- Japan

- /

- Real Estate

- /

- TSE:3498

Japanese Growth Companies With High Insider Ownership For October 2024

Reviewed by Simply Wall St

In recent weeks, Japan's stock markets have experienced notable gains, with the Nikkei 225 Index rising by 5.6% and the broader TOPIX Index up by 3.7%, buoyed by optimism surrounding China's new stimulus measures and dovish commentary from the Bank of Japan. This positive momentum in the Japanese market highlights an opportune time to explore growth companies with high insider ownership, as these firms often demonstrate strong alignment between management and shareholder interests, potentially benefiting from favorable economic conditions.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| Micronics Japan (TSE:6871) | 15.3% | 31.5% |

| Hottolink (TSE:3680) | 26.1% | 61.5% |

| Kasumigaseki CapitalLtd (TSE:3498) | 34.7% | 38.5% |

| Medley (TSE:4480) | 34% | 30.4% |

| Inforich (TSE:9338) | 19.1% | 29.5% |

| Kanamic NetworkLTD (TSE:3939) | 25% | 28.3% |

| ExaWizards (TSE:4259) | 22% | 75.2% |

| Money Forward (TSE:3994) | 21.4% | 68.1% |

| Loadstar Capital K.K (TSE:3482) | 33.8% | 24.3% |

| Soracom (TSE:147A) | 16.5% | 54.1% |

We'll examine a selection from our screener results.

Kasumigaseki CapitalLtd (TSE:3498)

Simply Wall St Growth Rating: ★★★★★★

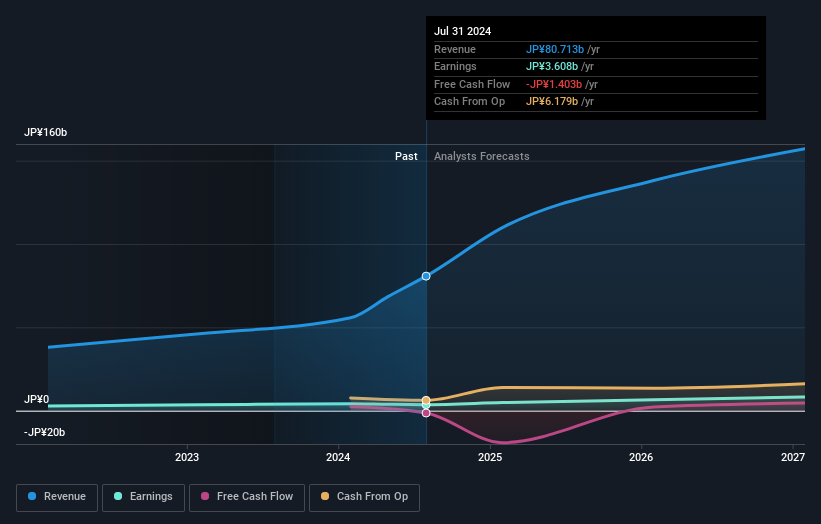

Overview: Kasumigaseki Capital Co., Ltd. operates in the real estate consulting sector in Japan and has a market capitalization of ¥184.47 billion.

Operations: Kasumigaseki Capital Co., Ltd. generates its revenue through various segments within the real estate consulting industry in Japan.

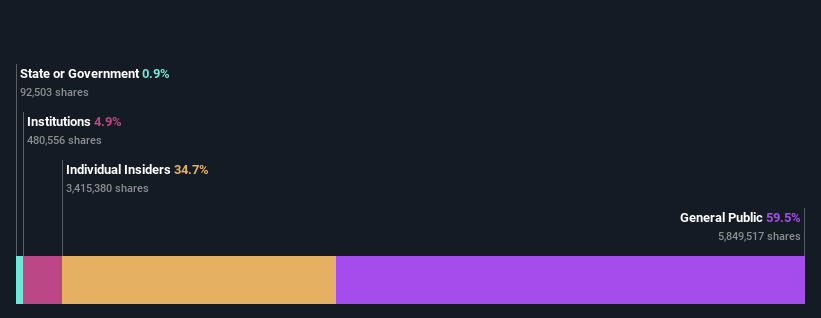

Insider Ownership: 34.7%

Revenue Growth Forecast: 26.3% p.a.

Kasumigaseki Capital Ltd. exhibits strong growth potential, with earnings forecasted to grow significantly at 38.54% annually over the next three years, outpacing the Japanese market. However, it faces challenges such as high share price volatility and past shareholder dilution. The company's recent expansion into luxury hospitality with seven x seven Ishigaki highlights its strategic growth initiatives despite concerns over debt coverage by operating cash flow.

- Get an in-depth perspective on Kasumigaseki CapitalLtd's performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Kasumigaseki CapitalLtd shares in the market.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K. provides cloud-based accounting and HR software solutions in Japan, with a market cap of ¥160.71 billion.

Operations: Revenue Segments (in millions of ¥):

Insider Ownership: 23.9%

Revenue Growth Forecast: 18.2% p.a.

freee K.K. is experiencing significant growth, with earnings projected to increase by 74.08% annually, outpacing the Japanese market's average growth rate. Despite a volatile share price recently, its revenue is expected to grow at 18.2% per year, surpassing market expectations. The company's strategic realignment includes appointing Yasuhiro Kimura as CPO and expanding business purposes in its articles of incorporation to support future growth initiatives while trading at a substantial discount to estimated fair value.

- Take a closer look at freee K.K's potential here in our earnings growth report.

- Our valuation report unveils the possibility freee K.K's shares may be trading at a discount.

GENDA (TSE:9166)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: GENDA Inc. operates amusement arcades primarily under the GiGO brand in Japan, with a market cap of ¥204.85 billion.

Operations: Revenue Segments (in millions of ¥):null

Insider Ownership: 19.3%

Revenue Growth Forecast: 13.4% p.a.

GENDA Inc. is experiencing robust growth, with earnings forecasted to expand by 20.9% annually, surpassing the Japanese market's average. Despite recent share price volatility and a reduction in profit margins from 7.5% to 4.5%, its revenue is projected to grow at 13.4% per year, outpacing the market rate. The company filed for a follow-on equity offering of over six million shares, potentially impacting shareholder value due to past dilution concerns but no substantial insider trading activity noted recently.

- Click to explore a detailed breakdown of our findings in GENDA's earnings growth report.

- The valuation report we've compiled suggests that GENDA's current price could be inflated.

Turning Ideas Into Actions

- Take a closer look at our Fast Growing Japanese Companies With High Insider Ownership list of 100 companies by clicking here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Valuation is complex, but we're here to simplify it.

Discover if Kasumigaseki CapitalLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3498

Kasumigaseki CapitalLtd

Engages in real estate consulting businesses in Japan.

Exceptional growth potential with solid track record.