October 2024's Top Japanese Growth Stocks With High Insider Ownership

Reviewed by Simply Wall St

Japan's stock markets have recently experienced gains, with the Nikkei 225 Index rising by 5.6% and the TOPIX Index up by 3.7%, buoyed by China's stimulus announcements and a dovish stance from the Bank of Japan. In this favorable environment, growth companies in Japan with high insider ownership are particularly interesting as they may align management's interests with shareholders, potentially enhancing company performance amidst these market conditions.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 31.5% |

| Hottolink (TSE:3680) | 27% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 43.5% |

| Medley (TSE:4480) | 34% | 30.4% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 68.1% |

| Loadstar Capital K.K (TSE:3482) | 33.8% | 24.3% |

| AeroEdge (TSE:7409) | 10.7% | 25.3% |

| freee K.K (TSE:4478) | 23.9% | 74.1% |

Let's take a closer look at a couple of our picks from the screened companies.

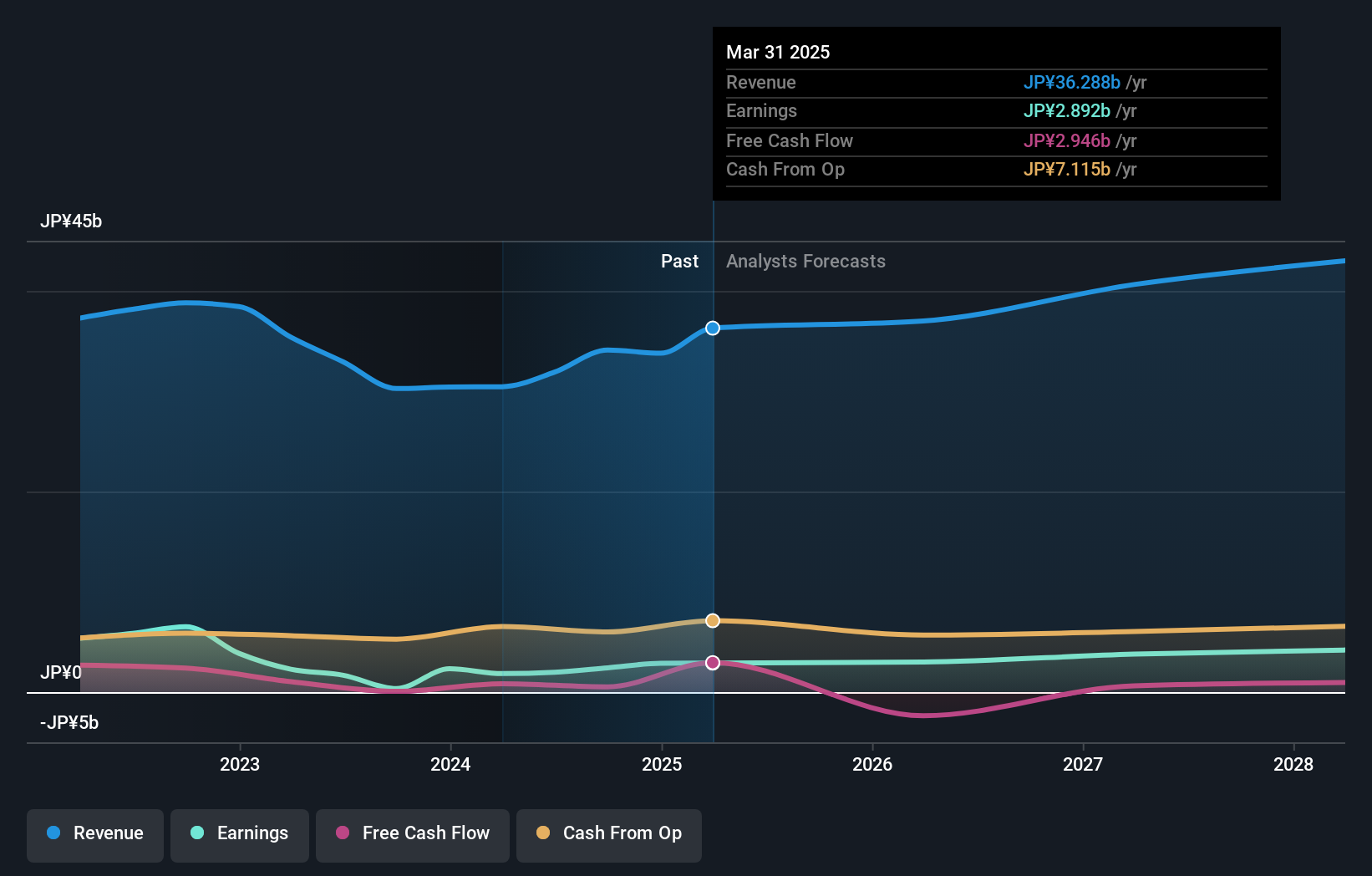

Stella Chemifa (TSE:4109)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Stella Chemifa Corporation manufactures and sells inorganic fluorine compounds both in Japan and internationally, with a market cap of ¥49.13 billion.

Operations: The company's revenue segments include High-Purity Chemical generating ¥27.44 billion and Transportation contributing ¥7.60 billion.

Insider Ownership: 23.5%

Earnings Growth Forecast: 23.5% p.a.

Stella Chemifa is positioned as a growth company with significant insider ownership, despite no recent insider trading activity. The company's earnings grew by 17.6% last year and are expected to rise significantly at 23.49% annually over the next three years, outpacing Japan's market average. However, its dividend yield of 4.17% is not well covered by earnings or cash flows, and while trading at a discount to fair value estimates, revenue growth remains moderate compared to its earnings trajectory.

- Delve into the full analysis future growth report here for a deeper understanding of Stella Chemifa.

- Our expertly prepared valuation report Stella Chemifa implies its share price may be too high.

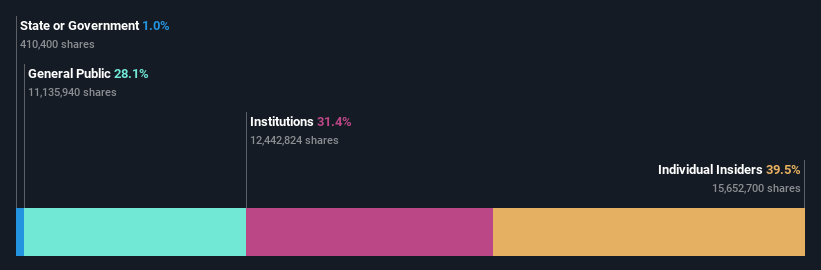

Visional (TSE:4194)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Visional, Inc., along with its subsidiaries, offers human resources platform solutions in Japan and has a market capitalization of ¥315.40 billion.

Operations: The company's revenue is primarily derived from its HR Tech segment, which generated ¥63.84 billion, with an additional contribution of ¥2.26 billion from the Incubation segment.

Insider Ownership: 39.5%

Earnings Growth Forecast: 12.4% p.a.

Visional, Inc. demonstrates potential as a growth-focused entity with high insider ownership, despite the lack of recent insider trading activity. The company's earnings grew by 30.8% last year and are forecast to increase by 12.4% annually, surpassing Japan's market average growth rate of 8.7%. Although trading at a significant discount to fair value estimates, revenue is expected to grow at a moderate 10.8% annually, reflecting steady but unspectacular expansion prospects.

- Click here to discover the nuances of Visional with our detailed analytical future growth report.

- Our comprehensive valuation report raises the possibility that Visional is priced lower than what may be justified by its financials.

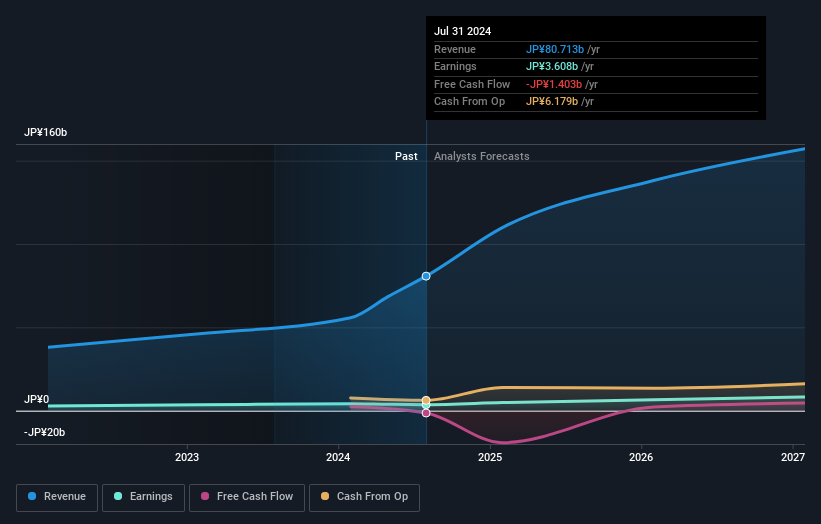

GENDA (TSE:9166)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GENDA Inc. operates amusement arcades primarily under the GiGO brand in Japan, with a market cap of ¥210.36 billion.

Operations: The company's revenue segments include amusement arcades operated primarily under the GiGO brand in Japan.

Insider Ownership: 19.3%

Earnings Growth Forecast: 20.9% p.a.

GENDA Inc. is experiencing significant earnings growth, projected at 20.9% annually, outpacing the Japanese market's average of 8.7%. However, its profit margins have decreased from 7.5% to 4.5%, and recent shareholder dilution has occurred due to a follow-on equity offering of 6.18 million shares in July 2024. Despite high revenue growth last year at ¥58 billion, the company faces share price volatility and forecasts slower revenue expansion at 13.4% annually compared to previous performance levels.

- Navigate through the intricacies of GENDA with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility GENDA's shares may be trading at a premium.

Where To Now?

- Navigate through the entire inventory of 100 Fast Growing Japanese Companies With High Insider Ownership here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4109

Stella Chemifa

Manufactures and sells inorganic fluorine compounds in Japan and internationally.

Flawless balance sheet with solid track record and pays a dividend.