In the current global market landscape, major stock indexes have shown moderate gains despite a decline in U.S. consumer confidence and mixed economic indicators, with large-cap growth stocks like those in the Nasdaq Composite initially driving the rally before a mid-week reversal. Amid this backdrop, small-cap stocks represented by indices such as the S&P 600 may present unique opportunities for investors seeking undiscovered gems that could offer potential growth due to their often overlooked position in broader market movements. Identifying such promising stocks involves looking beyond immediate market trends to assess underlying business fundamentals and long-term potential within their respective industries.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Central Forest Group | NA | 6.85% | 15.11% | ★★★★★★ |

| Philippine Savings Bank | NA | 5.49% | 20.73% | ★★★★★★ |

| COSCO SHIPPING International (Hong Kong) | NA | -3.84% | 16.33% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| BSP Financial Group | 7.53% | 7.31% | 4.10% | ★★★★★☆ |

| Lee's Pharmaceutical Holdings | 14.22% | -1.39% | -14.93% | ★★★★★☆ |

| Arab Banking Corporation (B.S.C.) | 213.15% | 18.58% | 29.63% | ★★★★☆☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Time Interconnect Technology | 212.50% | 18.13% | 93.08% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Yeni Gimat Gayrimenkul Yatirim Ortakligi (IBSE:YGGYO)

Simply Wall St Value Rating: ★★★★★☆

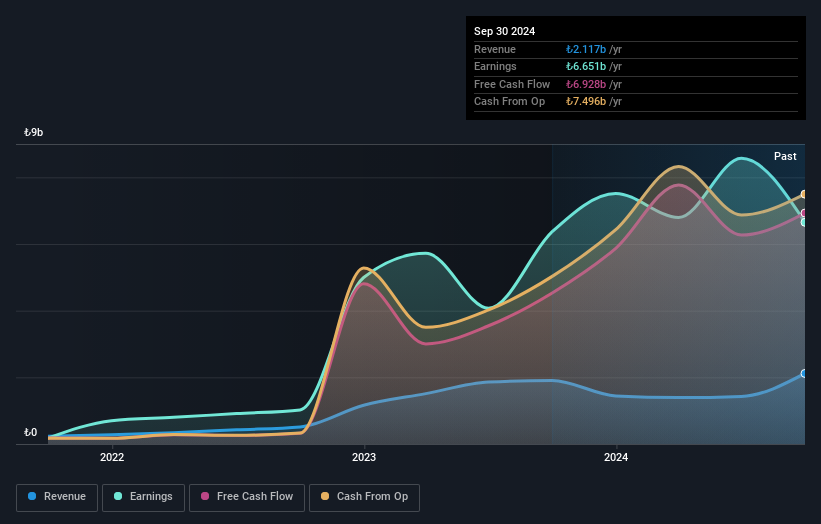

Overview: Yeni Gimat Gayrimenkul Yatirim Ortakligi operates primarily in real estate investment, with a market capitalization of TRY14.94 billion.

Operations: YGGYO generates revenue primarily from the Ankamall Shopping Mall, contributing TRY1.96 billion, and CP Ankara Hotel, adding TRY154.24 million. The company's net profit margin is a key financial metric to consider when evaluating its profitability within the real estate sector.

Yeni Gimat Gayrimenkul Yatirim Ortakligi, a relatively small player in the market, has shown a robust earnings growth of 65% annually over the past five years. Despite trading at 85% below its estimated fair value, recent financials reveal some challenges. For Q3 2024, sales soared to TRY 904 million from TRY 216 million year-on-year; however, net income fell sharply to TRY 564 million from TRY 2.48 billion previously. The company's debt-to-equity ratio is low at just 0.2%, and it holds more cash than total debt, indicating strong financial health despite slower growth compared to industry peers.

KITZ (TSE:6498)

Simply Wall St Value Rating: ★★★★★★

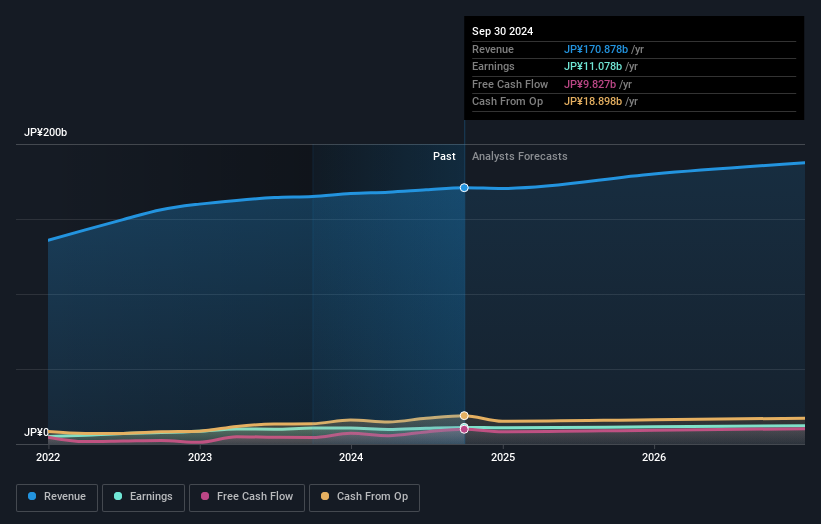

Overview: KITZ Corporation specializes in the manufacturing and distribution of valves and flow control devices globally, with a market cap of ¥98.89 billion.

Operations: KITZ Corporation generates revenue primarily from its Valve Business, which contributed ¥139.45 billion, and the Copper Products Business, which added ¥31.50 billion.

KITZ, a company in the machinery sector, has shown promising signs with its earnings growth of 4.6% over the past year, outpacing the industry average of 1.4%. The firm is trading at a notable discount of 40.8% below estimated fair value, suggesting potential for value investors. With a net debt to equity ratio of 5.5%, KITZ's financial health appears satisfactory and manageable. Recent share repurchases amounting to ¥2,999.98 million indicate confidence in its stock value and strategic capital management initiatives that could enhance shareholder returns moving forward.

- Take a closer look at KITZ's potential here in our health report.

Evaluate KITZ's historical performance by accessing our past performance report.

Kohsoku (TSE:7504)

Simply Wall St Value Rating: ★★★★★★

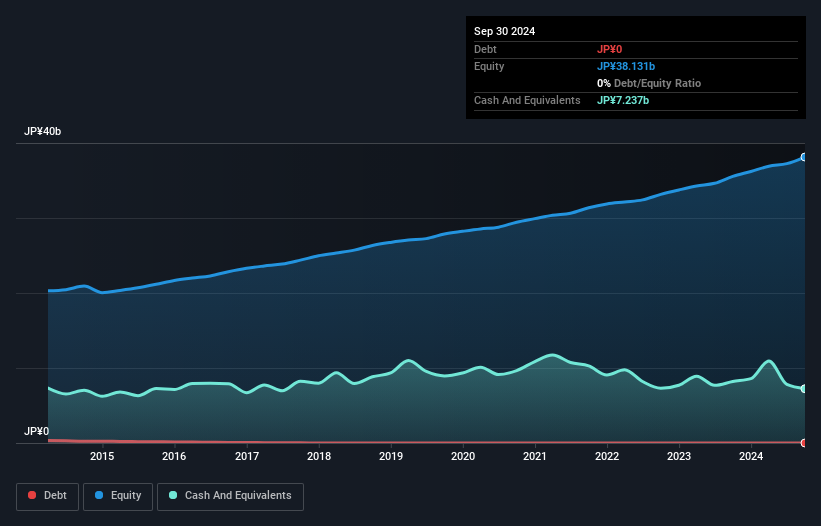

Overview: Kohsoku Corporation specializes in the sale of light food packaging materials in Japan, with a market capitalization of ¥49.53 billion.

Operations: Kohsoku generates revenue primarily from the manufacturing and sales of packaging materials, amounting to ¥108.91 billion.

Kohsoku, a company with no debt, has seen its earnings grow at 7.9% annually over the past five years, showcasing high-quality earnings. Despite not outpacing the packaging industry's recent growth of 19.5%, it remains profitable and free cash flow positive. The firm recently increased its dividend to JPY 27 per share from JPY 24 last year, reflecting confidence in its financial health. With a levered free cash flow of A$3.02 million as of March 2024 and capital expenditure at A$1.43 million, Kohsoku seems well-positioned within its industry landscape for steady performance moving forward.

- Get an in-depth perspective on Kohsoku's performance by reading our health report here.

Gain insights into Kohsoku's past trends and performance with our Past report.

Seize The Opportunity

- Navigate through the entire inventory of 4638 Undiscovered Gems With Strong Fundamentals here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Kohsoku might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7504

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives