- Japan

- /

- Oil and Gas

- /

- TSE:1605

Did INPEX's (TSE:1605) Latest Share Buyback Signal a Shift in Capital Allocation Strategy?

Reviewed by Sasha Jovanovic

- In the past week, INPEX Corporation announced it acquired 4,788,600 of its own shares through market purchases on the Tokyo Stock Exchange, as part of a buyback program targeting up to 50 million shares by the end of 2025.

- This ongoing share repurchase initiative highlights INPEX’s active capital management and its intention to potentially enhance shareholder value amid an evolving energy sector.

- We’ll examine how INPEX’s renewed commitment to buybacks could impact its investment narrative and future earnings per share.

Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

Inpex Investment Narrative Recap

For investors to view INPEX as an attractive holding, belief in resilient global LNG demand, especially in Asia-Pacific, alongside successful project execution and a disciplined capital return framework is essential. The recent buyback of nearly 4.8 million shares reflects management’s commitment to shareholder returns and could incrementally boost earnings per share, but is unlikely to materially shift the primary short-term catalysts or the most pressing risk: execution and cost risks on major LNG expansion projects. Among INPEX’s recent announcements, the August 2025 decision to boost its interim and year-end dividend demonstrates ongoing confidence in cash flows and further underscores proactive capital management. This dividend increase aligns directly with the share repurchase program’s aim to reward shareholders and may support share price stability if earnings targets are met. Yet, it’s worth contrasting these capital returns with the potential for execution delays or cost overruns, a factor investors should be mindful of as...

Read the full narrative on Inpex (it's free!)

Inpex's narrative projects ¥1,853.8 billion in revenue and ¥308.2 billion in earnings by 2028. This requires a 4.4% annual revenue decline and a decrease in earnings of ¥130.1 billion from the current level of ¥438.3 billion.

Uncover how Inpex's forecasts yield a ¥2521 fair value, a 6% downside to its current price.

Exploring Other Perspectives

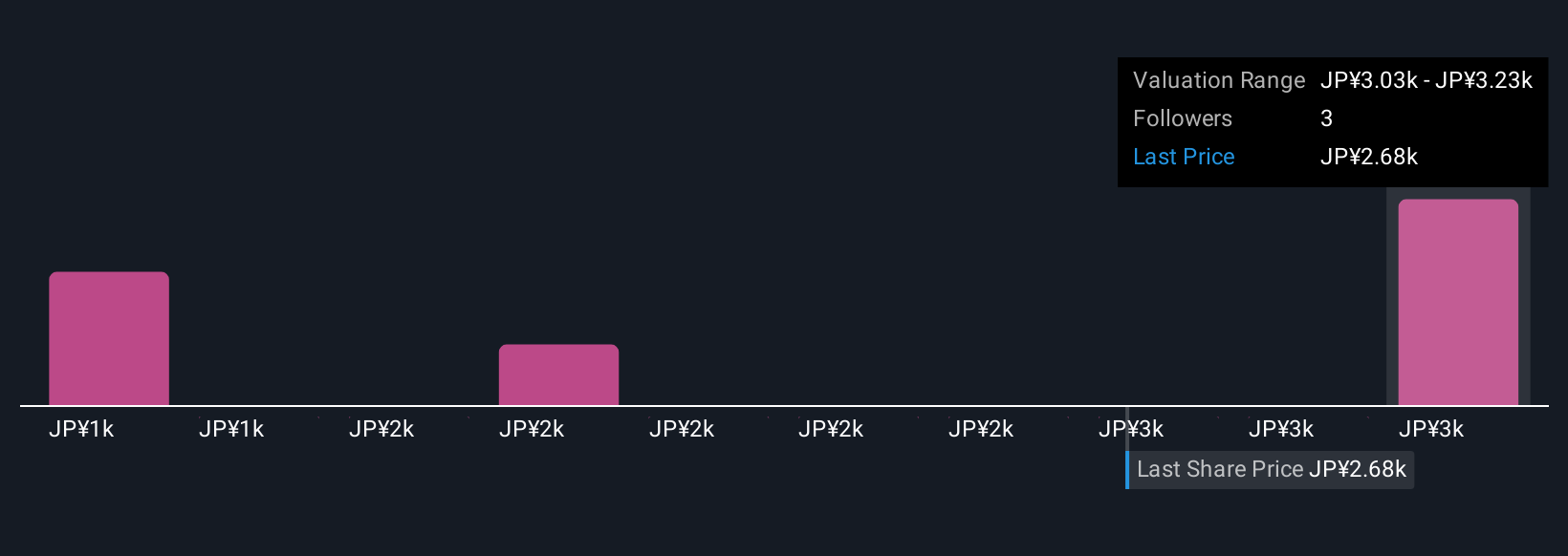

Four community members placed fair value estimates for INPEX that range from ¥1,225 to ¥3,229 per share, revealing a spectrum of opinions within the Simply Wall St Community. While optimism for project execution fuels higher outlooks, others remain cautious amid cost overrun risks, inviting you to weigh both the upside and uncertainties yourself.

Explore 4 other fair value estimates on Inpex - why the stock might be worth as much as 21% more than the current price!

Build Your Own Inpex Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Inpex research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Inpex research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Inpex's overall financial health at a glance.

No Opportunity In Inpex?

Our top stock finds are flying under the radar-for now. Get in early:

- We've found 19 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- The end of cancer? These 28 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- These 10 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:1605

Inpex

Engages in the research, exploration, development, production, and sale of oil, natural gas, and other mineral resources in Japan and internationally.

6 star dividend payer with solid track record.

Similar Companies

Market Insights

Community Narratives