- Japan

- /

- Electronic Equipment and Components

- /

- TSE:6908

Top Dividend Stocks To Consider In January 2025

Reviewed by Simply Wall St

As we move into January 2025, global markets are navigating a complex landscape marked by fluctuating consumer confidence and mixed economic signals. Despite these challenges, U.S. stock indices have shown moderate gains, with large-cap growth stocks leading the charge amid a backdrop of rising treasury yields and evolving geopolitical dynamics. In such an environment, dividend stocks can offer investors stability and income potential, making them an attractive option for those seeking to balance growth with consistent returns in their portfolios.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Tsubakimoto Chain (TSE:6371) | 4.09% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.33% | ★★★★★★ |

| CAC Holdings (TSE:4725) | 4.84% | ★★★★★★ |

| Yamato Kogyo (TSE:5444) | 4.04% | ★★★★★★ |

| Guangxi LiuYao Group (SHSE:603368) | 3.36% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.42% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.38% | ★★★★★★ |

| China South Publishing & Media Group (SHSE:601098) | 3.66% | ★★★★★★ |

| HUAYU Automotive Systems (SHSE:600741) | 4.26% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.38% | ★★★★★★ |

Click here to see the full list of 1941 stocks from our Top Dividend Stocks screener.

Let's review some notable picks from our screened stocks.

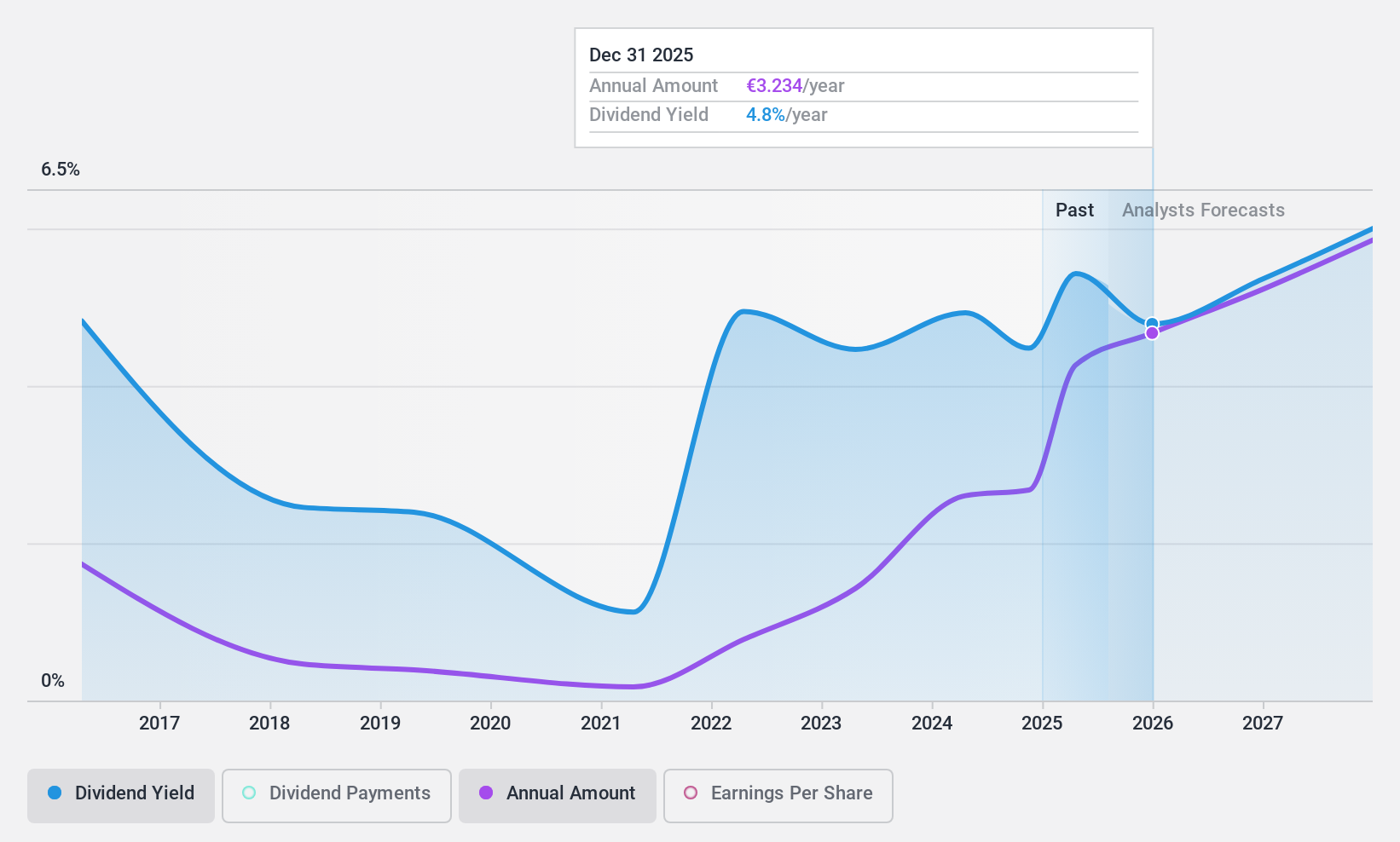

UniCredit (BIT:UCG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: UniCredit S.p.A. is a commercial bank offering services across Italy, Germany, Central Europe, and Eastern Europe with a market cap of €59.33 billion.

Operations: UniCredit S.p.A.'s revenue segments include €10.88 billion from Italy, €5.27 billion from Germany, €4.29 billion from Central Europe, €2.87 billion from Eastern Europe, and €1.36 billion from Russia.

Dividend Yield: 4.8%

UniCredit's recent dividend of €0.9261 reflects its commitment to shareholder returns, though the company's dividend history has been volatile and unreliable over the past decade. Despite a low payout ratio of 46.3%, ensuring dividends are covered by earnings, future earnings are expected to decline by 4.7% annually over three years. The stock trades at a significant discount to its estimated fair value, but concerns about high bad loans (2.4%) persist amid M&A rumors involving Commerzbank AG.

- Click to explore a detailed breakdown of our findings in UniCredit's dividend report.

- The valuation report we've compiled suggests that UniCredit's current price could be quite moderate.

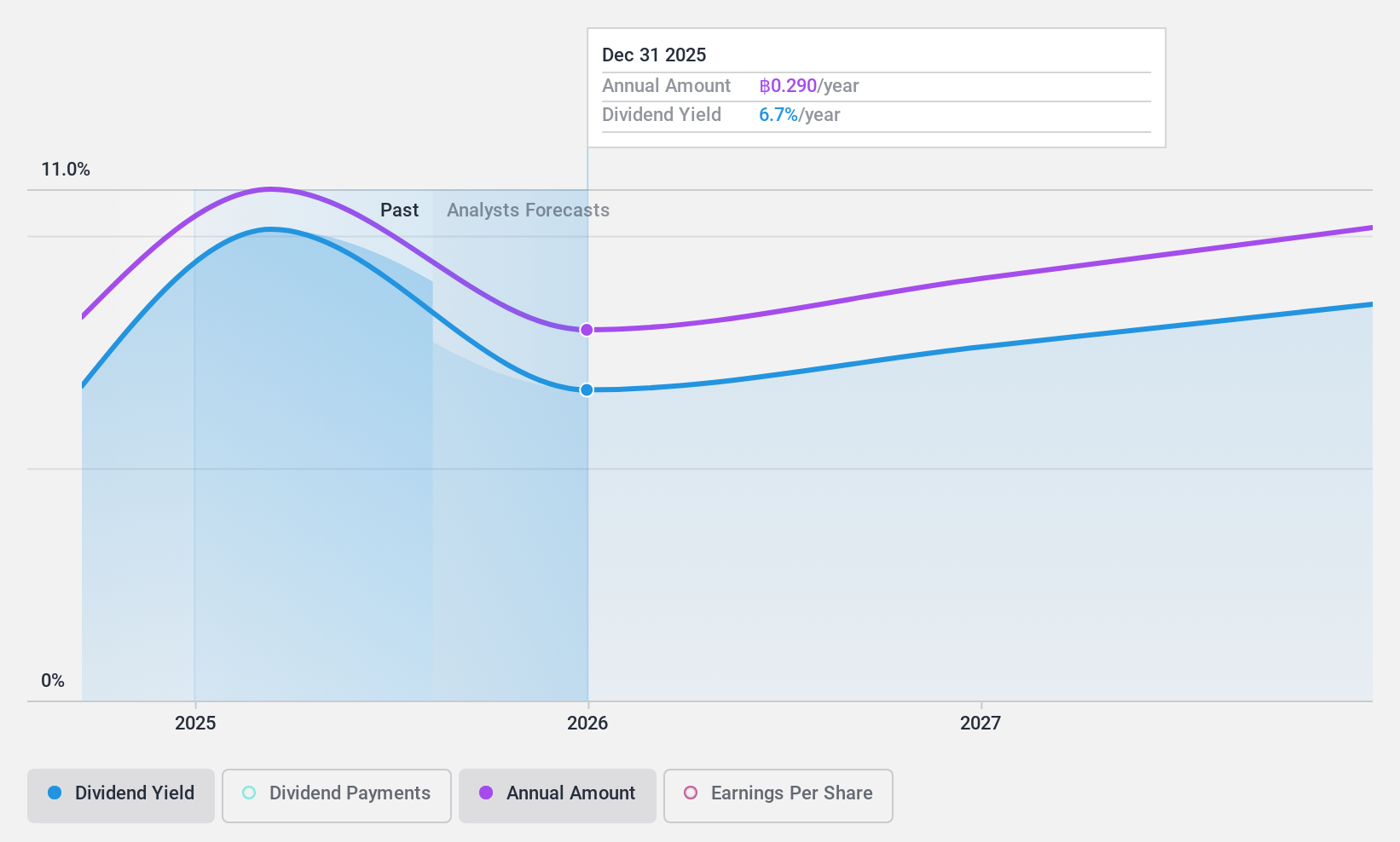

Food Moments (SET:FM)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Food Moments Public Company Limited operates in the production and sale of butchered chicken and processed chicken products, with a market cap of THB3.71 billion.

Operations: Food Moments Public Company Limited generates revenue through the production and distribution of chicken parts (THB5.28 billion) and processed chicken parts (THB2.65 billion).

Dividend Yield: 8%

Food Moments recently initiated dividend payments, offering a yield of 7.98%, placing it in the top 25% of Thai market payers. With a low payout ratio of 23.8%, dividends are well covered by earnings and cash flows, indicating sustainability despite their recent inception. The company reported strong earnings growth, with net income for the third quarter reaching THB 159.13 million, up from THB 89.22 million year-over-year, supporting its dividend potential amidst valuation attractiveness at below fair value estimates.

- Unlock comprehensive insights into our analysis of Food Moments stock in this dividend report.

- Our comprehensive valuation report raises the possibility that Food Moments is priced lower than what may be justified by its financials.

Iriso Electronics (TSE:6908)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Iriso Electronics Co., Ltd. is engaged in the development, manufacturing, and sale of connectors across Japan, Asia, Europe, and North America, with a market cap of ¥60.35 billion.

Operations: Iriso Electronics Co., Ltd. generates revenue from its connector business with ¥52.06 billion from Asia, ¥40.51 billion from Japan, ¥9.47 billion from Europe, and ¥6.39 billion from North America.

Dividend Yield: 3.7%

Iriso Electronics has demonstrated a mixed dividend history, with growth over the past decade but marked volatility, including annual drops exceeding 20%. Despite this, dividends are supported by earnings and cash flows with payout ratios of 59.7% and 38.8%, respectively. The company trades at a significant discount to estimated fair value and recently announced a share buyback program to enhance shareholder returns, indicating efforts to improve capital efficiency amidst lower profit margins compared to last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Iriso Electronics.

- The valuation report we've compiled suggests that Iriso Electronics' current price could be inflated.

Summing It All Up

- Gain an insight into the universe of 1941 Top Dividend Stocks by clicking here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6908

Iriso Electronics

Develops, manufactures, and sells connectors in Japan, rest of Asia, Europe, and North America.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives