High Growth Tech Stocks to Watch in Japan for September 2024

Reviewed by Simply Wall St

As Japan's stock markets recover from recent volatility, marked by gains in both the Nikkei 225 and TOPIX indices, investors are increasingly looking toward high-growth tech stocks that could capitalize on this momentum. In this environment, identifying companies with strong innovation, solid financial health, and the ability to adapt to evolving market conditions becomes crucial for spotting potential winners in Japan's tech sector.

Top 10 High Growth Tech Companies In Japan

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Hottolink | 50.99% | 61.55% | ★★★★★★ |

| Cyber Security Cloud | 20.71% | 25.73% | ★★★★★☆ |

| eWeLLLtd | 26.52% | 27.53% | ★★★★★★ |

| Medley | 24.98% | 30.36% | ★★★★★★ |

| f-code | 22.70% | 22.62% | ★★★★★☆ |

| SHIFT | 20.25% | 32.08% | ★★★★★★ |

| Kanamic NetworkLTD | 20.75% | 28.25% | ★★★★★★ |

| Bengo4.comInc | 20.76% | 46.76% | ★★★★★★ |

| ExaWizards | 22.69% | 62.99% | ★★★★★★ |

| Money Forward | 20.68% | 68.12% | ★★★★★★ |

We're going to check out a few of the best picks from our screener tool.

Kakaku.com (TSE:2371)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kakaku.com, Inc., along with its subsidiaries, offers purchase support and restaurant review services in Japan and has a market cap of ¥501.62 billion.

Operations: Kakaku.com, Inc. generates revenue through purchase support and restaurant review services in Japan. The company operates various platforms that facilitate consumer decision-making by providing price comparisons, product reviews, and dining recommendations.

Kakaku.com has demonstrated impressive growth, with earnings increasing by 23.4% over the past year, outpacing the Interactive Media and Services industry's 14.5%. The company forecasts annual profit growth of 8.9%, slightly above Japan's market average of 8.7%. Despite a highly volatile share price in recent months, Kakaku.com maintains high-quality earnings and robust R&D investments to drive innovation. In July 2024, they announced a disposal of treasury shares as restricted shares remuneration, reflecting strategic financial maneuvers to enhance shareholder value.

- Click to explore a detailed breakdown of our findings in Kakaku.com's health report.

Understand Kakaku.com's track record by examining our Past report.

JMDC (TSE:4483)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: JMDC Inc. offers medical statistics data services in Japan and has a market cap of ¥295.01 billion.

Operations: The company generates revenue primarily through its Healthcare-Big Data segment, which contributes ¥27.17 billion, followed by Tele-Medicine at ¥5.77 billion and Dispensing Pharmacy Support at ¥1.22 billion.

JMDC's forecasted annual earnings growth of 25.3% significantly outpaces the Japanese market average of 8.7%, reflecting strong potential in the healthcare services sector. Despite a recent 40.6% decline in earnings, revenue is expected to grow at an impressive rate of 17.5% per year, driven by robust R&D investments and strategic initiatives. The company's profit margins have narrowed from 19.3% to 9.7%, indicating challenges but also opportunities for operational improvements and market expansion. In August, JMDC provided consolidated earnings guidance for the six months ending September 2024, projecting revenue of ¥18,700 million and operating profit of ¥2,800 million—figures that highlight their commitment to growth despite recent setbacks. Their focus on innovation through substantial R&D spending underscores a long-term vision aimed at enhancing their technological capabilities within Japan's competitive healthcare landscape.

- Take a closer look at JMDC's potential here in our health report.

Assess JMDC's past performance with our detailed historical performance reports.

Trend Micro (TSE:4704)

Simply Wall St Growth Rating: ★★★★★☆

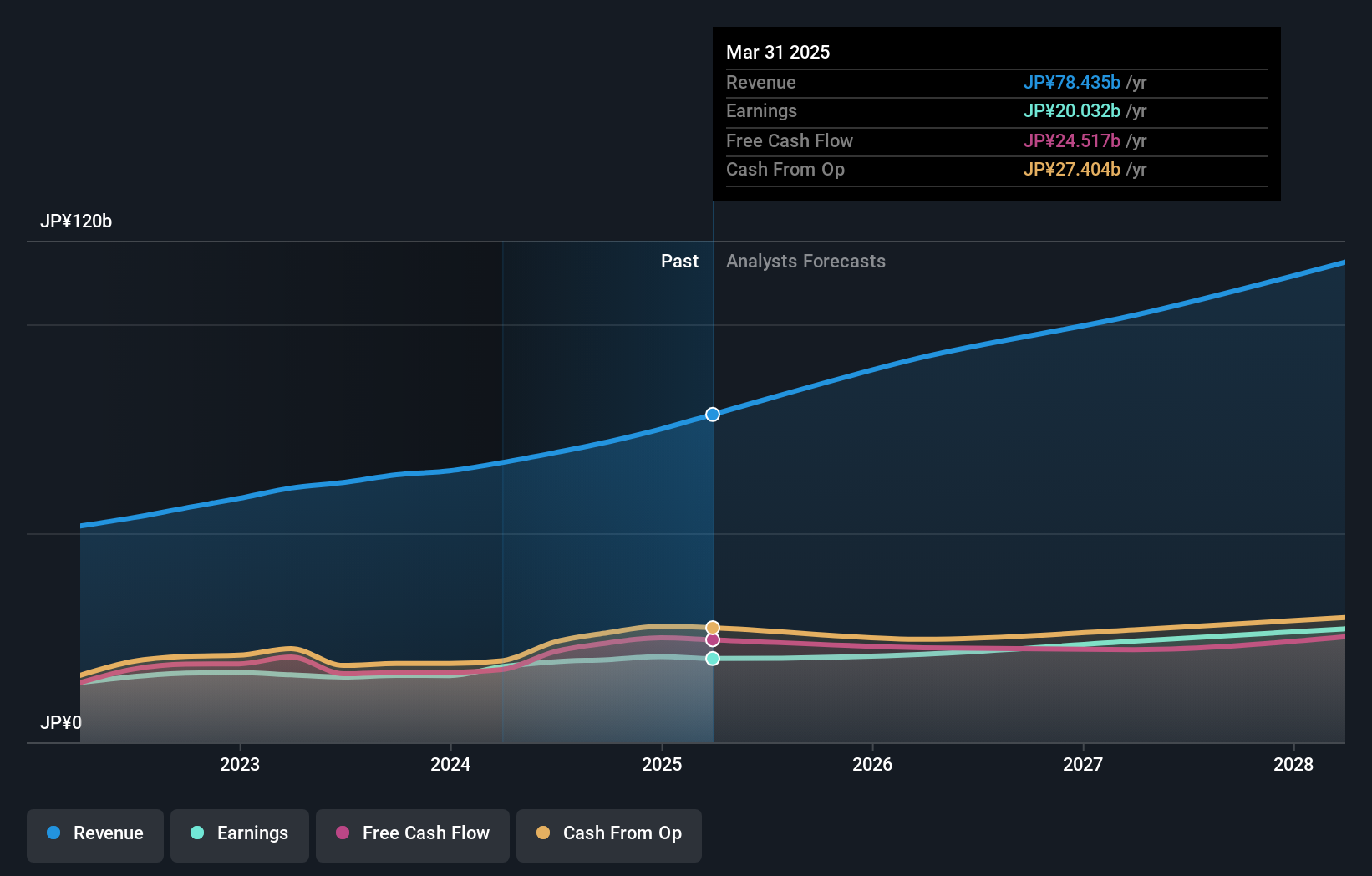

Overview: Trend Micro Incorporated develops and sells security-related software for computers and related services in Japan and internationally, with a market cap of ¥1.14 trillion.

Operations: The company generates revenue primarily from its security-related software and services, with significant contributions from Japan (¥84.17 billion), Asia Pacific (¥126.28 billion), Europe (¥63.59 billion), and the Americas (¥70.46 billion).

Trend Micro, a cybersecurity firm in Japan, is forecasted to grow its earnings by 21.9% annually, outpacing the Japanese market average of 8.7%. Despite a recent decline in profit margins from 11.2% to 6.4%, the company's revenue is expected to increase by 6.2% per year, faster than the market's growth rate of 4.3%. Significant R&D investments have been pivotal; for instance, they spent ¥39 billion on share repurchases recently and are actively collaborating with industry giants like Google and NVIDIA through initiatives such as COSAI to bolster AI security measures.

- Unlock comprehensive insights into our analysis of Trend Micro stock in this health report.

Evaluate Trend Micro's historical performance by accessing our past performance report.

Next Steps

- Unlock more gems! Our Japanese High Growth Tech and AI Stocks screener has unearthed 123 more companies for you to explore.Click here to unveil our expertly curated list of 126 Japanese High Growth Tech and AI Stocks.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trend Micro might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4704

Trend Micro

Develops and sells security-related software for computers and related services in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.

Similar Companies

Market Insights

Community Narratives