As global markets navigate a complex landscape of interest rate adjustments and economic indicators, investors are keenly observing the shifts in major indices like the Nasdaq Composite, which recently reached new heights. Amidst this backdrop of fluctuating market conditions, dividend stocks stand out as a reliable option for those looking to enhance their portfolios with steady income and potential long-term growth.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 6.99% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.62% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.75% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.43% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.00% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.44% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.86% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.67% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

| Banque Cantonale Vaudoise (SWX:BCVN) | 5.31% | ★★★★★★ |

Click here to see the full list of 1938 stocks from our Top Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

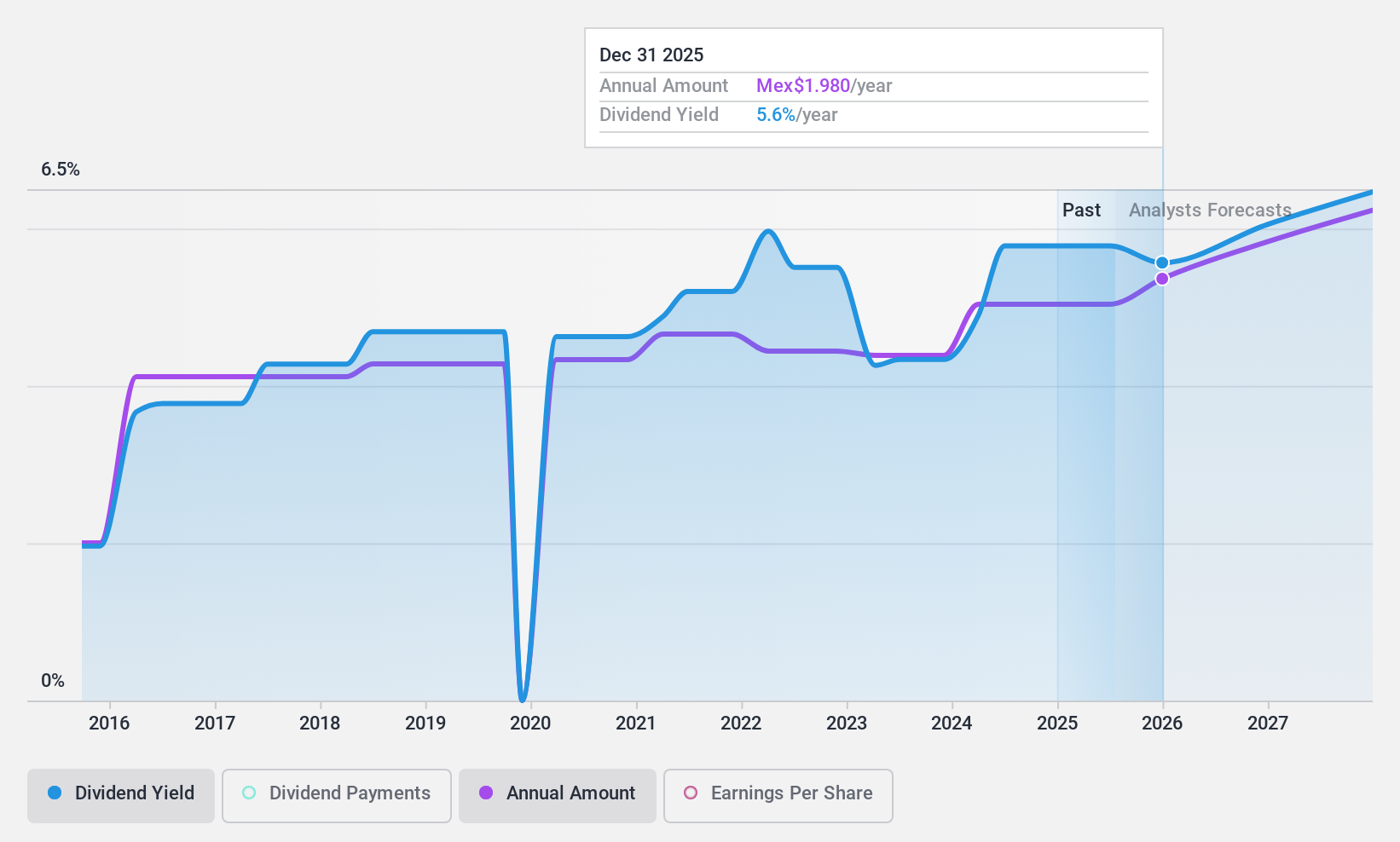

Kimberly-Clark de México S. A. B. de C. V (BMV:KIMBER A)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kimberly-Clark de México, S. A. B. de C. V., along with its subsidiaries, manufactures, distributes, and sells disposable products in Mexico with a market cap of MX$86.33 billion.

Operations: Kimberly-Clark de México generates revenue through its segments, with MX$4.83 billion from Export, MX$5.55 billion from Professional, and MX$44.01 billion from Consumer Products.

Dividend Yield: 6.5%

Kimberly-Clark de México's dividend payments are covered by earnings and cash flows, with payout ratios of 71.8% and 64.1%, respectively. Despite a history of volatility in dividend payments over the past decade, dividends have grown during this period. The company's high debt level is a concern, but it trades below its estimated fair value by 39.9%. Recent earnings reports show growth in sales and net income, supporting future dividend sustainability amidst positive corporate guidance for increased sales.

- Navigate through the intricacies of Kimberly-Clark de México S. A. B. de C. V with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Kimberly-Clark de México S. A. B. de C. V shares in the market.

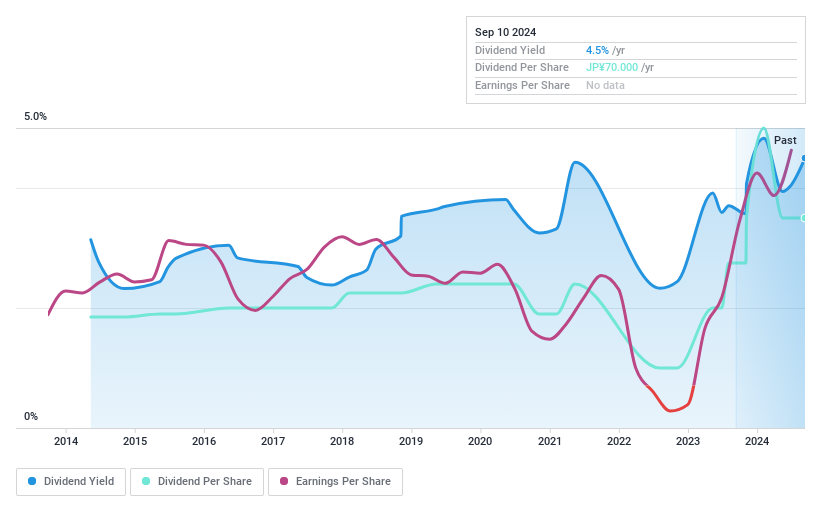

Yushiro Chemical Industry (TSE:5013)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Yushiro Chemical Industry Co., Ltd. and its subsidiaries manufacture and sell metalworking oils, fluids, and building maintenance chemicals globally, with a market cap of ¥29.60 billion.

Operations: Yushiro Chemical Industry Co., Ltd.'s revenue is primarily derived from its operations in North and South America (¥22.42 billion), Japan (¥20.91 billion), Southeast Asia/India (¥7.11 billion), and China (¥6.49 billion).

Dividend Yield: 4.5%

Yushiro Chemical Industry's dividends are well-covered by earnings and cash flows, with payout ratios of 29.5% and 42.4%, respectively. While the dividend yield is in the top 25% of JP market payers, past payments have been volatile. Recent dividend increases suggest growth potential, supported by a share buyback program aimed at enhancing capital efficiency. The company trades significantly below its estimated fair value, indicating potential undervaluation despite a highly volatile share price recently.

- Get an in-depth perspective on Yushiro Chemical Industry's performance by reading our dividend report here.

- Our comprehensive valuation report raises the possibility that Yushiro Chemical Industry is priced lower than what may be justified by its financials.

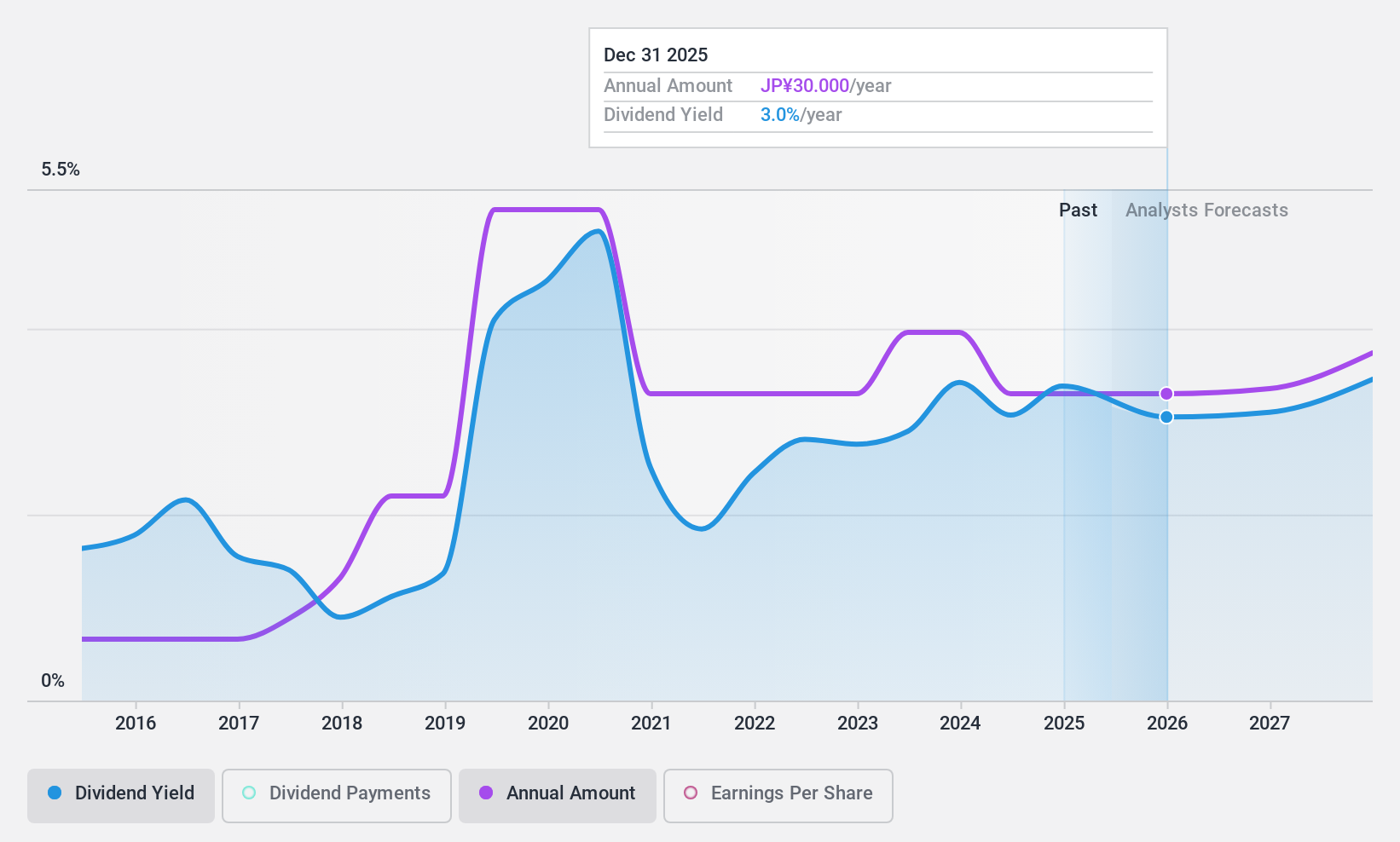

Tokai Carbon (TSE:5301)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Tokai Carbon Co., Ltd. is a Japanese company that manufactures and sells carbon-related products and services, with a market cap of ¥197.31 billion.

Operations: Tokai Carbon Co., Ltd.'s revenue segments include Fine Carbon at ¥53.71 billion, Graphite Electrodes at ¥51.48 billion, Smelting and Lining at ¥69.80 billion, Carbon Black Business at ¥156.69 billion, and Industrial Furnaces and Related Products at ¥14.31 billion.

Dividend Yield: 3.2%

Tokai Carbon's dividends are covered by earnings and cash flows, with payout ratios of 72.7% and 78.1%, respectively. However, the dividend yield is lower than the top 25% in the JP market. Despite an increase in dividends over the past decade, payments have been volatile and unreliable. Profit margins have decreased to 2.7% from last year's 7.7%, raising concerns about future dividend stability despite projected earnings growth of nearly 29%.

- Delve into the full analysis dividend report here for a deeper understanding of Tokai Carbon.

- Our expertly prepared valuation report Tokai Carbon implies its share price may be too high.

Turning Ideas Into Actions

- Get an in-depth perspective on all 1938 Top Dividend Stocks by using our screener here.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tokai Carbon might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5301

Tokai Carbon

Manufactures and sells carbon-related products and services in Japan.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives