- Japan

- /

- Metals and Mining

- /

- TSE:5401

Top Dividend Stocks To Watch In January 2025

Reviewed by Simply Wall St

As global markets show signs of optimism with cooling inflation and robust bank earnings propelling stocks higher, investors are keenly observing the performance of value stocks, particularly in sectors like energy and financials. In this environment, dividend stocks become an attractive option for those seeking steady income streams, as they can offer stability and potential growth even amidst fluctuating economic conditions.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.30% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.63% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

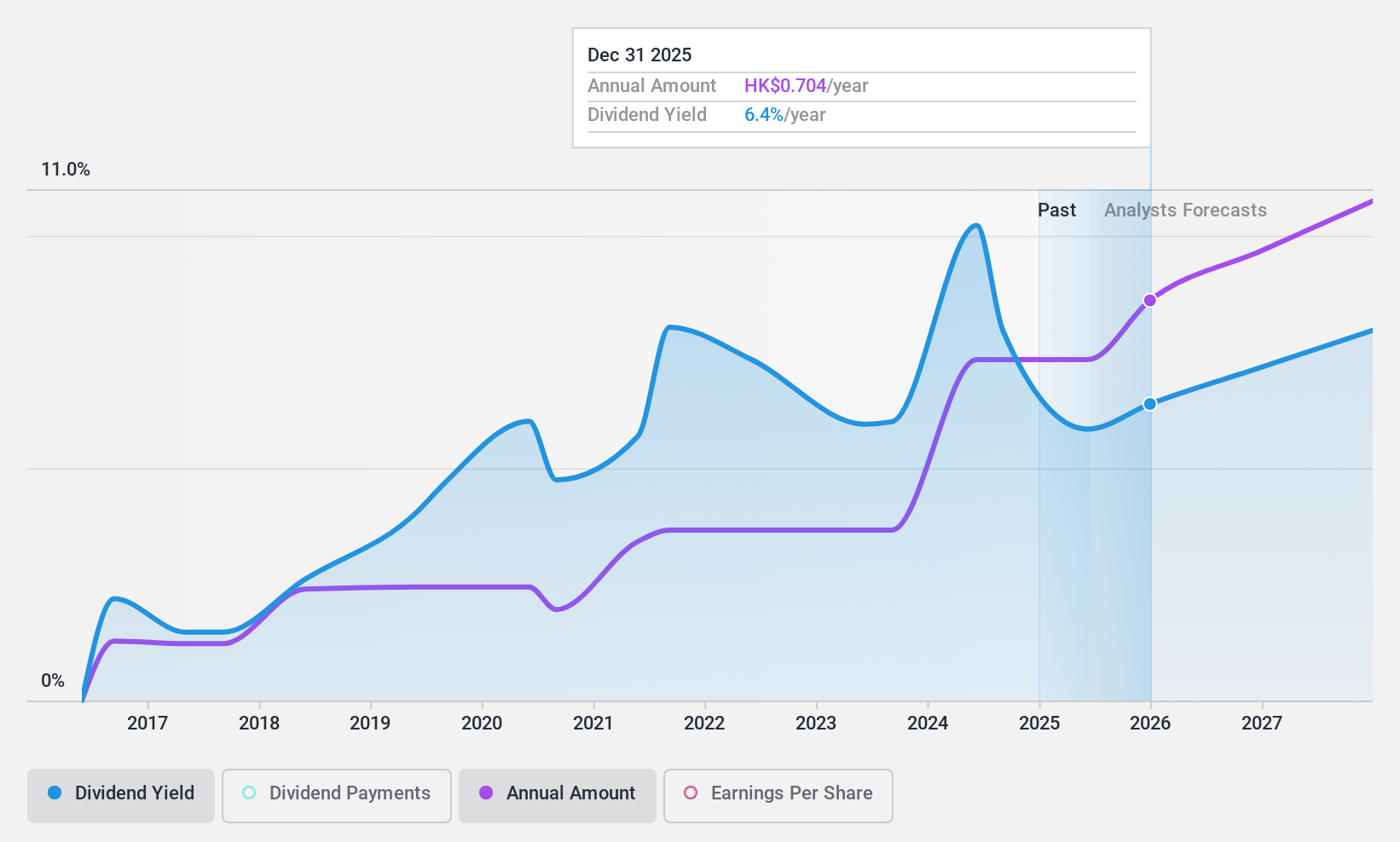

Consun Pharmaceutical Group (SEHK:1681)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Consun Pharmaceutical Group Limited is engaged in the research, development, manufacturing, and sale of Chinese medicines and medical contrast medium products in the People’s Republic of China, with a market cap of HK$6.52 billion.

Operations: Consun Pharmaceutical Group Limited's revenue is comprised of CN¥2.33 billion from the Consun Pharmaceutical Segment and CN¥410 million from the Yulin Pharmaceutical Segment.

Dividend Yield: 7.4%

Consun Pharmaceutical Group's dividend payments are covered by both earnings and cash flows, with payout ratios of 52.3% and 54% respectively. While dividends have grown over the past decade, they have been volatile with significant annual drops. The stock trades at a good value compared to peers and industry standards but offers a lower yield than top-tier Hong Kong dividend payers. Recent amendments to company bylaws could impact future governance or strategy decisions.

- Click here to discover the nuances of Consun Pharmaceutical Group with our detailed analytical dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Consun Pharmaceutical Group shares in the market.

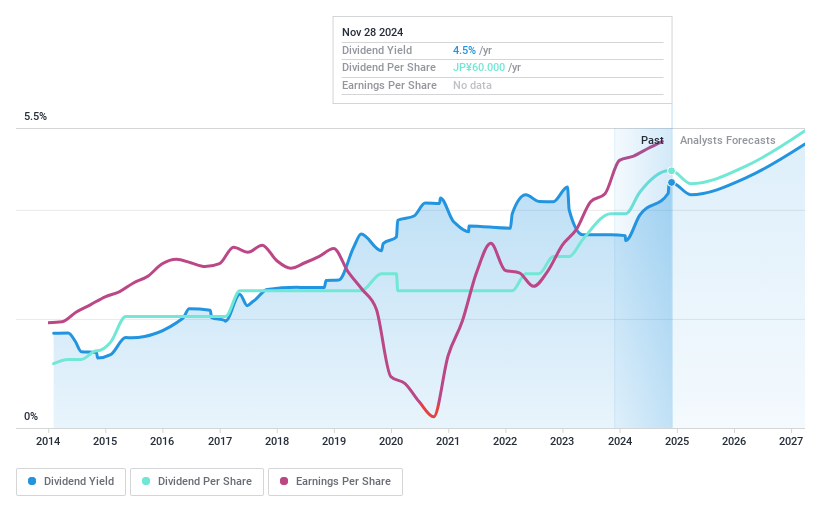

Daicel (TSE:4202)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Daicel Corporation operates in materials, medical/healthcare, smart, safety, and engineering plastics sectors across Japan, China, and internationally with a market cap of approximately ¥367.56 billion.

Operations: Daicel Corporation's revenue segments include the Material Business at ¥195.47 billion, Engineering Plastics Business at ¥242.85 billion, Safety Business at ¥95.51 billion, Smart Business at ¥35.82 billion, and Medical/Healthcare at ¥14.24 billion.

Dividend Yield: 4.4%

Daicel's dividends have been stable and growing over the past decade, with a current yield of 4.41%, placing it among the top dividend payers in Japan. Despite having no free cash flow, dividends are covered by earnings due to a low payout ratio of 26.3%. Recent share buybacks aim to enhance shareholder returns, but high debt levels and revised lower earnings forecasts pose challenges for future dividend sustainability.

- Navigate through the intricacies of Daicel with our comprehensive dividend report here.

- Our expertly prepared valuation report Daicel implies its share price may be lower than expected.

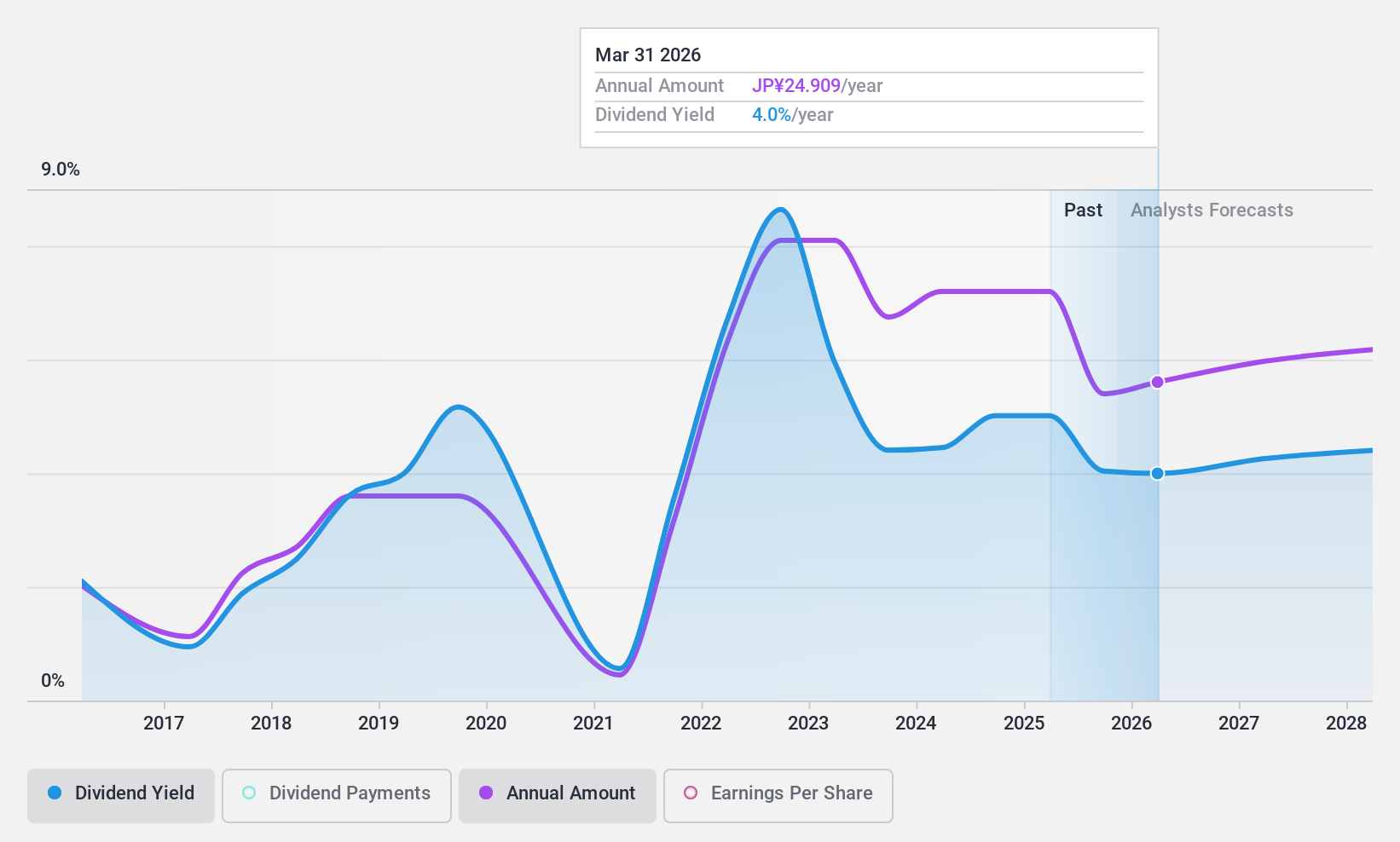

Nippon Steel (TSE:5401)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Nippon Steel Corporation operates in steelmaking and fabrication, engineering and construction, chemicals and materials, as well as system solutions both in Japan and globally, with a market cap of approximately ¥3.26 trillion.

Operations: Nippon Steel Corporation's revenue is derived from its operations in steelmaking and fabrication, engineering and construction, chemicals and materials, as well as system solutions across domestic and international markets.

Dividend Yield: 5.1%

Nippon Steel's dividend yield of 5.13% ranks in the top 25% of Japanese dividend payers, supported by a low payout ratio of 45.8%. However, the company's dividend history is unstable with past volatility. Recent dividends increased to ¥80 per share, reflecting improved earnings forecasts driven by asset sales and strategic partnerships like the Kamistiatusset Project. Despite challenges such as regulatory hurdles in acquisitions, Nippon Steel maintains a strong focus on sustaining its dividend payments through cash flow coverage.

- Take a closer look at Nippon Steel's potential here in our dividend report.

- The valuation report we've compiled suggests that Nippon Steel's current price could be quite moderate.

Key Takeaways

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1980 more companies for you to explore.Click here to unveil our expertly curated list of 1983 Top Dividend Stocks.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nippon Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5401

Nippon Steel

Engages in steelmaking and steel fabrication, engineering and construction, chemicals and materials, and system solutions businesses in Japan and internationally.

Flawless balance sheet established dividend payer.