- Japan

- /

- Metals and Mining

- /

- TSE:5401

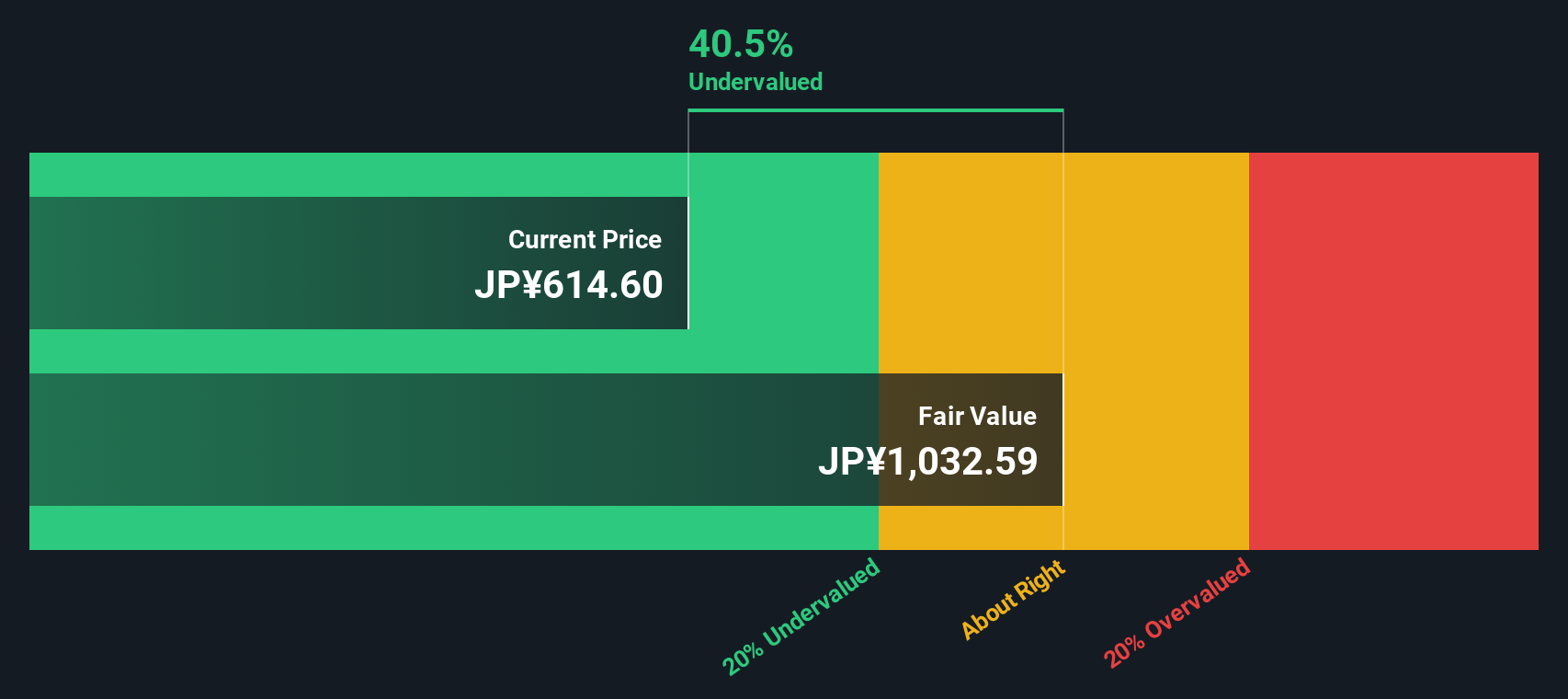

Nippon Steel (TSE:5401) Valuation After 2030 Global Expansion Plan and New Dividend Framework

Reviewed by Simply Wall St

Nippon Steel (TSE:5401) just secured board approval for its 2030 management plan, laying out aggressive overseas expansion, a bigger US footprint, and a clearer dividend framework that could subtly reshape how investors think about this stock.

See our latest analysis for Nippon Steel.

Despite the ambitious 2030 roadmap and the hefty U.S. Steel deal, the share price has drifted lower in recent weeks. Yet the three and five year total shareholder returns still signal solid long term momentum rather than a story that has already peaked.

If Nippon Steel’s global push has you rethinking where industrial growth might come from next, it could be worth exploring aerospace and defense stocks for other large scale capital intensive plays riding similar structural trends.

With shares off recent highs despite a fresh 2030 profit target and the U.S. Steel integration still ahead, are investors being too cautious, or is the current price already baking in the next decade of growth?

Price-to-Sales of 0.4x: Is it justified?

On a price-to-sales basis, Nippon Steel’s ¥604 share price screens as inexpensive versus peers, suggesting investors are not paying up for each yen of current revenue.

The price-to-sales ratio compares a company’s market value with its revenue, making it a useful yardstick for capital intensive, often cyclical, businesses where earnings can be volatile.

For Nippon Steel, trading on 0.4x sales looks conservative when placed against the peer average of 1.3x and the estimated fair price-to-sales ratio of 1x. This implies the market is assigning a sizable discount that could narrow if the 5.1 percent forecast annual revenue growth and an eventual return to profitability materialise.

Compared with the broader JP Metals and Mining industry, where 0.4x sales is the norm, Nippon Steel still stands out for being aligned with the sector headline yet materially cheaper than its closer peer set and the level the fair ratio suggests the market could ultimately gravitate toward.

Explore the SWS fair ratio for Nippon Steel

Result: Price-to-Sales of 0.4x (UNDERVALUED)

However, investors still face execution risk around the U.S. Steel integration, as well as uncertainty over sustaining revenue growth while turning recent net losses back to profit.

Find out about the key risks to this Nippon Steel narrative.

Another View: DCF Puts a Brake on the Bull Case

While the 0.4x price to sales points to value, our DCF model paints a cooler picture, with fair value around ¥428 versus today’s ¥604. This suggests the stock may be overvalued on cash flow terms. Is the discount on revenues real, or a value trap in disguise?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Nippon Steel for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 903 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Nippon Steel Narrative

If you see the story differently or want to stress test your own assumptions using the same data, you can build a custom view in just a few minutes, Do it your way.

A great starting point for your Nippon Steel research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Ready for your next investing move?

Before you stop here, lock in an edge by scanning fresh opportunities on Simply Wall Street’s screener, where data backed ideas are waiting right now.

- Harness reliable income potential by targeting companies in these 13 dividend stocks with yields > 3% that aim to reward shareholders with steady cash returns.

- Catch powerful secular trends by focusing on innovation leaders in these 26 AI penny stocks shaping the next generation of intelligent technology.

- Upgrade your value hunting by zeroing in on compelling opportunities in these 903 undervalued stocks based on cash flows where prices may lag underlying cash flow strength.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Nippon Steel might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5401

Nippon Steel

Engages in steelmaking and steel fabrication, engineering, chemicals and materials, and system solutions businesses in Japan and internationally.

Reasonable growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)