Japan’s stock markets have seen a robust rebound recently, with the Nikkei 225 Index gaining 8.7% and the broader TOPIX Index up 7.9%, buoyed by better-than-expected U.S. economic data and a stronger-than-anticipated expansion in Japan's GDP for the second quarter of the year. This positive market sentiment provides an opportune backdrop for investors interested in dividend stocks, which can offer steady income streams and potential capital appreciation. In this article, we will explore three top dividend stocks listed on the Japanese exchange that stand out due to their strong fundamentals and attractive yield profiles amidst these favorable market conditions.

Top 10 Dividend Stocks In Japan

| Name | Dividend Yield | Dividend Rating |

| Yamato Kogyo (TSE:5444) | 4.14% | ★★★★★★ |

| Tsubakimoto Chain (TSE:6371) | 3.93% | ★★★★★★ |

| Globeride (TSE:7990) | 4.05% | ★★★★★★ |

| Mitsubishi Research Institute (TSE:3636) | 3.74% | ★★★★★★ |

| KurimotoLtd (TSE:5602) | 4.92% | ★★★★★★ |

| Innotech (TSE:9880) | 4.57% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.50% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.35% | ★★★★★★ |

| E J Holdings (TSE:2153) | 3.83% | ★★★★★★ |

| DoshishaLtd (TSE:7483) | 3.73% | ★★★★★★ |

Click here to see the full list of 447 stocks from our Top Japanese Dividend Stocks screener.

We're going to check out a few of the best picks from our screener tool.

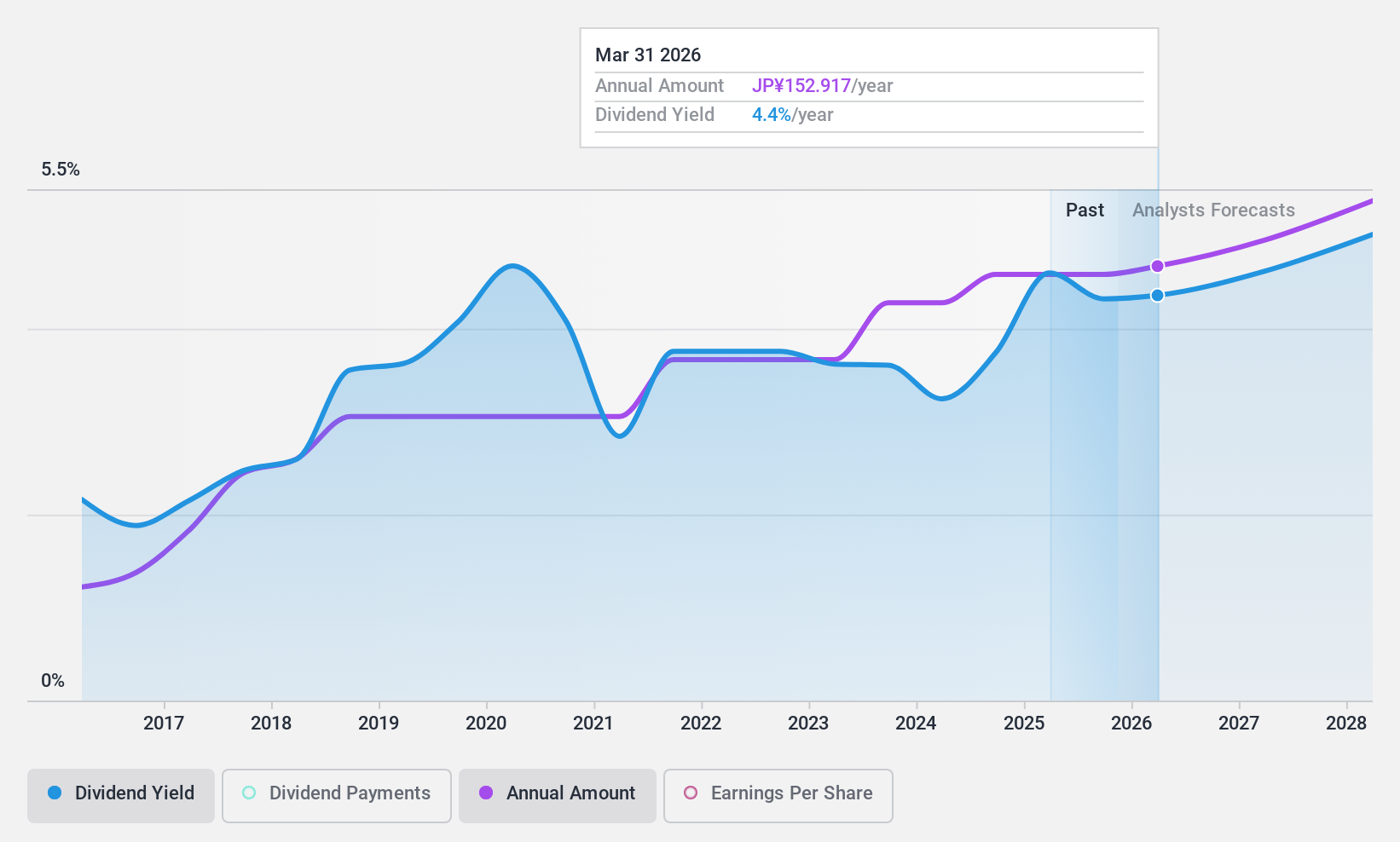

Mitsui Chemicals (TSE:4183)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Mitsui Chemicals, Inc. operates globally in sectors including mobility, life and health care, basic and green materials, and ICT, with a market cap of ¥705.20 billion.

Operations: Mitsui Chemicals generates revenue from several segments, including Basic & Green Materials (¥805.18 billion), Mobility Solutions (¥563.83 billion), Life & Healthcare Solutions (¥285.77 billion), and ICT Solutions (¥241.08 billion).

Dividend Yield: 4%

Mitsui Chemicals offers a compelling dividend profile, with its 4.04% yield ranking in the top 25% of Japanese dividend payers. The company’s dividends are well-covered by both earnings (payout ratio: 45.7%) and cash flows (cash payout ratio: 57.2%). Despite high debt levels and a history of volatile dividends, recent innovations like their materials used in Toyota's Hyper-F CONCEPT car underscore potential growth avenues, supported by analysts predicting a significant stock price increase.

- Click to explore a detailed breakdown of our findings in Mitsui Chemicals' dividend report.

- Our comprehensive valuation report raises the possibility that Mitsui Chemicals is priced lower than what may be justified by its financials.

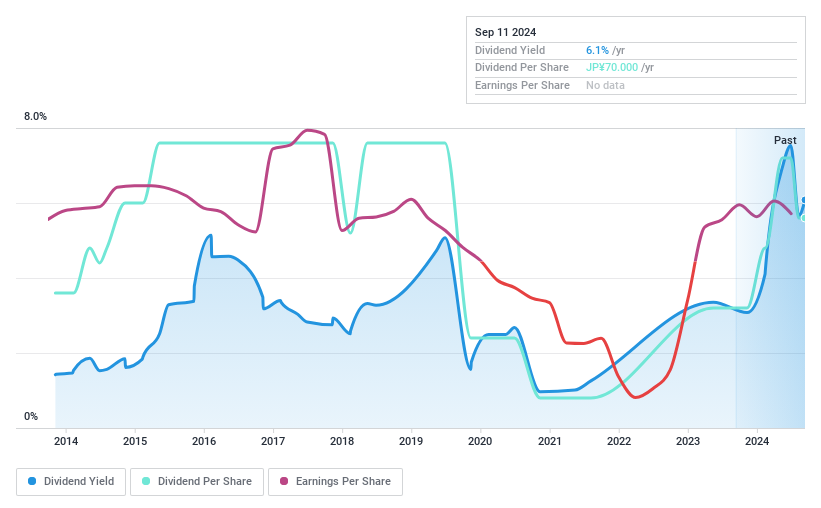

Kato WorksLtd (TSE:6390)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Kato Works Co., Ltd. manufactures and sells mobile cranes, construction, and industrial equipment globally, with a market cap of ¥14.85 billion.

Operations: Kato Works Ltd. generates revenue from the manufacture and sale of mobile cranes, as well as construction and industrial equipment, on a global scale.

Dividend Yield: 7.1%

Kato Works Ltd. offers a notable dividend yield of 7.1%, placing it in the top 25% of Japanese dividend payers, but this is not well covered by free cash flows or earnings. While the company has experienced earnings growth of 14.5% over the past year and maintains a low price-to-earnings ratio (4.4x), its dividend payments have been volatile and unreliable over the past decade. Recent guidance projects significant losses, raising concerns about future sustainability despite ongoing joint venture discussions in India aimed at long-term growth.

- Navigate through the intricacies of Kato WorksLtd with our comprehensive dividend report here.

- The analysis detailed in our Kato WorksLtd valuation report hints at an inflated share price compared to its estimated value.

Shibaura ElectronicsLtd (TSE:6957)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Shibaura Electronics Co., Ltd. (TSE:6957) manufactures and sells thermistor elements and related products in Japan, with a market cap of ¥47.89 billion.

Operations: Shibaura Electronics Co., Ltd. (TSE:6957) generates revenue from various regions, with ¥25.33 billion from Japan, ¥17.86 billion from Asia, ¥1.28 billion from Europe, and ¥909 million from the U.S.A.

Dividend Yield: 4.8%

Shibaura Electronics Ltd. offers a dividend yield of 4.76%, placing it in the top 25% of Japanese dividend payers. The dividends are well covered by earnings (payout ratio: 47.7%) and cash flows (cash payout ratio: 53.3%), despite a history of volatility and unreliability over the past decade. Recent buybacks, including ¥41.68 million worth from July 1-4, indicate strong capital management, though the unstable dividend track record remains a concern for long-term investors.

- Take a closer look at Shibaura ElectronicsLtd's potential here in our dividend report.

- Our expertly prepared valuation report Shibaura ElectronicsLtd implies its share price may be lower than expected.

Next Steps

- Gain an insight into the universe of 447 Top Japanese Dividend Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kato WorksLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6390

Kato WorksLtd

Engages in the manufacture and sale of mobile cranes, and construction and industrial equipment worldwide.

Mediocre balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives