In recent weeks, global markets have experienced notable fluctuations, with U.S. stocks giving back some gains amid uncertainties surrounding policy changes from the incoming Trump administration. This environment of volatility underscores the importance of identifying growth companies with high insider ownership, as these firms often demonstrate strong alignment between management and shareholder interests, potentially providing resilience during uncertain times.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| Archean Chemical Industries (NSEI:ACI) | 22.9% | 43% |

| Kirloskar Pneumatic (BSE:505283) | 30.3% | 26.3% |

| Laopu Gold (SEHK:6181) | 36.4% | 33.9% |

| Seojin SystemLtd (KOSDAQ:A178320) | 31.1% | 52.4% |

| Medley (TSE:4480) | 34% | 31.5% |

| Findi (ASX:FND) | 34.8% | 64.8% |

| Plenti Group (ASX:PLT) | 12.8% | 107.6% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.6% |

| UTI (KOSDAQ:A179900) | 33.1% | 134.6% |

We're going to check out a few of the best picks from our screener tool.

AU Small Finance Bank (NSEI:AUBANK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: AU Small Finance Bank Limited provides a range of banking and financial services in India, with a market cap of ₹430.64 billion.

Operations: The bank's revenue segments include Treasury services generating ₹20.65 billion, Retail Banking contributing ₹116.13 billion, Wholesale Banking at ₹13.60 billion, and Other Banking Operations bringing in ₹3.86 billion.

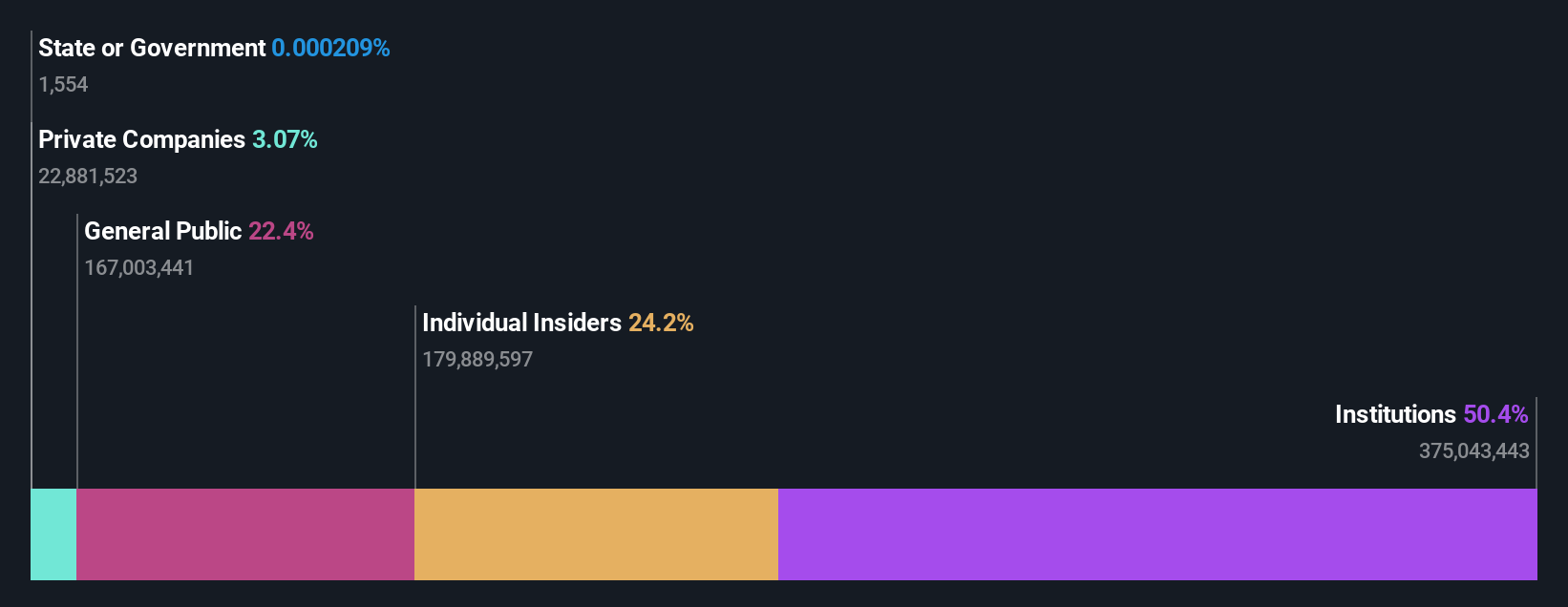

Insider Ownership: 24.2%

Earnings Growth Forecast: 24.3% p.a.

AU Small Finance Bank demonstrates robust growth potential with earnings and revenue forecasted to grow significantly above the Indian market average. Despite a high level of bad loans at 2%, its price-to-earnings ratio is favorable compared to the broader Indian market. Recent partnerships in insurance aim to expand its service offerings, enhancing customer value and reach. However, regulatory penalties related to GST issues could pose challenges, highlighting areas for operational improvement.

- Delve into the full analysis future growth report here for a deeper understanding of AU Small Finance Bank.

- According our valuation report, there's an indication that AU Small Finance Bank's share price might be on the expensive side.

Brainbees Solutions (NSEI:FIRSTCRY)

Simply Wall St Growth Rating: ★★★★☆☆

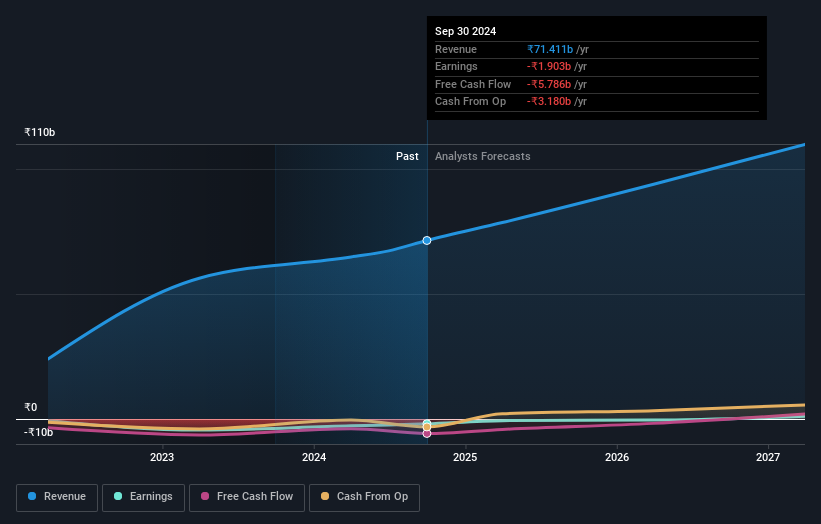

Overview: Brainbees Solutions Limited operates a multi-channel retailing platform for mothers’, babies’, and kids’ products in India and internationally, with a market cap of ₹284.05 billion.

Operations: The company's revenue is derived from its multi-channel retailing platform focused on products for mothers, babies, and kids across both Indian and international markets.

Insider Ownership: 10.3%

Earnings Growth Forecast: 104.4% p.a.

Brainbees Solutions is forecasted to achieve profitability within three years, with revenue expected to grow faster than the Indian market. Recent second-quarter results show a decrease in net loss from INR 1,008.19 million to INR 502.25 million year-over-year, indicating financial improvement despite ongoing regulatory challenges related to GST discrepancies and legal metrology violations. While insider ownership remains high, these regulatory issues could impact investor confidence and necessitate strategic adjustments for sustained growth.

- Navigate through the intricacies of Brainbees Solutions with our comprehensive analyst estimates report here.

- The analysis detailed in our Brainbees Solutions valuation report hints at an inflated share price compared to its estimated value.

Medley (TSE:4480)

Simply Wall St Growth Rating: ★★★★★★

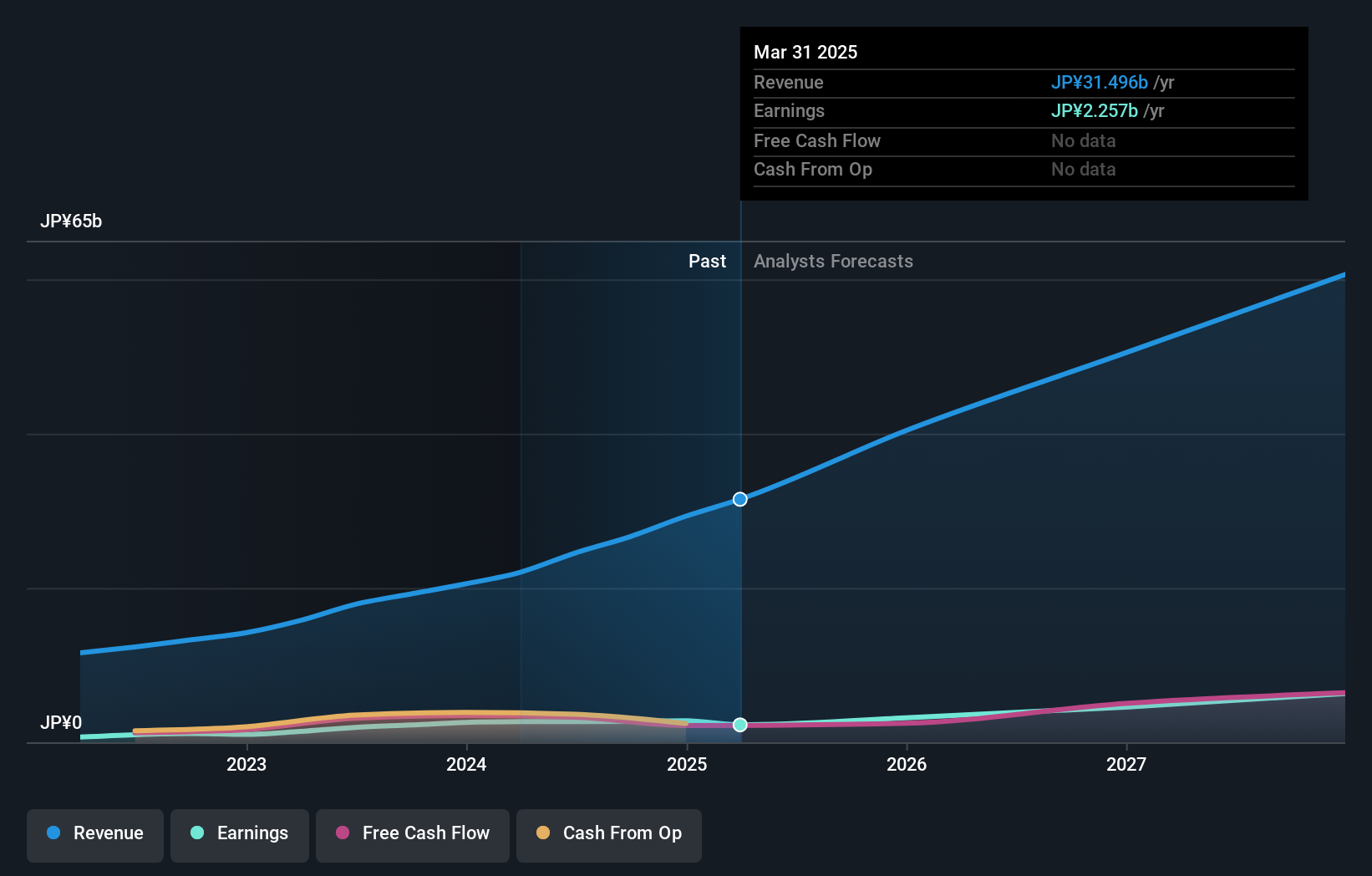

Overview: Medley, Inc. operates platforms for recruitment and medical businesses in Japan and the United States, with a market cap of ¥136.92 billion.

Operations: The company's revenue segments include the Human Resource Platform Business at ¥19.45 billion, the Medical Platform Business at ¥6.52 billion, and New Services at ¥713 million.

Insider Ownership: 34%

Earnings Growth Forecast: 31.5% p.a.

Medley is forecasted to achieve significant earnings growth of 31.5% annually, outpacing the JP market's 8%. Despite high volatility in its share price, it trades at a substantial discount to its estimated fair value. Revenue is expected to grow at 25.6% per year, surpassing market averages. Recent strategic moves include potential acquisitions of ASFON TRUST NETWORK and Offshore Inc., which could enhance growth prospects despite the impact of large one-off items on earnings quality.

- Click here to discover the nuances of Medley with our detailed analytical future growth report.

- Our valuation report here indicates Medley may be overvalued.

Turning Ideas Into Actions

- Investigate our full lineup of 1538 Fast Growing Companies With High Insider Ownership right here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NSEI:AUBANK

AU Small Finance Bank

Engages in the provision of various banking and financial services in India.

High growth potential with adequate balance sheet.