- Japan

- /

- Entertainment

- /

- TSE:3659

With NEXON Co., Ltd. (TSE:3659) It Looks Like You'll Get What You Pay For

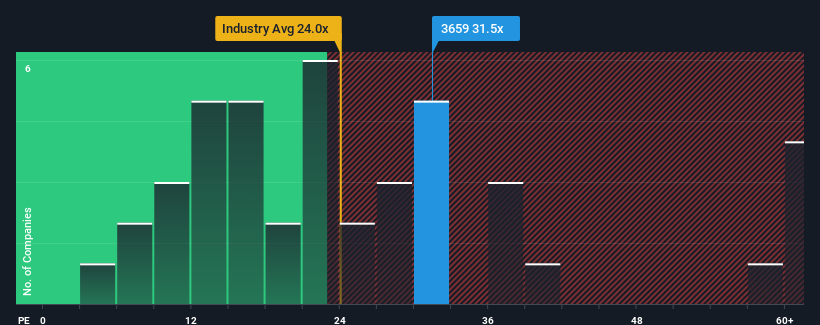

When close to half the companies in Japan have price-to-earnings ratios (or "P/E's") below 13x, you may consider NEXON Co., Ltd. (TSE:3659) as a stock to avoid entirely with its 31.5x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's so lofty.

NEXON hasn't been tracking well recently as its declining earnings compare poorly to other companies, which have seen some growth on average. It might be that many expect the dour earnings performance to recover substantially, which has kept the P/E from collapsing. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Check out our latest analysis for NEXON

How Is NEXON's Growth Trending?

In order to justify its P/E ratio, NEXON would need to produce outstanding growth well in excess of the market.

Retrospectively, the last year delivered a frustrating 38% decrease to the company's bottom line. Even so, admirably EPS has lifted 78% in aggregate from three years ago, notwithstanding the last 12 months. Although it's been a bumpy ride, it's still fair to say the earnings growth recently has been more than adequate for the company.

Shifting to the future, estimates from the analysts covering the company suggest earnings should grow by 31% per year over the next three years. Meanwhile, the rest of the market is forecast to only expand by 9.6% each year, which is noticeably less attractive.

In light of this, it's understandable that NEXON's P/E sits above the majority of other companies. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From NEXON's P/E?

We'd say the price-to-earnings ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've established that NEXON maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. Unless these conditions change, they will continue to provide strong support to the share price.

Before you settle on your opinion, we've discovered 2 warning signs for NEXON that you should be aware of.

Of course, you might also be able to find a better stock than NEXON. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Valuation is complex, but we're here to simplify it.

Discover if NEXON might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSE:3659

NEXON

Produces, develops, distributes, and services PC online and mobile games in Japan and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives