- Japan

- /

- Semiconductors

- /

- TSE:6920

January 2025's Leading Growth Companies With Insider Confidence

Reviewed by Simply Wall St

As global markets navigate a complex landscape marked by fluctuating consumer confidence and mixed economic signals, the spotlight remains on growth stocks, which have demonstrated resilience amid recent market volatility. In this environment, companies with high insider ownership often attract attention due to the perceived alignment of interests between management and shareholders.

Top 10 Growth Companies With High Insider Ownership

| Name | Insider Ownership | Earnings Growth |

| Seojin SystemLtd (KOSDAQ:A178320) | 30.9% | 39.9% |

| People & Technology (KOSDAQ:A137400) | 16.4% | 37.3% |

| SKS Technologies Group (ASX:SKS) | 29.7% | 24.8% |

| Medley (TSE:4480) | 34% | 31.7% |

| Laopu Gold (SEHK:6181) | 36.4% | 34.2% |

| Plenti Group (ASX:PLT) | 12.8% | 120.1% |

| Brightstar Resources (ASX:BTR) | 16.2% | 84.5% |

| Fine M-TecLTD (KOSDAQ:A441270) | 17.2% | 131.1% |

| HANA Micron (KOSDAQ:A067310) | 18.5% | 110.9% |

| Findi (ASX:FND) | 34.8% | 112.9% |

We'll examine a selection from our screener results.

Pacific Textiles Holdings (SEHK:1382)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Pacific Textiles Holdings Limited manufactures and trades textile products across various regions including China, Vietnam, Bangladesh, and the United States, with a market cap of HK$2.09 billion.

Operations: The company's revenue from the manufacturing and trading of textile products amounts to HK$5.04 billion.

Insider Ownership: 11.2%

Earnings Growth Forecast: 50.6% p.a.

Pacific Textiles Holdings is engaging in a share buyback program, potentially enhancing net asset value per share. Despite recent earnings showing a decline in net income to HK$106.86 million, revenue increased to HK$2.67 billion. The company is trading below estimated fair value and forecasts suggest significant annual profit growth of 50.6%, outpacing the Hong Kong market average. However, its dividend yield of 7.74% appears unsustainable given current earnings coverage challenges.

- Click here and access our complete growth analysis report to understand the dynamics of Pacific Textiles Holdings.

- Upon reviewing our latest valuation report, Pacific Textiles Holdings' share price might be too pessimistic.

S Foods (TSE:2292)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: S Foods Inc. is a Japanese meat company involved in the manufacture, wholesaling, retailing, and food servicing of meat-related products, with a market cap of ¥86.63 billion.

Operations: Revenue Segments (in millions of ¥): The company generates revenue through its primary activities, including manufacturing, wholesaling, retailing, and food servicing within the meat-related food product sector in Japan.

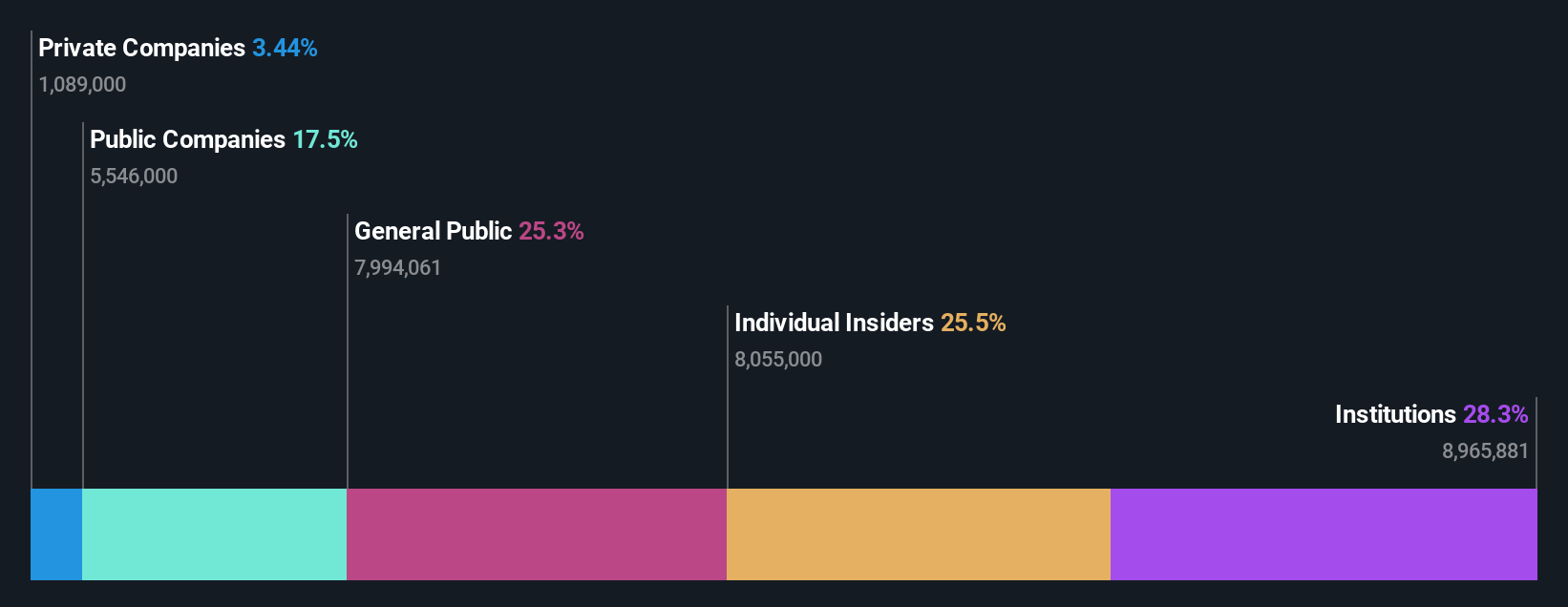

Insider Ownership: 25.5%

Earnings Growth Forecast: 32.9% p.a.

S Foods is trading at a significant discount to its estimated fair value, with earnings projected to grow substantially at 32.91% annually, outpacing the Japanese market. Despite a recent increase in dividends, the 3.29% yield isn't well-covered by earnings or cash flow. Revenue growth is expected to exceed market rates but remain below high-growth thresholds. Recent guidance anticipates net sales of ¥445 billion and operating profit of ¥7.3 billion for fiscal year-end February 2025.

- Dive into the specifics of S Foods here with our thorough growth forecast report.

- Our comprehensive valuation report raises the possibility that S Foods is priced higher than what may be justified by its financials.

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment both in Japan and internationally, with a market cap of ¥1.37 trillion.

Operations: The company's revenue primarily comes from its ¥202.94 million segment focused on the design, manufacture, and sale of inspection and measurement equipment worldwide.

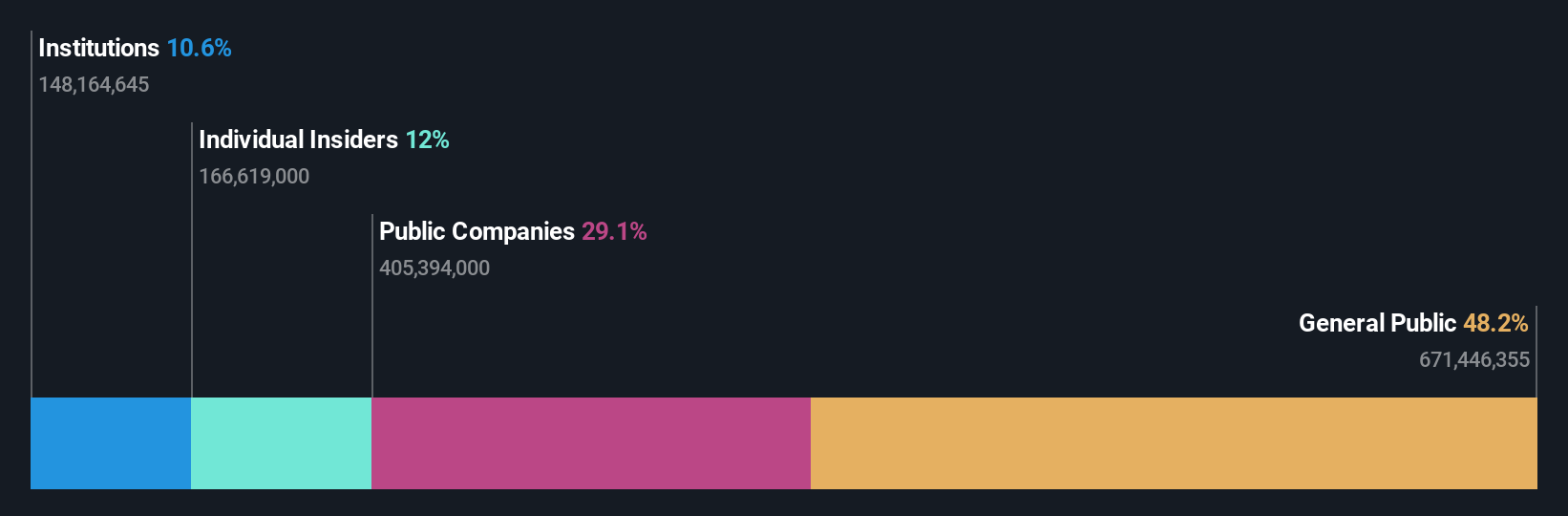

Insider Ownership: 11.1%

Earnings Growth Forecast: 12.8% p.a.

Lasertec's earnings are forecast to grow at 12.8% annually, surpassing the Japanese market average of 7.9%. The company trades at a 10.8% discount to its estimated fair value, with a volatile share price recently observed. Despite high non-cash earnings quality and past year profit growth of 27.9%, revenue growth is moderate at 11.9% per year, outpacing the market but not reaching high-growth levels. No significant insider trading activity was reported recently.

- Take a closer look at Lasertec's potential here in our earnings growth report.

- Our valuation report unveils the possibility Lasertec's shares may be trading at a premium.

Seize The Opportunity

- Delve into our full catalog of 1501 Fast Growing Companies With High Insider Ownership here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6920

Lasertec

Engages in the designing, manufacturing, and sale of inspection and measurement equipment in Japan and internationally.

Excellent balance sheet with reasonable growth potential and pays a dividend.