- Japan

- /

- Commercial Services

- /

- TSE:6544

freee K.K Leads Trio Of High Insider Ownership Growth Stocks On Japanese Exchange

Reviewed by Simply Wall St

Amidst a backdrop of cautious optimism in global markets, Japan's Nikkei 225 and TOPIX indices have shown marginal weekly losses, reflecting a complex interplay of economic signals and monetary policy expectations. In such an environment, growth companies with high insider ownership like freee K.K can be particularly compelling, as significant insider stakes often align management’s interests with those of shareholders, potentially enhancing trust and long-term value in turbulent times.

Top 10 Growth Companies With High Insider Ownership In Japan

| Name | Insider Ownership | Earnings Growth |

| SHIFT (TSE:3697) | 35.5% | 27.2% |

| Medley (TSE:4480) | 34.1% | 23.6% |

| Hottolink (TSE:3680) | 27% | 57.3% |

| Kasumigaseki CapitalLtd (TSE:3498) | 35.5% | 44.6% |

| Micronics Japan (TSE:6871) | 15.3% | 37.4% |

| Money Forward (TSE:3994) | 21.4% | 63.3% |

| ExaWizards (TSE:4259) | 24.8% | 84.3% |

| Soracom (TSE:147A) | 17.2% | 59.1% |

| freee K.K (TSE:4478) | 24% | 79.8% |

| CYBERDYNE (TSE:7779) | 38.9% | 72.3% |

Let's uncover some gems from our specialized screener.

freee K.K (TSE:4478)

Simply Wall St Growth Rating: ★★★★★☆

Overview: freee K.K., operating in Japan, provides cloud-based accounting and HR software solutions with a market capitalization of approximately ¥179.98 billion.

Operations: The company generates revenue primarily through its Platform Business, which amounted to ¥22.27 billion.

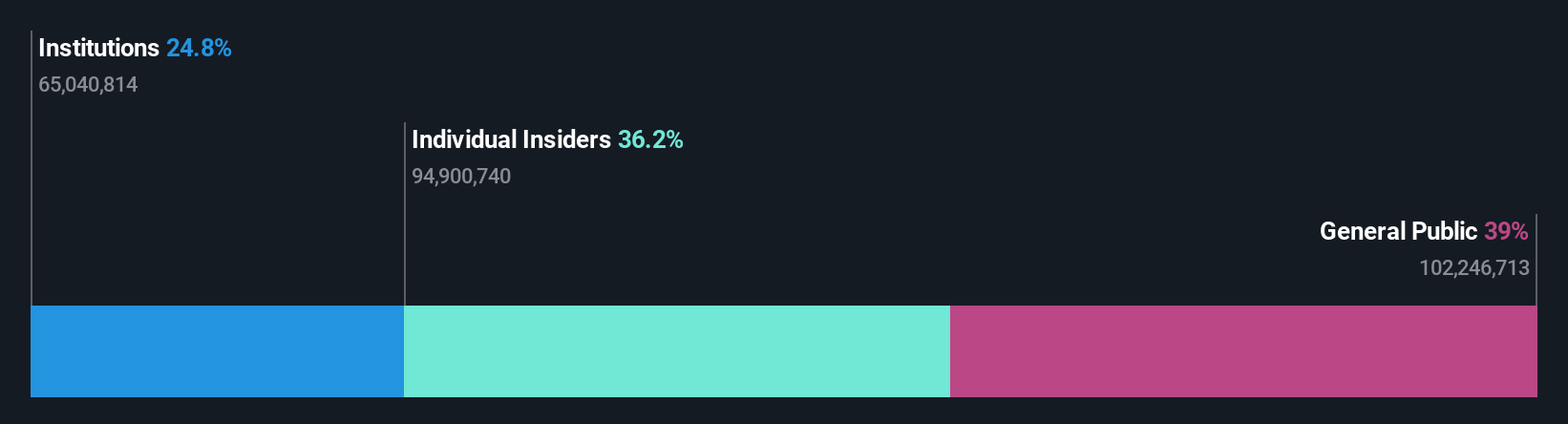

Insider Ownership: 24%

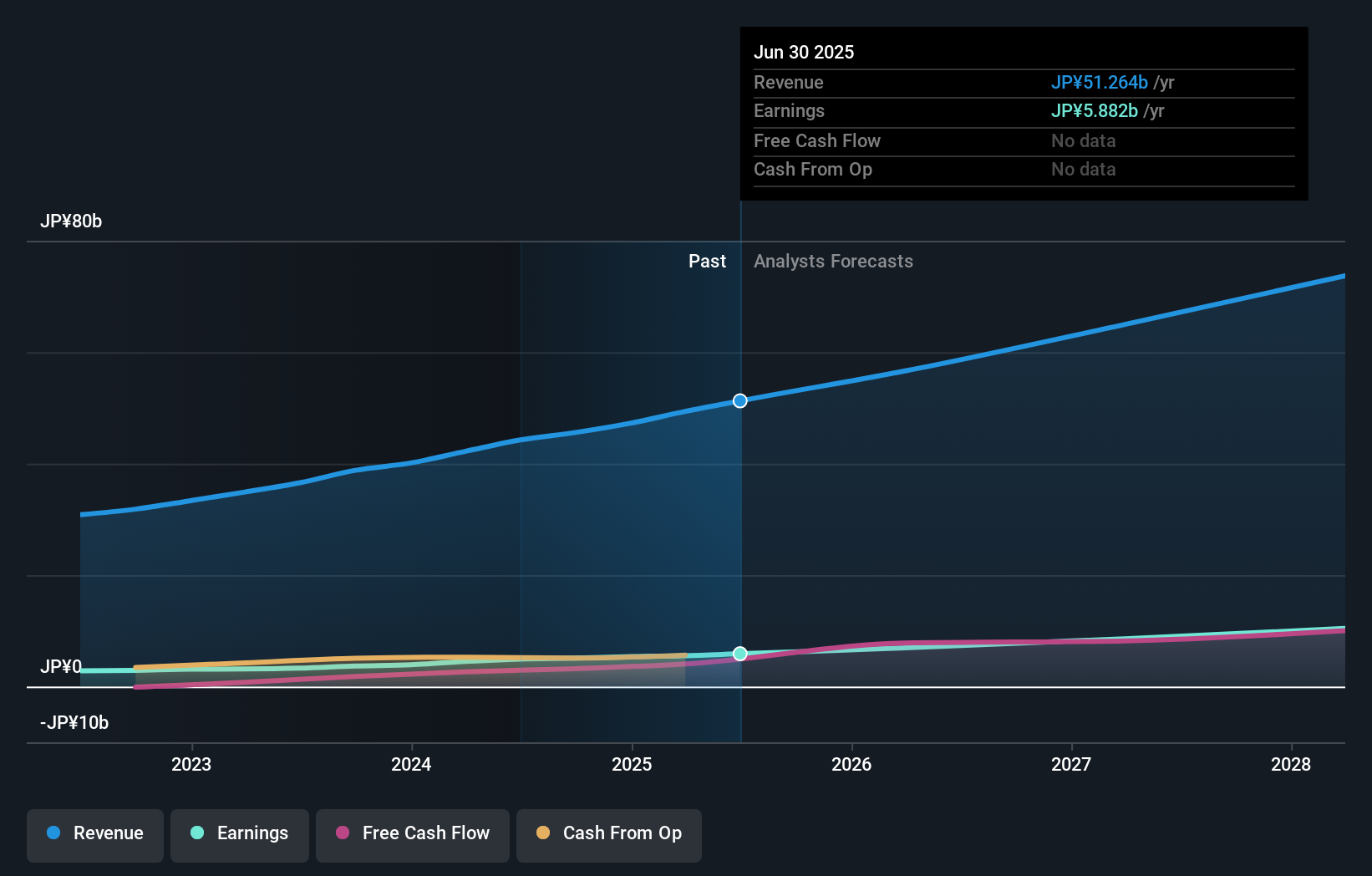

Freee K.K. is poised for significant growth with its revenue expected to increase by 21.1% annually, outpacing the Japanese market's average of 4.4%. Despite trading at 57.3% below its estimated fair value, which presents a potential upside, the company faces challenges with a forecasted low return on equity of 0.2% in three years and high share price volatility recently. Notably, freee K.K.'s earnings are also projected to surge, becoming profitable within the next three years.

- Click here to discover the nuances of freee K.K with our detailed analytical future growth report.

- The analysis detailed in our freee K.K valuation report hints at an deflated share price compared to its estimated value.

Round One (TSE:4680)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Round One Corporation operates indoor leisure complex facilities and has a market capitalization of approximately ¥196.60 billion.

Operations: The company generates revenue primarily from its indoor leisure complex facilities.

Insider Ownership: 35.2%

Round One Corporation, a company with high insider ownership in Japan, demonstrates robust growth potential with earnings forecasted to increase by 12.88% annually, outperforming the Japanese market's average of 9.2%. Despite slower revenue growth at 6.9% per year compared to the broader market expectation of 20%, Round One maintains a competitive edge with its recent sales reaching JPY 35.04 billion year-to-date as of April 2024. The firm also offers a consistent dividend yield of 1.92%, underscoring its financial stability amidst aggressive market conditions.

- Take a closer look at Round One's potential here in our earnings growth report.

- According our valuation report, there's an indication that Round One's share price might be on the cheaper side.

Japan Elevator Service HoldingsLtd (TSE:6544)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Japan Elevator Service Holdings Co., Ltd. specializes in the repair, maintenance, and modernization of elevators and escalators across Japan, with a market capitalization of approximately ¥239.12 billion.

Operations: The company generates ¥40.12 billion primarily through maintenance services for elevators and escalators.

Insider Ownership: 23.4%

Japan Elevator Service Holdings Ltd. is a growth-oriented company with high insider ownership, focusing on expanding its domestic presence through recent service office openings in Tokyo and Nara, enhancing customer support capabilities. The firm's earnings are expected to grow by 20.53% annually, outpacing the Japanese market average of 9.2%. Despite revenue growth projections not reaching the high threshold of 20%, they remain above the market forecast at 12% per year, indicating steady upward momentum.

- Unlock comprehensive insights into our analysis of Japan Elevator Service HoldingsLtd stock in this growth report.

- According our valuation report, there's an indication that Japan Elevator Service HoldingsLtd's share price might be on the expensive side.

Where To Now?

- Click this link to deep-dive into the 103 companies within our Fast Growing Japanese Companies With High Insider Ownership screener.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:6544

Japan Elevator Service HoldingsLtd

Provides repair, maintenance, and modernization services for elevators and escalators in Japan.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives