- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6779

Rubis And 2 Other Top Dividend Stocks For Your Portfolio

Reviewed by Simply Wall St

As global markets experience a rebound, driven by easing core inflation in the U.S. and strong earnings reports from major banks, investors are increasingly eyeing dividend stocks as a stable income source amidst fluctuating economic conditions. With value stocks outperforming growth shares and energy sectors showing strength, selecting dividend stocks that offer consistent returns can be an effective strategy for navigating the current market landscape.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.30% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.63% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.69% | ★★★★★★ |

| Southside Bancshares (NYSE:SBSI) | 4.54% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.08% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.44% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 4.12% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.49% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 4.01% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.89% | ★★★★★★ |

Click here to see the full list of 1983 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

Rubis (ENXTPA:RUI)

Simply Wall St Dividend Rating: ★★★★★★

Overview: Rubis operates bulk liquid storage facilities for commercial and industrial customers across Europe, Africa, and the Caribbean, with a market capitalization of approximately €2.55 billion.

Operations: Rubis generates its revenue primarily from Energy Distribution (€6.60 billion) and Renewable Electricity Production (€48.02 million).

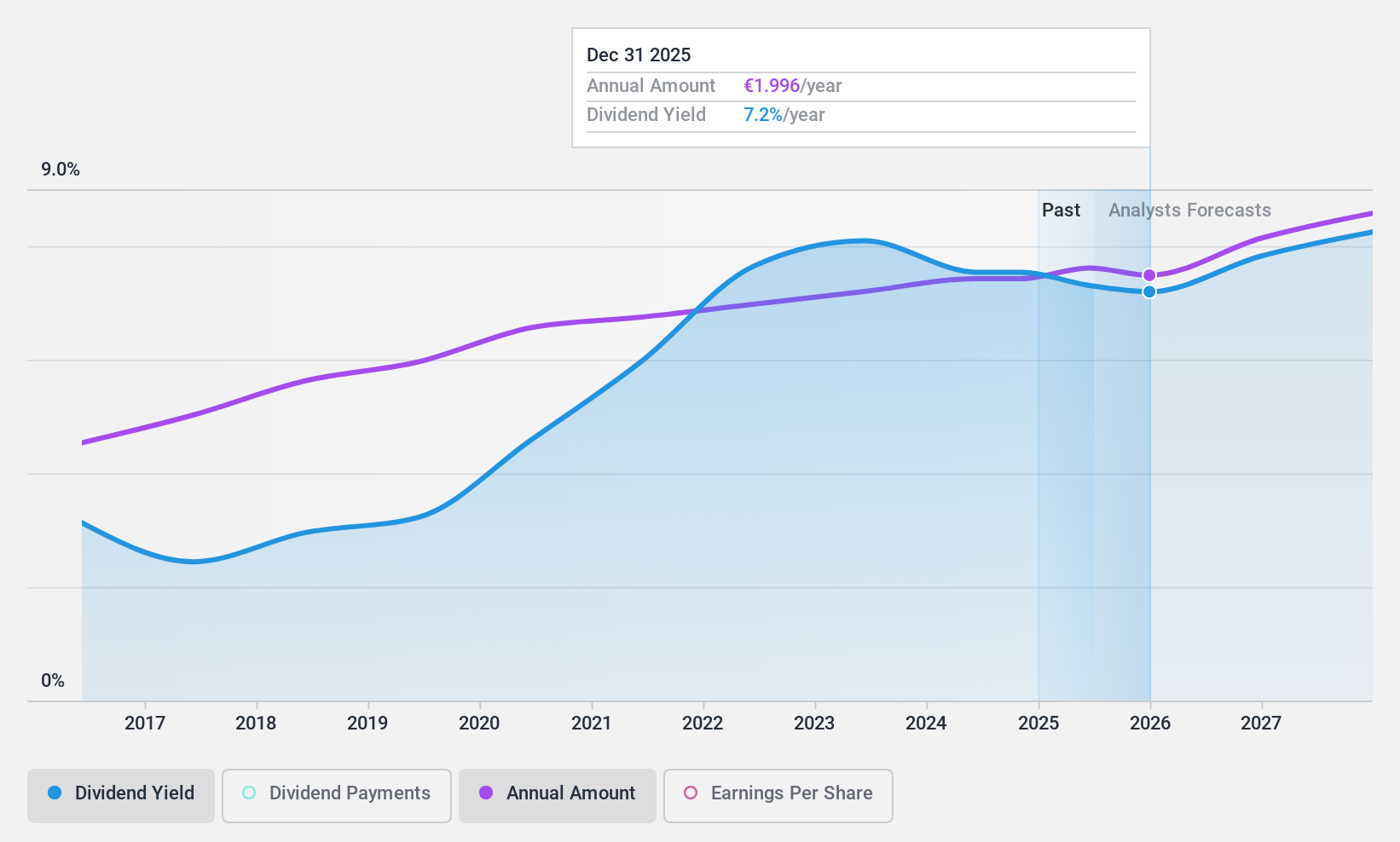

Dividend Yield: 8%

Rubis offers a compelling dividend profile with a high yield of 8.02%, placing it in the top 25% of French dividend payers. Its dividends have been stable and reliably growing over the past decade, supported by a sustainable payout ratio covered by both earnings (65.4%) and cash flows (57.9%). Despite its attractive valuation with a low P/E ratio of 8.1x, potential investors should note Rubis's high debt level and forecasted earnings decline.

- Navigate through the intricacies of Rubis with our comprehensive dividend report here.

- Upon reviewing our latest valuation report, Rubis' share price might be too pessimistic.

Nihon Dempa Kogyo (TSE:6779)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Nihon Dempa Kogyo Co., Ltd. manufactures and sells quartz crystal devices across Japan, the rest of Asia, Europe, and North America, with a market cap of ¥19.83 billion.

Operations: Nihon Dempa Kogyo Co., Ltd.'s revenue is derived from the manufacture and sale of quartz crystal devices across various regions including Japan, Asia, Europe, and North America.

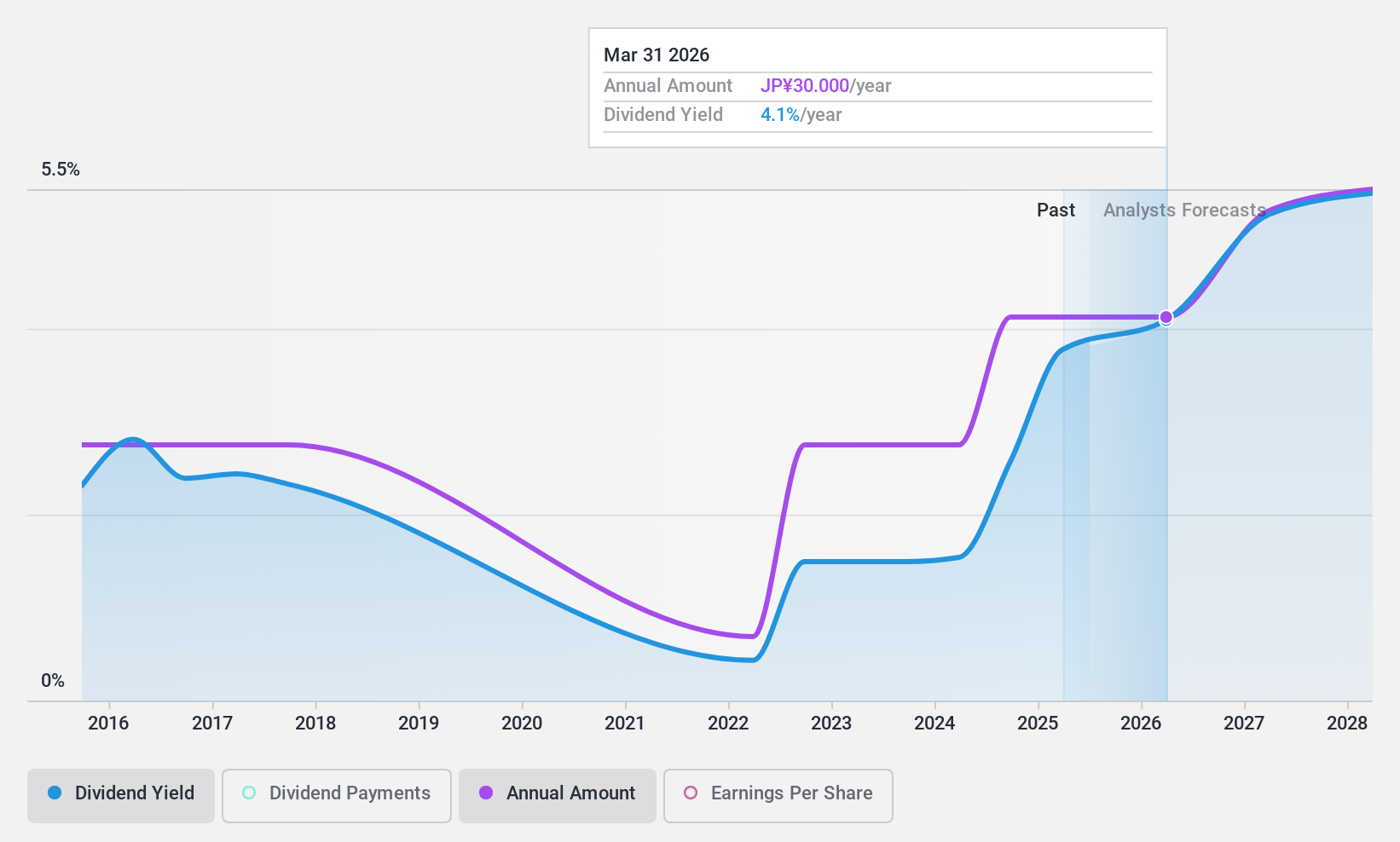

Dividend Yield: 3.5%

Nihon Dempa Kogyo's dividend profile is marked by volatility over the past decade, with payments not consistently growing. However, dividends are well-covered by earnings (payout ratio of 27.1%) and cash flows (cash payout ratio of 67.4%), indicating sustainability despite past instability. The current yield of 3.49% is below the top quartile in Japan, but the stock trades at a significant discount to its estimated fair value, offering potential value for investors seeking growth in earnings forecasted at 20.53% annually.

- Delve into the full analysis dividend report here for a deeper understanding of Nihon Dempa Kogyo.

- Our comprehensive valuation report raises the possibility that Nihon Dempa Kogyo is priced lower than what may be justified by its financials.

Shibaura ElectronicsLtd (TSE:6957)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shibaura Electronics Co., Ltd. manufactures and sells thermistor elements and related products in Japan, with a market cap of ¥49.46 billion.

Operations: Shibaura Electronics Co., Ltd. generates revenue from various regions, with ¥25.40 billion from Japan, ¥18.11 billion from Asia, ¥1.20 billion from Europe, and ¥1.01 billion from the U.S.A.

Dividend Yield: 4.6%

Shibaura Electronics Ltd. has experienced a volatile dividend history over the past decade, with payments showing significant annual drops. Despite this instability, dividends are well-covered by earnings (payout ratio of 61.4%) and cash flows (cash payout ratio of 63%), suggesting sustainability. The stock offers a competitive dividend yield of 4.57%, placing it in the top quartile within Japan's market, and trades at a substantial discount to its estimated fair value, presenting potential value for investors.

- Click here and access our complete dividend analysis report to understand the dynamics of Shibaura ElectronicsLtd.

- The valuation report we've compiled suggests that Shibaura ElectronicsLtd's current price could be quite moderate.

Taking Advantage

- Unlock our comprehensive list of 1983 Top Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Nihon Dempa Kogyo might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6779

Nihon Dempa Kogyo

Engages in the manufacture and sale of crystal-related products in Japan, China, the United States, Germany, Korea, Mexico, Hungary, and internationally.

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Airbnb Stock: Platform Growth in a World of Saturation and Scrutiny

Clarivate Stock: When Data Becomes the Backbone of Innovation and Law

Adobe Stock: AI-Fueled ARR Growth Pushes Guidance Higher, But Cost Pressures Loom

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

MicroVision will explode future revenue by 380.37% with a vision towards success

Trending Discussion