3 Asian Stocks Estimated To Be Trading Below Their Intrinsic Value By Up To 38.3%

Reviewed by Simply Wall St

As global markets grapple with trade policy uncertainties and inflation concerns, Asian stocks present unique opportunities for investors seeking value. In this environment, identifying stocks trading below their intrinsic value can be a prudent strategy, offering potential for growth when market conditions stabilize.

Top 10 Undervalued Stocks Based On Cash Flows In Asia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| DIT (KOSDAQ:A110990) | ₩13800.00 | ₩27411.84 | 49.7% |

| Insource (TSE:6200) | ¥797.00 | ¥1583.83 | 49.7% |

| Shenzhou International Group Holdings (SEHK:2313) | HK$58.40 | HK$115.05 | 49.2% |

| Kinsus Interconnect Technology (TWSE:3189) | NT$96.00 | NT$189.44 | 49.3% |

| Hyosung Heavy Industries (KOSE:A298040) | ₩429500.00 | ₩846698.91 | 49.3% |

| LITALICO (TSE:7366) | ¥1062.00 | ¥2120.56 | 49.9% |

| APAC Realty (SGX:CLN) | SGD0.42 | SGD0.83 | 49.5% |

| BalnibarbiLtd (TSE:3418) | ¥1085.00 | ¥2169.97 | 50% |

| Ryman Healthcare (NZSE:RYM) | NZ$2.84 | NZ$5.65 | 49.7% |

| Doosan Fuel Cell (KOSE:A336260) | ₩15810.00 | ₩31529.54 | 49.9% |

Here we highlight a subset of our preferred stocks from the screener.

Nihon M&A Center Holdings (TSE:2127)

Overview: Nihon M&A Center Holdings Inc. offers mergers and acquisition services both in Japan and internationally, with a market cap of approximately ¥193.95 billion.

Operations: The company generates revenue of ¥42.83 billion from its M&A Consulting Business segment.

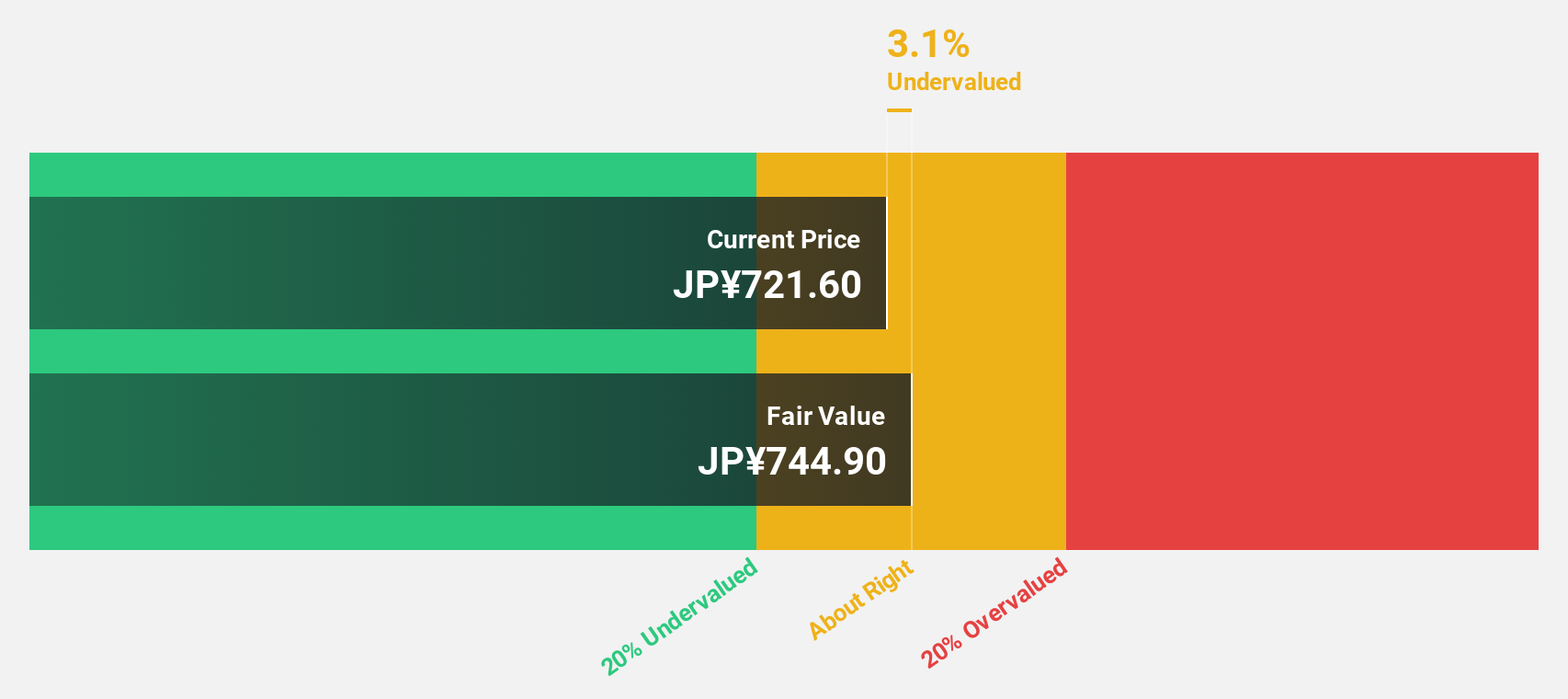

Estimated Discount To Fair Value: 18.7%

Nihon M&A Center Holdings is trading at ¥611.4, approximately 18.7% below its estimated fair value of ¥751.84, suggesting it may be undervalued based on cash flows. The company expects revenue growth of 10.9% annually and earnings growth of 9.2%, both outpacing the Japanese market averages. Despite recent executive changes, including Kiyofumi Nakano's appointment as Director, the company's fundamentals remain strong with a reliable dividend yield of 3.76%.

- Upon reviewing our latest growth report, Nihon M&A Center Holdings' projected financial performance appears quite optimistic.

- Navigate through the intricacies of Nihon M&A Center Holdings with our comprehensive financial health report here.

KeePer Technical Laboratory (TSE:6036)

Overview: KeePer Technical Laboratory Co., Ltd. is a Japanese company that develops, manufactures, and sells car coatings, car washing chemicals and equipment, with a market cap of ¥107.25 billion.

Operations: KeePer Technical Laboratory Co., Ltd. generates revenue through the development, manufacturing, and sale of car coatings, as well as car washing chemicals and equipment in Japan.

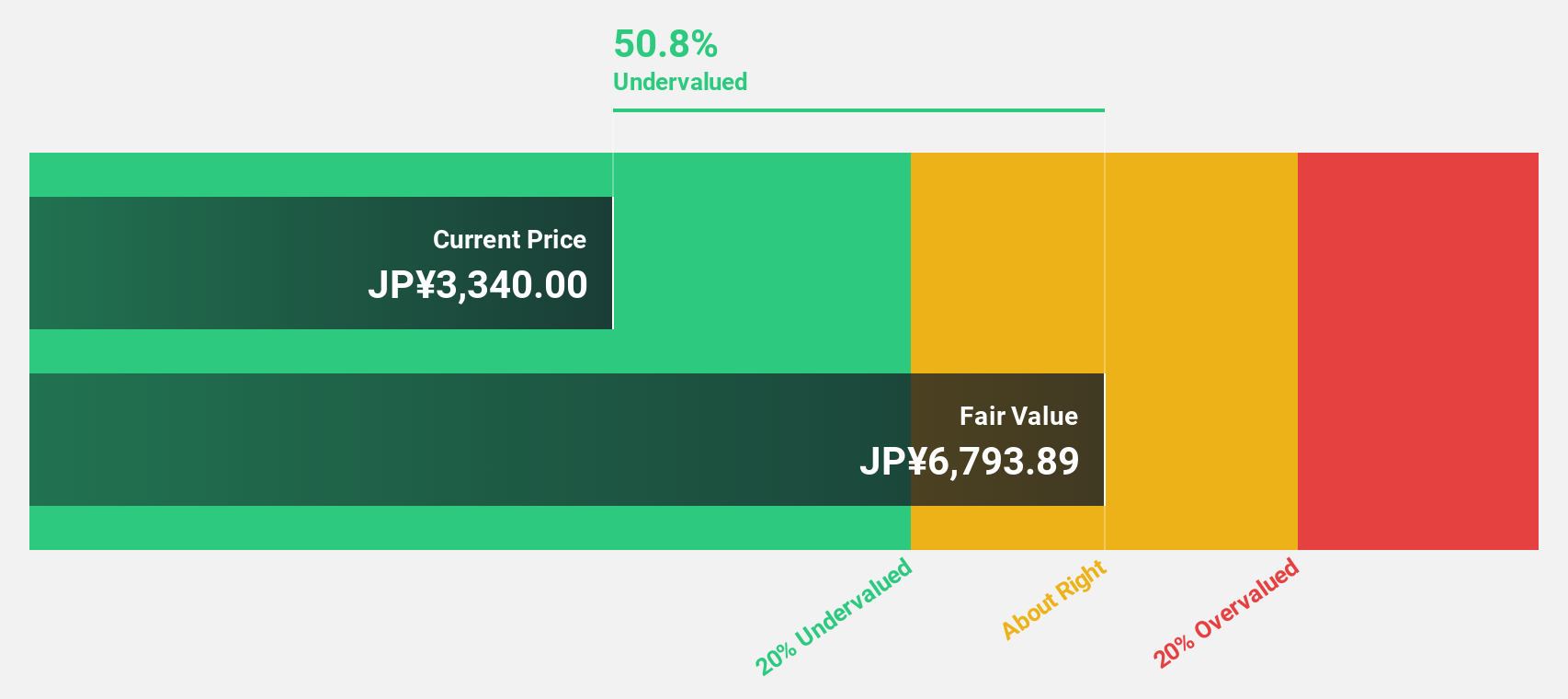

Estimated Discount To Fair Value: 38.3%

KeePer Technical Laboratory is trading at ¥3930, significantly below its estimated fair value of ¥6369.62, highlighting potential undervaluation based on cash flows. The company's earnings are projected to grow 15.81% annually, outpacing the Japanese market's expected growth rate of 8.1%. Recent expansions include new store openings in Yokohama and Nagasaki, enhancing its footprint and operational capacity. Preliminary sales results for February 2024 showed a year-on-year increase of 14.4%, reflecting robust demand.

- Insights from our recent growth report point to a promising forecast for KeePer Technical Laboratory's business outlook.

- Click here and access our complete balance sheet health report to understand the dynamics of KeePer Technical Laboratory.

SBI Sumishin Net Bank (TSE:7163)

Overview: SBI Sumishin Net Bank, Ltd. offers a range of banking products and services to both individual and corporate clients in Japan, with a market capitalization of ¥601.62 billion.

Operations: The company's revenue is primarily derived from its Digital Bank Business, contributing ¥68.41 billion, and the THEMIX Business segment, adding ¥0.35 billion.

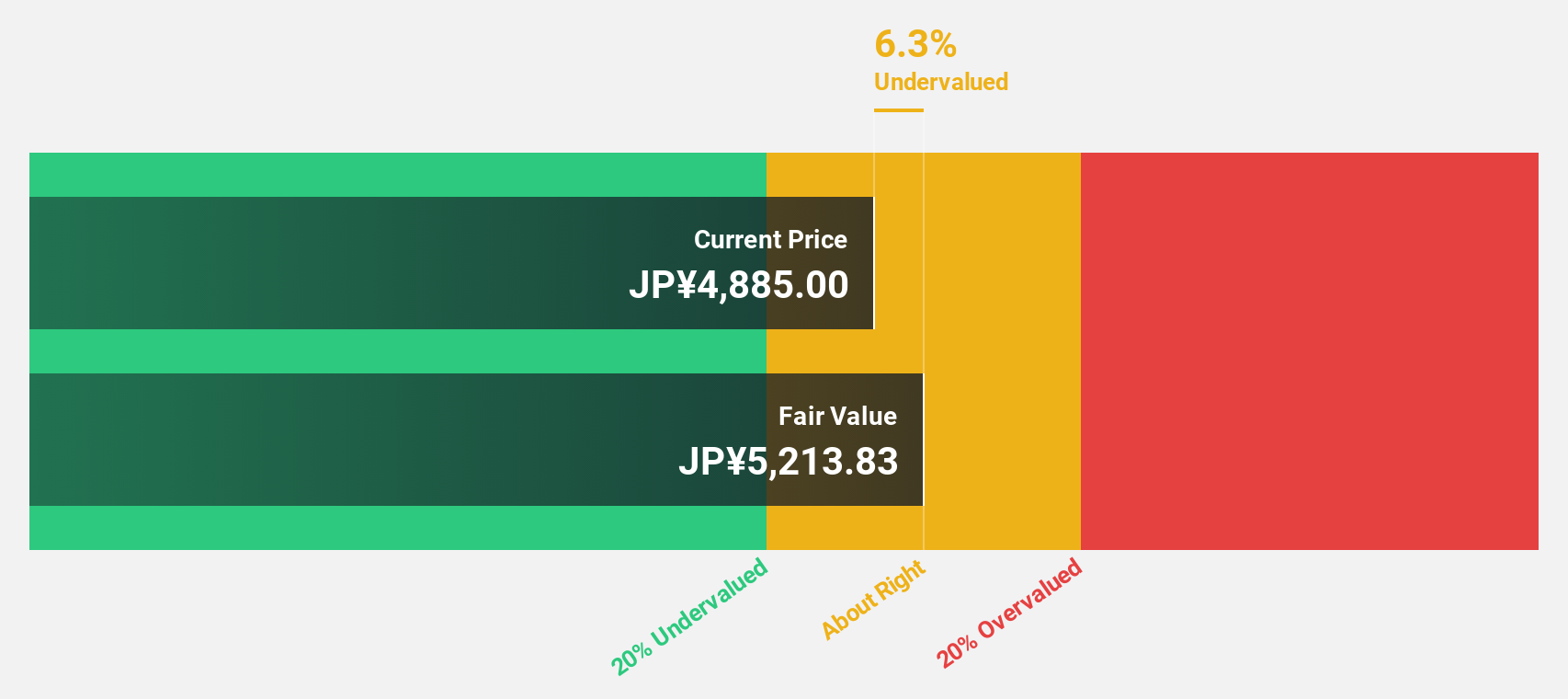

Estimated Discount To Fair Value: 17.3%

SBI Sumishin Net Bank is trading at ¥3990, 17.3% below its estimated fair value of ¥4826.15, suggesting potential undervaluation based on cash flows. Earnings are projected to grow significantly at 22.3% annually, outpacing the Japanese market's growth rate of 8.1%. Despite recent share price volatility and a low allowance for bad loans at 74%, the bank's revenue is expected to expand faster than the market average over the next few years.

- In light of our recent growth report, it seems possible that SBI Sumishin Net Bank's financial performance will exceed current levels.

- Delve into the full analysis health report here for a deeper understanding of SBI Sumishin Net Bank.

Summing It All Up

- Navigate through the entire inventory of 279 Undervalued Asian Stocks Based On Cash Flows here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:7163

SBI Sumishin Net Bank

Provides various banking products and services to individuals and corporate customers in Japan.

High growth potential with adequate balance sheet.