- Japan

- /

- Food and Staples Retail

- /

- TSE:3038

Kobe Bussan (TSE:3038) Margin Surge and 48.7% EPS Growth Challenge Cautious Narratives

Reviewed by Simply Wall St

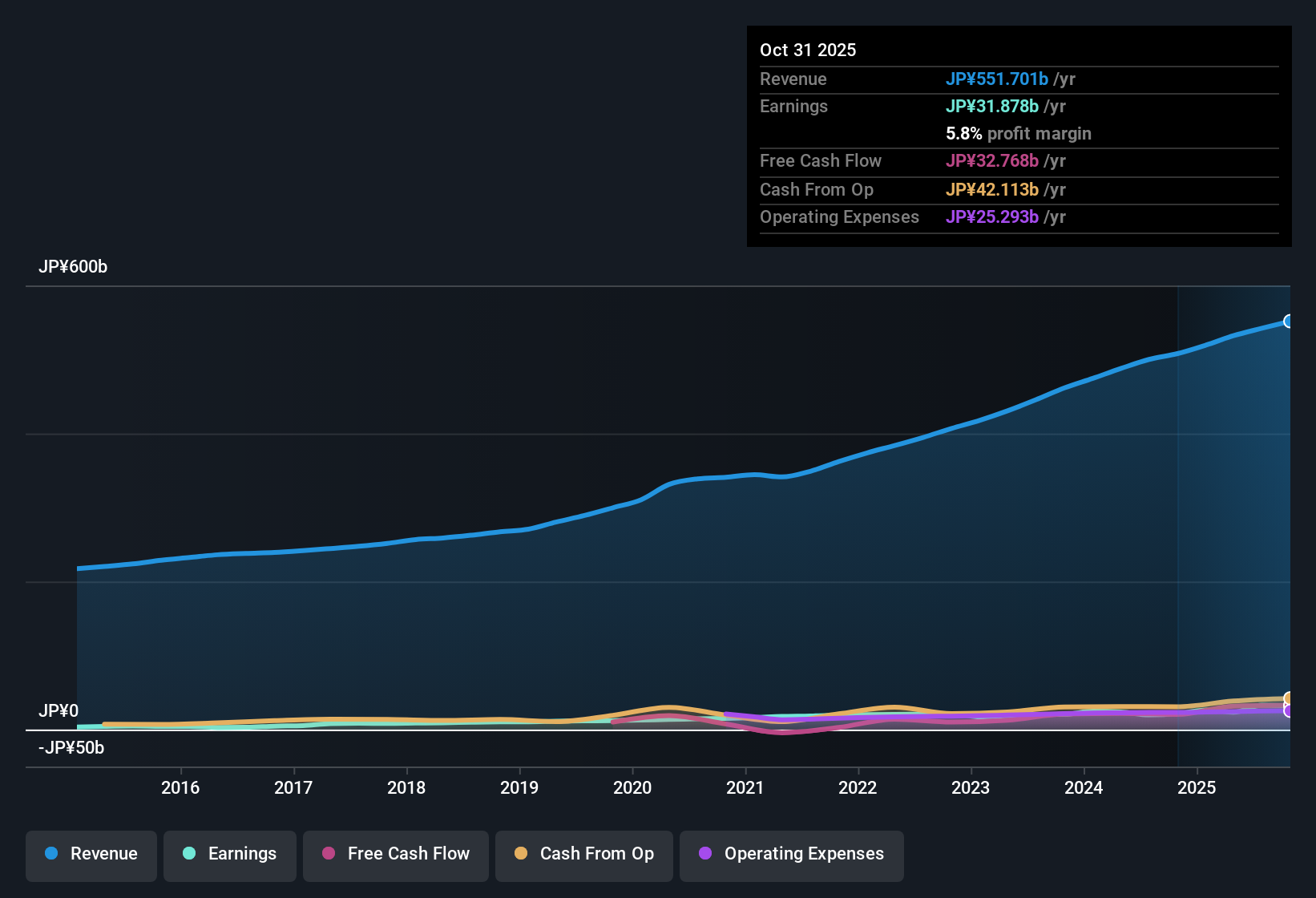

Kobe Bussan (TSE:3038) has just posted its FY 2025 second half numbers, with revenue of ¥279,395 million and net income of ¥17,611 million translating into EPS of ¥79.50, while trailing 12 month EPS stands at ¥143.98 on net income of ¥31,878 million from revenue of ¥551,701 million. Over the last year, the company has seen revenue move from ¥259,760 million in FY 2024 H2 to ¥279,395 million in FY 2025 H2, with net income climbing from ¥9,098 million to ¥17,611 million and EPS from ¥41.17 to ¥79.50. This points to expanding profitability and healthier margins for investors to consider.

See our full analysis for Kobe Bussan.With the headline numbers on the table, the next step is to weigh them against the prevailing narratives around Kobe Bussan, examining where the latest margin trends support the story and where they start to push back on consensus views.

Curious how numbers become stories that shape markets? Explore Community Narratives

48.7% profit growth reshapes margin story

- Over the last 12 months, net income rose to ¥31,878 million and EPS to ¥143.98, up 48.7% year on year, while net profit margin moved from 4.2% to 5.8%.

- What stands out for the bullish camp is how this step up in profitability lines up with the five year earnings growth of 11.2% a year, yet contrasts with more modest forecasts:

- The 48.7% earnings rise over the past year is far ahead of the projected 6.9% annual earnings growth, so bulls can point to recent execution running hotter than the medium term outlook.

- At the same time, revenue is only expected to grow about 6.3% per year, so improved margins, now at 5.8%, matter more than pure top line expansion for sustaining the bullish story.

Premium P/E meets discounted DCF value

- The shares trade at ¥3,655 with a P/E of about 25.4 times, above the consumer retail industry average of 13.2 times and the 22.3 times peer average, yet still roughly 28.9% below a ¥5,139.7 DCF fair value.

- Critics highlight the rich multiple, but the valuation picture is split between bearish and optimistic angles that both lean on the same set of numbers:

- Bears focus on the 25.4 times P/E versus 13.2 times for the industry and 22.3 times for peers, arguing that a premium price on earnings leaves less room if growth normalizes toward the 6.9% forecast.

- Supporters counter that the current ¥3,655 price still sits well below the ¥5,139.7 DCF fair value, so even with a higher P/E, the stock screens as undervalued on that cash flow based lens.

Steady top line, mid single digit growth outlook

- On a trailing basis, revenue reached ¥551,701 million, with forward estimates calling for around 6.3% annual revenue growth and about 6.9% annual earnings growth from here.

- Consensus style, balanced thinking tends to weigh this mid single digit growth profile against the recent margin lift to 5.8%, which creates a more nuanced read than a simple growth versus no growth framing:

- Investors looking for high growth might see the 6.3% revenue and 6.9% earnings forecasts as moderate, especially after a year of 48.7% earnings expansion, so they may question how repeatable the latest jump is.

- Others will note that even with those mid single digit expectations, the combination of a 5.8% net margin and the gap to the ¥5,139.7 DCF fair value leaves room for disciplined, margin focused execution to drive value.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Kobe Bussan's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

Despite a sharp earnings jump and margin expansion, Kobe Bussan faces questions over whether recent profit strength is sustainable, given only mid single digit growth forecasts and a premium P/E.

If you want steadier, less debate driven stories around growth durability and valuation, use our stable growth stocks screener (2103 results) to quickly find companies delivering consistent revenue and earnings progress across cycles.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Kobe Bussan might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:3038

Kobe Bussan

Primarily engages in the operation, management, and franchising of retail stores in Japan.

Flawless balance sheet with solid track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)