 34.7%

CyberAgent is positioned as an undervalued stock in Japan, trading at ¥970.5, significantly below the estimated fair value of ¥1487.24, reflecting a 34.7% discount. The company's earnings have increased by 23.5% over the past year and are expected to continue growing at a robust rate of 20.41% annually over the next three years, outpacing the Japanese market's average growth. However, its forecasted Return on Equity of 13.7% is relatively low, and recent revenue growth projections (6.5% per year) lag behind more aggressive growth rates seen elsewhere in the sector.

- Our comprehensive growth report raises the possibility that CyberAgent is poised for substantial financial growth.

- Unlock comprehensive insights into our analysis of CyberAgent stock in this financial health report.

Taiyo Yuden (TSE:6976)

Overview: Taiyo Yuden Co., Ltd. is a global developer, manufacturer, and seller of electronic components based in Japan, with operations extending to China, Hong Kong, and other international markets, boasting a market capitalization of approximately ¥637.47 billion.

Operations: The company generates its revenue from the development, manufacturing, and sales of electronic components across Japan, China, Hong Kong, and other global markets.

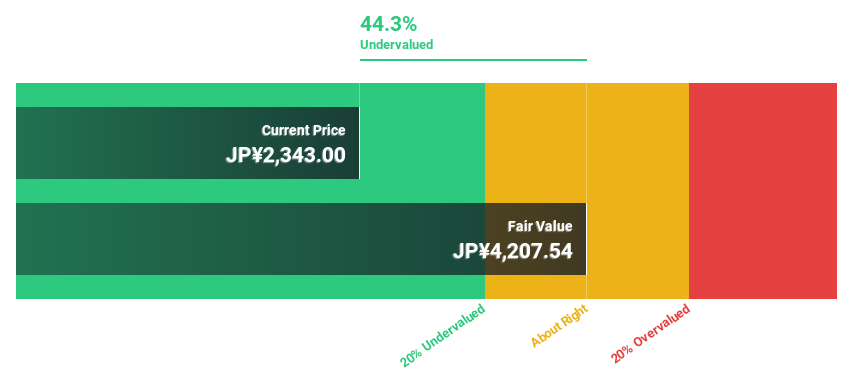

Estimated Discount To Fair Value: 10.5%

Taiyo Yuden, trading at ¥5115, is valued below its estimated fair value of ¥5714.59, marking it as undervalued based on cash flows. Despite a highly volatile share price recently, its earnings are poised for significant growth at 29.29% annually over the next three years, surpassing Japan's market average. However, challenges include a low net profit margin of 2.6%, down from last year's 7.3%, and a dividend yield of 1.76% that is poorly covered by earnings and free cash flows.

- Our earnings growth report unveils the potential for significant increases in Taiyo Yuden's future results.

- Delve into the full analysis health report here for a deeper understanding of Taiyo Yuden.

Nippon Gas (TSE:8174)

Overview: Nippon Gas Co., Ltd. operates in Japan, focusing on the supply and sale of LP gas and natural gas, with a market capitalization of approximately ¥270.32 billion.

Operations: The company's primary revenue is generated from the sale and distribution of LP gas and natural gas across Japan.

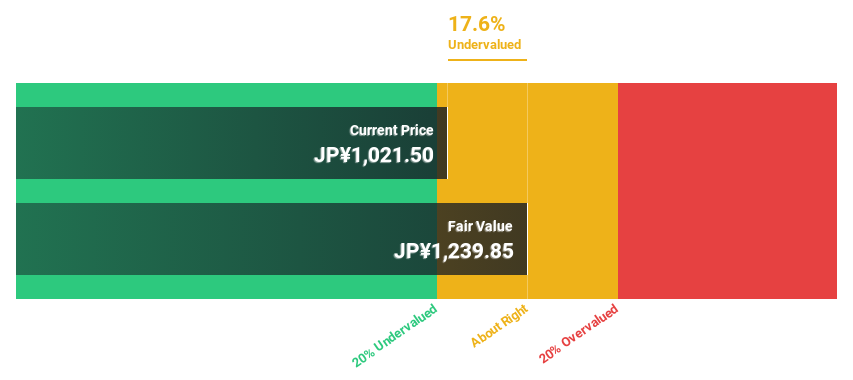

Estimated Discount To Fair Value: 33.8%

Nippon Gas, priced at ¥2424.5, is significantly undervalued with a fair value of ¥3661.03 according to DCF analysis, indicating a potential price increase of 30.6%. The company's earnings are expected to grow by 9.84% annually, outpacing the Japanese market forecast of 9%. Despite its unstable dividend record and modest revenue growth predictions (5.5% per year), recent strategic buybacks suggest active management engagement in enhancing shareholder value, including a significant repurchase plan announced for up to ¥3 billion by end-2024.

- The analysis detailed in our Nippon Gas growth report hints at robust future financial performance.

- Click here to discover the nuances of Nippon Gas with our detailed financial health report.

Turning Ideas Into Actions

- Dive into all 88 of the Undervalued Japanese Stocks Based On Cash Flows we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Gas might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:8174

Nippon Gas

Engages in the supply and sale of LP gas and natural gas in Japan.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives