- South Korea

- /

- Specialty Stores

- /

- KOSE:A284740

Top Asian Dividend Stocks To Consider In May 2025

Reviewed by Simply Wall St

As global markets navigate a landscape marked by trade negotiations and monetary policy adjustments, Asian equities have shown resilience, with indices in China and Japan experiencing gains amid positive trade developments. In this environment, dividend stocks can provide investors with a potential source of steady income and stability, making them an attractive option for those looking to balance growth prospects with reliable returns.

Top 10 Dividend Stocks In Asia

| Name | Dividend Yield | Dividend Rating |

| Wuliangye YibinLtd (SZSE:000858) | 4.74% | ★★★★★★ |

| Daito Trust ConstructionLtd (TSE:1878) | 4.27% | ★★★★★★ |

| Nissan Chemical (TSE:4021) | 3.90% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 4.26% | ★★★★★★ |

| Asian Terminals (PSE:ATI) | 6.48% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.14% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.50% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.78% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.25% | ★★★★★★ |

| Soliton Systems K.K (TSE:3040) | 4.23% | ★★★★★★ |

Click here to see the full list of 1222 stocks from our Top Asian Dividend Stocks screener.

Let's dive into some prime choices out of the screener.

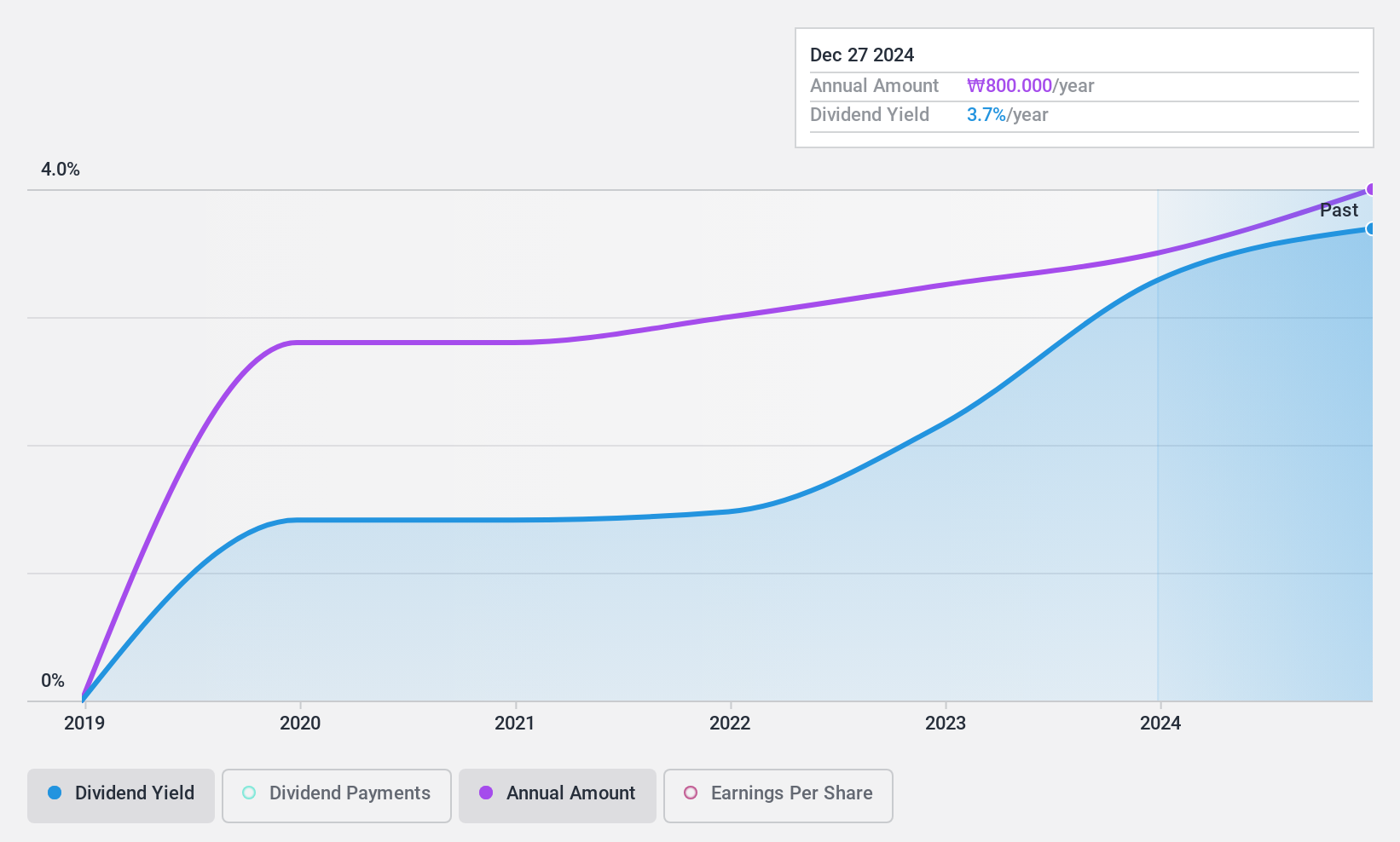

CUCKOO Homesys (KOSE:A284740)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: CUCKOO Homesys Co., Ltd. is involved in the manufacture, sale, and rental of household appliances with a market cap of ₩571.77 billion.

Operations: CUCKOO Homesys Co., Ltd. generates revenue through its primary segments of Rental services, contributing ₩1.14 billion, and IT Service, contributing ₩57.95 million.

Dividend Yield: 3.9%

CUCKOO Homesys offers a compelling dividend profile with a payout ratio of 18.3%, indicating dividends are well covered by earnings. The cash payout ratio stands at 76.9%, suggesting adequate coverage by cash flows, though higher than ideal for some investors. With a dividend yield in the top 25% of the KR market and stable payments over six years, its attractiveness is enhanced by recent earnings growth and a favorable price-to-earnings ratio of 4.7x compared to the market's 12.1x.

- Delve into the full analysis dividend report here for a deeper understanding of CUCKOO Homesys.

- Our valuation report here indicates CUCKOO Homesys may be overvalued.

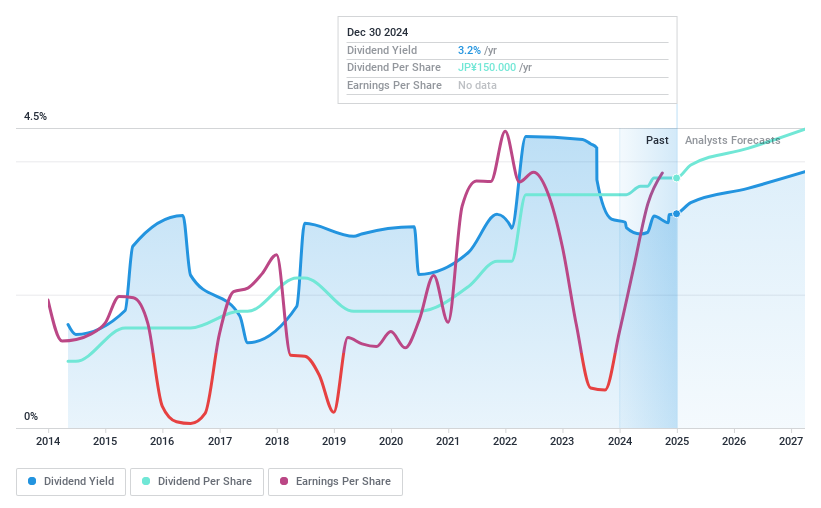

Mitsui Mining & Smelting (TSE:5706)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsui Mining & Smelting Co., Ltd. is involved in the manufacture and sale of nonferrous metal products both in Japan and internationally, with a market cap of ¥252.17 billion.

Operations: Mitsui Mining & Smelting Co., Ltd. generates revenue through its Metals segment at ¥294.82 billion, Mobility segment at ¥204.91 billion, and Engineering segment at ¥153.45 billion.

Dividend Yield: 4.4%

Mitsui Mining & Smelting faces a complex dividend scenario. Despite a top-tier yield of 4.42% in Japan, its dividends are unreliable due to past volatility and unstable track record. The board resists shareholder proposals for higher dividends, prioritizing internal reserves for growth. Dividends are well-covered by earnings (payout ratio: 14.6%) and cash flows (cash payout ratio: 24.6%), but recent activism challenges the current policy amidst volatile share prices and expected earnings decline.

- Click to explore a detailed breakdown of our findings in Mitsui Mining & Smelting's dividend report.

- In light of our recent valuation report, it seems possible that Mitsui Mining & Smelting is trading behind its estimated value.

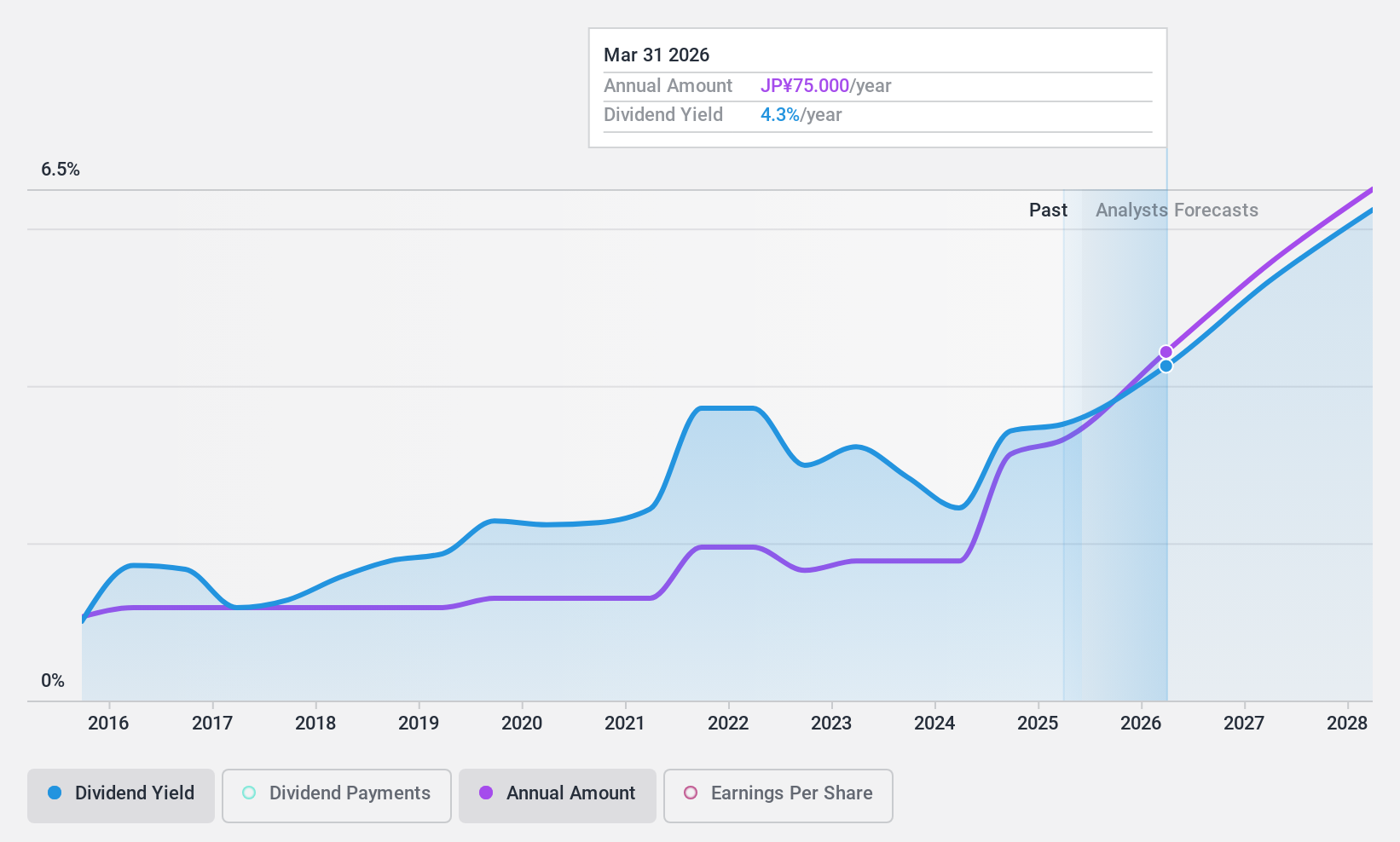

Chugin Financial GroupInc (TSE:5832)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Chugin Financial Group, Inc., with a market cap of ¥306.30 billion, operates through its subsidiary The Chugoku Bank, Limited to offer a range of financial services to both corporate and individual clients in Japan.

Operations: Chugin Financial Group, Inc., through The Chugoku Bank, Limited, delivers a variety of financial services tailored to both corporate and individual customers in Japan.

Dividend Yield: 3.3%

Chugin Financial Group's dividend profile is characterized by stability and growth, with dividends increasing consistently over the past decade. The company's dividend yield of 3.27% is modest compared to top-tier Japanese payers but remains reliable, supported by a low payout ratio of 45.1%. Recent announcements include a share buyback program aimed at enhancing shareholder returns and capital efficiency, reflecting strategic efforts to bolster corporate value amidst earnings growth and share price volatility.

- Dive into the specifics of Chugin Financial GroupInc here with our thorough dividend report.

- In light of our recent valuation report, it seems possible that Chugin Financial GroupInc is trading beyond its estimated value.

Turning Ideas Into Actions

- Access the full spectrum of 1222 Top Asian Dividend Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

If you're looking to trade CUCKOO Homesys, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About KOSE:A284740

CUCKOO Homesys

Engages in the manufacture, sale, and rental of household appliances.

Excellent balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives