- Japan

- /

- Capital Markets

- /

- TSE:2127

3 Stocks Estimated To Be Trading Below Intrinsic Value By Up To 26.5%

Reviewed by Simply Wall St

In recent weeks, global markets have been influenced by rising U.S. Treasury yields and subdued economic growth, leading to a mixed performance across major indices. As investors navigate these uncertain conditions, identifying stocks that are trading below their intrinsic value can offer potential opportunities for long-term gains. In such an environment, a good stock is often characterized by strong fundamentals and resilience in the face of broader market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Provident Financial Services (NYSE:PFS) | US$19.03 | US$37.92 | 49.8% |

| Western Alliance Bancorporation (NYSE:WAL) | US$84.27 | US$168.24 | 49.9% |

| California Resources (NYSE:CRC) | US$52.32 | US$104.35 | 49.9% |

| Beyout Investment Group Holding Company - K.S.C. (Holding) (KWSE:BEYOUT) | KWD0.395 | KWD0.79 | 49.9% |

| Acerinox (BME:ACX) | €8.52 | €16.98 | 49.8% |

| Semiconductor Manufacturing International (SEHK:981) | HK$27.05 | HK$53.78 | 49.7% |

| SBI Sumishin Net Bank (TSE:7163) | ¥2706.00 | ¥5411.18 | 50% |

| ChromaDex (NasdaqCM:CDXC) | US$3.58 | US$7.15 | 49.9% |

| Energy One (ASX:EOL) | A$5.53 | A$11.06 | 50% |

| Fine Foods & Pharmaceuticals N.T.M (BIT:FF) | €8.36 | €16.70 | 49.9% |

Underneath we present a selection of stocks filtered out by our screen.

Beijing Huafeng Test & Control TechnologyLtd (SHSE:688200)

Overview: Beijing Huafeng Test & Control Technology Co., Ltd. operates in the field of test and control technology, with a market cap of approximately CN¥15.56 billion.

Operations: The company's revenue segments are not specified in the provided text.

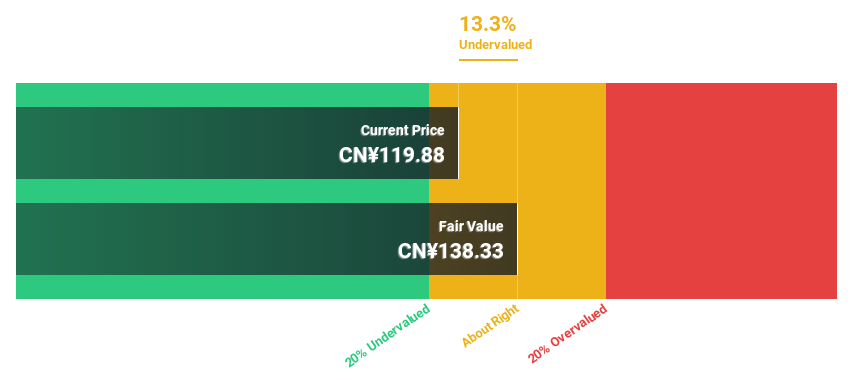

Estimated Discount To Fair Value: 13.3%

Beijing Huafeng Test & Control Technology Ltd. reported sales of CNY 621.2 million for the first nine months of 2024, up from CNY 518.73 million a year ago, with net income rising to CNY 213.09 million. Despite its low forecasted return on equity and recent share price volatility, the stock trades at CN¥119.88, below its estimated fair value of CN¥138.33, with significant expected earnings growth of 35% annually over three years.

- Upon reviewing our latest growth report, Beijing Huafeng Test & Control TechnologyLtd's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Beijing Huafeng Test & Control TechnologyLtd.

Winner Medical (SZSE:300888)

Overview: Winner Medical Co., Ltd. focuses on the R&D, manufacturing, and marketing of cotton-based medical dressings and disposables in China, with a market cap of CN¥18.38 billion.

Operations: The company generates revenue from cotton-based medical dressings, medical disposables, and consumer products in China.

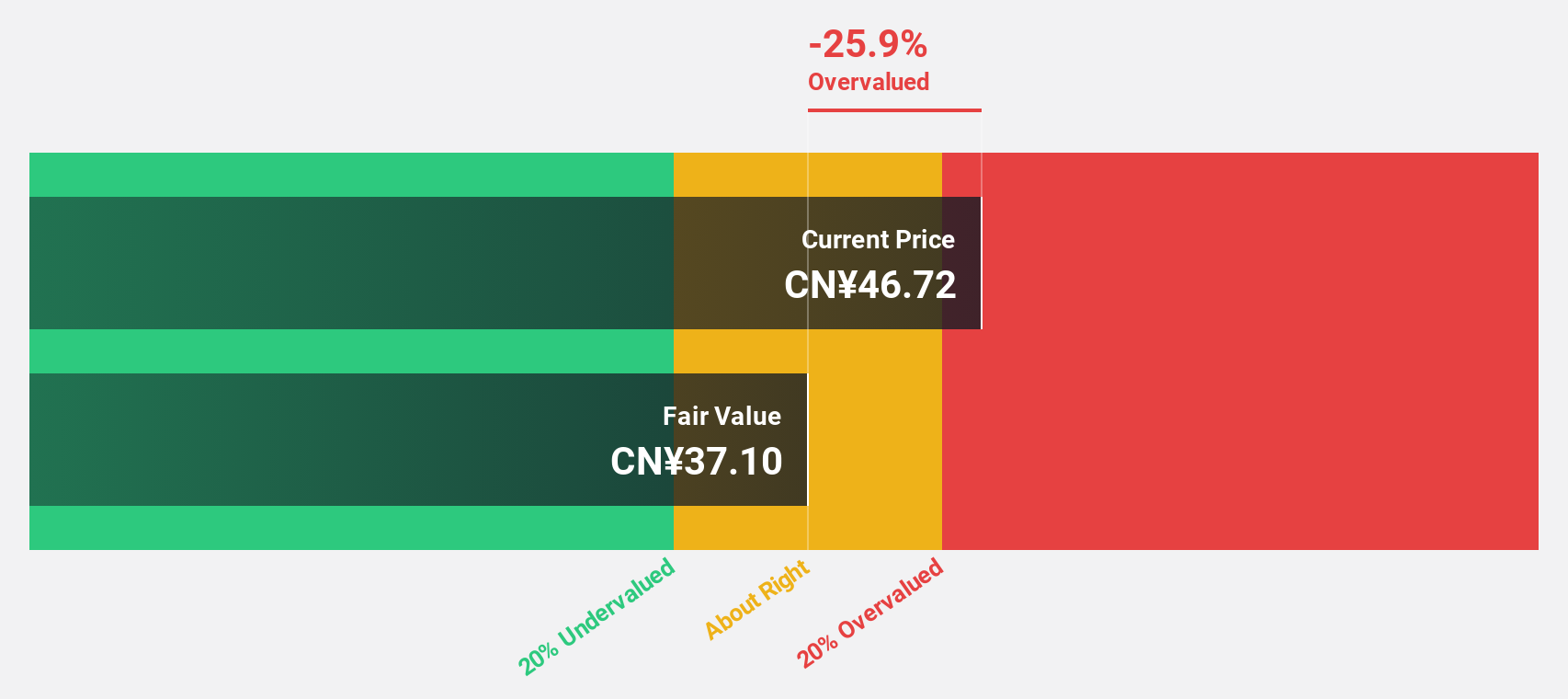

Estimated Discount To Fair Value: 26.5%

Winner Medical's recent earnings show a decline in net income to CNY 552.97 million for the first nine months of 2024, down from CNY 2.15 billion a year ago, though sales increased slightly to CNY 6.07 billion. The stock trades at CN¥31.19, below its estimated fair value of CN¥42.45, indicating undervaluation based on cash flows despite low forecasted return on equity and unsustainable dividend coverage from earnings or cash flows.

- Our growth report here indicates Winner Medical may be poised for an improving outlook.

- Take a closer look at Winner Medical's balance sheet health here in our report.

Nihon M&A Center Holdings (TSE:2127)

Overview: Nihon M&A Center Holdings Inc. offers mergers and acquisitions-related services both in Japan and internationally, with a market cap of ¥188.33 billion.

Operations: The company generates revenue primarily through its M&A Consulting Business, which accounted for ¥43.53 billion.

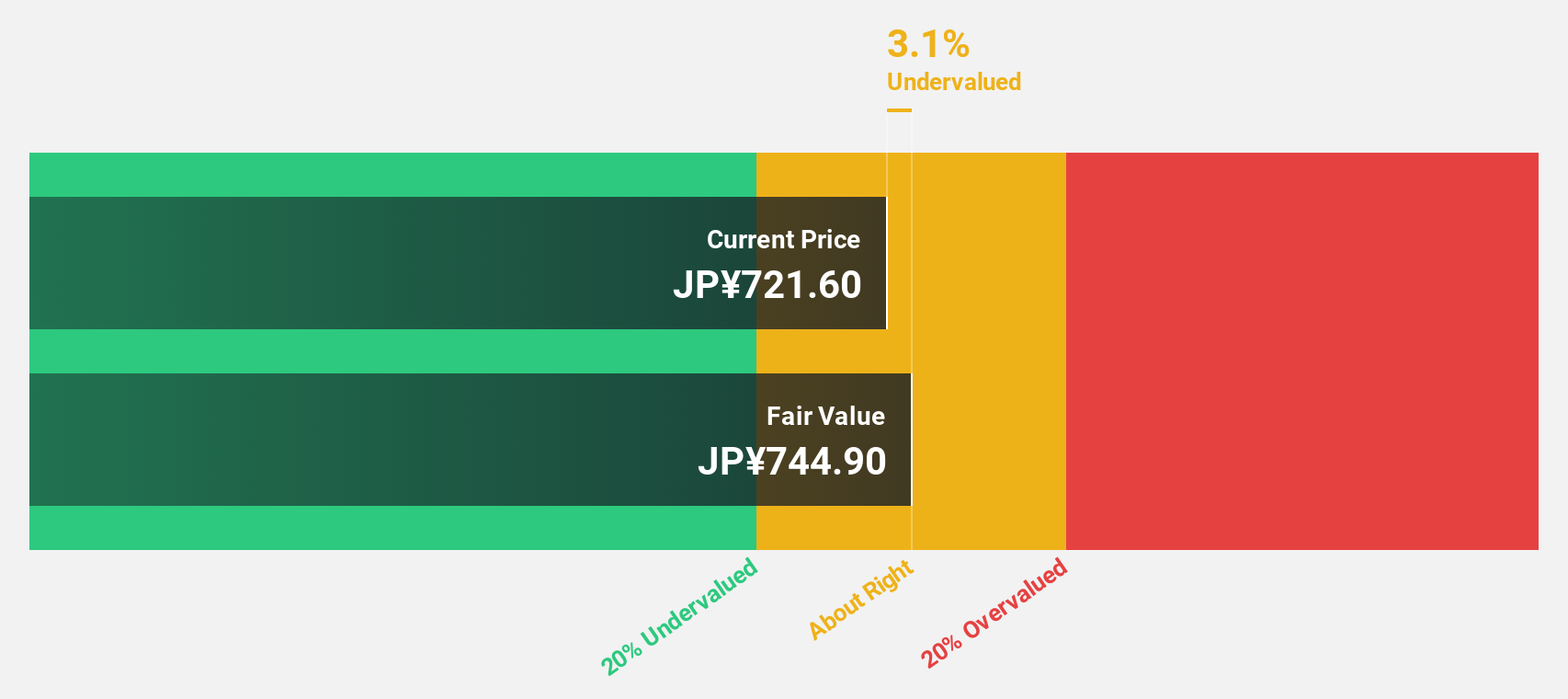

Estimated Discount To Fair Value: 22.5%

Nihon M&A Center Holdings is trading at ¥667.5, significantly below its estimated fair value of ¥860.79, highlighting potential undervaluation based on cash flows. The company's revenue is expected to grow by 9.5% annually, outpacing the Japanese market's growth rate of 4.2%. Although earnings growth isn't significant, it's projected at 9.8%, surpassing the market average of 8.8%. The stock also offers a reliable dividend yield of 3.45%.

- Our comprehensive growth report raises the possibility that Nihon M&A Center Holdings is poised for substantial financial growth.

- Delve into the full analysis health report here for a deeper understanding of Nihon M&A Center Holdings.

Summing It All Up

- Investigate our full lineup of 965 Undervalued Stocks Based On Cash Flows right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nihon M&A Center Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:2127

Nihon M&A Center Holdings

Provides mergers and acquisition (M&A) related services in Japan and internationally.

Excellent balance sheet established dividend payer.