3 Growth Companies With High Insider Ownership On The Japanese Exchange

Reviewed by Simply Wall St

As Japan's stock markets recently experienced sharp losses amid political shifts and monetary policy adjustments, investors are closely monitoring the impact on growth companies within the country. In this environment, stocks with high insider ownership can be particularly appealing as they often indicate a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 31.5% |

| Hottolink (TSE:3680) | 26.1% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 40.2% |

| Medley (TSE:4480) | 34% | 30.4% |

| Inforich (TSE:9338) | 19.1% | 29.8% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 68.1% |

| Loadstar Capital K.K (TSE:3482) | 33.8% | 24.3% |

| AeroEdge (TSE:7409) | 10.7% | 25.3% |

Let's take a closer look at a couple of our picks from the screened companies.

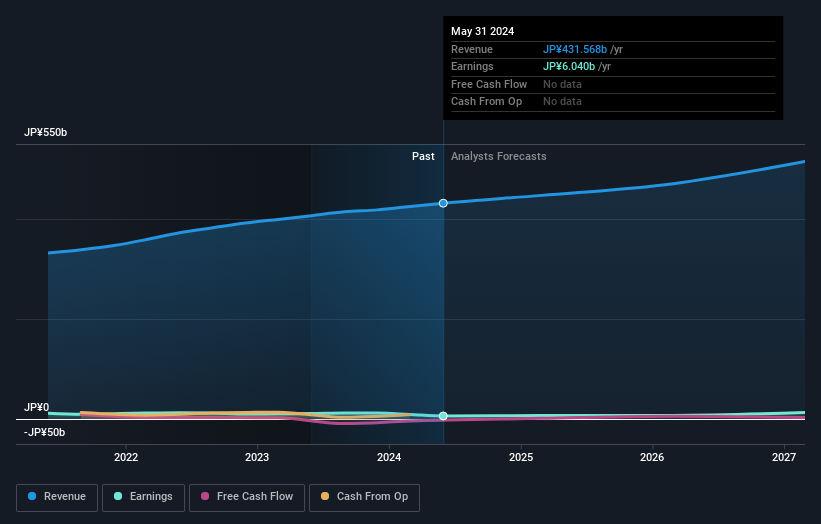

S Foods (TSE:2292)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: S Foods Inc. is a Japanese meat company involved in the manufacture, wholesaling, retailing, and food servicing of meat-related products with a market cap of ¥87.82 billion.

Operations: The company's revenue segments include Manufacturing and Wholesale of Meat, Etc. at ¥406.97 billion, Retail Business of Meat, Etc. at ¥24.15 billion, and Meat Restaurant Business at ¥8.33 billion.

Insider Ownership: 25.5%

S Foods is trading at a good value, 35.4% below its estimated fair value, with earnings expected to grow significantly at 22.4% annually, outpacing the JP market's 8.7%. Revenue growth is projected at 7.8%, faster than the market's 4.2%. However, profit margins have decreased to 1.4% from last year's 2.7%, and the dividend yield of ¥3.21 isn't well covered by free cash flows, indicating potential sustainability concerns.

- Unlock comprehensive insights into our analysis of S Foods stock in this growth report.

- The analysis detailed in our S Foods valuation report hints at an deflated share price compared to its estimated value.

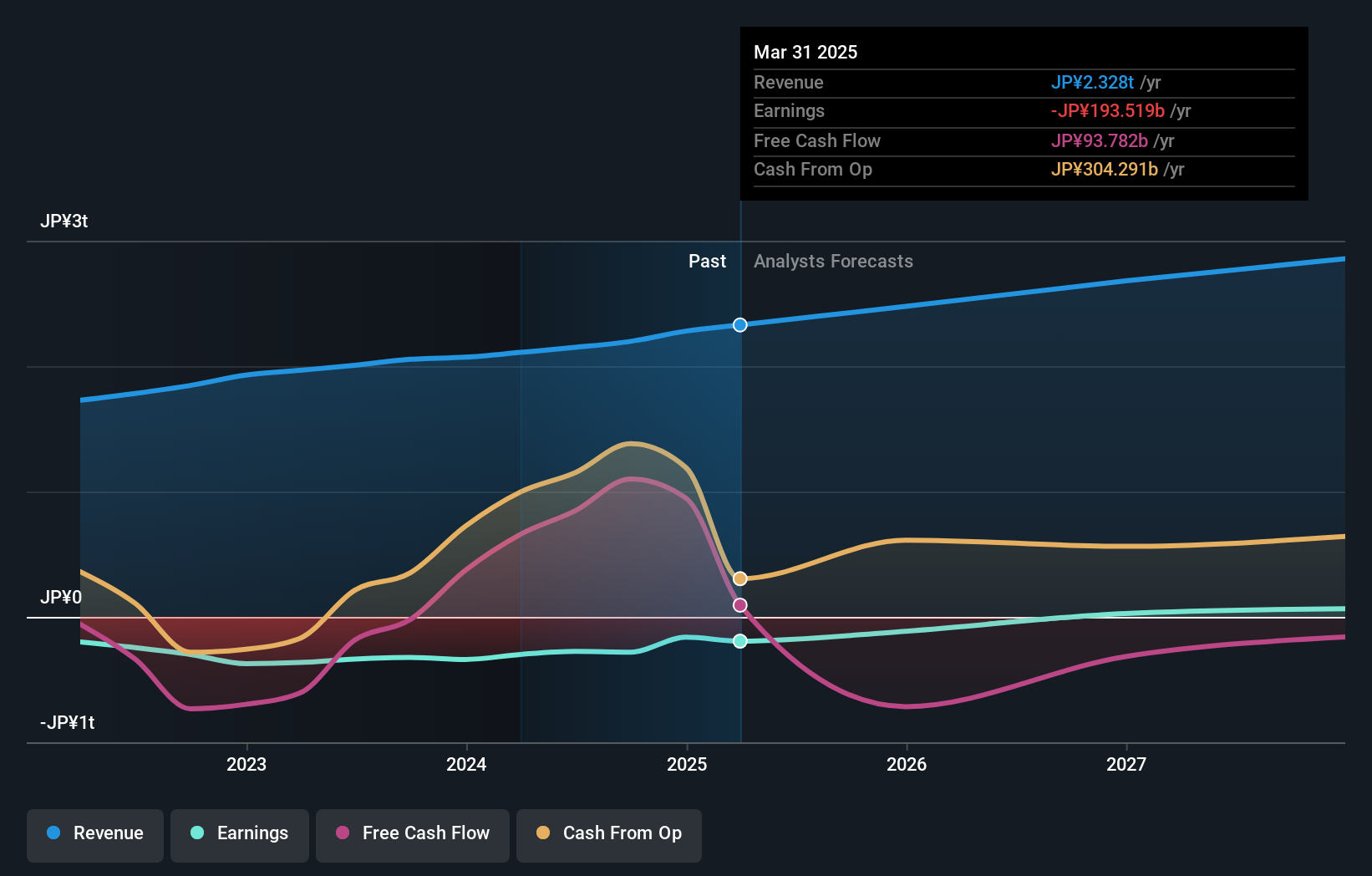

Rakuten Group (TSE:4755)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Rakuten Group, Inc. operates in e-commerce, fintech, digital content, and communications sectors both in Japan and globally, with a market cap of ¥2.04 trillion.

Operations: The company's revenue segments are comprised of Mobile at ¥382.95 million, Fin Tech at ¥772.29 million, and Internet Services at ¥1.24 billion.

Insider Ownership: 17.3%

Rakuten Group is trading at 90.2% below its estimated fair value, with earnings projected to grow significantly at 79.35% annually, surpassing the JP market's growth rate. Although revenue growth is slower than 20%, it still exceeds the market average of 4.2%. The company has no substantial insider trading activity over the past three months and recently presented at a healthcare showcase in New York, highlighting its strategic initiatives despite a volatile share price.

- Click here to discover the nuances of Rakuten Group with our detailed analytical future growth report.

- Our expertly prepared valuation report Rakuten Group implies its share price may be lower than expected.

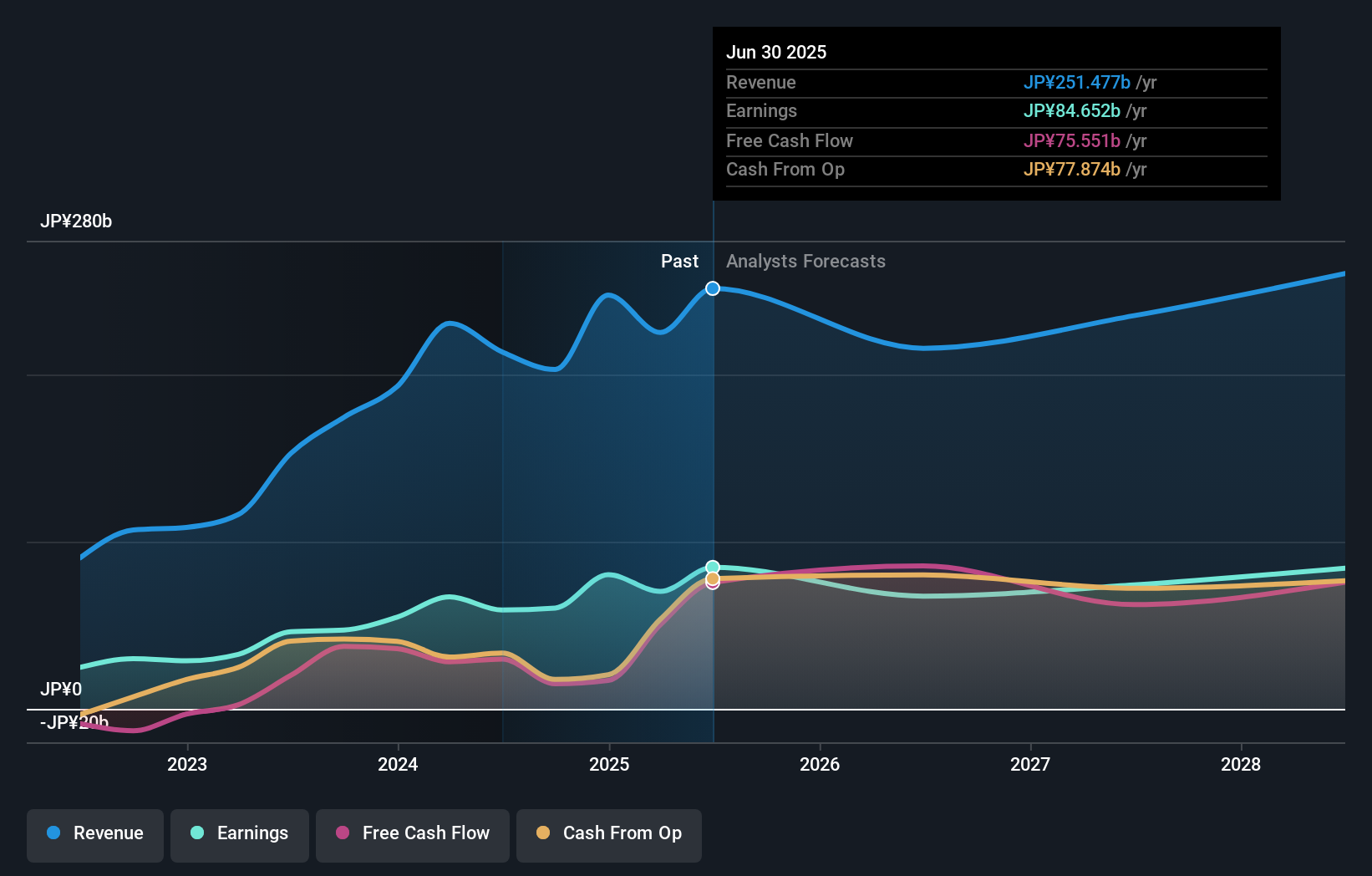

Lasertec (TSE:6920)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Lasertec Corporation designs, manufactures, and sells inspection and measurement equipment both in Japan and internationally, with a market cap of ¥2.19 trillion.

Operations: Revenue Segments (in millions of ¥): Semiconductor-related Photomask Inspection Equipment ¥109,400; Mask Blanks and Wafer Inspection Equipment ¥89,300; Flat Panel Display Photomask Inspection Equipment ¥20,500.

Insider Ownership: 11.1%

Lasertec's earnings are forecast to grow at 15.8% annually, outpacing the Japanese market average of 8.7%, despite its slower revenue growth rate of 13.2%. The company recently launched SICA108, enhancing SiC wafer inspection capabilities, crucial for applications like electric vehicles and solar cells. Despite recent board changes and a volatile share price, Lasertec maintains high-quality earnings with no significant insider trading activity reported over the past three months.

- Take a closer look at Lasertec's potential here in our earnings growth report.

- In light of our recent valuation report, it seems possible that Lasertec is trading beyond its estimated value.

Seize The Opportunity

- Access the full spectrum of 101 Fast Growing Japanese Companies With High Insider Ownership by clicking on this link.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:4755

Rakuten Group

Provides services in e-commerce, fintech, digital content, and communications to various users in Japan and internationally.

Reasonable growth potential with adequate balance sheet.